17 |

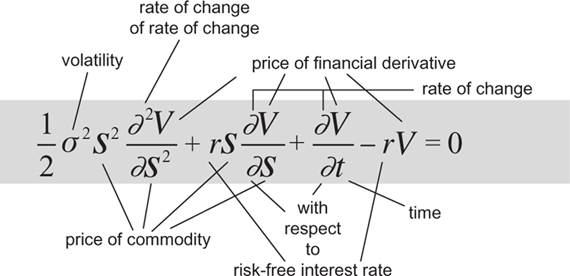

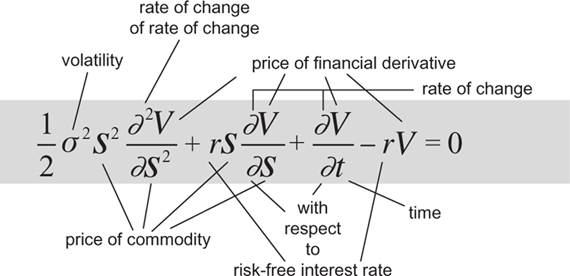

The Midas formula |

It describes how the price of a financial derivative changes over time, based on the principle that when the price is correct, the derivative carries no risk and no one can make a profit by selling it at a different price.

It makes it possible to trade a derivative before it matures by assigning an agreed ‘rational’ value to it, so that it can become a virtual commodity in its own right.

Massive growth of the financial sector, ever more complex financial instruments, surges in economic prosperity punctuated by crashes, the turbulent stock markets of the 1990s, the 2008–9 financial crisis, and the ongoing economic slump.