FV Function

The FV function calculates the future value (at a specified date in the future) of an investment based on a constant interest rate. You can use FV to calculate the future value of regular payments, periodic payments, or a single lump sum payment.

Syntax

FV(rate,nper,pmt,[pv],[type])

Arguments

Please see the Definitions section of this chapter for more a detailed description of these arguments.

|

Arguments

|

Description

|

|

Rate

|

Required. This is the interest rate per period.

|

|

Nper

|

Required. The total number of payment periods in an annuity i.e. the term.

|

|

Pmt

|

Required. This is the payment made for each period in the annuity.

If you omit pmt, you must include pv.

|

|

Pv

|

Optional. This is the present value of an investment based on a constant growth rate.

If you omit pv, it is assumed to be 0 (zero) and you must include pmt.

|

|

Type

|

Optional. The type

is 0 or 1 and it indicates when payments are due.

0 (or omitted) = at the end of the period.

1 = at the beginning of the period.

|

Example

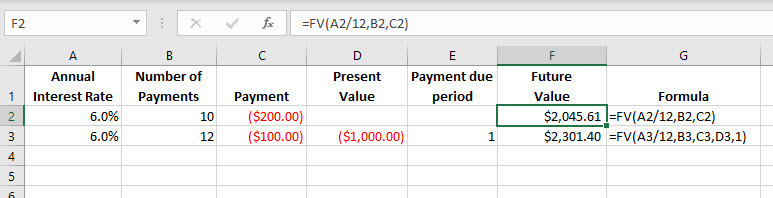

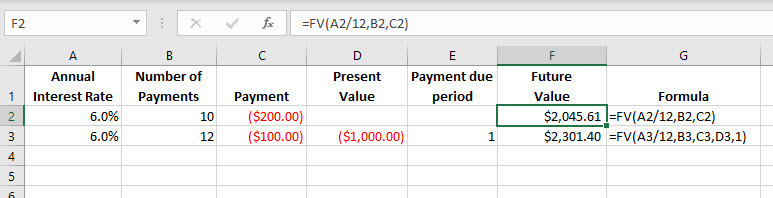

In the example below, we use the FV function to calculate:

- The future value of a monthly payment of $200 over 10 months at an interest of 6% per annum.

- The future value of a lump sum of $1,000 plus 12 monthly payments of $100, at an interest rate of 6%.

Explanation of Formulas:

=FV(A2/12,B2,C2)

Note that the rate

argument has been divided by 12 to represent monthly payments. The pmt

argument is a negative value (C2) as this is money being paid out.

=FV(A3/12,B3,C3,D3,1)

This formula has the pmt argument as well as the optional pv argument which represents the present value of the investment. The payment due period is 1 which means the payment starts at the beginning of the period.