The sole purpose of building wealth in a complying super fund must be to provide retirement benefits to members, and benefits to dependants in the event of a member’s death. A significant advantage of running an SMSF is your capacity to choose your own investments to fulfil these core conditions. Although this may seem like a great idea, you need to weigh up your personal commitment, the rules you must comply with, and whether you can consistently outperform the professionally managed super funds. In this chapter, I explain the different types of asset classes an SMSF can own to help fund retirement strategies, and the key principles of investing.

Chapter 7: Building wealth: accumulating retirement benefits

Investment strategy

The trustees of an SMSF are permitted to purchase certain approved asset classes to help maximise member benefits and fund retirement strategies. To do this by the book, the trustees must prepare and implement an investment strategy. All investment decisions must be made in accordance with the fund’s investment strategy, and they must not contravene the SIS Act. If in doubt the trustees should seek professional advice. And any advice they receive should be documented. According to the SIS Act, having an investment strategy provides a defence for trustees against an action by a member for loss or damages suffered as a result of the trustee making an investment. This is on the condition that the trustees have acted in good faith in accordance with the fund’s investment strategy. The investment strategy must be in writing and should consider the following important issues:

• The fund’s objectives. The trustees must set out your core objectives (for instance, to achieve a certain rate of return), and the steps you intend to take to achieve those objectives.

• Diversification. The trustees must list the different types of asset classes you plan to hold to achieve your objectives (such as shares, fixed interest securities, real estate, managed funds and collectables).

• Investment risk. The trustees must consider the risks involved for each of the different asset classes you plan to hold. This is extremely important as certain investment assets (particularly shares) can decrease in value, which could have an adverse effect on member benefits.

• Investment yield. The trustees must note the return you believe you are likely to receive on your investment portfolio.

• Liquidity. The trustees must set out your fund’s ability to pay retirement benefits (pensions) and the various ongoing costs you’re likely to incur when pensions or lump sums become due and payable. This could become a problem if your super fund owns predominantly investment assets (for instance, property and collectables) that can’t be readily sold at short notice.

The trustees must review the investment strategy at regular intervals and make any necessary changes in the best interest of all members. The trustees must also keep proper records to verify the existence of these investment assets (such as a holding statement for shares and a certificate of title for property) and how they’re valued. These documents must be produced when your superannuation fund is audited by an independent auditor at the end of each financial year (see chapter 4).

At a glance: eligible investment assets

Eligible asset classes an SMSF can hold include:

• business real property from a related party. Your super fund can purchase your business premises and lease them back to you (see chapter 4)

• certain approved collectables and personal use assets (such as artwork, antiques, rare coins and stamps). However, members cannot gain a personal benefit from them (for instance, display the collectables at a member’s home or use and enjoy them). The federal Labor government has proposed that, from 1 July 2011, collectables must be insured and kept in storage, and the trustee must get annual valuations

• derivatives such as call and put options, and contracts for differences. For more details about these investments see the Australian Security Exchange website <www.asx.com.au> and go to ‘Self managed super funds’, then ‘Using ASX listed products in SMSFs’

• fixed interest securities (such as government bonds and term deposits)

• in-house assets (for instance, lease agreements) that do not exceed more than 5 per cent of the market value of the super fund’s total investment assets (see chapter 4)

• instalment warrants to buy certain approved investment assets (see chapter 4)

• managed funds operated by major financial institutions

• real estate (such as commercial, industrial and residential property)

• shares listed on the Australian Securities Exchange (ASX).

At a glance: what your SMSF can’t do

Your SMSF can’t do the following:

• acquire property from a related party (for instance, a main residence from a member or a member’s relative)

• lease a residential property your super fund owns to a related party

• lend money to your super fund

• lend money to members or their relatives (for instance, spouse, child or parent).

General investment principles

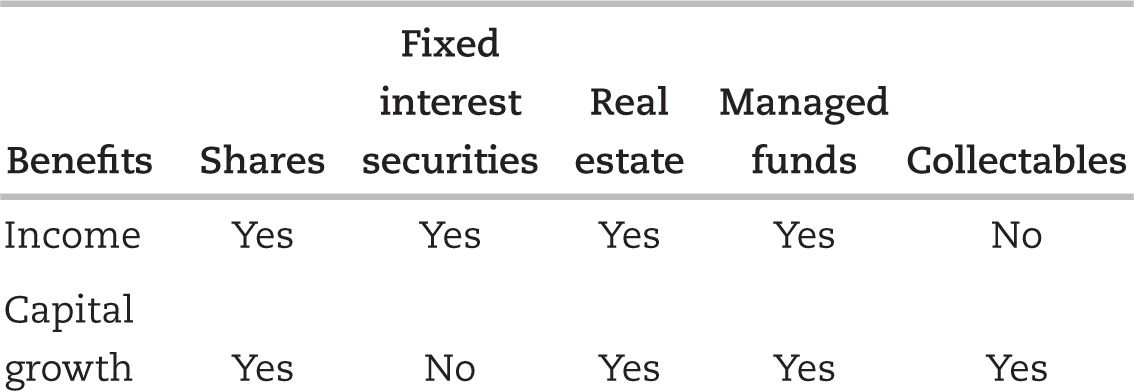

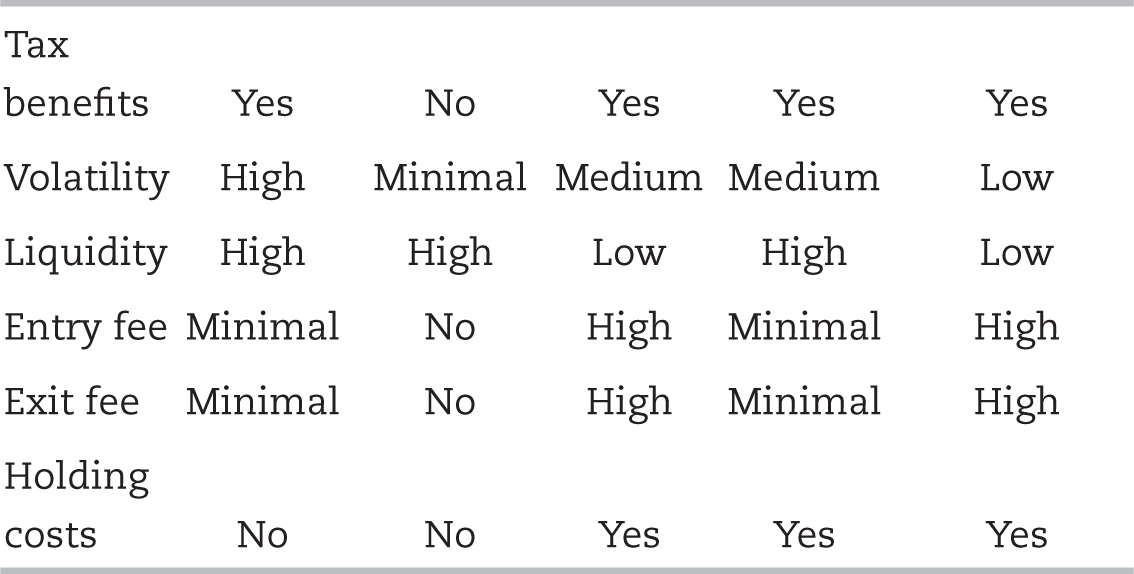

There are many factors you need to compare and consider when putting together a suitable investment portfolio to help maximise member benefits. This is because each asset class will have certain features that may or may not interest you as a trustee. You need to weigh up key factors, such as the income the asset may earn; whether you can expect capital growth; what the tax benefits may be; as well as the volatility, liquidity, entry and exit fees and holding costs (see table 7.1) of each asset. An ideal investment is one that has the capacity to deliver long-term capital growth while also paying you a regular income stream. The most common investments your super fund is likely to consider are:

• shares

• fixed interest securities

• real estate

• managed funds

• collectables.

Table 7.1: investment asset classes at a glance

Shares

When you invest in the share market you will be buying shares in major Australian companies that are listed on the ASX, such as BHP Billiton, the Commonwealth Bank (CBA) and Woolworths. You will be relying on these companies running profitable businesses to provide you with a steady income stream in the form of dividends, and long-term capital growth. You will generally find capital growth depends primarily on a company’s capacity to continually expand its business operations and boost profits. The more profitable these companies become, the more likely it is that your fund’s investment portfolio will appreciate in value. So it’s important that you understand what these companies do to generate sales and whether they’re trading profitably. A stockbroker can help you with this exercise.

When you invest in shares listed on the ASX, you need to be aware of four major documents. These documents are:

• Buy contract note. When you buy shares your stockbroker will issue a buy contract note setting out details such as the purchase price, the number of shares you bought, and your purchase costs. You need this information to calculate the cost base of your shares (see chapter 6).

• Holding statement. Shortly after you buy your shares, the company you have invested in will send you a holding statement setting out the number of shares you own in the company. This document proves that you are the owner of these shares.

• Sell contract note. When you sell shares your stockbroker will issue a sell contract note setting out details such as the sale price, the number of shares you sold, and your sale costs. The buy and sell contract notes can be used to quickly calculate the amount of capital gain or capital loss you made on the sale (see chapter 6).

• Dividend statements. Once you have bought shares you become a part-owner of the company, and so you’re eligible to receive a share of the company’s profits, which are referred to as dividends. When a company pays you a dividend, it will issue a dividend statement setting out the amount of dividends you were paid, and the dividend franking credits you can claim (see chapter 6).

You need to produce all of these documents when your super fund is audited by the approved auditor that you must appoint each year. This is to verify the number of shares your super fund owns, and the amount of dividends and dividend franking credits your fund received. As share prices are published daily you can quickly calculate the market value of all the shares your super fund owns, and check whether they have increased or decreased in value.

At a glance: benefits of investing in shares

The benefits your super fund can gain from investing in the share market are listed here:

• Income (dividends). Companies normally declare and pay two dividends each year. They are described as an interim dividend and a final dividend. The average dividend yield of the major companies listed on the ASX is normally around 4 per cent per year, and the grossed-up dividend yield (dividend + franking credit) is normally around 5.2 per cent per year.

• Capital growth. A significant benefit from owning shares is their capacity to increase in value. Under Australian tax law, unrealised capital gains are not liable to tax until the shares are sold. To add icing to the capital growth cake, if you sell the shares during the super fund’s pension phase, any capital gain you make on sale is free of tax (see chapters 6 and 8).

• Tax benefits. These come in two main forms:

• Dividend franking credits. If a company pays your super fund a franked dividend you will receive a dividend franking credit tax offset that you can deduct from the gross tax payable. And if the total dividend franking credits exceed the gross tax payable, the excess amount is refunded to your super fund (see chapter 6).

• CGT discount. If your super fund makes a capital gain on sale of shares during the accumulation phase, only two-thirds of the capital gain is assessable, providing the shares were owned for more than 12 months (see chapter 6).

• Liquidity. As shares listed on the ASX can be sold within a matter of seconds; you can quickly access cash at short notice (normally within four days), which means that shares are highly liquid. This is good to know if you need to pay a substantial retirement benefit to a member or lump sum death benefit to a dependant in the event of a member’s death (see chapters 8 and 9).

• Prices published daily. You can quickly determine the market value of your super fund’s share portfolio, and calculate the amount of benefits that members are accumulating in their respective accounts whenever you need to.

• Entry and exit fees. The brokerage fees associated with buying and selling shares are minimal (usually around 0.05 per cent of the cost of the shares if bought and sold online). No GST is payable on share transactions, although your super fund will have to pay GST on brokerage fees.

• No holding costs. The good news is there are no ongoing holding costs associated with owning shares, as is the case if you invest in real estate, managed funds and collectables.

At a glance: limitations of investing in shares

The limitations of investing in the share market are:

• Volatility. As share prices fluctuate daily, there’s a major risk that your share portfolio could fall in value, adversely affecting member benefits. Under Australian tax law, an unrealised capital loss cannot be claimed until you sell the shares.

• Dividend payments could fall. There’s a risk that a company may not pay you a dividend or that the dividend payment could decrease. This could become a major concern if your super fund is in the pension phase, and you’re relying on dividends to pay pensions to members.

a complying superannuation fund, a complying approved deposit fund or a pooled superannuation trust in relation to the year of income. See also appendix B, Special income.

Shares: diversification

Trustees of an SMSF are required to consider diversification when preparing an investment strategy, so it’s best to invest in a number of companies from different sectors of the Australian economy. A manageable portfolio of around 10 companies may be worth examining. If you do this you won’t be putting all your eggs in one basket, and you will avoid any potential disasters that could adversely affect your portfolio if one of these companies were to perform poorly. Further, the more companies you have, the greater the chance of getting into something that could make you a lot of money. A good starting point when putting together a quality share portfolio is to examine the S&P/ASX 20 index (see table 7.2, overleaf). This index consists of the top 20 Australian companies listed on the ASX: it represents more than 50 per cent of the entire wealth of the Australian economy. A financial planner or stockbroker can put together a quality share portfolio to help you maximise member benefits.

Table 7.2: S&P/ASX 20 Index

Fixed interest securities

When you invest in fixed interest securities (such as bank bills, term deposits, debentures and government bonds), you will be depositing your money with reputable financial institutions or government authorities that are properly regulated. In return for the use of your money, you will ordinarily receive a fixed rate of interest at regular intervals (for instance, every six months), which you can usually take in cash or have added to the principal. When the loan matures, you will get back the amount you initially invested (plus the interest if you have not taken it in cash). Investing in fixed interest securities may interest you if you feel uncomfortable with alternative assets (such as shares, real estate and managed funds) that can fall in value and adversely affect member benefits.

As superannuation is a long-term retirement strategy you could consider the benefit of compound interest, where you can reinvest the interest you derive and earn interest on your interest. For instance, if you deposit $10 000 in a term deposit for five years, and the interest rate is 7 per cent compounding annually, when the loan matures your initial $10 000 deposit will have increased to $14 025. And the growth rate will be even higher if the interest is paid more frequently (for instance, every three or six months). Under Australian tax law the interest that’s allowed to compound in your account each financial year must be included as part of your super fund’s taxable income (as is the case if it is paid to you each year), and it is liable to tax at the rate of 15 per cent. For more details see Tax Office interpretative decision ID 2002/886: Income tax: assessability of compound interest.

At a glance: benefits of investing in fixed interest securities

The benefits your super fund can gain from investing in fixed interest securities are:

• Income (interest). Interest is ordinarily credited to your super fund’s account on a monthly, quarterly, half-yearly or yearly basis. Interest rates vary in line with the prevailing market and the term of the investment (currently around 6 per cent).

• Liquidity. When the loan matures you will get back the amount you initially invested. This is a worthwhile benefit to have up your sleeve if you need a specific amount of cash to meet a future commitment. This may not be the case if you invest in market-linked securities (such as shares, real estate and managed funds), which can decrease in value.

• Entry and exit fees. There are no entry and exit fees, but you could incur a penalty (for instance, receive a lesser amount of interest) if you terminate the investment before the maturity date.

• No holding costs. There are no ongoing costs with this class of investment.

At a glance: limitations of investing in fixed interest securities

The limitations, or risks, of investing in fixed interest securities are:

• No capital growth. A major drawback with this class of investment is that they don’t increase in value (in contrast to shares or real estate, for instance), which could adversely affect member benefits in the long-term.

• No tax benefits. There are no tax benefits that you can take advantage of, as is the case if you receive a franked dividend from a share investment.

• Interest rates could fall. There’s a risk that interest rates could fall, which means the return on your investment will decrease. For instance, you are currently receiving 7 per cent interest on a term deposit. If the best rate you can get when the term deposit matures is 5 per cent, the return on your investment will decrease by 2 per cent if you decide to reinvest your money in another term deposit.

Real estate

If your super fund were to invest in income-producing property (such as commercial and residential property), your fund would receive a regular income stream (rent) plus capital growth if the property appreciated in value. As a general rule, property in good locations tends to double in value every seven to 10 years. As superannuation is a long-term investment strategy, this class of investment could prove a good way of accumulating benefits that members can access when they retire.

At a glance: benefits of investing in real estate

The benefits your super fund can gain from investing in real estate are:

• Income (rent). Rent is normally payable every month. Under Australian tax law, rent is liable to tax when it’s paid or credited to your super fund. The average gross rental yield is normally around 4 per cent, and the net yield (after payment of rental expenses and taxation) is generally around 3 per cent.

• Capital growth. Real estate is a long-term investment strategy that has the capacity to increase in value. This could prove an excellent way of building up member benefits.

• Tax benefits. There are three tax advantages to investing in real estate:

• Tax deductions. Expenditure (such as interest, rates and land taxes, insurance, repairs and depreciation) are tax deductible, and you could qualify for a capital works deduction (building write-off deduction).

• CGT discount. If your super fund makes a capital gain on the sale of a property during the accumulation phase, only two-thirds of the capital gain is assessable, provided the property has been owned for more than 12 months (see chapter 6). The good news gets even better if you sell a property during the super fund’s pension phase, as the entire capital gain on sale is then exempt from tax (see chapter 8).

• Small business concessions. If you operate a small business and sell or transfer your business premises to your SMSF, under the CGT concessions for small business, any capital gain you make on disposal of those assets may be concessionally taxed or exempt from tax (see chapter 4).

• No volatility. Property values tend to be less volatile than the value of shares and tend to rise over the long term.

At a glance: limitations of investing in real estate

The limitations, or risks, of investing in real estate are:

• Expensive investment. The purchase price of a property can vary upwards from $200 000 to well over a few million dollars. So your super fund may not be in a position to buy a property outright. But an SMSF is permitted to borrow money under certain circumstance to purchase a rental property (see chapter 4).

• Liquidity problems. A major risk with real estate is that it is not liquid: it could take months to sell and there’s no guarantee you will receive the sale price you’re seeking. This could become a major concern if your super fund needs cash immediately to pay retirement benefits to members or a lump sum death benefit to a dependant in the event of a member’s death (see chapter 8). The Tax Office has advised that an inability to cash pension assets (such as property) to meet minimum pension payments is a common mistake of SMSFs.

• Entry and exit fees. You will incur purchase costs (such as stamp duty imposed by state and territory governments on property purchases) and selling costs (such as an agent’s commission to sell the property). Depending on the value of the property, these outlays could amount to many thousands of dollars.

• Holding costs. Ongoing costs (such as rates and land taxes, insurance and maintenance costs) must be met whether the property is leased or vacant. This could have an adverse impact on a super fund’s cash flow if the property were to become vacant.

• Lose money. There’s a risk property values could fall or the property could become vacant for a substantial period of time; which could adversely affect member benefits.

Managed funds

Managed funds are mutual investment funds managed by Australia’s leading financial institutions. They give small investors (such as SMSFs) the opportunity to invest in a wide range of asset classes that they cannot ordinarily afford to purchase. The minimum you can invest is normally $2000. This is a good way of building up a diversified investment portfolio, and you can select a mix of investment options to suit your particular circumstances. The asset classes you can consider include:

• Cash. Your money is invested in securities such as bank bills and government bonds.

• Equity growth. Your money is invested in domestic and foreign share markets.

• Indexed. Your money is invested in a particular index (such as the S&P/ASX 200 index comprising the top 200 companies and property trusts listed on the ASX).

• Property. Your money is invested in major residential, industrial and commercial property developments located throughout Australia or overseas, or both.

When you invest in a managed fund you will buy units. Depending on the investments you select, the value of your units will rise and fall in line with the prevailing market. You can also buy additional units at regular intervals.

At a glance: benefits of investing in managed funds

The benefits your super fund can gain from investing in managed funds are:

• Income. Managed funds normally pay at least two income distributions each year.

• Capital growth. Your units can increase in value and help build member benefits. This will depend on the performance of the underlying investments you had selected.

• Tax benefits. If you invest in shares that pay franked dividends, your fund will benefit from dividend franking credits, and if you invest in property, your fund may receive tax-free distributions.

• Liquidity. Your units can be sold quickly and you will normally get your money back within seven days. The amount you receive will depend on the market value of your units at the time of sale.

• Entry and exit fees. The cost of buying and selling your units is minimal.

At a glance: limitations of investing in managed funds

The limitations, or risks, of investing in managed funds are:

• Holding costs. You will incur ongoing management and administration fees, and you could also have to pay contribution fees and switching fees. The relevant details are set out in the product disclosure statement that you need to read when you join the fund (see chapter 1).

• Volatility. Your units will rise and fall in line with the prevailing market, as is the case with shares, and there’s a risk that your units could fall in value, which would adversely affect member benefits.

Collectables

An SMSF can invest in certain approved collectables and personal-use assets (such as artwork, jewellery, antiques, classic cars, wine, rare coins and stamps) provided the investment is in accordance with your super fund’s investment strategy (see Investment strategy on p. 140). However, a member cannot gain a personal benefit from the purchase of collectables, and the sole purpose of buying them must be to provide retirement benefits for members. This means a trustee cannot display the collectables in their home, nor can a trustee use and enjoy them (for instance, drive a prized classic car or wear jewellery that the super fund owns). For more information, see Tax Office Ruling SMSFR 2008/2: Self Managed Superannuation Funds: the application of the sole purpose test in section 62 of the Superannuation Industry (Supervision) Act 1993 to the provision of benefits other than retirement, employment termination or death benefits. Generally, you need to have some degree of skill and knowledge regarding what collectables are worth buying, and whether they’re likely to appreciate in value. It’s best that you seek expert advice if you’re not sure, and that you check the collectables you plan to buy do not contravene the SIS Act. Stiff financial penalties may apply if you fail to comply with the various rules and regulations associated with investing in collectable and personal-use assets. And your super fund could be deemed non-compliant if the breaches are found to be serious and lose its tax concessions.

At a glance: benefits of investing in collectables

The benefits your super fund can gain from investing in collectables are:

• Capital growth. Certain collectables (such as artwork) have a capacity to increase in value and help build member benefits.

• Tax benefits. Under the CGT provisions, capital gains on collectables that cost $500 or less are disregarded, and capital gains on the sale of classic cars are exempt from tax.

At a glance: limitations of investing in collectables

The limitations (risks) of investing in collectables are:

• Income. As most collectables must be kept in storage, you will not ordinarily derive an income stream from them.

• Volatility. The market value of major collectables rise and fall in line with the prevailing market.

• Entry and exit fees. As these items are normally purchased at an auction, you will incur commission fees at the time you buy and sell them. (The commission fees are generally around 10 to 20 per cent of the purchase and sale price.)

• Liquidity. Collectables are not a liquid investment. It could take months to sell a collectable and there’s no guarantee you will receive the sale price you’re seeking. This could become a major concern if your super fund has insufficient cash on hand to meet minimum pension payments. To reduce the risk, it’s best that you invest in popular collectables, such as artwork, antiques, classic cars, rare coins and stamps that can be readily sold at auction.

• Capital losses. There’s a risk that collectables could fall in value. Under the CGT provisions, a capital loss on the sale of a collectable can only be deducted from a capital gain you make on the sale of another collectable.

• Holding costs. The federal Labor government has proposed that from 1 July 2011 collectables must be insured and kept in storage, and the trustee must get annual valuations.

Useful references

• Department of Families, Community Services and Indigenous Affairs publication: Investing for your retirement available from <www.fahcsia.gov.au/>

• Australian Securities & Investments Commission consumer website <www.moneysmart.gov.au>. Go to ‘About financial products — Superannuation’, and click on ‘Choosing your investment strategy’.

Australian Taxation Office interpretative decisions

• ID 2007/56: Superannuation: Self Managed Superannuation Funds: contracts for differences (CFDs) — no fund assets deposited with CFD provider

• ID 2007/57: Superannuation: Self Managed Superannuation Fund: contracts for differences (CFDs) — fund assets deposited with CFD provider — charge over fund assets

• ID 2007/58: Superannuation: Self Managed Superannuation Fund: trustee using a margin account for fund investments in listed shares

• ID 2009/92: Superannuation income tax: tax treatment of losses realised by a complying SMSF on disposal of shares

• ID 2010/162: Superannuation: Self Managed Superannuation Fund: limited recourse borrowing arrangement — borrowing from a related party on terms favourable to the self managed superannuation fund

Other taxation rulings

• Superannuation Circular 2003/1: Self managed superannuation funds

• SMSFR 2008/2: Self Managed Superannuation Fund: the application of the sole purpose test in section 62 of the Superannuation Industry (Supervision) Act 1993 to the provision of benefits other than retirement, employment termination or death benefits