Chapter 15

Dealing with Money in a Foreign Land

In This Chapter

Deciphering different currencies

Deciphering different currencies

Exchanging your money

Exchanging your money

Getting the gist of basic banking

Getting the gist of basic banking

Spotting bargains and paying for your purchases

Spotting bargains and paying for your purchases

What do traveling, shopping, dining, going out, and moving into a new place all have in common? They all require деньги (dyehn’-gee) (money). This chapter takes you on a tour of the Russian monetary business. You find out about Russian currency and how to exchange the money you have for the currency you want. You also discover phrases to use at the bank and while making payments. It pays to be prepared!

Paying Attention to Currency

In spite of ubiquitous dollar signs in fancy restaurant menus and “for rent” ads, the official Russian currency is not the U.S. dollar. In the following sections, you discover the names and denominations of Russian and international forms of money.

Rubles and kopecks

To talk about different numbers of rubles, you need to use different cases. For example, два рубля (dvah roohb-lya) (2 rubles) is in the genitive singular case, пять рублей (pyat’ roohb-lyehy) (5 rubles) is in the genitive plural case, and двадцать один рубль (dvaht-tsuht’ ah-deen roohbl’) (21 rubles) is in the nominative singular case. For more info on numbers followed by nouns, see Chapter 5.

Dollars, euros, and other international currencies

Although the official Russian currency is the ruble, some foreign currencies, such as U.S. dollars and European euros, are widely used to indicate the price but are not accepted officially in payments. Here’s a list of foreign currencies that you may need to exchange when you’re in Russia:

доллар Ю.С. (doh-luhr yooh. ehs.) (U.S. dollar)

доллар Ю.С. (doh-luhr yooh. ehs.) (U.S. dollar)

канадский доллар (kuh-nahts-keey doh-luhr) (Canadian dollar)

канадский доллар (kuh-nahts-keey doh-luhr) (Canadian dollar)

австралийский доллар (uhf-struh-leey-skeey doh-luhr) (Australian dollar)

австралийский доллар (uhf-struh-leey-skeey doh-luhr) (Australian dollar)

евро (yehv-rah) (euros)

евро (yehv-rah) (euros)

фунт стерлингов (foohnt styehr-leen-gahf) (British pound)

фунт стерлингов (foohnt styehr-leen-gahf) (British pound)

японская йена (ee-pohns-kuh-yeh yeh-nuh) (Japanese yen)

японская йена (ee-pohns-kuh-yeh yeh-nuh) (Japanese yen)

Changing Money

Upon arriving in Russia, you have to immediately jump into the “ruble zone.” Big Russian cities are saturated with пункты обмена (poohnk-ti ahb-myeh-nuh) (currency exchange offices), which are also called обмен валют (ahb-myehn vuh-lyooht). You can usually find a пункт обмена in any hotel. The best курс обмена (koohrs ahb-myeh-nuh) (exchange rate), however, is offered by банки (bahn-kee) (banks).

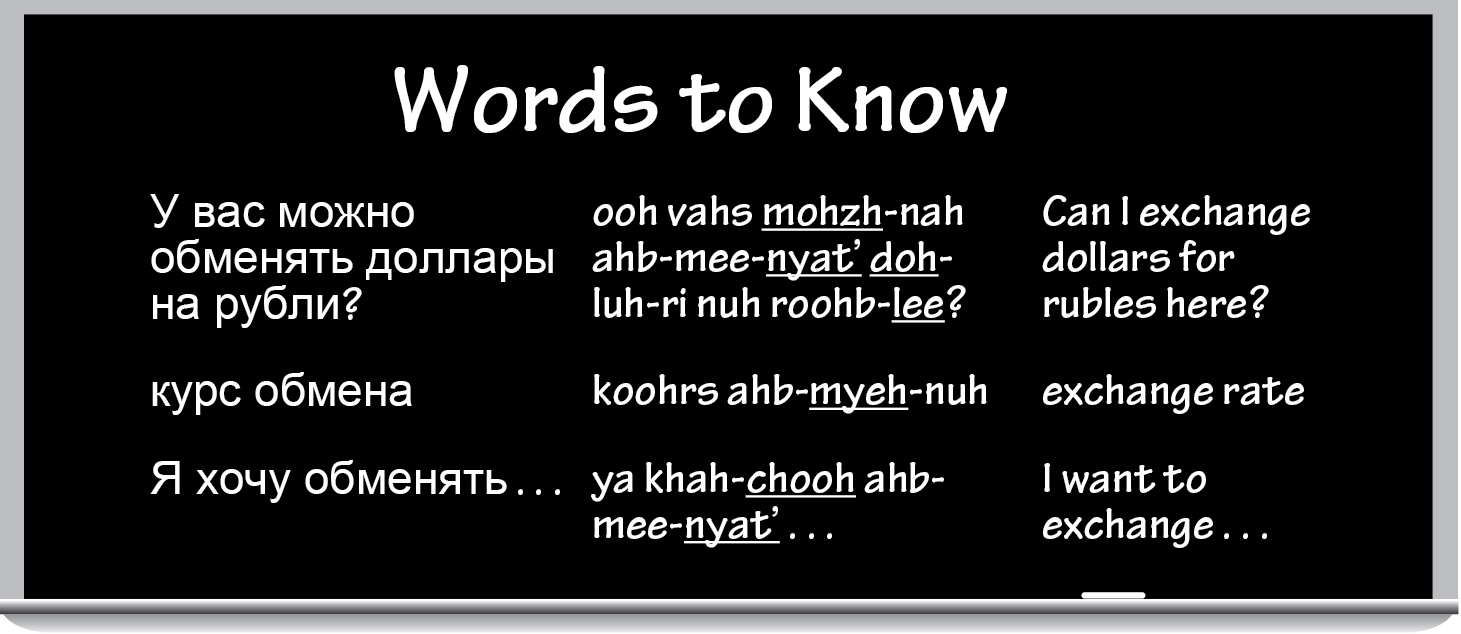

Some handy phrases to use when you exchange currency include the following:

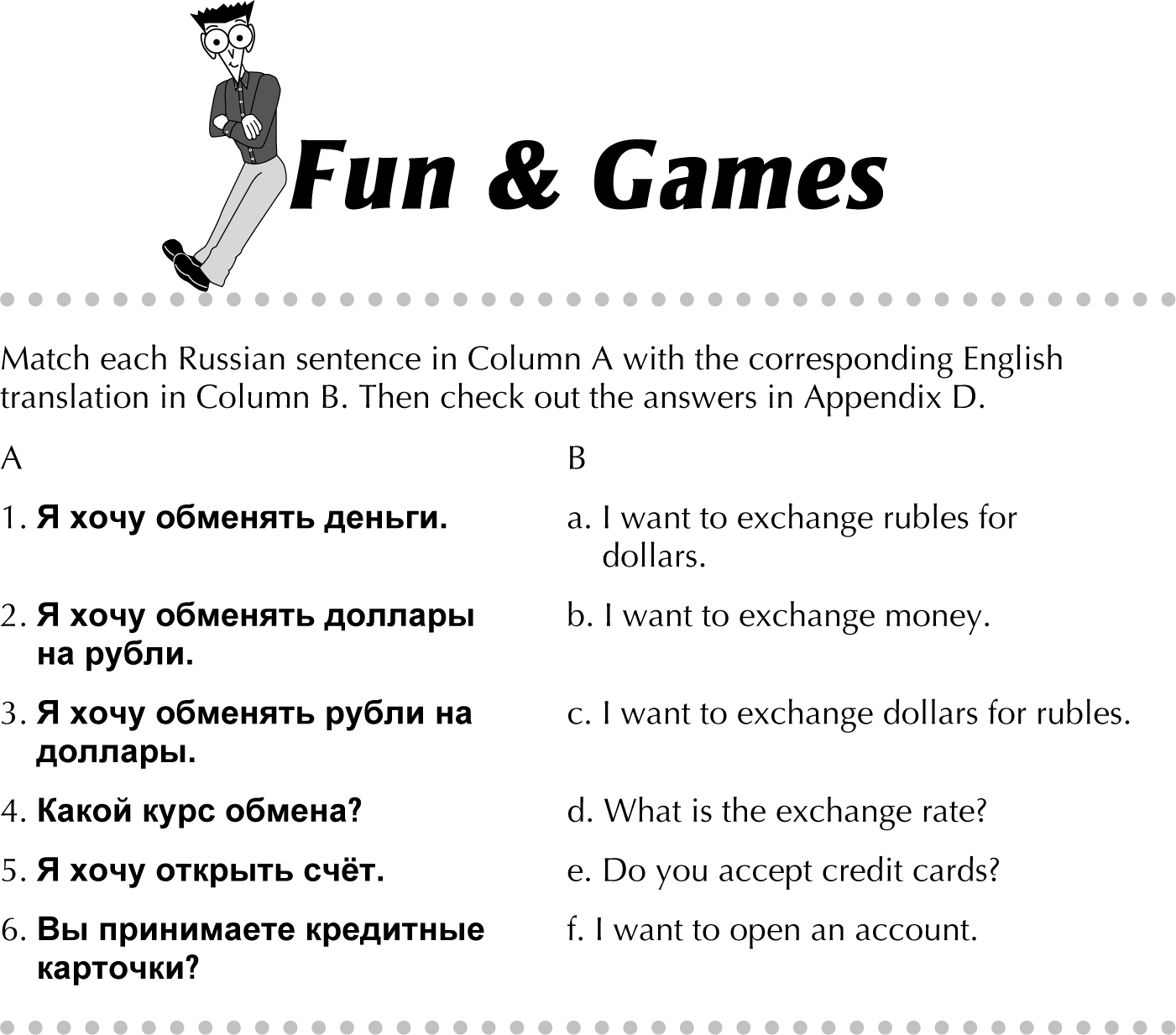

Я хочу обменять деньги. (ya khah-chooh ahb-mee-nyat’ dyehn’-gee.) (I want to exchange money.)

Я хочу обменять доллары на рубли. (ya khah-chooh ahb-mee-nyat’ doh-luh-ri nuh roohb-lee.) (I want to exchange dollars for rubles.)

Я хочу обменять рубли на доллары. (ya khah-chooh ahb-mee-nyat’ roohb-lee nuh doh-luh-ri.) (I want to exchange rubles for dollars.)

Какой курс обмена? (kuh-kohy koohrs ahb-myeh-nuh?) (What is the exchange rate?)

Надо платить коммиссию? (nah-dah pluh-teet’ kah-mee-see-yooh?) (Do I have to pay a fee?)

Using Banks

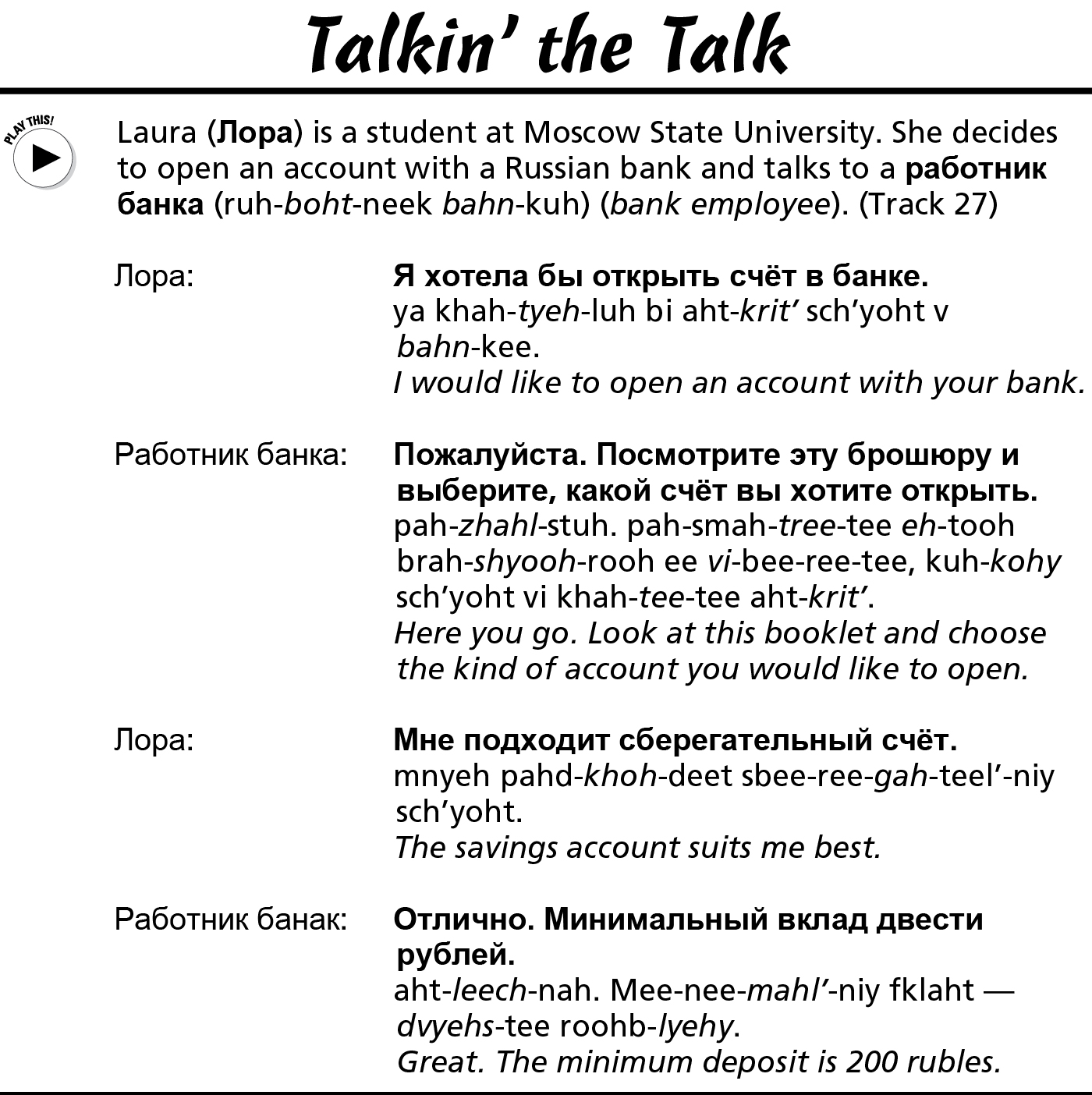

Opening a bank account is a useful thing to do if you want to have payments deposited directly to your account, make money transfers easier, or get rid of the nerve-wracking obligation of thinking about your cash’s safety. The following sections show you how to open and manage a bank account in Russian.

Opening an account at the bank of your choice

The first thing you need to do is decide on the type of bank you want to work with: Do you prefer a коммерческий банк (kah-myehr-chees-keey bahnk) (commercial bank) or a госбанк (gahs-bahnk) (state bank)? A privately owned коммерческий банк offers a much better процент (prah-tsehnt) (interest rate).

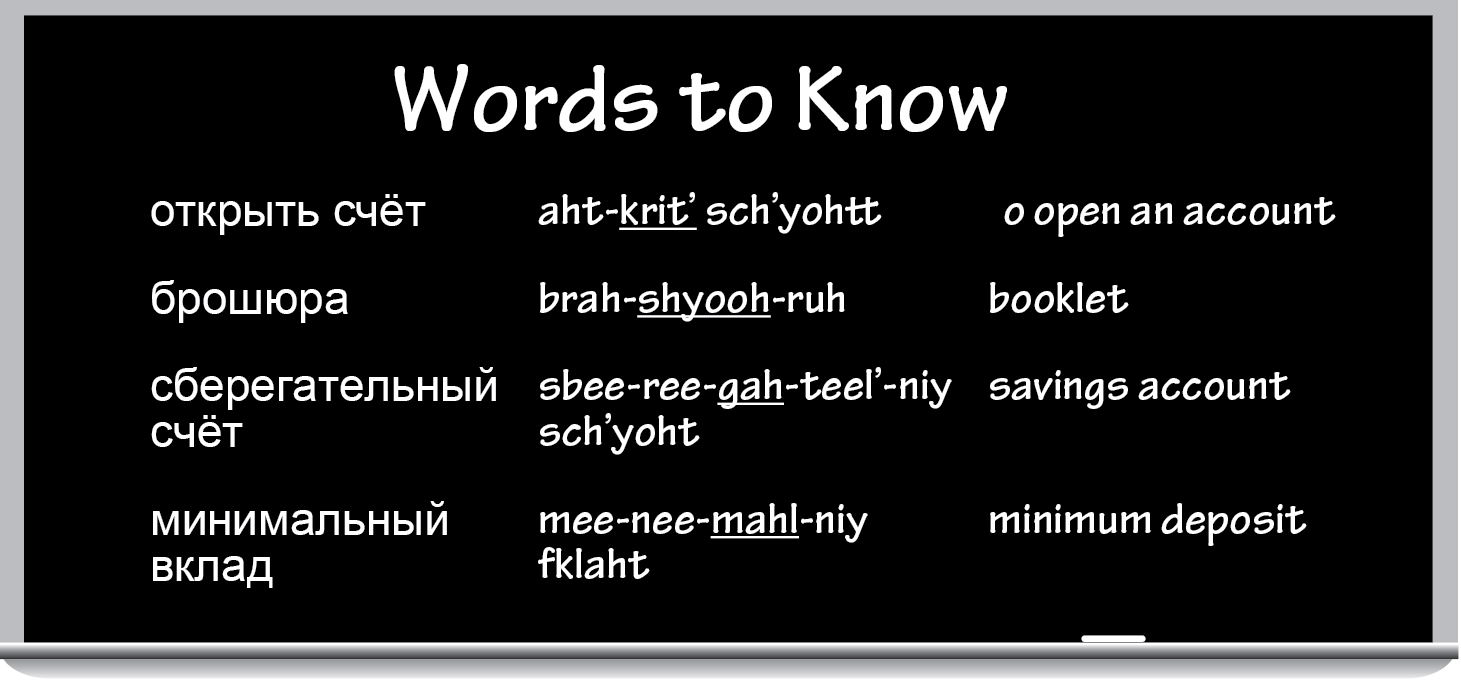

Your next decision concerns the type of счёт (sch’yoht) (account) you want to open. Although сберегательный (sbee-ree-gah-teel’-niy) literally translates as savings, this type of счёт corresponds to the English checking account. The accounts that involve a minimal term of investment are called срочные вклады (srohch-ni-ee fklah-di); they correspond to savings accounts.

To open an account, you need to talk to a работник банка (ruh-boht-neek bahn-kuh) (bank employee). Simply say

Я хочу открыть счёт. (ya khah-chooh aht-krit’ sch’yoht.) (I want to open an account.)

You’ll need to показать паспорт (pah-kuh-zaht’ pahs-pahrt) (show your passport) and to заполнить заявление (zuh-pohl-neet’ zuh-ee-vlyeh-nee-ee) (fill out forms). On a заявление (zuh-eev-lyeh-nee-ee) (application), you’ll need to provide your имя (ee-myeh) (given name), фамилия (fuh-mee-lee-yeh) (last name), адрес (ahd-rees) (address), номер паспорта (noh-meer pahs-pahr-tuh) (passport number), and the type of счёт you want to open.

Making deposits and withdrawals

You have several ways to сделать вклад (sdyeh-luht’ fklaht) (deposit money) into your account:

класть деньги на счёт (klahst’ dyehn’-gee nuh sch’yoht) (to deposit money directly at the bank or ATM; Literally: to put money into an account)

класть деньги на счёт (klahst’ dyehn’-gee nuh sch’yoht) (to deposit money directly at the bank or ATM; Literally: to put money into an account)

перечислять деньги на счёт (pee-ree-chees-lyat’ dyehn’-gee nuh sch’yoht) (to deposit money into an account)

перечислять деньги на счёт (pee-ree-chees-lyat’ dyehn’-gee nuh sch’yoht) (to deposit money into an account)

переводить деньги на счёт (pee-ree-vah-deet’ dyehn’-gee nuh sch’yoht) (to transfer money from a different account or have it deposited by a third party; Literally: to transfer money to an account)

переводить деньги на счёт (pee-ree-vah-deet’ dyehn’-gee nuh sch’yoht) (to transfer money from a different account or have it deposited by a third party; Literally: to transfer money to an account)

получать перевод (pah-looh-chaht’ pee-ree-voht) (to have money wired to your account; Literally: to receive a transfer)

получать перевод (pah-looh-chaht’ pee-ree-voht) (to have money wired to your account; Literally: to receive a transfer)

When you fill out a deposit slip, you need to enter the сумма вклада (sooh-muh fklah-duh) (deposit amount) and the номер счёта (noh-meer sch’yoh-tuh) (account number).

Now that you have some money in your account, you can

снять деньги со счёта (snyat’ dyehn’-gee sah sch’yoh-tuh) (withdraw money from an account)

снять деньги со счёта (snyat’ dyehn’-gee sah sch’yoh-tuh) (withdraw money from an account)

перевести деньги на другой счёт (pee-ree-vees-tee dyehn’-gee nuh drooh-gohy sch’yoht) (transfer money to a different account)

перевести деньги на другой счёт (pee-ree-vees-tee dyehn’-gee nuh drooh-gohy sch’yoht) (transfer money to a different account)

послать деньги переводом (pahs-laht’ dyehn’-gee pee-ree-voh-dahm (wire money; Literally: to send a money transfer)

послать деньги переводом (pahs-laht’ dyehn’-gee pee-ree-voh-dahm (wire money; Literally: to send a money transfer)

And, finally, if you no longer need your bank account, you can just закрыть счёт (zuhk-rit’ sch’yoht) (close the account).

Heading to the ATM

The fastest way to access your account is via the банкомат (buhn-kah-maht) (ATM). Банкоматы (buhn-kah-mah-ti) (ATMs) are less ubiquitous in small cities; they’re usually found in banks. Keep in mind that you have to pay a комиссия (kah-mee-see-yeh) (ATM fee) each time you use a банкомат that belongs to a bank other than your own. The комиссия is usually 1.5 percent of the sum you’re withdrawing, but no less than $3–$6 depending on the type of card. So, it probably makes sense to withdraw larger sums of money to avoid numerous комиссии (kah-mee-see-ee) (fees) for smaller withdrawals.

Here’s your guide to the phrases you see on the банкомат screen:

вставьте карту (fstahf’-tee kahr-tooh) (insert the card)

вставьте карту (fstahf’-tee kahr-tooh) (insert the card)

введите ПИН-код (vee-dee-tee peen-koht) (enter your PIN)

введите ПИН-код (vee-dee-tee peen-koht) (enter your PIN)

введите сумму (vee-dee-tee sooh-mooh) (enter the amount)

введите сумму (vee-dee-tee sooh-mooh) (enter the amount)

снять наличные (snyat’ nuh-leech-ni-ee) (withdraw cash)

снять наличные (snyat’ nuh-leech-ni-ee) (withdraw cash)

квитанция (kvee-tahn-tsee-yeh) (receipt)

квитанция (kvee-tahn-tsee-yeh) (receipt)

заберите карту (zuh-bee-ree-tee kahr-tooh) (remove the card)

заберите карту (zuh-bee-ree-tee kahr-tooh) (remove the card)

By the way, the card you use to withdraw cash from the ATM is called a дебитная карта (dee-beet-nuh-yeh kahr-tuh) (debit card). In addition to this card, you may also have a кредитная карта (kree-deet-nuh-yeh kahr-tuh) (credit card).

Spending Money

The best thing about money is spending it. In the following sections, you discover what to do and what to say while making payments two different ways: by cash or by using a credit card.

|

Conjugation |

Pronunciation |

|

я плачу |

ya pluh-chooh |

|

ты платишь (informal singular) |

ti plah-teesh’ |

|

он/она платит |

ohn/ah-nah plah-teet |

|

мы платим |

mi plah-teem |

|

вы платите (formal singular or plural) |

vi plah-tee-tee |

|

они платят |

ah-nee plah-tyeht |

Using cash

У вас можно заплатить наличными? (ooh vahs mohzh-nah zuh-pluh-teet’ nuh-leech-ni-mee?) (Can I pay with cash here?)

In fact, this last question may be superfluous: Cash is always preferable in the country where checks and credit cards are still looked upon with suspicion.

Russian rubles come both in купюры (kooh-pyooh-ri) (bills) and монеты (mah-nyeh-ti) (coins). Kopecks always come in coins, but they’re virtually extinct now (see “Rubles and kopecks” earlier in this chapter for more info). Here’s a list of Russian bills and coins in use (so you know to be a little suspicious if you receive change in 15-ruble bills and 25-kopeck coins):

купюры (kooh-pyooh-ri) (bills):

купюры (kooh-pyooh-ri) (bills):

• десять рублей (dyeh-seet’ roohb-lyehy) (10 rubles)

• пятьдесят рублей (pee-dee-syat roohb-lyehy) (50 rubles)

• сто рублей (stoh roohb-lyehy) (100 rubles)

• пятьсот рублей (peet’-soht roohb-lyehy) (500 rubles)

• тысяча рублей (ti-see-chuh roohb-lyehy) (1,000 rubles)

монеты (mah-nyeh-ti) (coins):

монеты (mah-nyeh-ti) (coins):

• десять копеек (dyeh-seet’ kah-pyeh-eek) (10 kopecks)

• пятьдесят копеек (pee-dee-syat kah-pyeh-eek) (50 kopecks)

• один рубль (ah-deen roohbl’) (1 ruble)

• два рубля (dvah roohb-lya) (2 rubles)

• пять рублей (pyat’ roohb-lyehy) (5 rubles)

Paying with credit cards

У вас можно заплатить кредитной карточкой? (ooh vahs mohzh-nah zuh-pluh-teet’ kree-deet-nahy kahr-tahch-kahy?) (Can I pay with a credit card here?)

Вы принимаете кредитные карточки? (vi pree-nee-mah-ee-tee kree-deet-ni-ee kahr-tahch-kee?) (Do you accept credit cards?)

Вы берёте комиссионный сбор за оплату кредитной карточкой? (vi bee-ryoh-tee kah-mee-see-oh-niy zbohr zuh ahp-lah-tooh kree-deet-nahy kahr-tahch-kahy?) (Do you charge a fee for paying with a credit card?)

The imperfective verb

The imperfective verb  Before inserting your card, make sure that the

Before inserting your card, make sure that the