Double diagonal strategy: In order to properly use the double diagonal strategy, you will start with a diagonal put spread along with a diagonal call spread. You can turn a horizontal spread into a diagonal spread by simply shifting the long leg to a new strike point with a different timeframe. Any spread where the two legs don’t use the same month is said to be diagonal.

When using a diagonal call spread, you will need to combine a short call spread and a long calendar spread to allow it to move based on the rate at which time decay affects the option in question. Once you sell off the second call at the initial strike point, you will have backed into a spread for the short call. This will allow you to create a net credit which means that after the second call has been sold anything else you make is pure profit. A diagonal put works in largely the same way with the specifics reversed.

When using a diagonal call spread, you will need to combine a short call spread and a long calendar spread to allow it to move based on the rate at which time decay affects the option in question. Once you sell off the second call at the initial strike point, you will have backed into a spread for the short call. This will allow you to create a net credit which means that after the second call has been sold anything else you make is pure profit. A diagonal put works in largely the same way with the specifics reversed.

To run a double diagonal, you will start by putting a diagonal put spread and a diagonal call spread into play. This will provide you with the opportunity to profit from the increased time decay that front-month options experience when compared with back-month options.

To do so, you start with buying a put that is currently out of the money at a strike price that will be good for two months. At the same time, you will want to sell an out of the money put at a strike price that is good for one month. Furthermore, you are going to want to sell a call that is out of the money at a strike price that is good for one month. Finally, you will purchase a call at a separate strike price that is good for two months.

If everything goes according to plan, then the underlying asset will remain at a price that is between the second put and the first call. If the price remains above that pair of strike prices, then you are going to want to sell the options that are one month out. At the same time, you are going to want to sell another call with the same strike price as the call that is two months out.

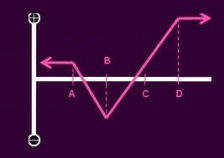

When graphing this strategy, it is important to keep in mind that the profit and loss lines are not going to be as straight as you might expect because the two month options are still growing concerns. Straight lines and hard angles can only exist if the options you are graphing are all going to expire in the same timeframe.

While this strategy might seem extremely complicated at first, it can be made to seem much more manageable if you instead consider it as a form of profiting from a neutral amount of movement in the market, simply spread out into multiple expiration cycles.

The most useful time to use this strategy is when an underlying asset is halfway between the second put and the first call, the closer to the true midpoint the better. If the underlying asset isn’t at this point, then biases towards bullishness or bearishness can skew the results. If the underlying asset remains at the midpoint, then the options you sold will expire without generating a profit, allowing you to keep a greater percentage of the premium.

This occurs because the first put and the second call that you purchased will help to decrease your overall risk, even if the underlying asset moves more than you might like. The goal of this strategy is to leave you with a net credit, though this is not always how things shake out. It is not a sure thing because the front month trades inherently have less time value which means that a net debit is a possibility. If this occurs, then you can make up the difference by selling the remaining options after the front month pair expires.

When the front month pair is close to expiring, and the price of the underlying asset is somewhere between the price of the second put and the first call then you are going to way to buy close to the pair of puts and create an additional put for sale at the second strike price along with a third call at the third strike price. These new options should have the same expiration as the other two month options. This is what is known as rolling out, and it can easily double, or even triple, your profits.

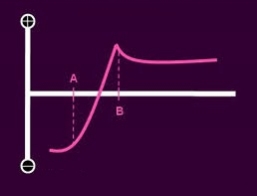

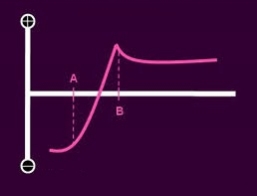

Leveraged covered call strategy: Also known as the fig leaf strategy, the leveraged covered call strategy is a great way to mitigate some of the risks that come along with trading options based on Long Term Equity Anticipation Securities (LEAPS). A standard LEAPS call is not set to expire for at least a year which means a short-term call lasts about 45 days. This strategy is useful if you feel somewhat bullish about the market’s chances over this timeframe.

To utilize this strategy, you are going to start by purchasing a LEAPS call with access to a profitable strike price for the related underlying asset. At the same time, you are going to sell a call at a favorable strike price to ensure you can make a profit if you end up being assigned early. The goal here is to provide a covered call for the LEAPS transaction. While the two options you have committed two are similar, the fact that they have different expiration dates allows you to maximize your profits when compared with a standard covered call. Next, you are going to sell a call that is out of the money in the short term at the same strike price as the call. Ideally, the underlying asset will then stick close to the second strike price and not the first.

To utilize this strategy, you are going to start by purchasing a LEAPS call with access to a profitable strike price for the related underlying asset. At the same time, you are going to sell a call at a favorable strike price to ensure you can make a profit if you end up being assigned early. The goal here is to provide a covered call for the LEAPS transaction. While the two options you have committed two are similar, the fact that they have different expiration dates allows you to maximize your profits when compared with a standard covered call. Next, you are going to sell a call that is out of the money in the short term at the same strike price as the call. Ideally, the underlying asset will then stick close to the second strike price and not the first.

This strategy is useful if you don’t want to put up all of the required capital right at the start. This, in turn, means that the premium that is generated as you sell the call is going to represent a larger percentage of your initial investment, leverage will ensure your profits are proportionally higher as well.

When graphing this strategy, be aware that your loss and profit lines will not be straight as the LEAPS call is going to remain open while the other call expires. You should also keep in mind that determining what your likely profits are going to be is tricky, in this instance, because the available data won’t be reliable until enough time has passed to see where the LEAPs call is likely to end up.

When using the fig leaf strategy, your goal should be to purchase a LEAPS call that is going to move in the same way as the underlying asset. As such, it is recommended that you only consider calls that have a delta of .8 or higher. This means you are going to want to look at options that are at least 20 percent of the money. If you are considering an underlying asset that experiences a high degree of volatility, then options that are at least 40 percent of the money are recommended.

While this strategy is more useful in many situations than a traditional covered call, it is not with additional risks. First, unlike most underlying assets, LEAPS eventually expire which is something you need to take into account if you are to keep your investment. Second, being assigned on the short call can be cumbersome as you likely won’t own the underlying asset when it occurs. You won’t want to exercise your option to buy on the LEAPS call because you lose out on a significant amount of time value. The best solution is simply to hope that the short call expires out of the money and that you can sell it multiple times before the LEAPS call ultimately expires. Alternatively, you can sell the LEAPS call on the open market to ensure that you profit from the time value that remains. If you go this route, you are going to want to ensure that you also purchase the underlying asset to cover any short positions that might materialize.

This is an effective strategy if you have a clear idea of how an underlying asset is going to move but cannot currently afford to purchase it directly. If the price of this assets jumps the first strike price and heads right toward the second, then you can make an early profit by closing out the whole option.

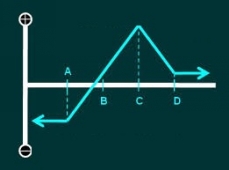

Skip strike butterfly call spread: The biggest difference between a skip strike butterfly call spread and a traditional butterfly spread is that is much more directionally focused. With the skip strike version, you are going to want the underlying stock price to increase, though not beyond the limit of your secondary strike price. The calls at the second and fourth strike points will be nearly 0 though you will still retain the premium generated by the call at the primary strike price.

This strategy works by placing a short call spread into a butterfly long call spread. Essentially what you are doing is unloading the short call spread as a means of paying for the butterfly. While this would technically mean that you need to buy and sell a call at the same strike price, the results of this transaction would balance out so it can be skipped.

The spread on the short call allows for this strategy to be arranged with little extra cost in exchange for the chance at a significant gain. This also adds risk to the proceedings making the skip strike butterfly call spread riskier than a traditional butterfly spread. In order to get the best results from this strategy, you are going to want to ensure that all of the strike prices that you use are equidistance from one another while also expiring in the same month. The price of the underlying asset in question should then remain at or below the first strike price for the best results.

To use the skip strike butterfly call spread the first thing you are going to want to do is to purchase a call at the primary strike point. You will then want to sell a pair of calls at the second strike price. Finally, you are going to want to ignore the third strike price and purchase a call at the fourth strike price.

This is a terrific strategy to use if you are primarily interested in minimizing risk. This is the case because the underlying asset would need to see significant movement before breaking past the strike point for you to see serious losses. The risk with this strategy can be further mitigated if you utilize it with options based on indices instead of stocks because many indices experience very low volatility as conflicting internal price movements often cancel one another out.

This is a terrific strategy to use if you are primarily interested in minimizing risk. This is the case because the underlying asset would need to see significant movement before breaking past the strike point for you to see serious losses. The risk with this strategy can be further mitigated if you utilize it with options based on indices instead of stocks because many indices experience very low volatility as conflicting internal price movements often cancel one another out.

This strategy is especially effective if you are bullish about the state of the market as it currently stands and where it is likely to go in the time frame that you have established. As long as you hit the third strike price, you can expect to make a profit even if the options are going to expire at a point that would traditionally allow you to break even. In order to make the maximum amount of profit, you would want to exercise the moment the underlying asset reaches the second strike price. You will then make a profit based on the second strike price subtracted by the first and any related fees.

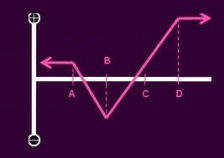

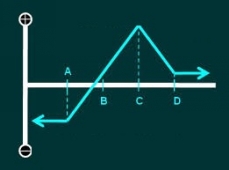

Skip strike butterfly put spread: Much like the skip strike butterfly call spread, the put version skews more towards a directional strategy than the butterfly spread version. The biggest difference between the two is that while the traditional version hopes for the underlying asset to increase, the skip strike version hopes for the underlying asset to decrease in value, though not beyond the third strike price you have established.

As such, this is a good strategy to use if you are a little bearish on the state of the market as you will not want the underlying asset to decrease too far. If things work out as they should, you would then make no profit off of the first and second put, but you will earn a premium on the fourth put. This strategy works by establishing a short put spread inside a butterfly put spread that has a longer timeframe. Much like with the call variant, you can avoid buying and selling at the second strike point as these actions will cancel one another out. Furthermore, the short spread will provide you with the opportunity to use this strategy as a way to generate either a small debit or a positive credit. Like its counterpart, the skip strike butterfly put is riskier than the standard butterfly variation, though the potential for return is greater as well.

As such, this is a good strategy to use if you are a little bearish on the state of the market as you will not want the underlying asset to decrease too far. If things work out as they should, you would then make no profit off of the first and second put, but you will earn a premium on the fourth put. This strategy works by establishing a short put spread inside a butterfly put spread that has a longer timeframe. Much like with the call variant, you can avoid buying and selling at the second strike point as these actions will cancel one another out. Furthermore, the short spread will provide you with the opportunity to use this strategy as a way to generate either a small debit or a positive credit. Like its counterpart, the skip strike butterfly put is riskier than the standard butterfly variation, though the potential for return is greater as well.

To start using this strategy, you will first purchase a put at the primary strike price. The second strike point can then be skipped as the two purchases cancel one another out. Next, you will purchase two puts at the third strike price. Finally, you will purchase a put at the fourth strike price. All the strike prices need to be equidistance from one another and have the same expiration month. For the best results, you will want the underlying asset price to remain at or above the third strike price.

In order to make as much as possible from this strategy, you are going to want to execute the moment the underlying asset reaches the third strike price. The maximum amount of profit from this strategy is limited to the difference between the final two strike prices, minus any additional fees. In order to break even with this strategy, and still generate a credit, you will need the underlying asset to remain at or above the secondary strike price. On the other hand, if the trade was set up to generate a net debit then you will be able to break even at the fourth strike price as well as the second.

When using a diagonal call spread, you will need to combine a short call spread and a long calendar spread to allow it to move based on the rate at which time decay affects the option in question. Once you sell off the second call at the initial strike point, you will have backed into a spread for the short call. This will allow you to create a net credit which means that after the second call has been sold anything else you make is pure profit. A diagonal put works in largely the same way with the specifics reversed.

When using a diagonal call spread, you will need to combine a short call spread and a long calendar spread to allow it to move based on the rate at which time decay affects the option in question. Once you sell off the second call at the initial strike point, you will have backed into a spread for the short call. This will allow you to create a net credit which means that after the second call has been sold anything else you make is pure profit. A diagonal put works in largely the same way with the specifics reversed.  To utilize this strategy, you are going to start by purchasing a LEAPS call with access to a profitable strike price for the related underlying asset. At the same time, you are going to sell a call at a favorable strike price to ensure you can make a profit if you end up being assigned early. The goal here is to provide a covered call for the LEAPS transaction. While the two options you have committed two are similar, the fact that they have different expiration dates allows you to maximize your profits when compared with a standard covered call. Next, you are going to sell a call that is out of the money in the short term at the same strike price as the call. Ideally, the underlying asset will then stick close to the second strike price and not the first.

To utilize this strategy, you are going to start by purchasing a LEAPS call with access to a profitable strike price for the related underlying asset. At the same time, you are going to sell a call at a favorable strike price to ensure you can make a profit if you end up being assigned early. The goal here is to provide a covered call for the LEAPS transaction. While the two options you have committed two are similar, the fact that they have different expiration dates allows you to maximize your profits when compared with a standard covered call. Next, you are going to sell a call that is out of the money in the short term at the same strike price as the call. Ideally, the underlying asset will then stick close to the second strike price and not the first.  This is a terrific strategy to use if you are primarily interested in minimizing risk. This is the case because the underlying asset would need to see significant movement before breaking past the strike point for you to see serious losses. The risk with this strategy can be further mitigated if you utilize it with options based on indices instead of stocks because many indices experience very low volatility as conflicting internal price movements often cancel one another out.

This is a terrific strategy to use if you are primarily interested in minimizing risk. This is the case because the underlying asset would need to see significant movement before breaking past the strike point for you to see serious losses. The risk with this strategy can be further mitigated if you utilize it with options based on indices instead of stocks because many indices experience very low volatility as conflicting internal price movements often cancel one another out.  As such, this is a good strategy to use if you are a little bearish on the state of the market as you will not want the underlying asset to decrease too far. If things work out as they should, you would then make no profit off of the first and second put, but you will earn a premium on the fourth put. This strategy works by establishing a short put spread inside a butterfly put spread that has a longer timeframe. Much like with the call variant, you can avoid buying and selling at the second strike point as these actions will cancel one another out. Furthermore, the short spread will provide you with the opportunity to use this strategy as a way to generate either a small debit or a positive credit. Like its counterpart, the skip strike butterfly put is riskier than the standard butterfly variation, though the potential for return is greater as well.

As such, this is a good strategy to use if you are a little bearish on the state of the market as you will not want the underlying asset to decrease too far. If things work out as they should, you would then make no profit off of the first and second put, but you will earn a premium on the fourth put. This strategy works by establishing a short put spread inside a butterfly put spread that has a longer timeframe. Much like with the call variant, you can avoid buying and selling at the second strike point as these actions will cancel one another out. Furthermore, the short spread will provide you with the opportunity to use this strategy as a way to generate either a small debit or a positive credit. Like its counterpart, the skip strike butterfly put is riskier than the standard butterfly variation, though the potential for return is greater as well.