The accounts receivable module is subdivided as follows:

- Parameters: This identifies the company-wide parameters for accounts receivable. For accounts receivable parameters, navigate to Cash and bank management | Cash flow forecasting | Cash flow forecast setup, then go to Accounts receivable, and click on Sales forecast defaults, as shown in the following screenshot:

- Time between shipping date and invoice date: This identifies the period between the product's issuance and invoicing.

- Terms of payment: This identifies the period between the customer invoice posting and due date.

- Liquidity account for payments: This represents the liquidity account for settling payments.

- Percentage of amount to allocate to cash flow cast: This represents the allocation key used for budget reduction, with regard to the volume of orders.

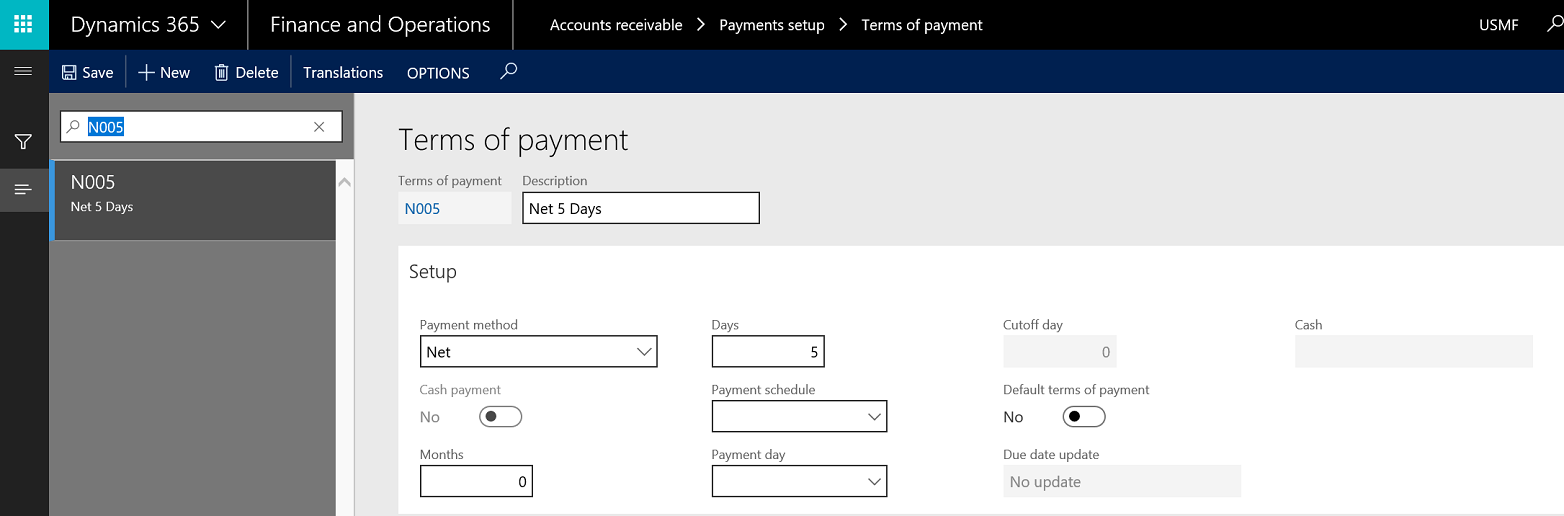

- Time between invoice due date and payment date: This identifies the period between the customer payment due date and payment execution. The terms of payment values are commonly used in the accounts receivable module's cash flow forecast, where we can set the number of days or months that identify the payment due date. To see the terms of payment, navigate to Accounts receivable | Setup | Payment | Terms of payment, as shown in the following screenshot:

- Customer posting profiles: This is an integration point between accounts receivable and general ledger, where identifying the ledger account will be used when posting a transaction on a customer attached to a particular posting profile. The Liquidity account for payments column in the following screenshot represents the liquidity accounts that are used for customer payments. To see the posting profiles, navigate to Cash and bank management | Cash flow forecasting | Cash flow forecast setup, then go to Accounts receivable, and click on Customer posting profiles, as shown in the following screenshot:

The Liquidity account for payments column in Customer posting profiles dominates the Liquidity account for payments column under Module parameters.

Customer groups: This represents the customer classification and the posting profile assigned to a specific customer group. You can also see the Time between invoice due date and payment date column in the following screenshot. It is used in the cash flow management logic.

To see the customer groups, navigate to Cash and bank management | Cash flow forecasting | Cash flow forecast setup, then go to Accounts receivable, and click on Customer groups:

- Customer master: In the customer master's data information, which is captured and recorded during the creation of a customer and has an effect on customer aging and the cash flow forecast as well, the Terms of payment under the PAYMENT section in the customer master data is considered as a default value proposed when the customer is selected in a transaction—the value can be changed on a transactional level without modifying the master data record. For this, navigate to Accounts receivable | Customers | All customers, select a particular customer, and click Edit, then move to the Payment default fast tab: