Chapter 9: Death and taxes: superannuation death benefits

One of the major conditions for contributing to a complying superannuation fund, and more particularly an SMSF, is to provide benefits to dependants in the event of a member’s death. The trustee(s) can pay either a superannuation income stream (pension) or a lump sum death benefit to dependants. How your beneficiaries are taxed depends on whether they are dependants or non-dependants, and whether they receive a pension or lump sum. In this chapter, I discuss the taxation issues associated with the payment of superannuation death benefits to your beneficiaries.

Dependants and non-dependants

The taxation of superannuation death benefits depends on whether the beneficiaries you have nominated to receive your super are dependants or non-dependants. Under Australian tax law the following beneficiaries are dependants (also described as SIS dependants) for the purposes of receiving a superannuation death benefit:

• spouse, including a de facto spouse

• former spouse or de facto spouse

• child less than 18 years of age

• a person who is financially dependent on the deceased (at date of death)

• a person who is in an interdependency relationship (at the time of death). According to the Tax Office, an interdependency relationship exists between two people where:

• they have a close personal relationship, and

• they live together, even if they are not related by family, and

• one or each of them provides the other with financial and domestic support and personal care.

If the nominated person does not fall within the definition of a dependant, they will be classified as a non-dependant.

Binding death benefit nomination

If you want your superannuation death benefits to be paid to a specific dependant (or to your estate), you need to fill in a binding death benefit nomination form. You can get this form from your super fund. If you run an SMSF it’s best that you give this form to a member. If you give your fund a properly completed form and it’s kept up to date, the trustee must comply with your instructions, and will have no discretion as to how the death benefits should be distributed. This form has to be witnessed, and to remain valid you must renew this legal document every three years.

If you do not make a binding death benefit nomination, the trustee will ordinarily make a payment to the relevant beneficiaries you nominated when you first joined the fund (and the name of your preferred beneficiary is shown every year in your member benefit statement, as described in chapter 1; though you can change the nomination at any time). However, the trustee is not technically obliged to make a payment to the beneficiary you have nominated. Your nomination is used only as a guide as to who should receive your death benefits. To reduce the risk of your benefit not going to the person you prefer it’s best to prepare a binding death benefit nomination form; see appendix B, Self managed superannuation funds (death benefit payments). For instance, you want your benefits to be paid to your spouse rather than to another dependant who may also be entitled to receive your benefits. Under these circumstances the trustee must comply with your request.

Superannuation death benefit pensions

The Tax Office describes pensions as income streams. If you are receiving a superannuation pension at the time of your death, your pension can continue to be paid as a superannuation income stream benefit to what’s known as a reversionary beneficiary. A reversionary beneficiary is a dependant who is eligible to receive your pension in the event of your death (and it cannot be paid to your estate). The following beneficiaries are dependants and eligible to be a reversionary beneficiary:

• spouse, de facto spouse, former spouse

• child less than 18 years of age

• a person who is financially dependent on the deceased (at the date of death)

• a person who is in an interdependency relationship (at the date of death).

In chapter 8 I pointed out that when you receive a payment from a complying superannuation fund, it may consist of a combination of three components. This is to take into account the way superannuation funds and contributions were taxed before 30 June 1983, and how certain contributions have been taxed since 1 July 1983. These components are:

• Tax-free components. These payments are tax free and are excluded from your assessable income. They include non-concessional contributions and other contributions, such as pre-1983 accumulated amounts and CGT-exempt components (see chapter 8).

• Taxable component — taxed element. These are post–July 1983 accumulated benefits in a complying super fund that was liable to tax, such as employer contributions, pre-tax concessional contributions and investment earnings (see chapter 8).

• Taxable component — untaxed element. These are post–July 1983 accumulated benefits in a superannuation fund that haven’t been taxed. These payments normally come from certain federal and state government super schemes that don’t pay tax, and proceeds of a life insurance policy that are not taxed when they’re distributed (see chapter 8).

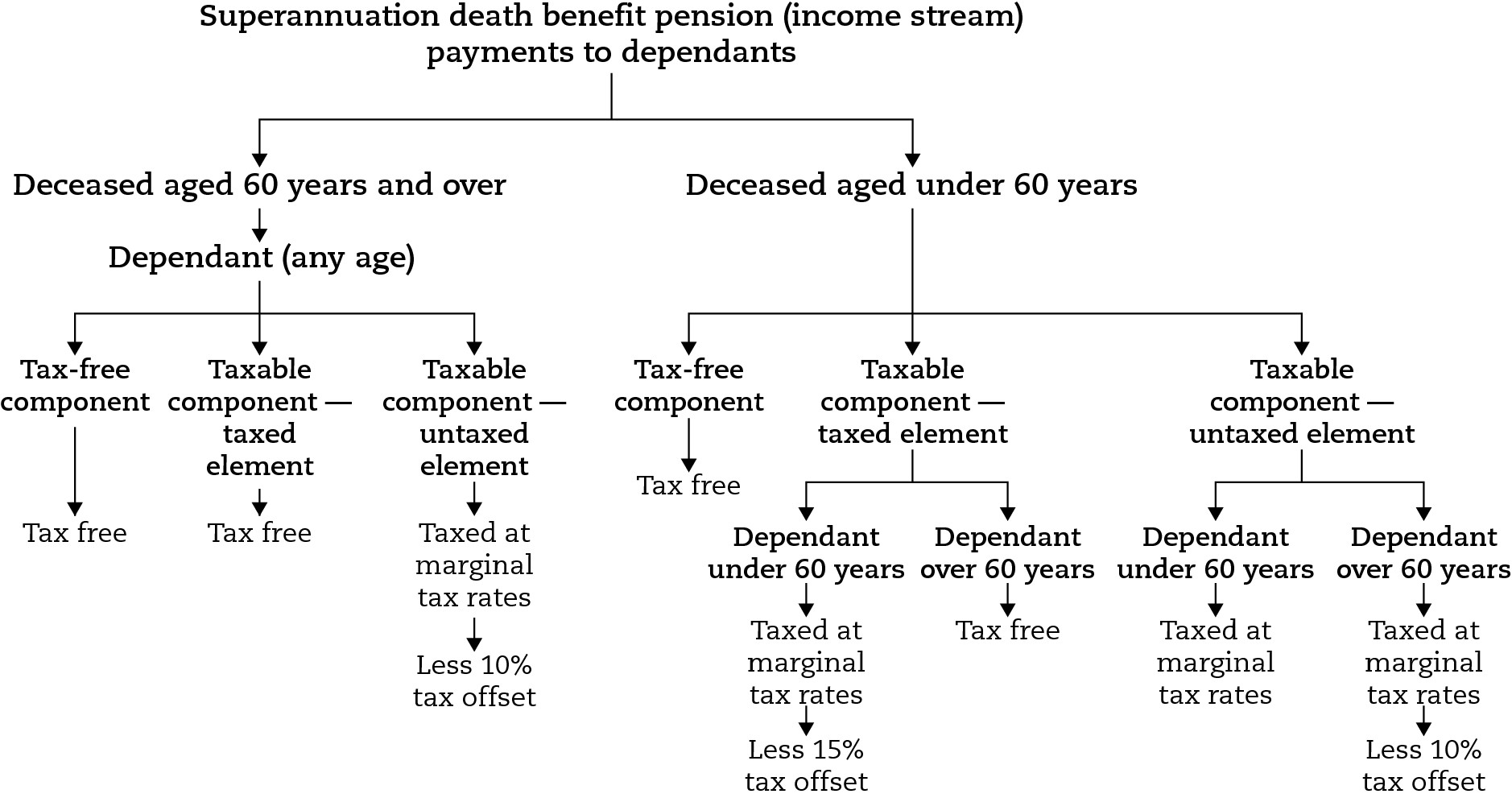

If your beneficiary is a dependant child, your pension can continue to be paid to them until they turn 18 years of age. It will then become a tax-free superannuation lump sum death benefit payment. If your dependant child is permanently disabled, the pension can continue to be paid after they turn 18 until all the funds are consumed. The amount of tax payable on the death benefit you leave depends on your age at the date of your death and the age of your dependant (see figure 9.1).

Figure 9.1: superannuation death benefit income stream

At a glance: how superannuation death benefit pensions are taxed

Only dependants may receive a death benefit pension (income stream, according to the ATO); non-dependants may only receive a lump sum.

How death benefit pensions are taxed in the hands of dependants depends on the age of the deceased and the age of the dependant at the date of the member’s death, and the nature of the components (taxed or untaxed elements) of the payment:

Deceased aged over 60 years and a dependant at any age

• tax-free component: tax free

• taxable component: tax free

• untaxed component: dependant’s marginal tax rates less 10 per cent tax offset.

Deceased aged under 60 years and a dependant aged more than 60 years

• tax-free component: tax free

• taxable component: tax free

• untaxed component: dependant’s marginal tax rates less 10 per cent tax offset.

Deceased aged under 60 years and a dependant aged less than 60 years

• tax-free component: tax free

• taxable component: dependant’s marginal tax rates less 15 per cent tax offset

• untaxed component: dependant’s marginal tax rates.

Superannuation lump sum death benefits

If your beneficiaries are eligible to receive a lump sum death benefit in the event of your death, the taxation treatment depends on whether the benefit is paid to a dependant or non-dependant, and whether the payment is from a tax-free component or taxable component (taxed element or untaxed element). Non-dependants can only be paid a lump sum death benefit (see figure 9.2, overleaf), though dependants can choose whether they would rather receive a lump sum or a pension from the trustee.

Figure 9.2: superannuation death benefit lump sum payments

At a glance: how superannuation lump sum death benefits are taxed

Death benefit lump sums are tax free when they are paid to dependants. On the other hand lump sums paid to non-dependants are taxed as follows:

Deceased at any age and non-dependant at any age

• tax-free component: tax free

• taxable component:

• taxed element: 16.5 per cent

• untaxed element: 31.5 per cent.

Update your legal documents

In conclusion, if you’re in receipt of a superannuation pension you should regularly review and update your legal documents (for instance, a binding death benefit nomination and your will) that set out who should receive your pension in the event of your death. This is because your circumstances can quickly change (for instance, your spouse could die or you could get divorced or remarry). Further, beneficiaries who were originally considered dependants under Australian income tax law may now be ineligible (for instance, children over 18 years of age who are no longer classified as dependants). Otherwise, family disputes could arise if your instructions are not clear and precise, and it could be costly if the matter has to be referred to the courts for a resolution.

Useful references

• Australian Securities & Investments Commission consumer website <www.moneysmart.gov.au>. Go to ‘About financial products — Superannuation’ and click on ‘Accessing superannuation death benefits’.

Australian Taxation Office publications

• Guide to deceased estates

• Managing the tax affairs of someone who has died

• Paying an income stream death benefit

• Paying a lump sum death benefit

• Understanding a death benefit paid from a super fund