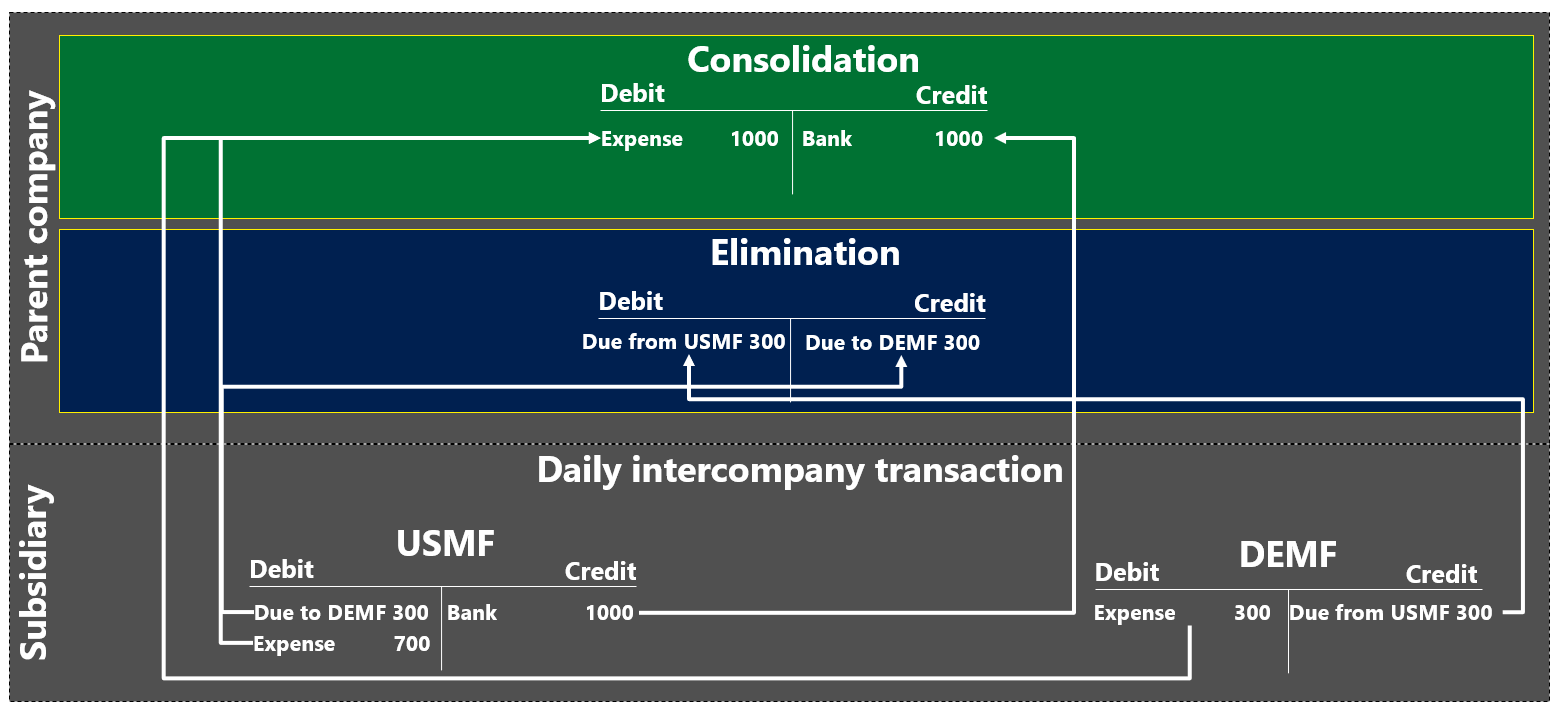

In the course of normal business operations, daily transactions are executed on the subsidiary level, then you run the elimination and consolidation process. Assuming that subsidiaries have inter-company transactions covering marketing expense, the USMF company pays the expense from its accounts and identifies the expense part for the DEMF company. The following diagram illustrates the subsidiary inter-company transaction, in addition to elimination and consolidation process on the parent company level:

To execute the consolidation and elimination process, navigate to Consolidation | Consolidate online; the parameter dialog will open up to identify the consolidation and elimination criteria, as shown in the following screenshot. Enter the description, identify the consolidation period, and include the actual amounts:

Then, move to Financial dimensions to identify which dimensions will be carried on the consolidation process and what the segment order is for each dimension, as shown in the following screenshot:

Move to the Legal entities tab, to determine which legal entities are included in the consolidation and elimination process, identify the share percentage, and account type of conversion differences, as shown in the following screenshot:

Then, determine the elimination process by identifying the elimination rule in the Elimination tab, the GL posting date, and proposal options, as shown in the following screenshot:

Finally, define the Currency translation for companies that have a different accounting currency from the consolidation company, identify the exchange rate type, and designate the applied exchange rate, as shown in the following screenshot:

After the process is finished, the elimination journal is created; it eliminates the due to (133332) against the due from (231367). The due to line is posted in EUR and it is equivalent to the USD amount of due from, as shown in the following screenshot:

The used exchange rate from EUR to USD is 1.20.

Then, move to Consolidations, where the system gathers transactions from the subsidiary level, as shown in the following screenshot:

The consolidated trial balance of the parent company represents the total of the expense account 1,000 USD (300 DEMF + 700 USMF); the due to and the due from have been eliminated, and the petty cash account has a credit balance of 1,000 USD. To access the trial balance, go to General ledger | Inquiries and reports | Trial balance, as shown in the following screenshot: