APPENDIX 21

The Credit for Elderly or Disabled

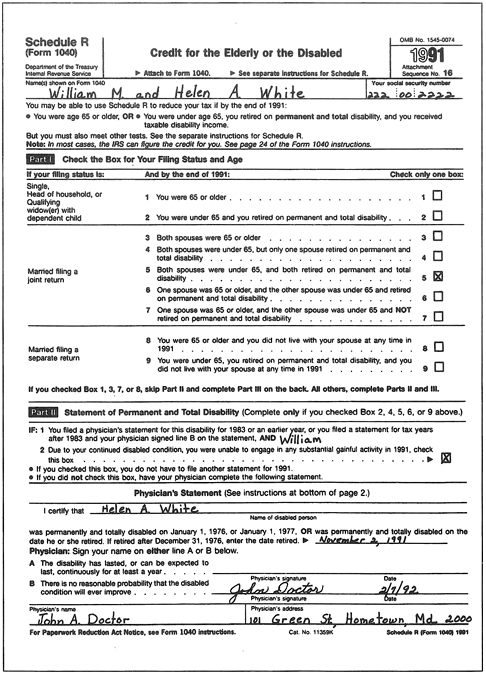

You will use Schedule R to figure your CED benefit, so we’ve reproduced Schedule R in Appendix 21. (If you file IRS Form 1040A, use Schedule 3 instead of Schedule R.) Don’t get scared off by the form—it’s really not as bad as it looks.

Start with Part I. Check the one box that fits your situation. The Single category includes Head of Household and Qualifying Widow(er), which we’ve defined on here.

If you are claiming the CED based only on age, not disability (so you would have checked box 1, 3, 7, or 8 in Part I), then you don’t have to worry about Part II—skip it and go on to Part III. If you or your spouse has a disability, then fill out Part II. We told you about the Physician’s Statement on here.

If you don’t want to do any more, you don’t have to. Just attach Schedule R to your tax return and write CED on the dotted line next to Line 42 of your Form 1040—the IRS then will figure your credit.

Unfortunately, the IRS has been known to make a mistake or two. Try to fill out Part III of Schedule R yourself, using our easy-to-follow instructions below; it’s really not too tough. You’re better off not to rely on the Government.

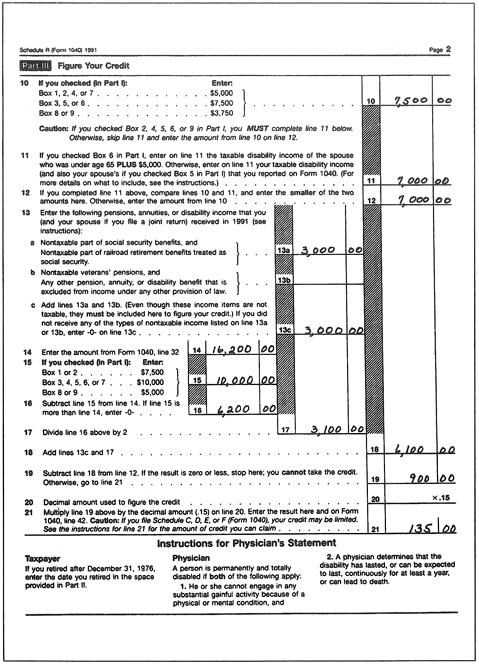

On line 10, just write in the amount—$5,000, $7,500, or $3,750—that corresponds to the number you checked in Part I.

If you checked box 1, 3, 7, or 8 in Part I, you can skip line 11 and write in the number from line 10 on line 12.

If you checked box 2, 4, 5, 6, or 9 in Part I (because you or your spouse has a disability), then you must also fill in line 11. Here’s how to figure the amount to write in on line 11:

• If you checked box 2, 4, or 9 in Part I, write in the amount of your taxable disability income for the year (this is the amount you reported on your IRS Form 1040).

• If you checked box 5 in Part I, write in the amount of your and your spouse’s combined taxable disability income.

• If you checked box 6 in Part I, write in the amount of the taxable disability income of the spouse who is under 65, plus $5,000.

After you have put the right number on line 11, compare the amounts on lines 10 and 11—pick the smaller amount and write it on line 12.

So far, so good (we hope!). Now for line 13a, write in the amount of nontaxable Social Security benefits (retirement, survivor, or disability) you (and your spouse, if you file a joint return) received. We discussed how to figure the tax on Social Security benefits in Chapter 1. Include the gross amount of benefits, before subtracting the amounts withheld to pay premiums on supplementary Medicare insurance and before any reduction for Worker’s Compensation benefits.

On line 13b, write in the amount of any nontaxable veterans’ pensions and any other pension, annuity, or disability benefits. Ignore any service-connected disability compensation, life insurance proceeds, proceeds from accident or health insurance, and the portion of any pension which is just the return of your investment.

Add the amounts on lines 13a and 13b, and write the total on line 13c.

On line 14, write in the amount of your adjusted gross income. You can get that amount from line 32 of your Form 1040.

Line 15 is easy; just put in the amount that corresponds to the box number you checked in Part I. The amount will be either $7,500, $10,000, or $5,000.

Subtract the amount on line 15 from the amount on line 14, and put the result on line 16.

Divide the amount on line 16 in half, and put that amount on line 17. Don’t sweat, you’re almost done!

Add the numbers from lines 13c and 17—the total goes on line 18.

Subtract line 18 from line 12. If you get a number, put it on line 19. If the answer is zero or below, take the Schedule R, roll it into a ball, and toss it in the can—you can’t get any CED benefit. Chalk the time up to an exercise in mathematical gymnastics.

Line 20 is already done for you. See—Uncle Sam can be a real sport.

Now get out your calculator and multiply lines 19 and 20; put the result on line 21. Take a good look at the number—that’s your tax credit. The amount is money in your pocket!

Note: In rare cases, the CED tax break may be limited if both:

• You file Schedule C, D, E, or F (to Form 1040).

• The amount on line 23 of your Form 1040 is more than $30,000 if you are single or head of household; $30,000 if married filing jointly or qualifying widow(er); or $20,000 if married filing separately.

Most people don’t have to worry about this limit. If you think you do, get IRS Publication 554, “Tax Information for Older Americans,” available free from your local IRS office, for more information.

The Schedule R form we have reprinted is filled out to help you follow the instructions.