Fixed assets can be equipment, cars, and/or buildings. They represent the lowest level of assets master data, which contains the fixed asset record, the unique ID, description, grouping, and specific characteristics for fixed assets. There are two ways you can create a fixed asset record. You can either create a record manually or automatically through purchase order posting. The method of creation differentiates the acquisition document. The following diagram shows the creation methods and acquisition documents:

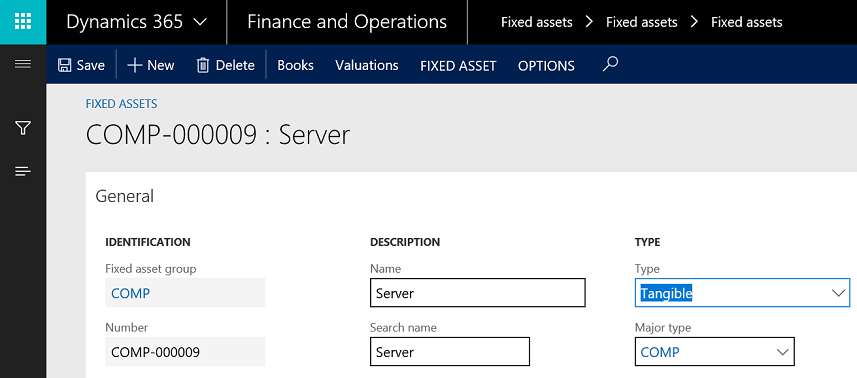

In order to create a new record of fixed assets, go to Fixed assets | Fixed assets | Fixed assets, and press Alt + N to create a new record. Here, the Fixed asset group and Number fields are the mandatory fields. When the user selects the Fixed asset group value, the number is automatically created. Enter the Name and Search name of the fixed assets under Description, as shown in the following screenshot:

Under Books, there are two types of data. The first type of data is populated automatically, which represents the book assigned to the fixed asset group. These fields contains depreciation, service life, and depreciation periods. This is shown in the following screenshot:

As shown in the preceding screenshot, there is an option to assign alternative depreciation profiles. When using a depreciation method that is based on a percentage, you can use the alternative depreciation profile to automatically switch to the alternative depreciation method from the original depreciation method. You can do this when the amount for the straight line method is higher than for the original method.

The second type of field can be identified manually. For this, navigate to the General fast tab to identify the acquisition date and price. These are shown in the following screenshot: