In order to perform a digital payment in a situation where we are physically present, such as paying in a store, we need technology to

• identify the customer, or more specifically, the customer’s account

• register the amount and date, and the ID of the shop

• transfer these data to a central system, such as a bank or a credit card broker.

I shall discuss this form of payment before moving to other forms of transactions.

Paying in a Store

Consumers in a store need some form of electronic ID to identify themselves, or more specifically, the account that they will use for the transaction. Credit or debit cards with a magnetic, computer readable, strip have been the norm in this regard. The information on the card is coded on the magnetic strip, and the card can be read in a simple magnetic reader. This is an old, robust, and proven technology that was used in magnetic tapes and cassettes.

A card with a magnetic strip is cheap to produce, but has the disadvantage of being easy to copy. Many types of credit card fraud have been based on making illegal copies. This can be done manually, such as in a restaurant if the waiter has your card, or electronically by mounting illegal card readers in front of the card reader slot in an ATM.

More secure cards use an embedded chip. This is much more difficult to copy and the information on the chip may be better protected than on the magnetic strip. Cards may also have an RFID1 chip. This can be detected simply by tapping the card on a reader. Such tap-to-pay systems often allow small payments to be performed without a PIN.

With only the card as identification we have single-factor authentication. This is very convenient to use, but authorities often set an upper limit on the amount that can be paid, for example £30 (approximately US$42) in Great Britain (in 2018). For larger amounts, two-factor authentication, such as the card and a PIN, is needed. Later on, we shall offer suggestions for systems that combine simplicity and security.

As we have seen, smartphones can also be used for payments, replacing the card. Many smartphones have a convenient fingerprint reader, which makes it possible to authorize a payment without the PIN. In the simplest system, a customer pays by holding the phone next to the terminal after starting an app. Communication is then based on NFC. As the name (near-field communication) implies, this is a form of radio communication that works within a range of some centimeters. Most smartphones and many point-of-sale terminals support NFC. Several providers, such as Apple and many banks, now offer smartphone payment systems.

Other information needed to perform a payment, such as the amount and the ID of the store, can be retrieved automatically. The only data that has to be entered manually is the PIN, and this may also be avoided with a fingerprint reader.

For customers, an advantage of digital payments is that all data are registered and can be presented in a bank statement on paper or electronically. Today most systems offer limited data, such as the date, the name of the store, and the amount. However, we should expect more in the future, such as information about the items we have bought. Some systems are already available and I discuss the merits of such systems in Chapter 15.

An advantage for the store is that the payment can be registered in a customer’s profile. The store will then need to connect the transaction to a customer. There are many ways of doing this. The customer can have a separate loyalty card or have his or her profile connected to a credit card. By registering all transactions, the store will learn more about each customer and can use this information for marketing, special offers, bonus points, and so on. I also discuss these aspects in Chapter 15.

The advantage of a digital payment for the bank and the credit card company is that they are now in the payment loop. In addition, the data provided by the payments will offer important insights into the customer, the retailer, and commerce as a whole. For example, such data should make it possible to build good customer profiles, information that may be used for marketing.

To date, such data has been proprietary for the banks and credit card companies. However, new EU laws, the Payments Services Directive (called PSD2), will force banks and other companies that store data on private individuals to share the data with third parties. The idea is to let customers have ownership of their own data. Since these data are confidential, the third parties have to be confirmed and the customer must explicitly give consent. This effort shows that the EU feels that information of this kind is too important to let the banks exploit their monopoly.

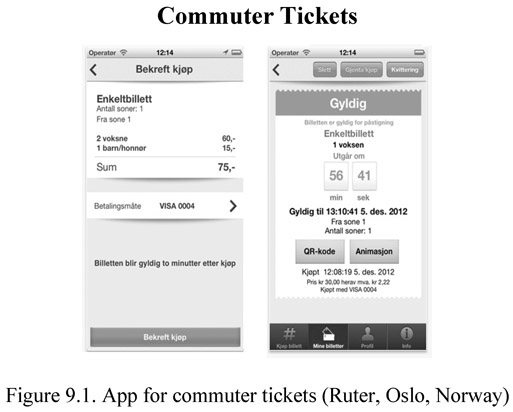

There are many ways to pay for commuter tickets: on the bus or the train, in shops, or at vending machines. Different countries and different cities have had their own systems. Until recently, vending machines were seen as the future. The Oslo-based company Ruter spent more than 600 million Norwegian kroner (US$70 million) on an automatic ticket system with card readers and ticket automats at every station. The system never became operational. Then they spent 20 million Norwegian kroner (US$2.4 million) developing the app mentioned previously that became a great success (Figure 9.1).

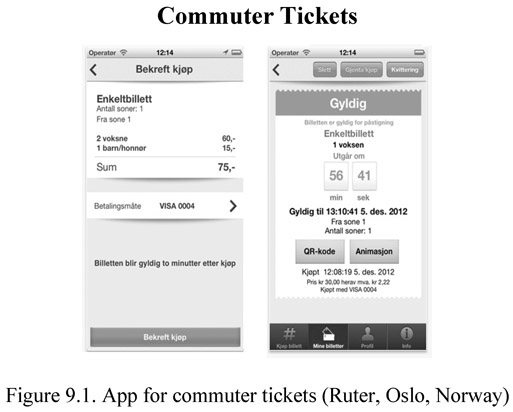

Apps are now the norm in many countries. With a registered user and a registered credit card, a ticket can be bought by just by a few button clicks. Some systems will also detect your location and can then automatically insert some information, saving button clicks. For example, when I buy a ticket for the airport express train at Oslo Airport (Oslo Lufthavn), it will suggest a ticket from the airport to the city center (Oslo S), the latter information having been collected from a previous trip (Figure 9.2). It is then literally a “one-button click” operation that is initiated with the “buy” (“kjøp”) button.

The apps may also tell users when the bus or train will arrive according to the schedule, or better, according to actual online infomation. For example, if the bus is delayed in traffic, the system can estimate an arrival time based on distance and speed, or based on a big-data analysis of previous data.2

The Ruter app offers customer a set of functions that were never possible when using cash or a travel card. The app counts down to when the train or bus will depart. It can give warnings when a monthly pass is about to expire. With an app, a user can buy tickets for more than one person or buy a ticket and forward it to another person. Since the company and its customers rely on smartphones, USB contacts are now being installed in buses, trains, and boats so that passengers can charge their phones.

What we see here, and what we have discussed previously, is that the actual payment is part of a process that helps users fulfill all of their needs. This is where digital systems have a large advantage. The payment is an integrated part of the whole process, not separated out as when using cash.

Digital Payments for Net Shopping

While cash is an alternative when we are physically present in a store, it cannot be used online; here, credit cards are the most common form of payments. Alternatives are to prepay for products by transferring the amount to the store’s bank account or to use a collect-on-delivery payment. However, both of these alternatives are cumbersome and collect-on-delivery may also be expensive. Many delivery services also require a digital payment. In addition, an advantage of using a credit card is that the credit card company will guarantee the transaction; if you don’t get what you ordered, they will cancel the payment. In practice, net payments cannot be performed with cash.

By verifying the transaction through the use of a smartphone and PIN code, as we discussed in Chapter 8, these transactions can be made secure, at least secure enough to make customers confident that the transaction will be performed as it should be. In addition, computer systems can check for fraud. For example, the transaction may be found to be suspect if the goods ordered are expensive, easy to sell, and not being delivered to your home address. Based on big-data analysis, a computer system can detect fraud or at least indicate where fraud can be a problem. Such a system can also learn from experience, so that data on every faulty transaction can be used to improve the detection of this type of transaction in the future. There are many “machine learning” applications that have succeeded in this area.

In developed countries, most customers shop on the net. Online shopping may comprise as much as 15 percent of all shopping in some countries, even higher for some products, and the percentage is increasing every year. Nearly everyone uses the Internet to book airplane tickets and hotels. Customers who use digital payments on the Internet may want to use the same means of payments in retail stores. In this way we see that online shopping is defining digital payments as the norm.

Other Forms of Digital Payments

The advantage of using smartphones for payments is that the customer brings his or her own device, meaning there is no need for a separate point-of-sale terminal, although good Internet coverage is a requirement.

In the simplest situation, the terminal can be replaced by a QR code, an optical code that can be read by a smartphone. For example, the code could be placed in a parking area. It will then give information on the parking company, the receivers of the funds, and the amount involved. To pay, the user will open the correct app, provide the PIN code to get access and then take a picture of the QR code. Additional information, such as the license number of the car, can be typed in.

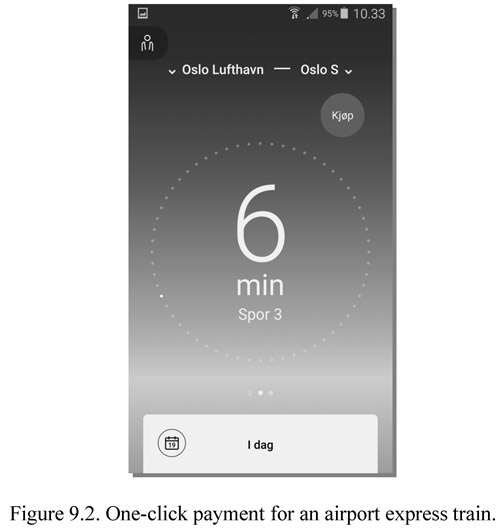

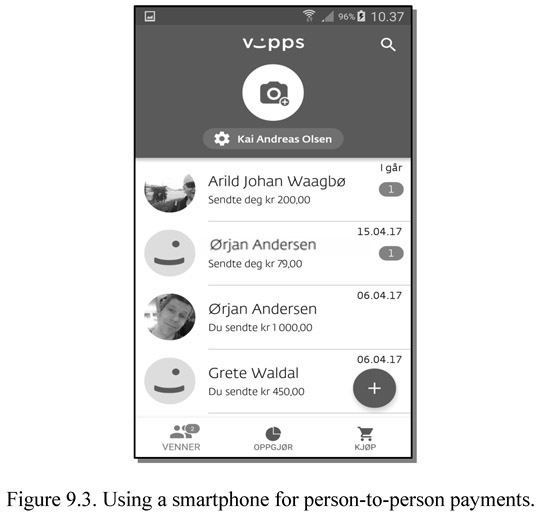

Smartphones are also used for payments between private persons. One way of doing this is to use a bank app to get access and then transfer the amount to the receiver’s bank account. The transactions can be simplified by using the receiver’s phone number as a replacement for the bank account number. An example is shown in Figure 9.3. The advantage is that phone numbers are more easily recalled. Everybody has their friends’ phone numbers, but few have their account numbers. It is also more convenient and more secure to offer your phone number to other people than a bank account number. This requires that all users connect their phone number to a credit card or a bank account.

Until these systems emerged, cash had the advantage of offering real-time clearing of transactions—that is, when the customer handed over the cash to the seller and received the product in return. These new phone-based systems also perform transactions immediately. That is, there may be some time before the money is taken out or inserted in the underlying accounts, but the transaction is registered in real time and cannot be revoked. Internet banks are also starting to offer real time transactions. This will probably be the norm in a few years. There is no good reason why monetary digital transaction cannot be performed immediately. The advantage is that customers receive real-time clearing and balances that are updated after every transaction.

These systems can also be used for payments in stores and for paying invoices. In the latter case, the invoice will be sent to the customer’s smartphone and can be paid by a button click. No additional information has to be entered. However, the simplest way of paying with a smartphone in a store is to use NFC and the tap-to-pay service, as described above, since this requires less input.

When customers have smartphones, stores can offer apps that handle the complete customer experience. This also allows for the implementation of more complex discount systems. For example, a Norwegian grocery chain has introduced a system where customers get an immediate discount on the ten most bought products (based on frequency and value). In the future, this process of collecting data and offering discounts may be seamlessly integrated with digital payments, but not with cash.

Conclusion

In this chapter we have explored different ways of making payments in retail stores, for getting commuter tickets, and for online shopping. We have also looked at other ways of making payments, using QR codes and apps on smartphones. For many of these operations, cash either cannot be used or would be very cumbersome. We also see that the payment is only a part of a large digital transaction where all the operations are an integrated whole.

While the smartphone is ideal for many types of operations, it will not necessarily replace debit or credit cards. In a store, it may be more convenient to use the card than a phone; when verifying an online transaction the smartphone is often convenient as it offers a high degree of security. We shall see later that phones and cards may also work together in other ways.

Notes

1 RFID—Radio-frequency identification.

2 Several years ago I was involved in a project that estimated the time of arrival for passenger boats on the northwest coast of Norway. By collecting all data on each trip, the system was soon able to offer detailed estimates based on a big-data analysis of previous trips. See Olsen, K.A., Indredavik, B. (2011) “A Proofreading Tool Using Brute Force Techniques,” IEEE Potentials, 30(4).