Chapter 5: Building the nest egg: making a super contribution

Making a superannuation contribution to a complying superannuation fund is not a simple matter of crediting a sum of money to your account, as is the case if you deposit money into a bank savings account. When dealing with the Income Tax Assessment Act 1997 and Superannuation Industry (Supervision) Act 1993 (SIS Act), there are strict rules you need to comply with. And if you get it wrong, the Tax Office could impose stiff penalties. Furthermore, once you make a contribution, you cannot legally touch that money until you satisfy a condition of release. In this chapter, I discuss the key provisions for making a superannuation contribution and the tax issues you need to be aware of.

Making a contribution

The federal government has introduced a number of concessions to encourage you to make a contribution to a complying super fund or retirement savings account (RSA). Under Australian tax law any person who is under 65 years of age is eligible to make a superannuation contribution, and there is no employment test that you need to satisfy. But this is not the case once you reach 65 years of age, as then you need to be gainfully employed (described as satisfying a work test) before you can make a contribution.

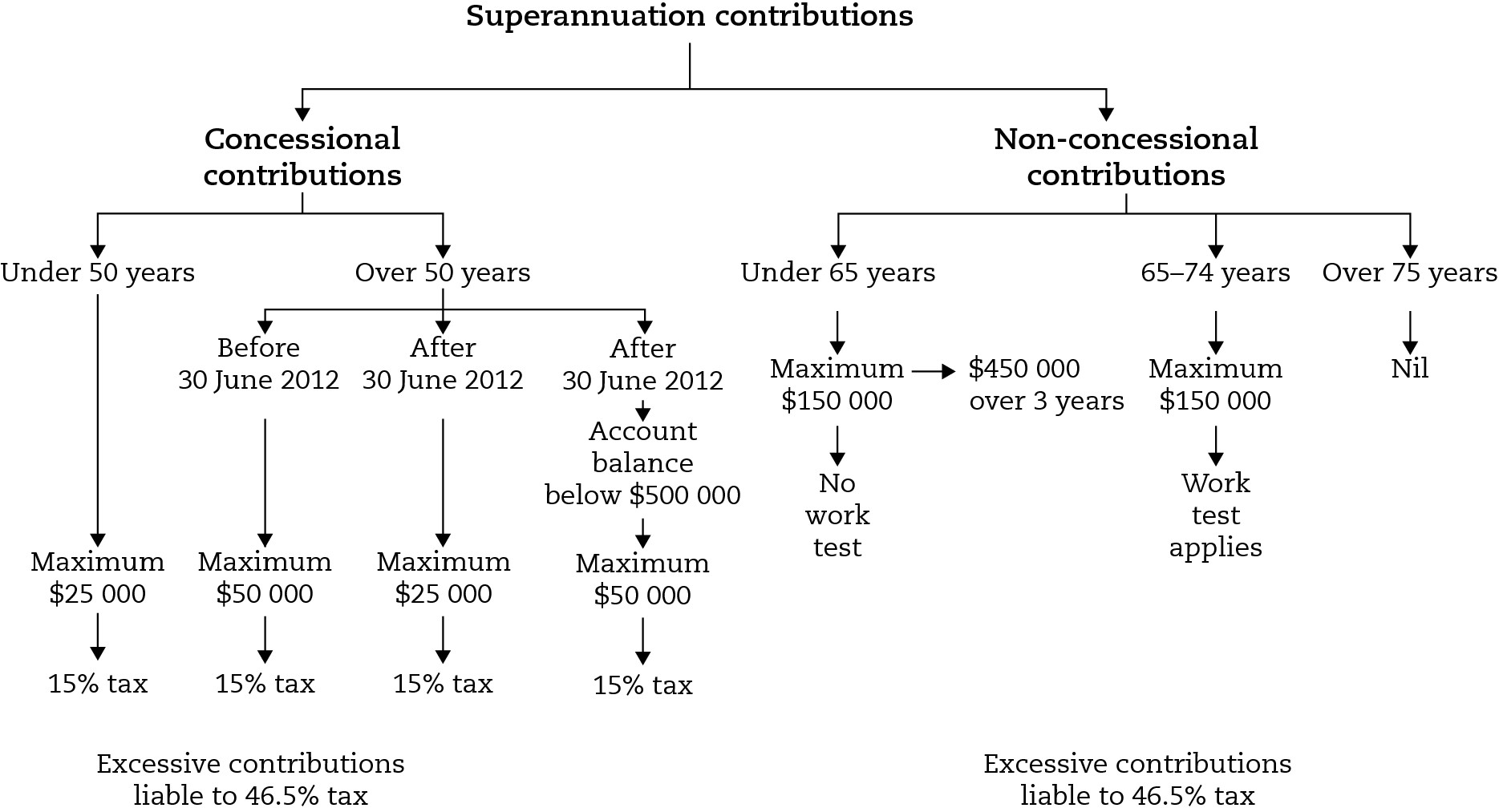

You can make two types of contributions to a superannuation fund or RSA. They are referred to as concessional contributions and non-concessional contributions. You must also comply with statutory rules that limit (or cap) the amount of concessional and non-concessional contributions you can make to your super fund each financial year. If you exceed these limits, the excess amount is liable to a 46.5 per cent tax rate (see figure 5.1). Under Australian tax law, you will be considered to have made a superannuation contribution when it is received by your superannuation fund (following Tax Office Ruling TR 2009/D3, paragraph 19).

Concessional contributions

Concessional contributions (also described as personal pre-tax contributions) are contributions you make to a complying super fund that qualifies for a tax deduction. Concessional contributions are liable to 15 per cent contributions tax, and there is a concessional contribution cap amount to limit what you can contribute each financial year. If you are under 50 years of age the maximum concessional contribution you can make in a financial year is $25 000 (indexed). If you are over 50 years of age, the amount increases to $50 000. The federal Labor government has proposed that from 1 July 2012 you will only be able to make the maximum $50 000 concessional contribution if you have less than $500 000 in your super fund account balance. If your balance is more than $500 000, the maximum you will be able to put in each year will be reduced to $25 000. If you exceed the concessional contribution cap, the excess amount is liable to tax at the rate of 46.5 per cent (see figure 5.1 on p. 85). Any amount that’s not tax deductible may be accepted as a non-concessional contribution (provided you don’t exceed the non-concessional contribution cap amount).

Figure 5.1: making a contribution to a self managed super fund

If you plan to make a concessional contribution and claim a tax deduction, you need to forward to your super fund a Section 290-170 notice of intent to claim a deduction for personal super contributions, and specify the amount you intend to claim. The trustee must acknowledge your notification and the amount you’re claiming before you lodge your annual tax return. For more details see the Tax Office publication Deduction for personal super contributions (NAT 71121).

At a glance: what are concessional contributions?

The common types of concessional contribution are:

• employer super guarantee contributions made on behalf of employees

• employee salary sacrifice personal contributions

• personal pre-tax contributions by individuals who are self-employed or substantially self-employed and who qualify for a tax deduction.

Only employers and the self-employed (or substantially self-employed) can make concessional contributions. If you’re an employee you can only make a non-concessional contribution; incidentally, the Tax Office classifies salary sacrifice contributions as employer super contributions — see Employee salary sacrifice personal contributions on p. 92).

Employer super guarantee contributions

Under the superannuation guarantee legislation employers have a statutory obligation to make a superannuation contribution to a complying super fund on behalf of their employees. This will happen if you are an employee aged over 18 years and under 70 years, and earn more than $450 per month on either a full-time or part-time basis. The super guarantee rate is currently 9 per cent of your ordinary time earnings (or gross pay). For example, if you earn $1000 per week your employer must make a $90 super guarantee contribution to a complying super fund of your choice ($1000 × 9 per cent = $90) (see chapter 1). The federal Labor government has proposed to progressively increase the rate to 12 per cent by 2019–20; see appendix A, table 11.

Employers are not required to pay super guarantee contributions on employee salaries that exceed a statutory amount. For the 2010–11 financial year the statutory amount was $168 880; see appendix A, table 8.

A summary of your employer super guarantee contributions, and the date they were paid, is usually recorded on the member benefit statement that your super fund issues to you each year (see chapter 1). For more details see the Tax Office publication Employer guide for reportable employer superannuation contributions.

Employers are statutorily obligated to make at least four super guarantee contributions to your super fund each year. The payments must be made no later than 28 days after the end of each quarter. The payments are ordinarily paid to your super fund within 14 days at the end of each month. If an employer fails to forward the super guarantee contributions to your super fund by the due date, the employer must prepare a Superannuation guarantee statement and pay the amount outstanding to the Tax Office. A super guarantee charge (or penalty) will apply, and the charge is not tax deductible. For more details see the Tax Office publication Completing your superannuation guarantee charge statement — quarterly (NAT 9600).

At a glance: who is not eligible for an employer super guarantee contribution

The following employees are not eligible for an employer super guarantee contribution:

• employees who earn less than $450 per month

• employees who are under 18 years of age and work 30 hours or fewer per week

• employees who are over 70 years of age (the federal Labor government proposes to increase the age limit from 70 to 75 from 1 July 2013)

• members of the Army, Navy or Air Force Reserve (the Tax Office has advised that the armed forces don’t have to pay super contributions for reserve members)

• part-time nannies or housekeepers who are paid to do work of a domestic or private nature for fewer than 30 hours a week

• employees who earn salaries that exceed a statutory amount.

Employee salary sacrifice personal contributions

To help build up the retirement nest egg, employees are permitted to make additional contributions under a salary sacrifice arrangement. Under this arrangement extra super contributions are deducted from your pre- tax gross pay. Unfortunately, employees can’t claim a tax deduction for the additional amount they contribute, as they’re ineligible to make a concessional contribution. But the trade-off here is that your salary or take home pay will reduce and you will pay less tax (see Case study: making a salary sacrifice contribution on p. 94). As the Tax Office classifies these additional contributions as employer super contributions, the amounts contributed are liable to 15 per cent contributions tax. If you decide to enter into a salary sacrifice agreement with your employer, the combined employer and employee contributions cannot exceed the concessional contribution cap amount. For example, if you’re under 50 years of age the concessional contribution cap amount is $25 000. Under these circumstances, if your employer makes a $10 000 super guarantee contribution on your behalf, the most you can contribute under a salary sacrifice arrangement is $15 000 ($25 000 − $10 000 = $15 000).

Case study: making a salary sacrifice contribution

Elise is a secondary school teacher earning a $75 000 salary. Under a salary sacrifice arrangement, her employer deducted a further $10 000 super contribution from her salary and paid the amount to her nominated super fund. When her employer did this, her gross salary was reduced from $75 000 to $65 000. As the Tax Office classifies these additional payments as employer super contributions, the $10 000 is liable to 15 per cent contributions tax. As the $10 000 would have been liable to tax at the rate of 31.5 per cent if Elise did not salary sacrifice, she will effectively save $1650 in tax: $10 000 × 31.5 per cent – 15 per cent = $1650. But the trade-off here is she cannot access these funds until she reaches her preservation age and satisfies a condition of release. Under the salary sacrifice arrangement, her employer agreed to calculate the employer superannuation contribution based on a salary of $75 000 rather than on the lower amount of $65 000.

Personal pre-tax contributions (non-concessional contributions)

A personal contribution, or non-concessional contribution, is a voluntary contribution that you can make to a complying super fund, but it doesn’t qualify for a tax deduction. This is a good way of saving for your retirement given that investment earnings will be exempt from tax during the pension phase (see chapter 8). If you want to do this, you need to complete an application form and quote your TFN, and forward the details to your super fund. These contributions are not liable to 15 per cent contributions tax, as is the case if you make a concessional contribution.

Anyone who is under 65 years of age can make a personal or non-concessional contribution. But once you turn 65, you need to satisfy a work test, if you want to make a non-concessional contribution. To satisfy the work test, you need to work a minimum 40 hours over a 30-day consecutive period in the financial year in which you want to make the super contribution. Once you reach 75 years of age, you can no longer make a non-concessional contribution (see figure 5.1 on p. 85).

As is the case with concessional contributions, there is a non-concessional cap amount to limit the amount you can contribute each financial year. If you’re under 65 years of age the non-concessional cap amount is $150 000 each financial year (though this amount is indexed and increases regularly). Alternatively, if you’re less than 65 years of age, you can make non-concessional contributions of up to a maximum $450 000 during the financial year — this is referred to as the bring-forward option. If you make the maximum contribution, you can’t make any further non-concessional contributions for the next two years. Once you turn 65 years of age, the maximum amount you can contribute each year is $150 000, provided you satisfy the work test and are aged less than 75. If you exceed the non-concessional cap amount, the excess is liable to tax at the rate of 46.5 per cent (see figure 5.1 on p. 85).

Federal government concessions

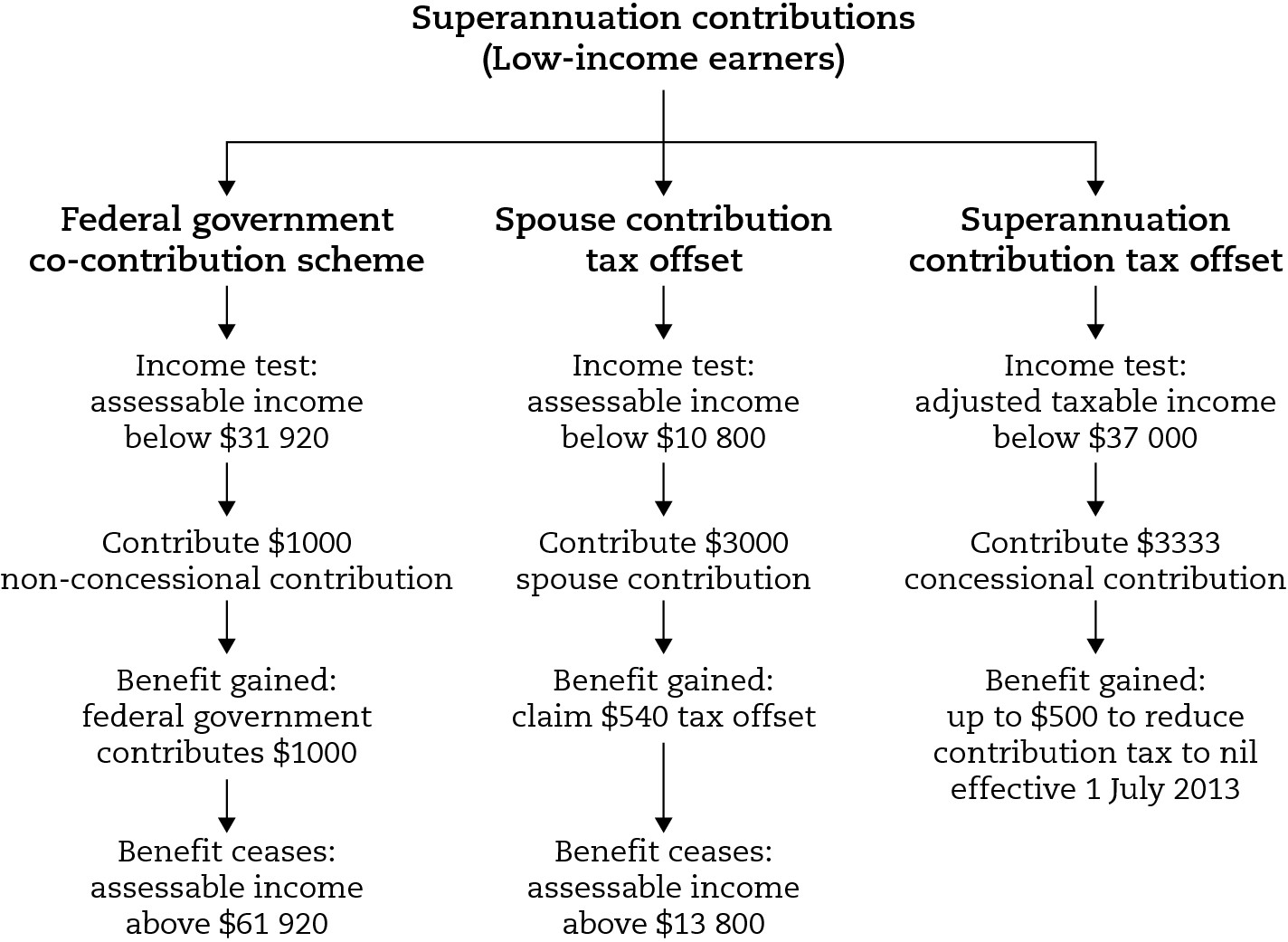

The federal government has introduced a number of tax concessions to encourage low-income earners to make a contribution to a complying superannuation fund (see figure 5.2, overleaf). This is to help boost benefits that they can access when they retire. These concessions are:

• superannuation co-contribution scheme

• spouse contribution tax offset.

Superannuation co-contribution scheme

If your total income is less than $31 920 and you make a maximum $1000 personal after-tax non-concessional contribution to a complying super fund (or RSA), the federal government (through the Tax Office) will make a $1000 superannuation co-contribution payment on your behalf to your nominated super fund. The payment is reduced if you contribute less than $1000. On the other hand, if your total income is more than $31 920, and you make a non-concessional contribution, the co-contribution payment reduces by 3.333 cents for every dollar you earn above $31 920.

Figure 5.2: federal government concessions

Co-contributions cut out once your total income exceeds $61 920. You can use your super fund’s online calculator to work out how much you’re entitled to receive if you earn more than $31 920 (or you can use the Tax Office Super co-contribution calculator on its website at <www.ato.gov.au>). As you can do this each year, this could prove a great way of boosting your retirement benefits with no strings attached! Like all other super contributions, you can’t access the co-contribution payment until you reach your preservation age and retire, and you can’t split this with your spouse.

You don’t have to fill in an application form or do anything else to receive a co-contribution payment (apart from make your non-concessional contribution). But you need to lodge a tax return disclosing the taxable income you derived during the financial year. Your tax return will be checked to see whether you’re eligible to receive the payment (see At a glance: super co-contribution eligibility test overleaf). If you satisfy all the conditions, your super fund will notify you when the super co-contribution payment is received from the Tax Office and credited to your account in the following financial year. The co-contribution will also be recorded on your annual member benefit statement (see chapter 1). The Tax Office will also notify you. For more information see the Tax Office publication Super co-contributions or you can contact your super fund or refer to your fund’s website.

At a glance: super co-contribution eligibility test

You must satisfy the following conditions to qualify for a government co-contribution payment:

• lodge an income tax return

• supply your TFN to your super fund or RSA

• earn less than $61 920

• make a personal after-tax non-concessional contribution to a complying super fund or RSA

• be an Australian resident (for instance, you do not hold a temporary visa at any time during the financial year)

• be less than 71 years of age at the end of the financial year in which the eligible contribution is made

• satisfy an income test and a 10 per cent eligible income test: this means that you must earn at least 10 per cent of your total income from eligible employment-related activities (for instance, receive salary and wages and allowances), carrying on a business or a combination of both.

Self-employed individuals are also eligible for a super co-contribution payment.

Case study: superannuation co-contribution scheme

Margaret is a 55-year-old part-time fashion designer earning a salary of $27 000. This is her sole source of income. Under the super guarantee legislation her employer must contribute $2430 to her nominated complying super fund. To help boost her super balance, during the financial year Margaret made a $1000 personal after-tax non-concessional contribution to her super fund. As Margaret’s total income is less than $31 920 (and she satisfies all the eligibility tests), the Tax Office will make a $1000 super co-contribution payment on her behalf to her nominated super fund. But she needs to lodge a tax return before she becomes eligible to receive the payment. If Margaret’s total income was $40 000, and she made a $1000 personal after-tax non-concessional contribution to her super fund, the super co-contribution payment reduces from $1000 to $731. This is how the lower super co-contribution payment is calculated:

$1000 – [(0.03333 × ($40 000 – $31 920)] = $731.

Spouse contribution tax offset

To help low-income earning spouses or non-working spouses boost their superannuation fund balances, the federal government has introduced spouse contributions, so that an individual can make a superannuation contribution on behalf of their spouse. Under this scheme, if your spouse’s total assessable income and reportable fringe benefits is less than $10 800, and you make a maximum $3000 super contribution on behalf of your spouse to a complying super fund or RSA, you could qualify for a maximum $540 superannuation spouse contribution tax offset. If your spouse earns more than $10 800 the amount of the tax offset you can claim reduces by 18 cents for every dollar your spouse earns above $10 800, and ceases once your spouse earns more than $13 800. The tax offset can be used to reduce the tax payable on your taxable income. As with all super contributions, your spouse cannot withdraw the money you contribute until they reach their preservation age and satisfy a condition of release (such as retiring). For more details see the Tax Office publication Superannuation spouse contribution tax offset.

At a glance: spouse contribution tax offset eligibility test

You need to satisfy the following conditions to qualify for a superannuation spouse contribution tax offset (maximum allowed $540):

• You are married or in a de facto relationship (same-sex couples also qualify).

• Your spouse’s assessable income and reportable fringe benefits must not exceed $13 800.

• You did not claim a tax deduction in respect of the contribution you made on behalf of your spouse.

• You must make a spouse contribution to a complying super fund or RSA (maximum permitted $3000).

• You and your spouse are Australian residents at the time you make the contribution and live together on a permanent basis.

• If your spouse is over 65 years of age and less than 70 years of age, your spouse must have satisfied the work test; in other words, worked at least 40 hours in 30 consecutive days in the financial year in which the contribution is made.

Case study: spouse contribution

Henry is married to Louisa who is 56 years of age. His spouse’s assessable income and reportable fringe benefits is $13 000. During the financial year, Henry made a $3000 superannuation contribution on behalf of his spouse to a complying superannuation fund. As Henry satisfies all the eligibility tests, he can claim a $144 tax offset against the tax payable on the taxable income he derived. This is how the tax offset is calculated:

$540 – [($13 000 – $10 800) × 18 cents] = $144.

Self-employed contributions

A self-employed person is a person who receives no superannuation support (for instance, is a sole trader carrying on a small business). There are strict tests to check whether you’re genuinely self-employed or an employee (see Employee or contractor? on p. 107). This is an important test, because if you’re self-employed and you make a personal pre-tax concessional contribution, the amount you contribute is a tax-deductible expense. A self-employed person can claim a tax deduction up to age 75 years.

The maximum concessional contribution you can make each financial year is limited to $25 000 if you’re under 50 years of age, and $50 000 if you’re over 50 years of age. The federal Labor government has proposed that from 1 July 2012, the maximum for those over age 50 will reduce from $50 000 to $25 000. But the good news is you can still make a maximum $50 000 concessional contribution if you’re over 50 years of age and your superannuation fund account balance is less than $500 000 (see figure 5.1 on p. 85).

Substantially self-employed

A substantially self-employed person is a person who derives less than 10 per cent of their assessable income from a superannuation-supported source. This is commonly known as the maximum earnings test (see Tax Office Ruling TR 2009/D3: Income tax: superannuation contributions). For instance, this could arise if your income comes mainly from investments or you’re self-employed, and you derive less than 10 per cent of your assessable income from salary and wages; see appendix B, Substantially self-employed (10 per cent rule). If you satisfy the 10 per cent rule test and make a personal pre-tax concessional contribution, the amount you contribute will qualify as a tax-deductible expense. But, as is the case if you’re self-employed, the maximum concessional contributions you can make each financial year are limited to $25 000 if you’re under 50 years of age, and $50 000 if you’re over 50 years of age.

Case study: substantially self-employed

Gerry is 45 years of age and carries on a small plumbing business. During the financial year he made a $20 000 personal pre-tax concessional contribution to his SMSF. At the end of the financial year his accounting records showed he derived $100 000 from his plumbing activities. During the financial year Gerry taught plumbing at the local trade school. His employer paid him a $5000 salary and made a $450 employer super guarantee contribution to his nominated fund. As Gerry derived less than 10 per cent of his total assessable income ($105 000) from a superannuation-supported source ($5000), he is considered to be substantially self-employed. The $20 000 concessional contribution he made to his super fund is therefore a tax-deductible expense.

If, however, Gerry had derived a $20 000 salary from his teaching activities, he would have failed the substantially self-employed test. This is because more than 10 per cent of his total assessable income ($120 000) came from a superannuation supported source ($20 000). Under these circumstances, Gerry would be ineligible to claim a tax deduction in respect of the $20 000 personal superannuation contribution he made to his SMSF. Under these circumstances, the contributions would be treated as non-concessional contributions, rather than concessional contributions.

Employee or contractor?

As employers have a statutory obligation to make super contributions to a complying super fund on behalf of their employees, you need to establish at the outset whether you are an employee or contractor. The Tax Office defines employees as persons engaged to perform services for salaries and wages; persons working under a contract wholly or principally for their labour; paid company directors; and certain sports persons, artists and performers. For more details see Tax Office Ruling TR 2010/1: Income tax: superannuation contributions.

Two major advantages of being classified as a contractor are that your payments are not liable to pay-as-you-go (PAYG) withholding tax, and you can claim certain tax deductions that are not ordinarily available to employees (such as car expenses and superannuation contributions to your complying super fund).

There is often a fine line as to whether you should be classified as an employee or contractor. The following tests are ordinarily used to determine your employment status:

• Results test. This test checks whether you are paid to produce a specific result or task; whether you are required to supply your own tools and equipment; and whether you are responsible for your own work and for fixing defects.

• Control test. This test checks whether you can delegate tasks to other people if you’re unable to complete the task; to what extent you have control as to how the task should be completed; when you can do it; and how you should be paid.

As a general rule you’re considered to be a contractor if you satisfy the following key tests:

• You normally advertise for jobs.

• You normally work at different locations.

• You supply your own tools and equipment to complete each task.

• You are required to fix errors and defects.

• You can delegate work to other people to complete each task.

• You have control as to how each task should be completed.

• You can set your own hours to complete each task.

• You prepare a tax invoice setting out services rendered on completion of each task you perform, and charge GST if you’re registered or required to be registered.

If you’re not sure of your employment status, it’s best to consult a professional accountant or registered tax agent. You can also read the Tax Office publication PAYG withholding guide no 2 — how to determine if workers are employees or independent contractors. You can download a copy from the Tax Office website at <www.ato.gov.au>. See also appendix B, Employees and independent contractors, and Superannuation guarantee charge.

Rollovers from other complying superannuation funds

If you’re dissatisfied with your super fund’s performance or would like to amalgamate a number of small super funds that you currently belong to, you can roll over (transfer) your benefits from one complying super fund to another complying super fund. You can also roll over your benefits to your SMSF (see chapter 3). You need to complete Rollover benefit statement (NAT 70945) and provide documentary evidence (such as certified copies of your driver licence or passport) to prove that these benefits belong to you. You can get a copy of the statement from the Tax Office website or contact your superannuation fund(s).

At the time of transfer, your existing super fund may charge you an administration fee or an exit fee or both. The trustee must roll over your benefits within 30 days of receiving your request. On the other side of the fence, your new super fund may charge you a deposit fee, and you will need to take out a new death and disability insurance policy if you want this insurance cover through your fund. If you roll over your benefits to another complying superannuation fund, no 15 per cent contributions tax is payable because the rollover contributions are coming from a previously taxed source. For more details see the Tax Office publication How to complete a rollover benefits statement (NAT 70945).

Partnerships and superannuation

If you carry on a business in partnership, a partner of a partnership can claim a tax deduction for concessional contributions made on behalf of the employees of the partnership. But a partnership cannot claim a tax deduction in respect of any superannuation contributions the partnership makes on behalf of the partners. This is because, under Australian tax law, a partner is not an employee of the partnership. Nevertheless, a partner may qualify for a tax deduction for personal superannuation contributions they make in their individual income tax return. This is on the condition that they are self-employed or substantially self-employed (they satisfy the 10 per cent rule test). For more information see the Tax Office publication Personal superannuation contributions.

Useful references

• Australian Securities & Investments Commission consumer website <www.moneysmart.gov.au>. Go to ‘About financial products’, choose ‘Superannuation’ and click on ‘Building your super’.

Australian Taxation Office publications

• Contributions splitting application (NAT 15237)

• Deduction for personal super contributions: how to complete your notice of intent to claim or vary a deduction for personal super contributions (NAT 71121)

• Excess contributions tax — applying to have your contributions disregarded or reallocated

• Salary sacrificing super — information for employers

• Super guarantee (SG) contributions calculator on the ATO website <www.ato.gov.au>

• Tips to help you keep track of your super contributions

Australian Taxation Office interpretative decisions

• ID 2010/217: CGT small business concessions: retirement exemption — contribution to complying superannuation fund — transfer of real property

Other taxation rulings

• SGR 2005/1: Superannuation guarantee: who is an employee?

• TA 2010/2: Circumvention of excess contributions tax

• TA 2010/3: Non market value acquisition of shares or share options by a self-managed superannuation fund