Chapter 8: Accessing your super fund benefits: enjoying the spoils

The sole purpose of a complying super fund must be to provide benefits to members upon retirement, and benefits to dependants in the event of a member’s death. Contributions to a complying super fund are also made to provide benefits to you when you retire, and benefits to dependants in the event of your death. As superannuation is a long-term strategy, the more you’re able to accumulate, the more you will have when you can legally access your preserved benefits, which usually occurs when you reach your preservation age and retire. When that historic moment in your life arrives, you have the option to purchase a superannuation pension, take a lump sum payment or receive a combination of both. As an added bonus, you will also gain significant tax benefits. In this chapter, I discuss when you can legally access your preserved benefits, the various superannuation pension options available, and the tax benefits you can gain.

Conditions of release

Under Australian tax law, you generally cannot access your preserved benefits until you reach your preservation age and satisfy a condition of release.

Preservation age

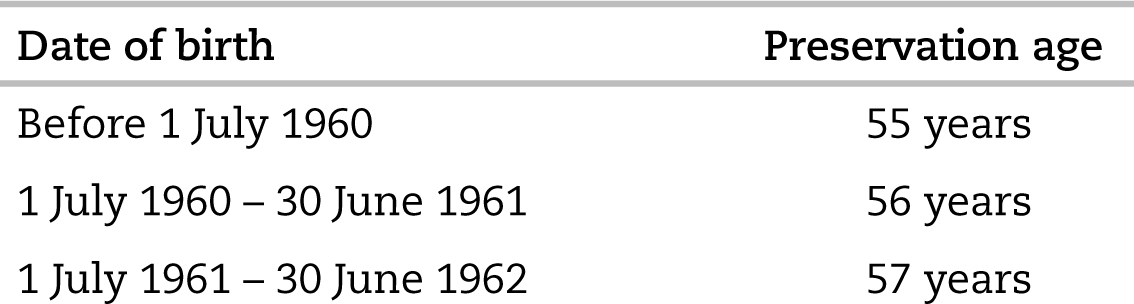

Your preservation age depends on the date you were born. If you were born before 1960 you can access your preserved benefits once you reach 55 years of age, and if you were born after 1964 you need to wait until you turn 60 (see table 8.1). The most common condition of release is retirement. You will be considered to have retired if you can satisfy the trustee of your super fund that you have no intention of working more than 10 hours per week.

Table 8.1: preservation age

At a glance: conditions of release

The main means by which you can access your preserved benefits are summarised below.

• You reach your preservation age and retire. This will depend on the date you were born; contact the trustee(s) of your fund.

• You reach your preservation age (currently 55 years of age) and elect to receive a transition to retirement pension; contact the trustee(s) of your fund.

• You cease your current employment after you reach 60 years of age, and you’re no longer contributing to your super fund; contact the trustee(s) of your fund.

• You reach 65 years of age — even if you’re still working; contact the trustee(s) of your fund.

• You have less than $200 in preserved benefits and terminate employment; contact the trustee(s) of your fund.

• You become disabled or ill and are unlikely to work again; contact the trustee(s) of your fund.

• You need to access your preserved benefits on compassionate grounds (for instance, for medical reasons, mortgage assistance or funeral assistance); contact the Australian Prudential Regulation Authority (APRA).

• You are experiencing severe financial hardship; contact the Australian Taxation Office (ATO).

• You are a temporary resident permanently leaving Australia; contact the ATO.

• You are terminally ill; contact the trustee(s) of your fund (see chapter 9).

• You die; your next-of-kin should contact the trustee(s) of your fund (see chapter 9).

Severe financial hardship

If you experience severe financial hardship, you may be eligible for early release of your preserved superannuation fund benefits. However, you can only make an application if you satisfy certain conditions:

• Under your preservation age. If you’re less than 55 years of age you must have been in receipt of Commonwealth income support for the past 26 weeks, and also be able to demonstrate that you’re unable to meet ‘reasonable and immediate living expenses’. For example, you have insufficient funds to pay for overdue household bills, such as rent, gas, electricity, telephone and credit cards. If your superannuation fund approves your application, the trustee may release during a particular financial year a lump sum payment of between $1000 and $10 000, or the entire amount if you have less than $1000 in your account.

• Over your preservation age. You must have been in receipt of Commonwealth income support for the past 39 weeks and not be gainfully employed either full time or part time. If your superannuation fund approves your application, the trustee may release your entire benefit to you.

For more details you can visit the Australian Prudential Regulation Authority (APRA) website <www.apra.gov.au> and go to ‘Other grounds for early release of superannuation benefits’.

Temporary resident

If you hold an eligible temporary resident visa that has expired or been cancelled and you permanently leave Australia, you can claim your superannuation benefits while you were working in Australia (referred to as departing Australia superannuation payments). These payments are ordinarily liable to 35 per cent withholding tax, which is payable before you leave. For more details see the Tax Office publication Working temporarily in Australia — claim your superannuation after you leave (NAT 8592).

Pensions

On 1 July 2007 the federal government introduced a number of tax incentives to encourage Australians to take a superannuation pension rather than withdraw their benefits in cash.

At a glance: SMSFs and starting a pension

The key conditions and procedures to start a superannuation pension are as follows:

• The member must lodge a formal notification and proof with the trustee(s) that they have met a condition of release. The member must specify the pension option they want and the amount to be transferred to a pension fund. Note that an SMSF can only pay a transition to retirement pension or account-based pension (see Buying a superannuation pension on p. 181).

• The trustee(s) prepares minutes confirming the notification and checks whether the super fund’s trust deed permits payment of the pension option to the member.

• The relevant member’s super fund benefits convert from the accumulation phase to the pension phase, in which earnings are no longer liable to tax.

• The trustee(s) identifies the assets that will fund pension payments. The trustee(s) must obtain an annual actuarial report if the pension assets are not segregated. (The actuarial report verifies the market value of the assets that fund the pension payments.)

• The trustee(s) prepares a product disclosure statement (PDS) setting out the assets that back the fund pension payments, payment details and tax payable if the member is aged less than 60.

• The trustee(s) withholds pay-as-you-go (PAYG) withholding tax for the taxable component of pension if the member is less than age 60 (less the 15 per cent tax offset). (See chapter 8.)

• The trustee(s) notifies the member that the pension has been approved and details of payment. Pension must be paid in cash. For payments by cheque see Tax Office Ruling SMSFR 2010/D1: Self managed superannuation funds: the scope and operation of subparagraph 17A(3)(b)(ii) of the Superannuation Industry (Supervision) Act 1993.

• The trustee(s) must pay an annual minimum pension each year for a transition to retirement pension or account-based pension (see Buying a superannuation pension on p. 181).

Taxation

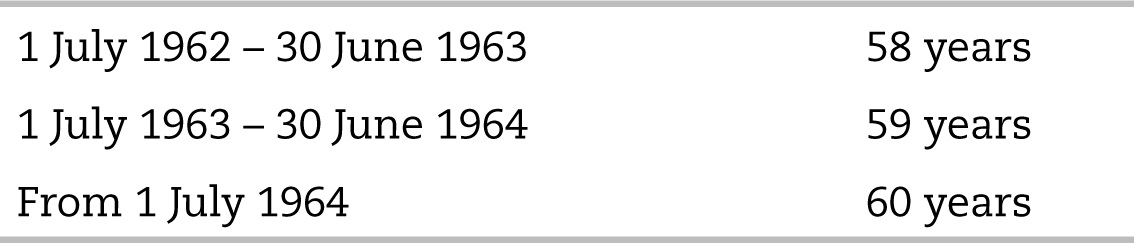

If you purchase a superannuation pension from a complying superannuation fund with your preserved benefits, the amount of tax payable depends on whether you’re under or over 60 years of age, and the payment’s classification (see figure 8.1). The Tax Office calls a superannuation pension a superannuation income stream. Your preserved benefits may consist of a combination of tax-free components and taxable components. This is to take into account the old rules of taxing super funds and contributions before 30 June 1983 (pre-1983), and the new tax rules that apply to taxing super funds and certain contributions made after 1 July 1983 (post-1983). These components are taxed as follows.

Tax-free component

These payments are tax free and are excluded from your assessable income. They can be made up of the following:

• pre–1 July 1983 component (if you commenced employment before 1 July 1983)

• concessional component (see chapter 5)

• post-1994 invalidity component

• CGT-exempt amount component (see chapter 5)

• non-concessional contributions component (see chapter 5).

Taxable component — taxed element

These are post–July 1983 accumulated benefits in a complying super fund that was liable to a 15 per cent tax rate (such as employer contributions, pre-tax concessional contributions and investment earnings).

Figure 8.1: taxing a superannuation income stream

These payments are liable to tax, but are tax free once you turn 60 years of age (see figure 8.1).

Taxable component — untaxed element

These are post–July 1983 accumulated benefits in a superannuation fund that haven’t been taxed. These payments will ordinarily come from certain federal and state government super schemes that don’t pay tax, and proceeds of a life insurance policy that are not taxed when they’re distributed (see figure 8.1).

Receiving a superannuation pension

This section describes how you will be taxed if you receive a superannuation pension (or superannuation income stream).

Under 55 years of age

If you can access your preserved benefits before you turn 55 years of age (for instance, because you are incapacitated), your pension payments are liable to tax at your marginal rates, plus a Medicare levy (see figure 8.1 on p. 177). This can very between 0 per cent and 46.5 per cent; see appendix A, table 1.

Between 55 and 59 years of age

If you are aged between 55 and 59 years, the taxable component — taxed element part of your pension payment is taxed at your marginal rates, plus a Medicare levy. As the pension is paid from a taxed source (your super fund), you can claim a 15 per cent tax offset (see figure 8.1) on these payments when you do your income tax return each year. For example, if you receive a $50 000 pension, you can claim a $7500 tax offset ($50 000 × 15 per cent = $7500), which you can offset against the tax payable on the taxable income you derive. Any unused tax offsets cannot be refunded back to you (as is the case if you receive a dividend franking credit). The good news here is when your superannuation fund is in the pension phase, all investment income and capital gains your fund derives from the assets that fund your pension payments are exempt from tax.

On the other hand, the taxable component — untaxed element part of your pension payment is taxed at your marginal rates, plus a Medicare levy. In this case, you will miss out on claiming the 15 per cent tax offset, as the pension payments are coming from a super fund that doesn’t pay tax. This will ordinarily be the case if you’re a government employee (see figure 8.1 on p. 177).

Over 60 years of age

Once you reach 60 years of age all pension payments and cash withdrawals from a complying superannuation fund are tax free. To add icing to the exemption cake, the pension is also excluded from your assessable income. This means that if the superannuation pension is your sole source of income; your taxable income is effectively nil. On the other hand, if you receive a pension from a super fund that doesn’t pay tax (such as certain federal and state government super schemes), the pension is taxed at your marginal rates, plus a Medicare levy. Your super fund may deduct PAYG withholding tax from your pension payments. To help ease the pain you can claim a 10 per cent tax offset (see figure 8.1 on p. 177).

Buying a superannuation pension

There are three different types of superannuation pensions (or superannuation income streams, in the Tax Office’s terminology) that you can purchase from a complying super fund with your accumulated benefits. Each pension option will have certain features that may or may not interest you. The three pensions you can select are:

• transition to retirement pension

• account-based pension

• non–account based pension (or life pension).

Transition to retirement pension

A transition to retirement pension is an account-based pension that allows a member to receive a pension (or superannuation income stream), and remain working either full time or part time. This is a kind of account-based pension because the pension payments are based on investment performance and the amount of benefits you have in your account. You need to satisfy a number of conditions if you want to receive a transition to retirement pension. The main ones are as follows:

• You must reach your preservation age, currently 55 years of age if you’re born before 1960, at the time you apply for this pension.

• You must elect to receive a non-commutable pension. This means your accumulated benefits in your pension fund can’t be converted into a lump sum payment until you reach 65 years of age or retire before 65.

• The amount of pension you can receive each year must fall between 4 per cent and 10 per cent of the balance in your super fund pension account. For instance, if your accumulated benefits are $350 000, you can receive a pension that falls between $14 000 and $35 000. The pension is recalculated at the beginning of each financial year.

• You can’t make any further contributions to your pension account once it’s set up. If you want to go on contributing to super, you can do this in a new superannuation account.

If you’re between 55 and 59 years of age at the time you receive a transition to retirement pension, PAYG withholding tax is deducted from the taxable component of your pension. But you will qualify for a 15 per cent tax offset. For instance, if the pension you receive is $35 000 you can claim a $5250 tax offset ($35 000 × 15 per cent = $5250). But once you reach 60 years of age, the entire pension is tax free and excluded from your assessable income. In the meantime, all the investment income and capital gains your pension fund account derives during the pension phase are exempt from tax. If you run an SMSF you can select the investment assets to fund your pension payments (such as a quality share portfolio).

The great thing about this pension option is your capacity to access your preserved benefits once you reach your preservation age (currently age 55) while still gainfully employed. It also gives you the flexibility to increase the amount of income you’re currently earning, or reduce your working hours if you want to work part time. Once you reach 55 years of age, you may qualify for a $500 mature age tax offset if you’re still gainfully employed and your income from working is between $10 000 and $53 000. Meanwhile, you can continue to make super contributions (such as salary sacrifice contributions) up to your cap amount into your super fund’s accumulation account, which you can access at a later date (see chapter 5).

Case study: transition to retirement pension

Gregory is 59 years of age and has a $500 000 balance in his complying superannuation fund. He’s keen to receive a pension and now wants to work part time. Because Gregory has reached his preservation age he can take a transition to retirement pension. According to the rules, Gregory needs to take a pension that falls between $20 000 per annum ($500 000 × 4 per cent = $20 000) and $50 000 per annum ($500 000 × 10 per cent = $50 000). He has elected to receive the maximum pension permitted namely $50 000. This pension is liable to tax at his marginal rates, plus a Medicare levy. As he is less than 60 years of age, he will qualify for a $7500 tax offset ($50 000 × 15 per cent = $7500). But once Gregory turns 60 years of age, the entire pension is tax free and excluded from his assessable income. Further, the investment earnings his pension fund derives to fund his pension payments are also exempt from tax. Meanwhile, Gregory has elected to make a $10 000 salary sacrifice contribution from his part-time salary, which he will be able to access when he permanently retires. Because Gregory is over 55 years of age he will qualify for a $500 mature age tax offset in respect of the salary he’s deriving.

Account-based pension

An account-based pension is similar to a transition to retirement pension, in which your benefits are invested on your behalf to fund your annual pension payments. To qualify for this pension you need to reach your preservation age and satisfy a condition of release, such as retire. You also need to transfer your unrestricted non-preserved benefits (benefits that you can now access immediately) to a pension fund account. All investment income and capital gains your pension fund derives from the assets backing your pension are exempt from tax. If you’re between 55 and 59 years of age, the pension qualifies for a 15 per cent tax offset. For instance, if you receive a $40 000 pension you can claim a $6000 tax offset ($40 000 × 15 per cent = $6000). But when you reach 60 years of age the entire pension is tax free and excluded from your assessable income.

What makes this an attractive pension option is your capacity to vary the pension payments each year, and the pension will continue to be paid until all your funds are diminished. This will depend on the amount you withdraw each year and the performance of the investments you had selected to fund your pension payments. No payment is required if you commence the pension between 1 June and 30 June. The pension is recalculated at the beginning of each financial year and there are no maximum withdrawal limits to restrict how much you can take out, which means you can effectively withdraw the entire amount. However, if you’re less than 60 years of age the taxable component of lump sum withdrawals is liable to tax (see the section Lump sum withdrawals on p. 192). In the event of your death, the pension can continue to be paid to your nominated beneficiaries (such as your spouse) until all the funds are used up, or you can have a lump sum balance paid to your estate (see chapter 9). To ensure that your instructions will be followed, it’s best that you prepare a binding death benefit nomination (see chapters 1 and 9).

But as they say in the small print, conditions apply! There are a number of rules you need to comply with if you want to receive an account-based pension. The main ones are:

• You must satisfy a condition of release (such as retire).

• You must invest a prescribed minimum to fund the pension (for instance, $20 000)

• The pension must be paid to you annually (though it is normally payable fortnightly).

• You must receive a prescribed minimum, which can vary depending on your age, between 4 per cent and 14 per cent of your account balance (see table 8.2, overleaf). For instance, if you’re under 65 years of age you must withdraw at least 4 per cent of your account balance, and if you’re 95 years and over, 14 per cent. (For financial years ended 30 June 2009 to 30 June 2011 inclusive, the prescribed minimum was reduced by 50 per cent for each age group. It was announced in the 2011–12 federal budget that a drawdown concession of 25 per cent will apply until 30 June 2012).

• Once you set up the pension fund you can’t make any further contributions to that account. If you still have benefits in your accumulation account or in another super fund, you can set up a second pension fund.

• If you’re less than 60 years of age, PAYG withholding tax is deducted from the taxable component of your pension.

A major risk with account-based pensions is your benefits can quickly diminish if the asset classes you chose to fund your pension payments were to decrease significantly in value (for instance, a share portfolio). If this were to occur your pension payments will decrease. It’s best that you invest your money wisely (see chapter 7).

Table 8.2: minimum superannuation pension payments from 2012

Case study: account-based pension

Christine is 57 years old, has $800 000 in her SMSF and wants to retire early. As she has reached her preservation age and satisfied a condition of release (retirement), she has elected to receive an account-based pension. As Christine is under 65 years of age, the minimum superannuation pension she must receive is $32 000 per annum (4 per cent of her account balance) ($800 000 × 4 per cent = $32 000) (see table 8.2). For this financial year she has elected to receive a $40 000 pension, which is recalculated at the beginning of each financial year. As her superannuation fund is now in the pension phase, all investment income and capital gains derived to fund her pension payments are exempt from tax. As Christine is between 55 and 59 years of age, the pension is liable to tax at her marginal rates plus a Medicare levy, but she will qualify for a $6000 tax offset ($40 000 × 15 per cent = $6000). Once Christine turns 60 years of age the entire pension is exempt from tax and excluded from her assessable income.

Non–account based pension

Non–account based pensions are normally lifetime pensions that you can purchase with your accumulated superannuation fund benefits. The pension can also be paid over a guaranteed period of time, such as 20 years. For instance, if the agreed pension amount is $40 000 per annum, you will be assured of getting this amount each year over the guaranteed period of time. The good news here is that if the investments used to fund your pension payments were to decrease in value, the super fund bears all the risk. This is great to know if you want this type of security. Unfortunately, this is not the case if you receive an account-based pension. Only industry funds, retail funds and government funds can offer this pension option to you. If you run an SMSF and want a non–account based pension, you will need to transfer your benefits to an industry fund or retail fund.

As is the case with all superannuation income streams, if you’re between 55 and 59 years of age the pension qualifies for a 15 per cent tax offset. For instance, if you receive a $40 000 pension you can claim a $6000 tax offset ($40 000 × 15 per cent = $6000). But when you reach 60 years of age the entire pension is tax free and excluded from your assessable income.

Although you’re guaranteed an agreed pension amount each year, there are a number of limitations that you need to be aware of. The main ones are:

• You can’t vary your pension payments each year (except for inflation). You can only increase your pension payments each year to counter the impact of inflation (for instance, in line with the consumer price index, or CPI — the index that Australia uses to measure the rate of inflation).

• You can’t withdraw lump sum payments as you can with an account-based pension.

• You can’t commute (change) your pension back into a lump sum.

• If you die shortly after the pension commences your beneficiaries may not be entitled to receive any benefits from this pension scheme. If you’re in poor heath a non–account based pension may not be the way to go.

Case study: non–account based pension

Harry is 57 years of age and in good health. He has $800 000 in his super fund and wants to retire early. As Harry has reached his preservation age and satisfied a condition of release (retirement), he has elected to receive a non–account based pension. He has done this because he likes the idea that the pension will be guaranteed for the rest of his life. In exchange for his $800 000 lump sum amount, he will receive a $40 000 pension each year. According to the superannuation rules, the pension can only increase each year to counter the impact of inflation, and it cannot be commuted back into a lump sum. As Harry is between 55 and 59 years of age, the pension is liable to tax at his marginal rates plus a Medicare levy, but he will qualify for a $6000 tax offset ($40 000 × 15 per cent = $6000). Once Harry turns 60 years of age the entire pension is exempt from tax and excluded from his assessable income.

Lump sum withdrawals

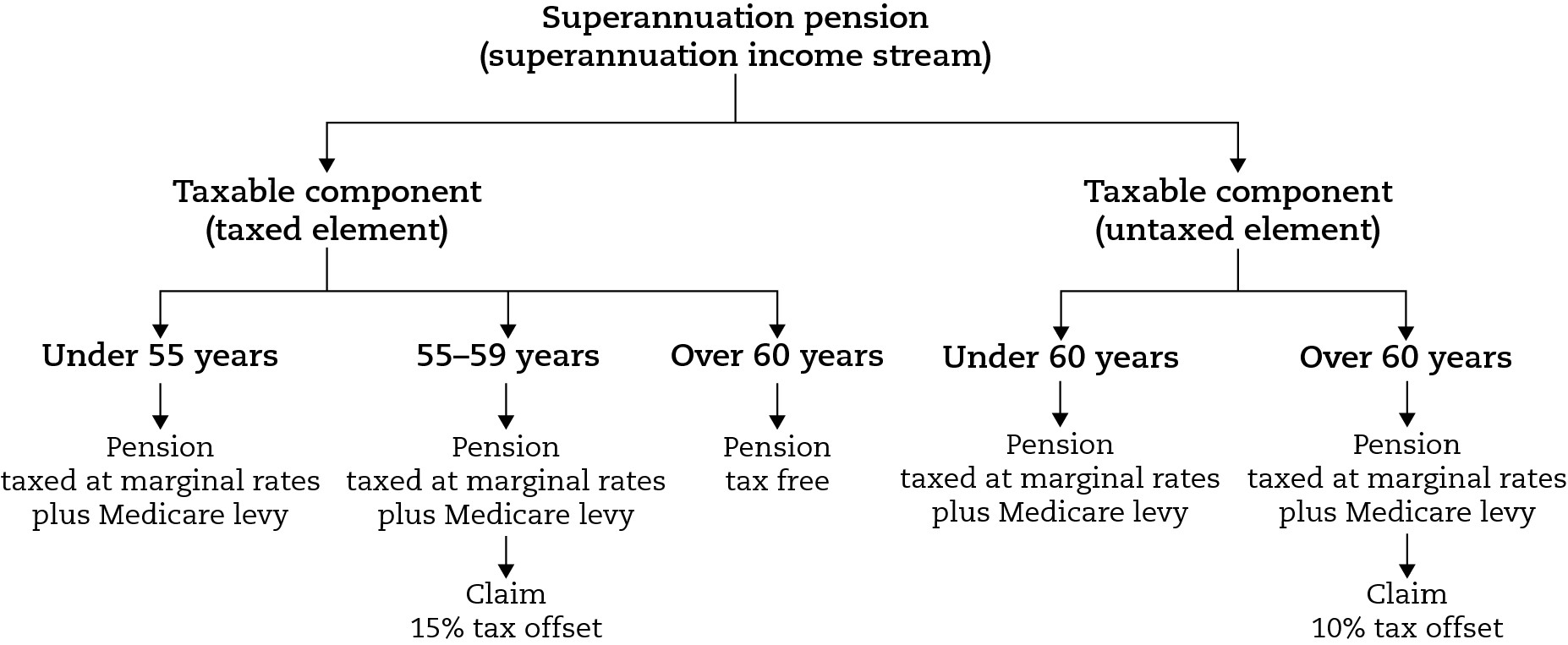

If you receive a lump sum payment from a complying superannuation fund you will be taxed as follows.

Under preservation age

If you have not reached your preservation age and are eligible to receive a superannuation lump sum payment, you will be taxed as outlined here:

• Taxable component (taxed element).The entire amount is taxed at the rate of 21.5 per cent.

• Taxable component (untaxed element). This is taxed at two different rates:

• Amounts up to the untaxed-plan cap amount (UPCA), which is $1 205 000 for the 2011–12 financial year, are taxed at the rate of 31.5 per cent.

• Amounts above the UPCA are taxed at the rate of 46.5 per cent (see figure 8.2).

Preservation age to 59 years of age

If you’re between your preservation age and 59 years of age and you receive a superannuation lump sum payment, you will be taxed as follows:

• Taxable component (taxed element). This is taxed at two different rates:

• Amounts up to the low rate cap amount (LRCA), which is $165 000 for the 2011–12 financial year, are tax free.

• Amounts above the LRCA are taxed at the rate of 16.5 per cent.

• Taxable component (untaxed element). This is taxed at three different rates:

• Amounts up to the LRCA are taxed at the rate of 16.5 per cent.

• Amounts between the LRCA and the UPCA are taxed at the rate of 31.5 per cent.

• Amounts above the UPCA are taxed at the rate of 46.5 per cent (see figure 8.2 on p. 195).

Over 60 years of age

If you’re over 60 years of age and eligible to receive a superannuation lump sum payment, you will be taxed as follows:

• Taxable component (taxed element). The entire amount you receive is tax free.

• Taxable component (untaxed element):

• Amounts up to the UPCA are taxed at the rate of 16.5 per cent.

• Amounts above the UPCA are taxed at the rate of 46.5 per cent (see figure 8.2).

Figure 8.2: superannuation lump sum payments

Receiving a super pension from an SMSF

Setting up an SMSF is worth contemplating if you are nearing your preservation age and have a substantial amount of money to invest. The following case study illustrates the benefits you can gain from investing your money in an SMSF to help fund your retirement.

Case study: funding your pension

John and Betty are both 59 years of age. They do not belong to a complying superannuation fund and are keen to retire when they turn 60 years of age. On 1 June they sold an investment property they jointly owned and now have $1 200 000 to invest. If they invest the funds outside the super system, the investment income they derive is liable to tax at their marginal rates, plus a Medicare levy. So they don’t have to pay tax, they have been advised to set up an SMSF (see chapter 3). This is because once they turn 60 years of age and retire, all pension payments and cash withdrawals payable from a complying superannuation fund during the pension phase are exempt from tax and are excluded from their assessable income.

Making a contribution

The first thing John and Betty need to do after they set up an SMSF is make a superannuation contribution to get the ball rolling. As they each have $600 000 to invest, there are restrictions on the amount they can contribute to a superannuation fund each financial year. If they breach the contributions cap amount, the excess amount is taxed at the rate of 46.5 per cent (see chapter 5).

To do this by the book, John and Betty need to make two contributions. They were advised to make a $150 000 personal after-tax, or non-concessional, contribution before the end of the current financial year (A), and a further $450 000 at the beginning of the next financial year (B). Under Australian tax law, as they are under 65 years of age, both John and Betty can make a one-off $450 000 non-concessional contribution during the financial year (B). However, if they do this they’re ineligible to make any further non-concessional contribution in the following two financial years (see chapter 5). That’s why they each need to contribute $150 000 at the outset and $450 000 in the following year. These contributions come from an after-tax source, so no 15 per cent contributions tax is payable, as these payments do not qualify for a tax deduction.

Investment strategy

To spread their risk John’s investment strategy is to invest his $600 000 in a quality share portfolio paying 5 per cent fully franked dividends, while Betty’s strategy is to invest in a term deposit paying a 6 per cent rate of interest. The benefits John and Betty will gain from investing in a superannuation fund (and, more particularly, an SMSF) are set out in the following case studies.

Case study: John

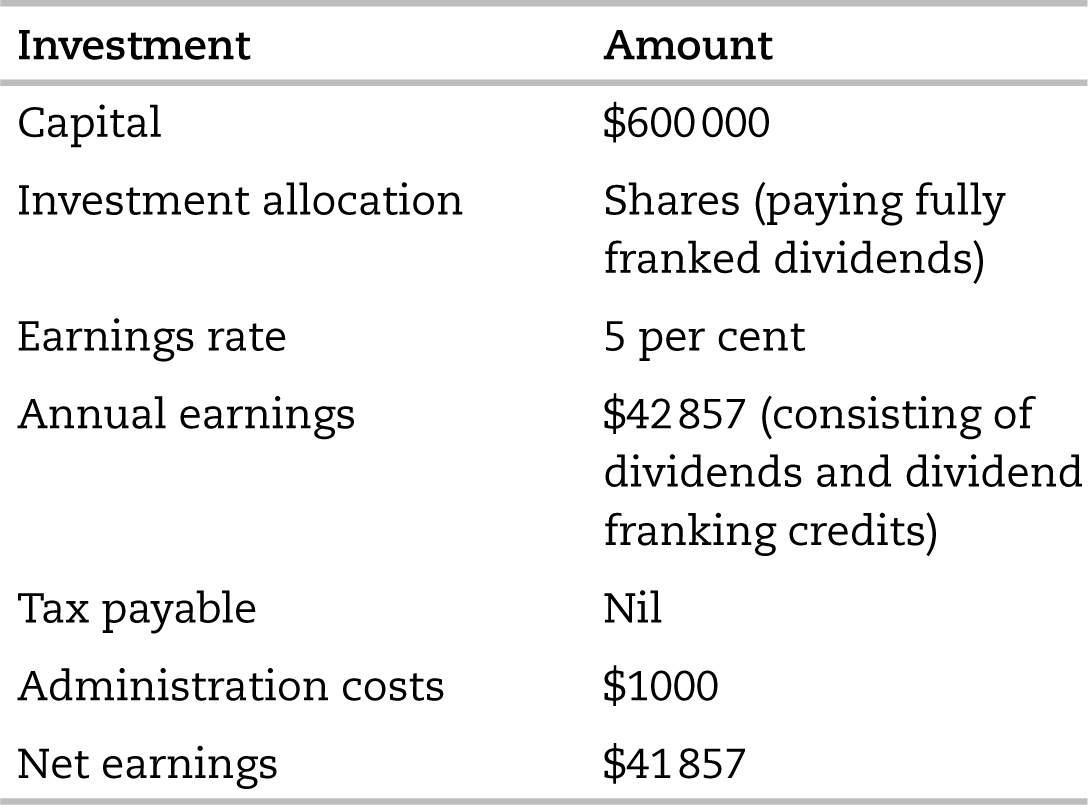

The details of John’s investment strategy (shares) and payments are shown in table 8.3.

Table 8.3: John’s investment strategy and payments

Here are the essential features of John’s pension:

• Dividends and franking credits and capital gains on the sale of shares derived during the pension phase to fund John’s pension are tax free.

• As John’s pension fund is exempt of tax, all dividend franking credits are refunded back to the pension fund.

• John can withdraw a $41 857 tax-free pension each year based on the pension’s earnings, which is excluded from his assessable income, without having to draw down any of his capital.

• John can earn a further $16 000 outside the super scheme before he is liable to pay tax, given that he can claim a low-income tax offset; see appendix A, table 3.

Case study: Betty

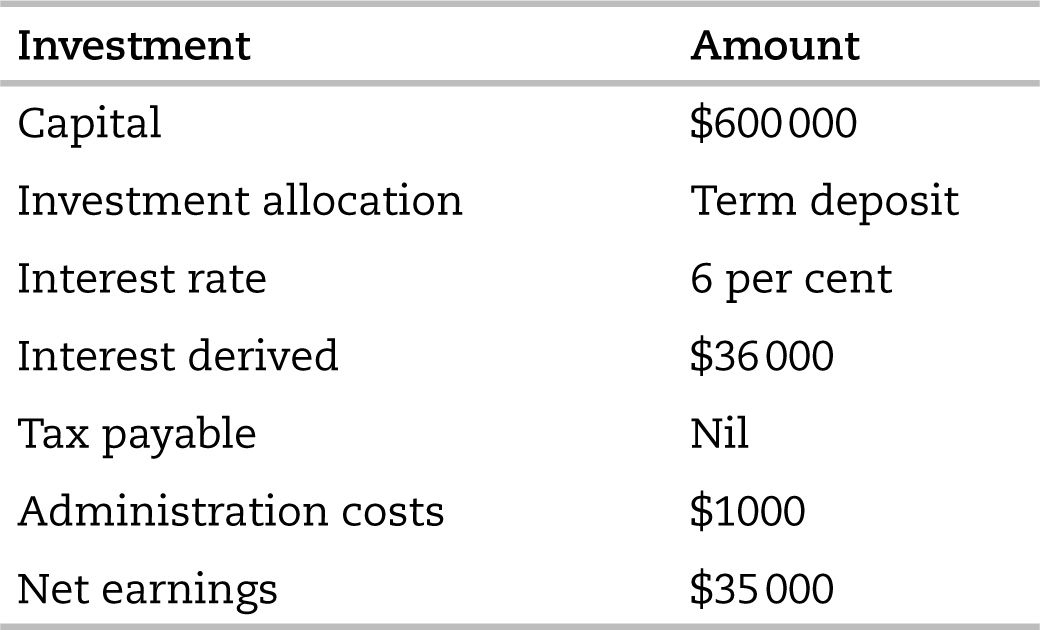

The details of Betty’s investment strategy (term deposit) and payments are shown in table 8.4.

Table 8.4: Betty’s investment strategy and payments

Here are the essential features of Betty’s pension:

• Interest derived during the pension phase to fund Betty’s pension is exempt from tax.

• Betty can withdraw a $35 000 tax-free pension each year based on the pension’s earnings, which is excluded from her assessable income, without having to draw down any of her capital.

• Betty can earn a further $16 000 outside the super scheme before she’s liable to pay tax, given that she can claim a low-income tax offset; see appendix A, table 3.

Useful references

• Australian Prudential Regulation Authority (APRA) publication: Early release of superannuation: information on accessing your superannuation before retirement age

Australian Taxation Office publications

• Changes to pension standards for self-managed super funds

• Self-managed super funds and tax exemptions on pension assets

• Transition to retirement (NAT 14967)

Other taxation rulings

• TA 2009/1: Superannuation illegal early release arrangements