Chapter 6: Sharing your wealth: taxing your accumulated benefits

There are two distinct phases or periods in the life cycle of a complying super fund. They are referred to as the accumulation phase, when member contributions are invested on their behalf, and the pension phase, when members can access their benefits once they satisfy a condition of release. Different tax rules apply to each phase of the super fund’s life cycle. In this chapter I discuss the tax issues relating to super fund members and how complying superannuation funds are taxed.

How the Australian tax system works

After the end of the financial year, which commences on 1 July and ends on 30 June each year, a superannuation fund must lodge a superannuation fund tax return by 31 October, disclosing the taxable income they earned during the financial year. Taxable income is defined as assessable income less allowable deductions. The Income Tax Assessment Act 1997 sets out the rules for determining what earnings are assessable and what losses or outgoings are allowable deductions.

At a glance: how complying super funds are taxed

This is how a complying superannuation fund is taxed under Australian tax law:

• Complying super funds pay tax at the rate of 15 per cent on the taxable income they derive, while non-complying super funds pay tax at the rate of 45 per cent.

• Under the CGT provisions, only two-thirds of any capital gains a super fund makes on sale of CGT assets held for more than 12 months is liable to a 15 per cent rate of tax. But the entire amount is taxed at the rate of 15 per cent if CGT assets are bought and sold within 12 months.

• Assessable contributions (such as concessional, or pre-tax, contributions) are included as part of a superannuation fund’s total assessable income and are liable to 15 per cent contributions tax.

• Non-concessional (after-tax) contributions are not included as part of a superannuation fund’s total assessable income and are not liable to 15 per cent contributions tax.

• All super pensions and cash withdrawals payable to members after they turn 60 years of age and retire are exempt from tax. Members who receive a super pension and are aged between 55 and 59 years pay tax at their marginal rates, but qualify for a 15 per cent tax offset.

• Income and capital gains that a super fund derives during the pension phase to fund pension payments are exempt from tax.

• The trustee of an SMSF must apply for a tax file number and lodge a Self-managed superannuation fund annual return, disclosing the super fund’s taxable income.

• Dividends paid from a private company to an SMSF are ordinarily treated as special income and are liable to tax at the rate of 45 per cent (rather than 15 per cent).

Contributions and taxation

The government has created a number of tax incentives to encourage you to make a contribution to a complying superannuation fund. The fund invests these contributions on your behalf and they cannot be accessed until you satisfy a condition of release, such as when you retire (see chapter 8). The tax issues you need to consider depends on whether the contribution you or your employer are making is classified as a concessional contribution or non-concessional contribution. Further, the federal government has introduced a number of tax incentives to help low-income earners boost their retirement benefits (see chapter 5).

Concessional contributions

Concessional contributions (or pre-tax contributions) are contributions you make to a complying super fund that qualify for a tax deduction. Under Australian tax law, a deduction is allowed in the financial year in which you make the contribution. As these contributions are tax deductible, your super fund treats them as assessable contributions and so 15 per cent contributions tax is deducted from these contributions. For instance, if you make a $10 000 concessional contribution, your super fund has to pay $1500 tax on this amount. Only employers, the self-employed and individuals who are substantially self-employed can make concessional contributions and claim a tax deduction. Employees cannot make concessional contributions, nor can they claim a tax deduction for the amount they contribute (see chapter 5).

Concessional contribution cap amount

A concessional contribution cap amount limits the amount of concessional contributions you can make to a complying super fund each financial year. The concessional contribution cap amount depends on your age at the time you make the contribution.

For the financial year ended 30 June 2012, the concessional contribution cap amount is $25 000 if you’re less than 50 years of age, and $50 000 if you’re over 50 years of age (see figure 5.1 on p. 85). The $25 000 cap is indexed annually and is rounded down to the nearest multiple of $5000. From 1 July 2012 if you’re over 50 years of age the concessional contribution cap will reduce from $50 000 to $25 000. But the good news here is the federal Labor government has proposed that the cap will remain at $50 000 if your super fund balance is below $500 000. If you breach this cap, you’re liable to pay excess concessional contributions tax (see figure 5.1 on p. 85).

Excess concessional contributions tax

If you exceed the concessional contribution cap the excess amount is taxed at the rate of 31.5 per cent. This effectively means you will be liable to pay 46.5 per cent tax on the excess (namely 15 per cent contributions tax + 31.5 per cent excess concessional contributions tax). The additional tax is referred to as excess concessional contributions tax. Any excess concessional contributions can count as non-concessional contributions. Your super fund must report this contravention to the Tax Office. If you’re notified that you’re liable to pay the excess concessional contributions tax you can pay the tax yourself. Alternatively, you can prepare a voluntary release authority and ask your super fund to release funds to help you meet your obligation to pay the tax. You can also use a combination of both payment methods. You must pay this tax within 21 days of receiving the notification. For more details see the Tax Office publication Super contributions — too much super can mean extra tax.

Non-concessional contributions

Non-concessional contributions (or after-tax contributions) are personal contributions you make to a complying superannuation fund that don’t qualify for a tax deduction. Anyone who is under 65 years of age can make a non-concessional contribution. Because these contributions are treated as capital contributions, your super fund does not have to pay 15 per cent contributions tax on the contribution, as is the case if you make a concessional contribution. To add icing to the contribution cake, these contributions are not liable to tax at the time they are withdrawn from your super fund (see chapter 8).

Non-concessional contribution cap

A non-concessional contribution cap amount limits the amount you can contribute to your super fund each year. For the financial year ended 30 June 2012 the non-concessional contribution cap amount is $150 000 if you’re under 65 years of age. Further, if you’re less than 65 years of age, you can make non-concessional contributions up to a maximum of $450 000 during the financial year. But if you do this, you can’t make any further non-concessional contributions for the next two financial years. Once you turn 65 years of age you need to satisfy the work test if you want to make a non-concessional contribution, and the maximum you can contribute each year is limited to $150 000. To comply with the work test you need to work a minimum of 40 hours over a consecutive 30-day period during financial year. Once you turn 75 years of age you can no longer make non-concessional contributions. If you exceed the non-concessional contribution cap, the excess amount is taxed at the rate of 46.5 per cent (see figure 5.1 on p. 85).

The accumulation phase

During the super fund’s accumulation phase, where member benefits are accruing on their behalf, the superannuation fund will ordinarily derive its assessable income from three major sources:

• assessable contributions from members that qualify for a tax deduction

• investment income from the fund’s investment activities (such as interest, dividends and rent)

• capital gains on sale of CGT assets (such as shares and property).

Assessable contributions

If you intend to claim a tax deduction for concessional contributions you make to a complying super fund, you need to lodge a Notice of intent to claim a tax deduction for super contributions or vary a previous notice (NAT 71121) and specify the amount you intend to claim. When you do this, your super fund will notify you that your intention to claim a tax deduction has been acknowledged. The letter of acknowledgement must be included when you lodge your individual tax return. The amount you contribute is treated as part of your super fund’s assessable income and is liable to a 15 per cent contributions tax, which is deducted from your account.

Case study: claiming a tax deduction

During the financial year the XYZ complying superannuation fund received a $20 000 personal pre-tax concessional contribution from a self-employed member. The member, who is aged less than 50 years, had lodged a notification of intent to claim a $20 000 tax deduction for the financial year ended 20XX. Under these circumstances, the fund will treat the $20 000 concessional contribution as assessable contributions and liable to a 15 per cent contributions tax. The member can claim a tax deduction when her super fund issues a notification acknowledging the intention to claim a tax deduction and amount that will be claimed.

Investment income

The investment income your super fund derives from its investment activities (such as interest, dividends and rent) is included as part of the super fund’s total assessable income and liable to tax at the rate of 15 per cent.

Dividends and franking credits

Under Australian tax law, when a company pays a dividend it must tell its shareholders (for instance, your super fund) whether the dividend is franked or unfranked. If the dividend is franked, your super fund will receive a dividend franking credit (or tax offset) that can be applied against the tax payable. The size of the dividend franking credit depends on whether the company had paid tax on its profits and to what extent the dividend is franked. A dividend payment can be either fully franked (meaning your fund will get a 100 per cent franking credit), partially franked (for instance, your fund will get a 50 per cent franking credit) or unfranked (meaning your fund will get no franking credits). The following formula is used to calculate a fully franked dividend:

Cash dividend × 30 ÷ 70 = franking credit

Incidentally, 30 ÷ 70 is the company tax rate (0.30) ÷ (1 − company tax rate: 0.70) For instance, if your super fund receives a $1000 fully franked dividend your super fund will receive $1000 in cash plus a $428 dividend franking credit ($1000 × 30 ÷ 70 = $428).

You need to include both the franked dividend amount ($1000 in this case) and dividend franking credit ($428 in this case) as part of your super fund’s total assessable income. But the great news here is the dividend franking credits ($428 in this case) can be offset against the gross tax payable. If the total dividend franking credits exceed the gross tax payable the excess amount is refunded to your super fund.

Case study: receiving a dividend franking credit

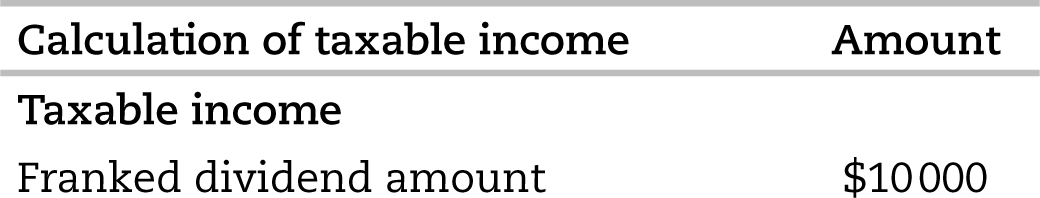

During the financial year an SMSF received a $10 000 fully franked dividend from CBA Ltd. The dividend franking credit was $4286 ($10 000 × 30/70 = $4286). This was the super fund’s sole source of income and the fund’s deductible expenses amounted to $500. The super fund needs to include the $10 000 franked dividend amount and $4286 dividend franking credit as part of its total assessable income ($10 000 + $4286 = $14 286), and the fund can claim a $4286 tax offset against the gross tax payable. If the dividend was partially franked (for instance, 50 per cent was franked) the dividend franking credit is reduced by 50 per cent to $2143 ($10 000 × 30/70 × 50 per cent = 2143).

Table 6.1 shows how the taxable income is calculated.

Table 6.1: calculation of taxable income for an SMSF receiving franked dividends

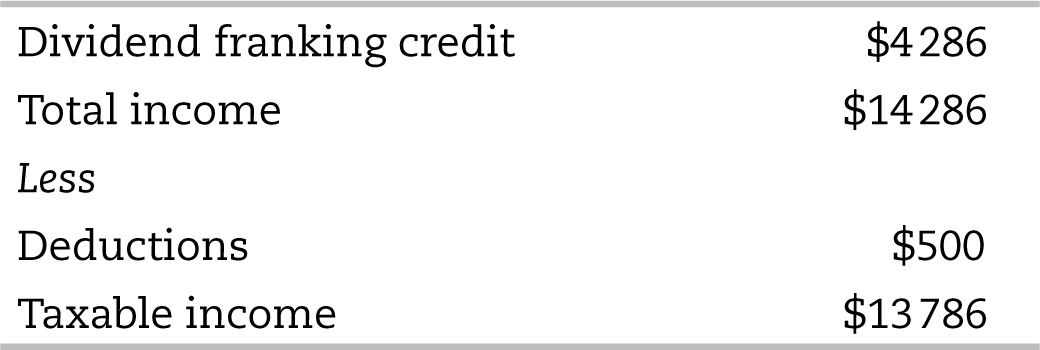

Table 6.2 shows how an SMSF is taxed.

As the total dividend franking credits ($4286) exceed the gross tax payable (plus a $180 supervisory levy) ($2247), the excess amount ($2039) is refunded to the super fund.

Dividend franking credits and the 45-day rule

To qualify for a dividend franking credit your super fund must hold the shares at risk (meaning that your shares could fall in value) for a minimum of 45 days (not including the purchase date and sale date). The holding period increases to 90 days for certain preference shares. If you fail to meet this technical condition, your super fund cannot claim a dividend franking credit. Further, your super fund is ineligible to claim the $5000 small shareholder threshold amount that’s available to individual shareholders who receive a total of $5000 or fewer dividend franking credits. For more details see the Tax Office publication Company tax franking credits: overview (NAT 5849). You can download a copy from the Tax Office website <www.ato.gov.au>.

Capital gains

If your super fund makes a capital gain on the sale of CGT assets (such as shares, real estate and units in a property trust) during the super fund’s accumulation phase, the capital gain is liable to tax. The amount of tax your super fund must pay depends on whether the CGT asset was owned for more than 12 months. This is how the tax is calculated:

• Only two-thirds of the capital gain is taxable at the rate of 15 per cent if the CGT asset was owned by the fund for more than 12 months.

• The entire capital gain is taxable at the rate of 15 per cent if the fund buys and sells a CGT asset within 12 months.

On the other hand, if the fund makes a capital loss on the sale of a CGT asset, the capital loss can be deducted only from a capital gain made in another asset sale. If the super fund makes no capital gains in the year the financial loss is made, the capital loss can be carried forward for an indefinite period until the super fund makes a capital gain.

If a super fund makes a capital gain on sale of CGT assets when the fund is in the pension phase, the entire capital gain is exempt from tax (see The pension phase on p. 137).

Case study: making a capital gain

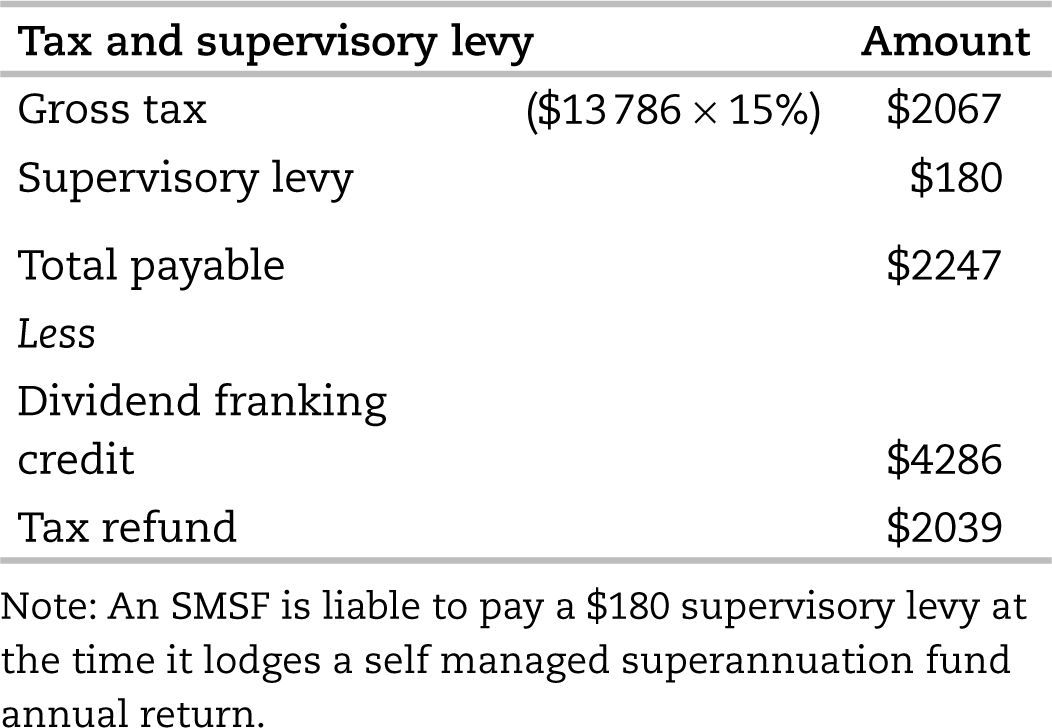

Three years ago the trustee of an SMSF purchased 1000 shares in XYZ Ltd at $10 per share (total cost $10 000) and paid $100 brokerage fee and GST. Today the trustee has sold the 1000 shares in XYZ Ltd and received $15 per share ($15 000) and paid $150 brokerage fee and GST. Table 6.3 shows how the CGT is calculated.

Table 6.3: calculation of CGT on the sale of SMSF assets

As the shares were owned for more than 12 months, only two-thirds of the capital gain is liable to tax (in this case $3166) at the rate of 15 per cent. This means that the entire capital gain ($4750) is effectively taxed at the rate of 10 per cent. (But if the shares were bought and sold within 12 months the entire capital gain would have been taxed at the rate of 15 per cent.)

If the capital proceeds on sale were $5000 the super fund would have made a $5250 capital loss ($10 250 − $5000 = $5250).

Capital gains and small business

If you carry on a small business you could qualify for a number of tax concessions. Under Australian tax law, you’re considered to be running a small business if your annual turnover (sales) is less than $2 million per year. If your turnover is higher than this, your net business assets cannot exceed $6 million for your enterprise to be classed as a small business.

One significant tax concession is available under the small business CGT retirement provisions. An individual can claim a $500 000 lifetime retirement exemption on the sale of active business assets, such as plant and equipment and business premises. The capital gain that is exempt is called the CGT exempt amount. If you are a sole trader or in partnership and you are over 55 years of age, capital gains up to your $500 000 lifetime limit are exempt from tax. You can keep the cash from the sale or put it into a complying super fund or retirement savings account (RSA).

If you’re less than 55 years of age, for the capital gain to be exempt, you must immediately contribute the CGT exempt amount into a complying super fund or RSA. This means you can’t access the funds until you reach your preservation age and satisfy a condition of relief (see chapter 8).

Different rules apply if the business assets are owned by a trust or company. For more information, see the Tax Office publication Retirement exemption — capital gains tax concession for small business.

Allowable deductions

Under Australian tax law, you can deduct from your assessable income any loss or outgoing (payment) to the extent that it is incurred in gaining or producing your assessable income. Expressed simply, for a loss or outgoing to qualify as a tax-deductible expense, there must be a relevant and necessary connection between the expenditure you incur and the derivation of assessable income. The Tax Office has issued Tax Office Ruling TR 93/17: Income tax: income tax deductions available to superannuation funds to explain what types of losses and outgoings a superannuation fund can claim. The common types of tax deductions a superannuation fund, and more particularly an SMSF, can claim are:

• actuarial costs

• accountancy fees

• approved audit fee

• death benefit increase (see chapter 9)

• capital works deduction (rental properties)

• death and disability premiums

• depreciation of assets (rental property)

• insurance premiums (rental property)

• interest expenses

• investment expenses

• legal costs

• management and administration expenses

• tax agent fees.

Self managed super funds tax return

At the end of each financial year the trustee must lodge a Self-managed superannuation fund annual return by 31 October disclosing the fund’s taxable income. The Tax Office has advised that refusal to lodge a tax return or not lodging a tax return on time are common mistakes with SMSFs. This contravention could cause a complying super fund to become a non-complying fund and lose its tax concessions. When the return is lodged the Tax Office will add a $180 supervisory levy to the gross tax payable (see the following case study).

Case study: calculating the taxable income

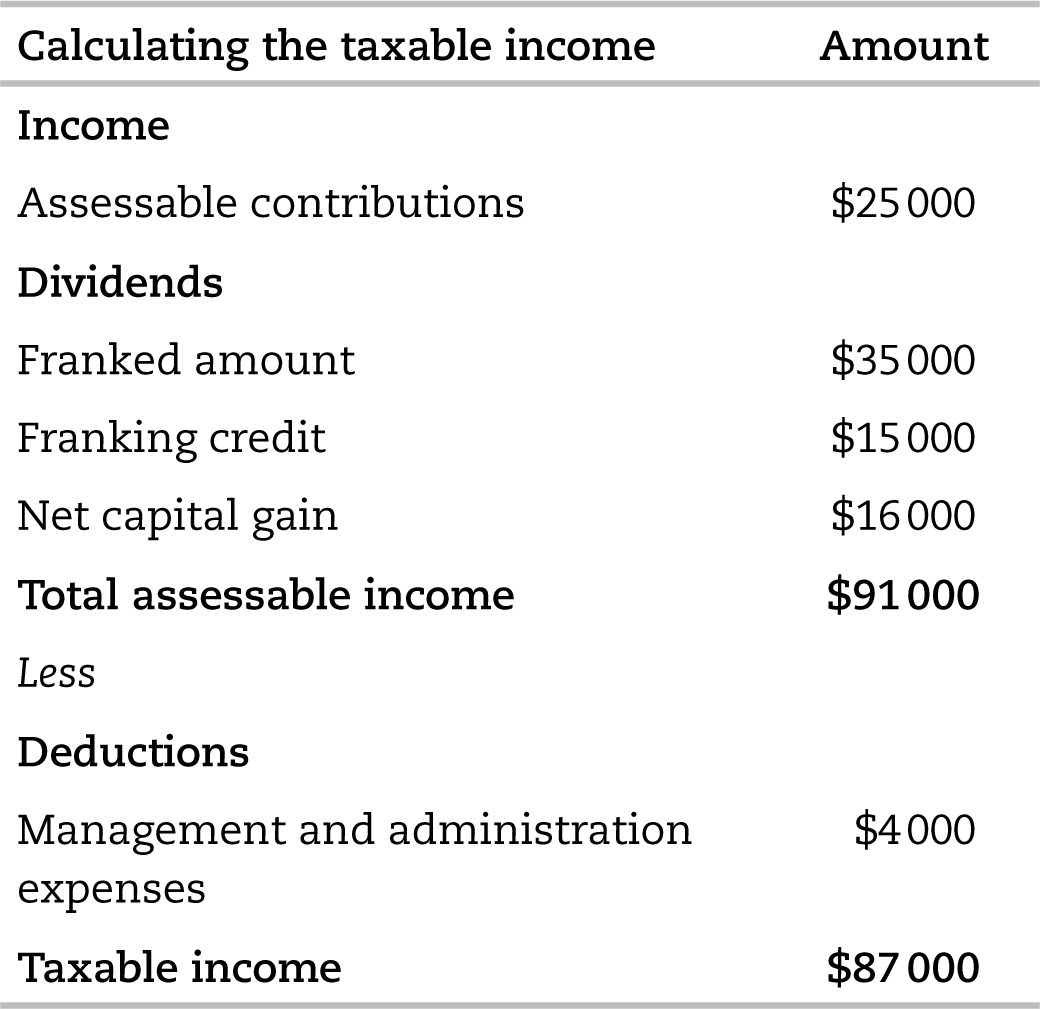

During the financial year, an SMSF received a $25 000 personal superannuation contribution from a self-employed member who was less than 50 years of age. The member has informed the trustee that they intend to claim a tax deduction for the contribution they made. Under these circumstances, the $25 000 personal contribution will be treated as an assessable contribution. During the financial year, the super fund also received $35 000 fully franked dividends from its investment activities, and the dividend franking credits were $15 000. The super fund also made a $24 000 capital gain on sale of shares that were owned for more than 12 months. The super fund’s management and administration expenses were $4000. Table 6.4 shows the SMSF’s taxable income and deductions.

Table 6.4: calculation of an SMSF’s income and deductions

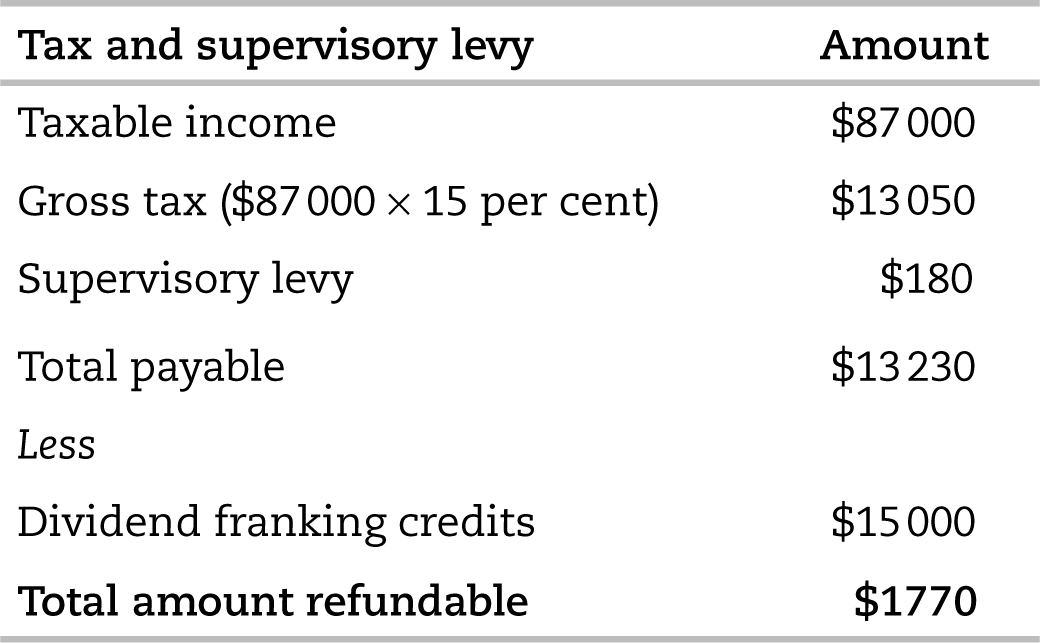

Table 6.5 shows how income tax is calculated for the SMSF, based on the amounts shown in table 6.4.

Table 6.5: calculation of income tax for the SMSF

Here’s an explanation of some of the entries in tables 6.4 and 6.5.

• As the shares were owned for more than 12 months, only two-thirds of the capital gain is liable to tax ($24 000 × 2/3 = $16 000).

• At the time of lodgement, the SMSF must pay a $180 supervisory levy.

• The SMSF must receive an audit report from an approved auditor before it can lodge its Self-managed superannuation fund annual return.

The pension phase

When a complying super fund (and more particularly an SMSF) is in the pension phase, all investment income earned and all capital gains on the sale of CGT assets to fund pension payments are exempt from tax. In addition, all dividend franking credits are refunded to your super fund (see Dividends and franking credits on p. 125). For a super fund to be in the pension phase, the relevant member must satisfy a condition of release. The most common way to meet this condition is reaching preservation age and retiring from the workforce (see chapter 8). (If there are other members who have not yet retired, their respective benefits will still be in the accumulation phase.)

Useful references

Australian Taxation Office publications

• Refunding excess imputation credits — superannuation funds, approved deposit funds and pooled superannuation trusts

• Super and capital gains tax

• Super co-contributions

• Super contributions — too much super can mean extra tax

Australian Taxation Office interpretative decisions

• ID 2002/371: Superannuation Part IX taxation of superannuation entities — superannuation fund expenses — trauma policy

• ID 2010/76: Superannuation benefits: deduction for insurance — increase in the untaxed element