9

Home Sweet Home: Treasures Right Under Your Roof

On paper, your net worth is pretty decent. Yet you never seem to have enough money to do all those things you want, or need, to do. How can this be?

The answer is simple. Many older Americans are short on cash but have built up a lot of equity in their home. Sound familiar? Over 16 million older Americans own their homes free and clear. Of those, at least 5 million, and probably more, qualify as house rich and cash poor.

How can you get the equity from your home? Most people think that the only way to cash in on their home equity is either to sell or borrow against the home, but neither option is very appealing. Owning a home means comfort and security; selling is often terribly traumatic. When you’ve lived in a home for 10, 20, even 30 years or more, you’re comfortable with the house and you know the neighborhood. Memories abound in every room. Moving can be both emotionally and financially costly!

Standard borrowing usually is no better an option. The pressure of large monthly payments imposes serious strains on older Americans. And you may not be able to get a conventional mortgage or home equity loan, even if you wanted to. To qualify for those loans, you must meet certain income requirements—and that may be impossible on a fixed income from Social Security, pension, interest, and dividends.

Even when you do qualify, your problems aren’t over; in fact, they may just be starting. With a standard loan, you must make monthly payments. If you become ill, are laid off, or for some other reason can’t meet your obligations, the lender can foreclose and force a sale of the home—your worst nightmare come true.

Wouldn’t it be nice if you could keep your home and increase your monthly income at the same time? Sure it would! What would you do if you could add $200, $300, even $500 or more to your monthly income? Take a trip to Hawaii? Buy a new car? Or maybe just maintain your current life-style in spite of rising taxes, insurance, utilities, and home maintenance costs?

Believe it or not, there may be a way that you can accomplish these objectives without having to rob a bank! When Dorothy (in The Wizard of Oz) tapped her heels together and chanted “There’s no place like home,” she was absolutely right. Your home is full of gold, and we’re going to help you get to it without having to move or pay a monthly mortgage. How? By using the following gems: reverse mortgages, sale and leaseback, home sharing, co-signor, and special-purpose loans.

REVERSE MORTGAGES

When we say the word mortgage, what’s the first thought that comes into your mind? Monthly payments, of course. With a usual mortgage or home equity loan, you borrow a lump sum, using your house as security. As you repay the loan each month, your debt to the bank shrinks, slowly but surely, and your share of ownership increases until the home is yours free and clear.

A reverse mortgage works just the opposite: it pays you money each month. Your debt to the bank grows, rather than shrinks. The monthly payments to you can be a wonderful supplement to your income. And you generally don’t have to worry about paying the loan back until you die. At that time, the home typically will be sold and the proceeds used to pay off the debt.

Reverse mortgages have been around for years, yet very few older Americans have taken advantage of them. These loans have not been widely available since banks, savings and loans, and mortgage companies have been hesitant to offer them. But all that is changing, thanks to Uncle Sam.

The Federal Housing Administration (FHA) is now guaranteeing reverse mortgages for homeowners 62 years of age or older. Any one of the 10,000 lenders that regularly do business with the FHA is allowed to make reverse mortgages guaranteed by the FHA, which means important protection for both you and the lender. Most important, if the amount of your debt grows to be more than the value of your home, you don’t have to worry—no one can ever try to collect more than the value of the home. If the lender can’t collect the entire debt from the proceeds of a sale of the house, the Government makes up the difference.

The FHA guarantees three primary types of reverse mortgages: tenure, term, and line of credit. Each is a little different. We tell you about each of these, and then we discuss the types of reverse mortgages that are not FHA insured.

Tenure Reverse Mortgage

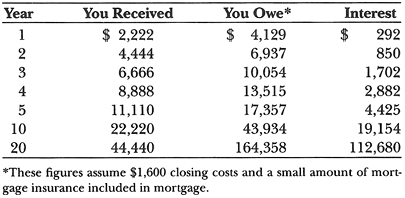

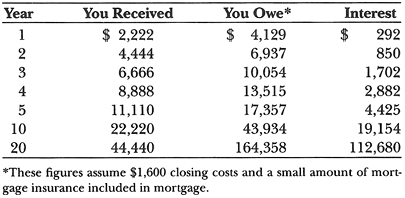

A tenure reverse mortgage makes monthly payments to you for life or, if you choose, until you leave the home, such as if and when you must enter a nursing home. The amount you receive is paid based on a complicated formula that considers your age, the interest rate, and the value of your home. You can see how the tenure reverse mortgage works in Example 1.

EXAMPLE 1

You are 65, and your income from Social Security doesn’t give you enough to meet your needs. Your home is worth about $80,000, but that doesn’t help you take a vacation to visit your grandchildren. So you get a tenure reverse mortgage paying you $185/month for life. If the interest is 10 percent per year, compounded monthly, here is what you will owe after each year:

As you can see, if you live five years, you’ll only owe $17,357. If your house is worth $100,000 at your death, it may be sold and your heirs will get in the neighborhood of $82,643 (after the $17,357 is paid to the lender). If you live 20 years, you’ll owe the lender more than $160,000.

But what if the house is worth only $150,000 after 20 years? Can the lender grab your bank accounts and other assets? No! Any shortfall is made up by good old Uncle Sam.

Term Reverse Mortgage

With a term reverse mortgage, you get monthly payments for a fixed number of years, not for life. When that time expires, the paychecks stop coming in. But you don’t have to pay the loan balance and you don’t have to move out. The loan just sits (accruing interest) until you die or move out—only then can the house be sold to pay the loan.

Since payments are for a fixed period rather than for your entire life, the payments you receive are higher than you’d get under a tenure reverse mortgage.

EXAMPLE 2

Let’s assume the same facts as in Example 1, except you get a term reverse mortgage paying you for 10 years. Instead of $185/month, you get paychecks of $278/month. At the end of 10 years, you’ll owe $63,720.

Should you die at that time, your house would then be sold and the debt paid from the proceeds. If the house sells for $130,000, your heirs would get about $66,280 and the lender would get the rest.

But let’s say you live another 10 years. That’s okay—in fact, it’s great! You can live in the house without paying anything to the lender. When you die, the loan balance would be more than $180,000, as interest accumulated on the $63,720 balance. If the house value hasn’t gone up enough to cover the balance, the Government will pick up the tab.

Line of Credit Reverse Mortgage

A line of credit reverse mortgage looks a little like a typical home equity line of credit that you can get from almost any bank. With both types of loans, the lender sets a maximum amount you can borrow, based primarily on the value of your home. Rather than getting steady monthly payments, you borrow as you need to.

So far, the line of credit reverse mortgage and the standard home equity line of credit sound the same. But here’s the important difference: with a standard home equity credit line, you must make regular monthly payments to repay the loan. This means your monthly income has to be high enough to make the payments. And if you fail to make the payments, the lender can foreclose and force a sale of your home. Finally, you may be required to requalify for a standard home equity loan each year; if you don’t requalify, the lender could demand repayment of the entire loan balance immediately.

An FHA-insured line of credit reverse mortgage cuts the risks. You do not have to make any monthly payments. The loan balance sits (accruing interest for the lender) until you sell or move out; only then will the lender be repaid. You cannot be forced out of your home! Also, you don’t have to requalify every year. Once you qualify, you can draw on the credit line until you reach the maximum.

Here’s one more nice benefit: your credit limit may increase each year by a percentage agreed to by you and the lender. For example, if your credit line is $30,000 and you don’t use it for a year, the line may increase to $33,000 for the following year.

A line of credit reverse mortgage is not designed to provide a monthly income supplement—a tenure or term reverse mortgage is better for that. But if you just want to have money available in case your spouse becomes ill and needs nursing care, or in case your furnace blows and you must suddenly replace it, or if you decide to splurge on a big, one-time vacation, then a line of credit reverse mortgage might be just right.

EXAMPLE 3

You are doing just fine on your regular monthly income. But every year or two something seems to go wrong. Last year the roof on your home sprung a leak and the repair job cost more than $2,000. This year, your dear old car died, and you have to come up with $15,000 to replace it. Unfortunately, your income isn’t enough to qualify for a standard bank loan to cover these costs, so you take out a line of credit reverse mortgage. The credit limit is $20,000, which is more than enough to cover your needs.

Let’s say this year you borrow $15,000 for the car. Next year, when the sewer line to your home breaks, you need another $3,000. And two years later, for your grandchild’s wedding present (and first house purchase), you take another $2,000.

Here’s how your loan account would stand after four years: You borrowed a total of $20,000, and your loan balance would be about $35,000 (assuming 10% interest). If you lived another five years and didn’t borrow any more funds, you would owe about $62,000. The loan does not have to be repaid until you die or move out.

Reverse Mortgage Questionnaire

We have described three types of reverse mortgages insured by the FHA. The specific terms of each loan must be worked out between you and the lender. To get the most for your money, you should ask a number of questions before signing on the dotted line. Here’s our questionnaire to help you:

1. How much cash will I receive? It depends on a number of factors that you and the lender evaluate. You must consider the monthly supplement you desire. Lenders will look at your age, home value (determined by a licensed independent appraiser), amount of any remaining mortgage, interest rate applied to your repayment, terms and limits on adjustable rate interest (if applicable), and length of time you’ll be receiving payments. You know how life insurance becomes less attractive as you get older owing to rising premium costs? Well, reverse mortgages become more attractive. The older you are, the more you can get each month with a tenure reverse mortgage.

2. What closing costs must I pay? As with other loans, points and fees will be charged. Make sure you understand how much. FHA-insured mortgages carry mortgage insurance requirements that will add to your costs. At this writing, you must pay up-front premiums of 2 percent of the value of your home, up to certain limits which can be no higher than $124,875, and ½ percent per year. Most of the initial costs can be made part of your loan balance.

3. What rate of interest will be charged? The higher the interest rate you must pay, the less your monthly income checks are likely to be. And remember that even though you don’t have to make monthly payments to the lender, your house will be used to repay the loan eventually—and the higher the interest rate, the more you’ll owe. With adjustable-rate loans, your monthly income checks will not vary—only the amount added to your loan balance will change as the interest charge increases or decreases.

4. Can you repay the loan early? You may want the flexibility to pay off all or some of the loan balance before you die or move. For example, if interest rates drop, or if you come into extra money, early repayment of the reverse mortgage may make sense. The FHA program gives you the right to prepay the loan at any time with no penalties.

Eligibility

To qualify for an FHA-insured reverse mortgage, you must:

• Be at least 62 years or older (if joint owners, each must be 62)

• Own your own home (condominiums included)

• Reside in your home

• Have maintained your home in good condition

• Go through mortgage counseling with a counselor approved by the U.S. Department of Housing and Urban Development

Qualifying for a reverse mortgage is much easier than for a regular mortgage because there are no income or credit requirements!

Benefits

We have already mentioned a number of glittering opportunities provided by all of these reverse mortgages insured by the FHA, but let us summarize the advantages that make reverse mortgages a gem of a deal:

• They supplement your income.

• You make no monthly payments.

• You can live in your home as long as you like.

• There’s no chance of foreclosure for nonpayment.

• No payments are due until you die or permanently leave the house.

• There is no obligation on your part or your heirs to pay any debt greater than the value of the house.

In addition, the reverse mortgage checks you receive are not taxable and should not affect your Social Security or Medicare benefits. These payments also should not affect SSI or Medicaid (in most states), as long as you spend the money as you get it. If you save the money, though, it may become an asset that can harm your SSI or Medicaid eligibility.

The most important benefit of an FHA-insured reverse mortgage is that you are guaranteed the right to remain in the home until you sell or permanently move out. What happens if you become ill and must enter a hospital and/or a nursing home, and you’re out of the home for five months? Will the lender nail you with a foreclosure lawsuit? No! Under the FHA program, you must be out of the house for at least a full year before the lender can claim you’ve permanently left. Note that if you take a reverse mortgage that is not insured by the FHA (see below), the lender may apply different rules to decide when you’ve left the home. Check them out before agreeing to the mortgage.

Reverse Mortgages Not Insured by FHA

Reverse mortgages not insured by FHA do not have to comply with the same requirements, and do not have to give you the same protections. Some plans are offered by banks and savings and loans; others are sponsored by state or local government agencies.

Although noninsured programs may be just fine, in many cases they are not. Ask these questions.

1. Can the lender force you to move out and sell your home to pay the loan back before you die or voluntarily leave? The reverse mortgage agreement may require you to repay the loan after a set number of years. For example, you may get a term reverse mortgage, which gives you monthly paychecks for 10 years, and then at the end of that time you must repay the loan. In that case, you’ll have to sell and move out if you don’t have other available cash to pay the balance. (Of course, if you intend to move in a few years, then a requirement that you must repay the loan after a fixed term should not be a problem.)

2. Can you be forced to pay off the loan if you transfer your interest to your spouse? Transferring your interest in the house to your spouse, which might make sense in your planning (see Chapter 11 discussing Medicaid), will not make the balance of the loan immediately due under the FHA program. But reverse mortgages that are not insured by the FHA may allow the lender to call the loan when transfers between spouses are made. Ask before you sign. (Note: If you sell or give your home to your kids for any reason, all reverse mortgages will be due and must be paid—whether or not insured by FHA.)

3. Is repayment limited to the value of the home? The FHA program assures that you or your heirs will not have to pay any more than the value of the home. Check to make sure you get the same protection from other programs before signing on.

4. Can you repay the loan early? Unlike FHA loans, which allow early repayment, other programs may not give you the same flexibility.

5. What if the lender goes under? In these days of bank and S&L closings, what would happen if the lender goes out of business in the middle of a reverse mortgage plan? Under FHA insurance, you’re protected; without that insurance, you could find yourself with a legal mess. Talk to the lender about what obligations you have before taking on an uninsured reverse mortgage.

Where to Get a Reverse Mortgage

Reverse mortgages are a new, though growing, field. For names of lenders in your area offering FHA-insured or uninsured reverse mortgages, send a self-addressed stamped envelope and $1 to the National Center for Home Equity Conversion, 1210 East College, Suite 300, Marshall, MN 56258. The NCHEC will send you a monthly updated list of lenders offering reverse mortgages. You can then contact the lender directly to initiate the application process.

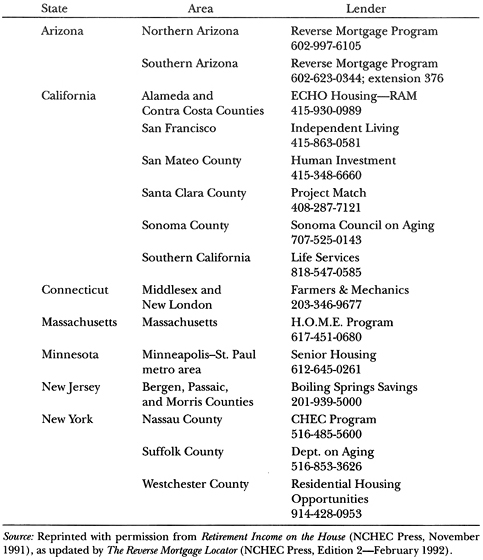

We have provided a list of lenders that have offered FHA-insured reverse mortgages in Table 9.1. Please keep in mind that these are not the only lenders authorized to make FHA-guaranteed reverse mortgages; most other lending institutions (banks and mortgage companies) can make reverse mortgages. Table 9.2 lists lenders currently making uninsured reverse mortgages. These two tables are constantly changing and growing. For up-to-date information, write to the NCHEC.

FHA-Insured Reverse Mortgage Lenders

State |

|

Lender |

|

||

Alabama |

|

United Savings; 205-237-6668 |

|

||

Arizona |

|

Directors Mortgage; 800-442-4966; |

|

|

extension 2201 |

|

|

Sun American; 602-832-4343 |

|

||

California |

|

ARCS Mortgage; 800-237-2727 |

|

|

Bank of Lodi; 209-367-2075 |

|

|

Beachfront Funding; 714-492-5000 |

|

|

CFE Mortgage; 818-577-0233 |

|

|

Directors Mortgage; 800-442-4966; |

|

|

extension 2201 |

|

|

Farwest Mortgage; 714-579-1177 |

|

|

Interstate Mortgage; 818-810-2665 |

|

|

Mical Mortgage; 619-452-8200 |

|

|

Northpoint Mortgage; 209-225-6762 |

|

|

Western Residential; 916-485-1900 |

|

||

Colorado |

|

Wendover Funding; 303-843-0480 |

|

|

Directors Mortgage; 800-442-4966; |

|

|

extension 2201 |

|

||

Connecticut |

|

Prudential Mortgagee; 800-473-6467 |

|

||

Delaware |

|

International Mortgage; 301-484-6016 |

|

|

Boulevard Mortgage; 215-331-6900 |

|

||

DC |

|

International Mortgage; 301-484-6016 |

|

||

Florida |

|

Sterling Savings; 407-968-1000 |

|

|

Brasota Mortgage; 813-746-6119 |

|

|

Chateau Mortgage; 813-545-3523 |

|

|

Homestead Federal; 305-556-1100 |

|

|

IDL Mortgage; 813-482-8686 |

|

|

TST Harms; 904-398-4476 |

|

||

Georgia |

|

Capital One Mortgage; 404-934-9790 |

|

|

Homestead Mortgage; 404-324-2274 |

|

|

Unity Mortgage; 404-493-1041 |

|

||

Hawaii |

|

ARCS Mortgage; 808-263-6602 |

|

|

First Hawaiian; 916-581-5626 |

|

||

Idaho |

|

Directors Mortgage; 800-442-4966; |

|

|

extension 2201 |

|

|

Investors West; 800-281-3338 |

|

||

Illinois |

|

Senior Income; 312-214-2540 |

|

|

WestAmerica; 708-916-9299 |

|

||

Indiana |

|

Merchants Mortgage; 317-237-5100 |

|

||

Iowa |

|

Commercial Federal; 402-554-9200 |

|

||

Kansas |

|

James B. Nutter; 816-531-2345 |

|

||

Kentucky |

|

Tri-County Mortgage; 606-523-1076 |

|

||

Massachusetts |

|

Prudential Mortgagee; 800-473-6467 |

|

||

Maine |

|

ME State Housing; 207-623-2981 |

|

||

Maryland |

|

International Mortgage; 301-484-6016 |

|

|

Home Equity Conversions; 410-269-4322 |

|

||

Michigan |

|

Unity Mortgage; 404-493-1041 |

|

||

Minnesota |

|

Executron Mortgage; 612-854-7676 |

|

|

Richfield Bank; 612-861-8339 |

|

||

Missouri |

|

James B. Nutter; 816-531-2345 |

|

||

Montana |

|

Intermountain Mortgage; 406-652-3000 |

|

||

Nebraska |

|

Commercial Federal; 402-554-9200 |

|

||

Nevada |

|

Directors Mortgage; 800-442-4966; |

|

|

extension 2201 |

|

||

New Hampshire |

|

Chittenden Bank; 802-660-2123 |

|

||

New Jersey |

|

Interchange State Bank; 201-845-5600 |

|

|

ARCS Mortgage; 201-795-0100 |

|

|

Pioneer Mortgage; 800-222-0057 |

|

|

Prudential Mortgagee; 800-473-6467 |

|

|

Boulevard Mortgage; 215-331-6900 |

|

||

New Mexico |

|

Charter Bank; 505-291-3758 |

|

|

Sunwest Bank; 505-765-2211 |

|

||

New York |

|

ARCS Mortgage; 800-237-2727 |

|

|

Onondaga Savings; 315-424-4011 |

|

|

Rockwell Equities; 516-334-7900 |

|

|

Prudential Mortgagee; 800-473-6467 |

|

||

Ohio |

|

Mid-America Mortgage; 216-861-4040 |

|

||

Oregon |

|

ARCS Mortgage; 800-640-4773 |

|

|

Directors Mortgage; 800-442-4966; |

|

|

extension 2201 |

|

||

Pennsylvania |

|

Boulevard Mortgage; 215-331-6900 |

|

|

Hart Mortgage; 215-628-3131 |

|

|

Landmark Savings; 412-553-7727 |

|

|

Pioneer Mortgage; 609-546-1700 |

|

|

Prudential Mortgagee; 800-473-6467 |

|

||

Rhode Island |

|

RI Housing & Mortgage; 401-751-5566 |

|

||

South Carolina |

|

First Citizens Mortgage; 803-733-2747 |

|

||

Tennessee |

|

Mortgage South; 615-624-3878 |

|

|

Randolph Mortgage; 615-622-8303 |

|

||

Utah |

|

AIM Mortgage; 801-485-9355 |

|

|

Directors Mortgage; 800-442-4966; |

|

|

extension 2201 |

|

||

Vermont |

|

Chittenden Bank; 802-660-2123 |

|

|

Prudential Mortgagee; 800-473-6467 |

|

||

Virginia |

|

International Mortgage; 301-484-6016 |

|

|

VA Housing; 804-782-1986 |

|

|

Ameribanc Savings; 703-658-5500 |

|

|

Crestar Mortgage; 804-498-8702 |

|

|

Mortgage Capital; 703-941-0711 |

|

|

Tidewater First; 800-282-4326 |

|

||

Washington |

|

ARCS Mortgage; 206-462-7055, 744-2727 |

|

|

Directors Mortgage; 800-442-4966; |

|

|

extension 2201 |

|

||

West Virginia |

|

International Mortgage; 301-777-1400 |

|

||

Wyoming |

|

Key Bank; 307-635-7724 |

Source: Reprinted with permission from Retirement Income on the House (NCHEC Press, November 1991), as updated by the Reverse Mortgage Locator (NCHEC Press, Edition 2—February 1992).

Lenders Currently Making Uninsured Reverse Mortgages

If you would like more information about reverse mortgages, you can write to the AARP for a free copy of the guide: “Home Made Money,” AARP Home Equity Conversion Service, 1909 K Street, N.W., Washington, D.C. 20049. An excellent full-length book discussing reverse mortgages, which we highly recommend, is Retirement Income on the House (NCHEC Press, November 1991); for information about how to get this book, call toll-free (800) 247-6553.

SALE AND LEASEBACK

A sale and leaseback is another gem that allows you to cash in on your home equity, making your life more comfortable, while allowing you to live in the house. This technique is especially useful if you’ve got a child or children who have a little spare cash.

The major drawback to a reverse mortgage is the cost. As we explained, the lender benefits by charging interest on the monies you receive. And although the lender won’t get paid right away, there’s a chance the bank will later end up with the entire house equity, leaving your kids with nothing at your death.

A sale and leaseback avoids this problem. No bank need be involved, so there are no fees. Only you and the buyer (probably your child) are involved. And even if your child finances the purchase with a bank, your child—not the lender—will get the house. You supplement your income, and your child gets the house when you die.

Overview

A sale and leaseback is just like it sounds: you sell your home and then lease it back. Sale and leasebacks are legally binding arrangements usually made with a child, though they can be done with a nonfamily member, too.

The best way to explain how a sale-and-leaseback arrangement works is with an example.

EXAMPLE 4

Your costs are rising much faster than your income. Though you’ve got a nice “buried treasure” in your house, you can’t get at it. So you arrange a sale and leaseback with your son.

You sell the house to him for $100,000, which is the market value. Since your child bought it, there are no real estate commissions or advertising fees. Your son goes to the bank to finance the purchase, just as he would with any sale. He puts down 20 percent and finances the balance over 30 years at 9½ percent, paying points and closing costs to the lender. You get the $100,000 in cash, tax-free (using your Age 55 Tax Loophole—see here).

You take your $100,000 and invest it at 9 percent; you receive $9,000/ year or $750/month. At the same time, your child rents the house back to you, under a long-term lease, for a fair market rental of $600/month. The lease is for a period far longer than your life expectancy.

So how do you benefit? You have $150/month more spending money ($750 – $600). Plus you save the costs for property taxes, homeowner’s insurance, and upkeep, which could easily save you another $200 or more each month. And depending on how you invest the sale proceeds, your income might be even higher, and some or all of your assets could be much more liquid (and so available to you) than when they were buried in your home. At the same time, the lease assures that you can remain in the home until you die.

What’s your son get out of the deal? This is a business arrangement, and he can and should do well, too. His income ($600) is less than his payments to the bank ($700/month, at 9.5% interest) by $100/month. And he’s also paying $200/month property taxes, insurance, and maintenance—so his apparent loss is $300/month, or $3,600/year.

But that’s not what he really loses, because Uncle Sam offers tax benefits. Your son can deduct his $300/month loss, and he can depreciate the value of the house (but not the land it sits on)—let’s say that’s $80,000—allowing him to take a further loss on his tax return of $2,900/year, or $242/month. In the 28 percent income tax bracket, your son’s deductions for the house would result in a cash benefit of $150/month—so he’s really only losing about $150/month out of his pocket (after taxes).

So far, this isn’t a very good deal for your son. But remember, he owns the house and will benefit by any appreciation. If you die 10 years later, and the house appreciated just 5 percent each year over that time, he could sell it for $163,000—$63,000 more than the purchase price. That gives him a profit of $40,000 ($63,000 – $23,000 out-of-pocket losses, including the points and closing costs he initially paid). If his original investment was $20,000, his return would be 100 percent in ten years, or 10 percent per year. And the investment couldn’t be much safer, now could it?

Example 4 shows how a sale and leaseback can be a Golden Opportunity for both you and a child. You supplement your income; you get to stay in the house for as long as you live; your child gets the house when you die; and your child receives a safe and, it is hoped, lucrative investment.

In Example 4, your child went to a bank for the financing, so he needed a down payment and was required to pay fees and interest, too. All of those costs can be avoided if you take back the financing, as shown in Example 5.

EXAMPLE 5

As in Example 4, you sell the house to your child for $100,000. Rather than have him get a bank loan, you act as the bank. He pays you just $5,000 for a down payment, and you finance the $95,000 balance at 9 percent over 20 years (you don’t charge closing costs or points). Your child’s mortgage payments to you are $855/month. You pay him back $600/month rent. In other words, you get an extra $255/month cash, which is more than you receive (Example 4) if he finances through a bank. The interest payments, which would have gone to the lender, now go to supplement your income. And you still save an additional $200/ month in property taxes, homeowner’s insurance, and upkeep.

What if you live longer than the 20-year financing? Where would you get the money to pay the $600/month rent? If you purchased a single-premium deferred annuity with the $5,000 down payment when your child first gave it to you, the annuity would start paying you more than $750/month for five more years (following the end of the 20-year financing).

What does your child get, other than a big debt? Again, this is an investment for him. He can deduct his out-of-pocket loss of $455/ month ($855 – $600 = $255, plus $200 taxes, insurance, and upkeep). And he can deduct $242/month depreciation. The deductions (in the 28% tax bracket) would result in a cash benefit of $195/month—so he’s really only losing $260/month.

If the house appreciates just 5 percent/year and he sells (when you die) in 10 years, he’ll receive $163,000. That gives him a profit of $8,400 ($63,000 – $54,600 out-of-pocket losses in 10 years). His return on his $5,000 investment would be 68 percent in 10 years, or 6.8 percent per year. Not too bad, right? (And if the house appreciated 7 percent/year, his return would be 700 percent, or 70 percent per year!)

Congress has made investments in rental property less attractive over the last few years. But as you can see from Examples 4 and 5, the benefits to a purchaser can still be worthwhile. Just looking around at the market bears this out. There are still many absentee landlords reaping the advantages offered by rental property. And the biggest concern for landlords—problems with a bad tenant—are avoided in the sale and leaseback arena where an older resident who has lived in and maintained the house for years plans to continue. The investment a buyer makes in your home is about as safe as purchasing U.S. Treasury Bonds.

If your child has the funds to contribute $455 a month to your support, as in Example 5, why go through the hassle of a sale and leaseback? Why not just have him give you the money? You can leave him the house when you die, and everybody’s happy.

While we strongly believe in simplicity, and in some circumstances gifts from your child may be all that you need, there are good reasons to make a sale and leaseback arrangement. Maybe most important is that Uncle Sam helps by giving tax breaks to your child. Consider Example 5: you get $455 a month, but your child only pays $260—Uncle Sam pays the other $195.

Also, your child gets the assurance that you won’t later change your mind and leave the house to someone else (although that assurance might be provided by you giving your child the house, perhaps keeping a “life estate”—a lifetime right to live there). And a sale and leaseback can be done with a third party, while gifts typically would only be made by a family member.

Are There Tax Benefits?

As you can see from Examples 4 and 5, a sale-and-leaseback arrangement can provide a variety of tax benefits. If the sale and rent is at a fair market rate, the buyer should be able to deduct interest, expenses, and depreciation.

At the time of the sale, you should be able to avoid paying tax on the profit up to $125,000, using the Age 55 Tax Loophole. And since the sale price is at the fair market value, the buyer (your child) gets a stepped-up basis (see here), which allows him to reduce or eliminate any capital gains tax on the profit, at least up to the date of the sale.

On the downside, you will also be receiving more income, which may increase your income tax. If you receive a lump sum that you invest, as in Example 4, the interest is counted as income; if you finance the sale, as in Example 5, part of each payment you receive is counted as income again.

You probably can’t escape income tax by financing the deal and not charging any interest. The IRS will most likely charge you tax on the income you should have received in a regular deal with a nonfamily member.

Will Your Other Benefits Be Affected?

A sale-and-leaseback arrangement might have an impact on Social Security, SSI, and Medicaid benefits. For example, interest that you receive by taking back financing for the buyer (Example 5) would be income—which could make part of your Social Security benefits taxable and could harm your eligibility for SSI and Medicaid. But only the interest portion matters, not the entire monthly payment you get.

NOTE

You might be able to avoid receiving income for tax purposes if you give the home to your child, instead of selling it, and then your child makes cash gifts to you each month in return. Gifts are not income. The reason we are telling you this as a “note,” rather than a Gem, is because it is a diamond in the rough and probably won’t work. The IRS is likely to say this is really a sale, so the cash gifts are really income. Talk to an accountant or tax lawyer before trying this.

Also, the down payment and any mortgage note you receive might be counted as an asset for Medicaid and SSI eligibility. We say might because it may be possible to prepare the sale-and-leaseback documents to avoid these problems. As we mention in the next section, an experienced lawyer can help protect your Social Security, Medicaid, and SSI benefits.

How Do You Get a Sale and Leaseback?

If you decide to use a sale-and-leaseback arrangement to supplement your income, you’ll need the help of a lawyer to put the deal together. Make sure the documents protect you against a variety of possible problems. The arrangement should:

1. Allow you the legal right to live in the house for life. If the buyer changes his mind and decides to throw you out, you need to be protected.

2. Protect you in case the buyer dies or sells the property while you’re still there. The new owner can be bound to follow your deal if the documents are properly made and recorded.

3. Include a due-on-sale clause, which gives you the right to cancel if ownership changes.

4. Provide remedies for you in case the buyer fails to make his mortgage payments to you or another lender.

5. Protect you from unexpected rent increases. You may want to provide for no rent increases, but that might cause you and the buyer to lose tax benefits. Instead, you might be better off providing for fixed rent increases, matched by increasing mortgage payments by the buyer.

6. Clearly spell out the buyer’s responsibility for taxes, insurance, repairs, and maintenance.

7. Give you the right to have someone move in with you, perhaps to provide you with nursing care or to share expenses.

8. Specify what occurs if you choose to move, or if you must enter a nursing home.

You will probably not be surprised to learn that a lawyer will charge you for preparing these papers. If you have an experienced lawyer who has done this before, a simple arrangement will probably run about $500. Take it from us—that’s money well spent. You can purchase a good set of model sale-and-leaseback forms from the National Center for Home Equity Conversion by sending $39 to the NCHEC at 1210 East College, Suite 300, Marshall, MN 56258.

Sale and Leaseback vs. Reverse Mortgages

Sale-and-leaseback arrangements may be better or worse than a reverse mortgage, depending on your circumstances. Let’s compare the pros and cons of each.

1. A sale and leaseback is much more complicated and requires the help of a lawyer; a reverse mortgage can be done between you and a lender.

2. A sale and leaseback requires you to find a willing buyer; a reverse mortgage requires you to find a willing lender. Today, lenders are much easier to find.

3. A sale and leaseback can be less costly, particularly if you provide the financing. Reverse mortgages can carry stiff interest charges that you don’t pay with a sale and leaseback.

4. With a sale and leaseback, you must protect your right to live in the home in writing; with a reverse mortgage you must also protect via documents your right to live in the home. Without these protections, you could wind up sleeping on a park bench.

5. You don’t have to worry about real estate taxes, insurance, and maintenance after a sale and leaseback; you’re not off the hook for these obligations with a reverse mortgage.

6. If your house has appreciated more than $125,000 in value since you bought it, you could wind up paying tax on part of the profit if you use a sale and leaseback; with a reverse mortgage, you and your heirs will pay no tax on profit, but there may be no house for them, either.

7. Your child gets the house if he buys under a sale and leaseback; your heirs could completely lose out under a reverse mortgage.

8. Your Social Security, SSI, and Medicaid will not be affected by a reverse mortgage; a sale and leaseback might cost you a portion of those benefits.

HOME SHARING

Another gem to supplement your income is to rent out a room in your home. This technique provides not only cash but also companionship, which some see as a plus and some as a minus.

The financial piece of the arrangement is fairly simple: you look in the rental ads in your local newspaper, figure a fair rental, and find a tenant. If you get $150 a month, that’s an extra $1,800 a year you didn’t have before; $300 a month would add $3,600 a year to your budget.

The money you receive is income for tax purposes, and the extra income may also impact your Social Security, SSI, and Medicaid benefits. But you may also get some tax breaks, since you are now a landlord.

The most important issue in home sharing is personal, not financial: you have someone living with you. You may find that attractive, particularly if the empty house has started to seem a little lonely lately. If you fall or become ill, having someone who can call the doctor or ambulance is useful, too. On the other hand, you may enjoy your privacy. The added money may not be worth the loss of peace and quiet around the house. And if you get a “bad apple,” watch out.

Home sharing makes you a landlord, with the responsibilities and risks that go with it. If a leak develops in your renter’s room, you can’t put off repairing it. If your renter stops paying and won’t move out, you may have to evict him.

No matter how nice and trustworthy the person appears, you should have a written lease between you and your renter that spells out your rights and your renter’s rights. For example, it should specify whether your renter must use a particular entry to the home, where he can park his car, which room or rooms he may use, whether he has access to the kitchen, when he must pay his rent and what happens if he’s late, and whether he can have guests or pets. You must also make sure you comply with any state or local laws governing rentals.

Home sharing can be a wonderful way to supplement income, especially with the right tenant. But make sure you understand all the risks before cashing in on this gem.

HAVE YOUR CHILD CO-SIGN A LOAN

Consider this situation. Your income generally is enough for you to live on, but once in a while you need additional money to repair the roof, replace the furnace, or go on a nice trip. Your kids would like to help, but they just don’t have the savings to give you. You don’t need a regular income supplement provided by a reverse mortgage or a sale and leaseback. Instead, a standard bank loan might be enough. The problem is that you can’t qualify based on your income.

Having your child co-sign a loan might be all you need. Even though you don’t qualify on your own, your child’s signature could help you get the loan. And if you are able to pay back the loan out of your income, the loan won’t cost your child a penny. For many older Americans, this is the easiest and least expensive way to cash in on the equity in their homes.

This gem probably won’t help if you need regular monthly income supplements, because you could never repay the debt. Normal loans or mortgages aren’t designed to handle growing balances—that’s the purpose for reverse mortgages. But for a one-time or occasional cash supplement, take a look at getting a child (or someone else) to co-sign a standard loan for you.

If your child wants some protection in case you can’t pay it off, you could give him a mortgage on your home. While it’s unlikely you’d ever default or he’d ever foreclose, the protection is there.

If the lender won’t approve the loan to you, even with your child’s co-signature, you might give the home to your child and have him take out a standard mortgage or home equity loan in his own name. In most cases, that step shouldn’t be necessary; if your child can qualify for a loan, then his signature on your loan should be enough.

SPECIAL-PURPOSE PROGRAMS

Many states and communities offer special programs designed to allow older homeowners to cash in on their home equity for specific purposes, including home repairs or improvements (but not decoration), weatherization, and property tax relief.

While there are no standard benefits, most programs have in common:

• Loans at low or no interest and no fees or points.

• No repayment until you die or permanently move out.

• Income, asset, age, and/or home value limits.

EXAMPLE 6

You need a new roof, and the cost will be $10,000. Your state offers a program that will loan you the $10,000 at 3 percent interest—that’s a deal you can’t pass up.

You gladly take the money and make the home repairs. You make no payments during your lifetime. When you die five years later, the house is sold and used to pay the loan balance, which at that time will be $11,600.

If you use a special-purpose loan to repair or improve your property, the value of your property may increase, and the added value may more than make up for the cost.

EXAMPLE 7

These days the stairs in your home seem like mountains and you can’t keep climbing. If you added a bathroom on the first floor, you wouldn’t have to move. The cost is $10,000, which is beyond your budget. Your state offers special-purpose loans with no interest and no repayment required until you die or move. You are a little concerned about taking on $10,000 of debt, but you go ahead.

The added bathroom immediately increases your home value by $5,000. You live another 15 years, and your home appreciates an average of 5 percent each year. During this time you have appreciated the convenience and your independence. By the time the house is sold, the bathroom has actually added more than $10,000 to the sale proceeds. The increase in value covers the entire amount of the loan, and then some. The amount you will be able to leave your spouse or children has gone up, not down, as a result of the borrowing.

Most of the loan programs that cover property taxes work the same way; you borrow the amount to cover your property taxes each year, but you don’t pay the money back until you sell the home or move. These Golden Opportunities allow some older Americans to use their resources for other purposes; for many, special-purpose property tax loans make the difference between moving and staying.

EXAMPLE 8

Your property taxes run $2,000/year. That breaks down to more than $160/month. When you add that to your other expenses, you might have no choice but to give up your home of 30 years.

Fortunately, your state offers a special program that will loan you the money for the taxes. The charge is 6 percent per year, but you don’t pay until you die. After five years, you would owe $11,000 ($1,000 of which is interest); after 10 years, the balance due would be $25,156 (including interest of more than $5,100).

But don’t forget the wonderful magic of appreciation. If your home was worth $80,000 when you first took the property tax loan, and it increases in value by just 3 percent each year, it would be worth $12,000 more in 5 years and $27,000 more in 10 years—in other words, the increased value is more than enough to cover the loan.

So instead of thinking about a special-purpose loan as a burden, think of it as an investment. If the difference between staying in your home and moving is the property tax, you can use a special-purpose loan to pay the tax, and the appreciation you gain should more than cover the eventual cost.

At this time, special-purpose loans to pay property taxes are available in all or parts of California, Colorado, Connecticut, Florida, Georgia, Illinois, Iowa, Massachusetts, Maine, New Hampshire, Oregon, Tennessee, Texas, Utah, Virginia, Washington, and Wisconsin. To find out whether your state offers special-purpose loans to pay property taxes, and if it does, on what terms, call the local agency to which you pay property taxes. Someone there should be able to point you in the right direction. (While you’re on the phone, ask about any other benefits that might be available.)

For other special-purpose loans, there’s no easy place to look for information. You should start with your city housing department or aging office. If that doesn’t work, try your area agency on aging or your state department on aging. Even your local consumer affairs office might be able to help.

* * *

Your home contains a “treasure chest” of riches; the trick is getting to them. By using a reverse mortgage, sale-and-leasehold arrangement, home sharing arrangement, child co-signature, or special-purpose loan, you can literally avoid having the roof cave in on you. These home advantages will enable you to cash in on the equity in your home to supplement your income and pay your bills.