APPENDIX 2

Special Minimum Benefit

The Special Minimum Benefits Rule can add to your regular retirement benefits. Table A shows how to figure the Special Minimum Benefit.

Calculating Special Minimum Benefit

1. Add up your income for each year from 1937 through 1950 and divide the total by $900. This provides the number of points you get for purposes of this calculation (14 points is the most anyone is allowed for work through 1950).

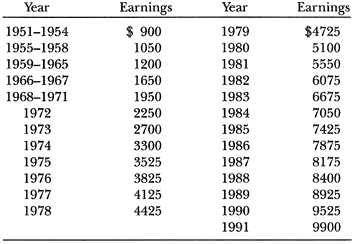

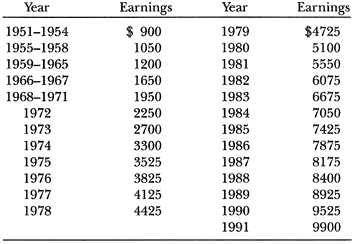

2. For work after 1950, you get one point for each year in which you earned at least the following amounts (up to a maximum of 30 points):

3. Take your total points from 1 and 2 above and check the amount of your Special Minimum Benefits listed on the next page.

Points |

|

Special Benefits Payable in 1992 |

|

||

11 |

|

$23.80 |

12 |

|

47.50 |

13 |

|

71.60 |

14 |

|

95.50 |

15 |

|

119.40 |

16 |

|

143.30 |

17 |

|

167.20 |

18 |

|

191.20 |

19 |

|

215.10 |

20 |

|

238.90 |

21 |

|

263.10 |

22 |

|

286.80 |

23 |

|

310.90 |

24 |

|

334.80 |

25 |

|

358.60 |

26 |

|

382.80 |

27 |

|

406.70 |

28 |

|

430.40 |

29 |

|

454.30 |

30 or more |

|

478.20 |

(Amounts will increase slightly each year.) |

||

Here’s how the table works. Let’s take the same facts as in the example in Appendix 1. From 1945 through 1950, you earned $4,500. Plugging into item 1 above, you get five points ($4,500 divided by $900 equals 5) for work through 1950.

From 1951 through 1975, you earned at least the amounts listed in item 2 above. So you get one point for each of the 25 years after 1950 that you worked.

Your total points from items 1 and 2 are 30. Using Table A, you find that with 30 points, your Special Minimum Benefits should be $478 a month. Your Social Security retirement checks should be no less than this.