Currency is any kind of money that circulates in an economy. Organizations must have one accounting currency, also known as the company currency or home currency. The accounting currency is identified based on how the company wants to represent its financial reports. On the other hand, companies report their transactions in a specific currency, known as reporting currency. It is normal to post transactions in a different currency, and this amount of money is translated to the home currency, using the current exchange rate. This is a business need in enterprises that operate in a multinational environment.

Each subsidiary has its local reporting currency and at the same time, there should be a specific secondary reporting currency. All the transactions are translated into the reporting currency, using the exchange rate.

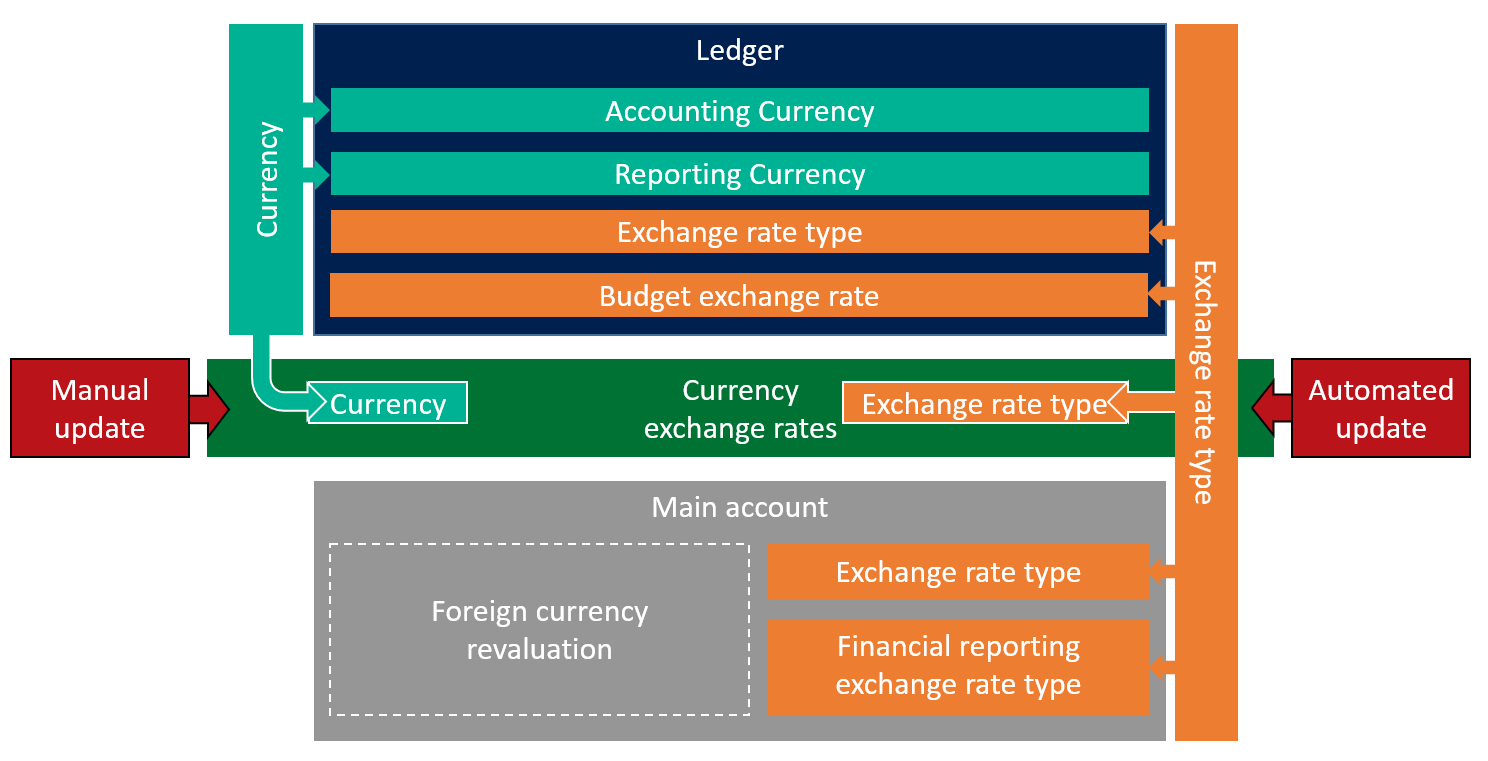

Currency elements are defined in the General ledger module. It is important to gather the currency business requirements in the early stages of the analysis phase. It is mainly used to identify the accounting currency, reporting currency, exchange rates that will be used, and how it will be maintained, either manually or through automated jobs. Additionally, the main accounts have three options for currency revaluation; the first option is if the main account is subjected to be reevaluated, the second option is, the exchange rate type, and the third option is the financial reporting exchange rate type. The following diagram illustrates the basic elements of currency in Microsoft Dynamics 365 for Finance and Operations:

Currency code is the heart of the Currencies setup. Microsoft Dynamics 365 for Finance and Operations is shipped with world currency codes and uses the standard three-digit designation used by banks. The following screenshot illustrates the currency setup: to access the Currencies form, navigate to General ledger | Currencies | Currencies:

Exchange rate types represent different exchange rates that could be used within one company. Companies may use different exchange rates for budgeting, and this decision is taken during the analysis and design phases of the implementation. To access exchange rate types, navigate to General ledger | Currencies | Exchange rate types, as shown in the following screenshot:

Currency and exchange rate types are assigned in the Ledger form, or the main account form. The form, as shown in the following screenshot, is where you define the accounting currency, the reporting currency, the exchange rate type, and the budget exchange rate. To access the Ledger form, navigate to General ledger | Ledger setup | Ledger:

Now move on to the exchange rates where the company assigns the exchange rate for a pair of currencies. To access the currency exchange rate, navigate to General ledger | Currencies | Currency exchange rates. The exchange rate type is identified in this form automatically, and it contains the exchange rate of any pair of currencies on a specific date. The following screenshot represents the Currency exchange rates form:

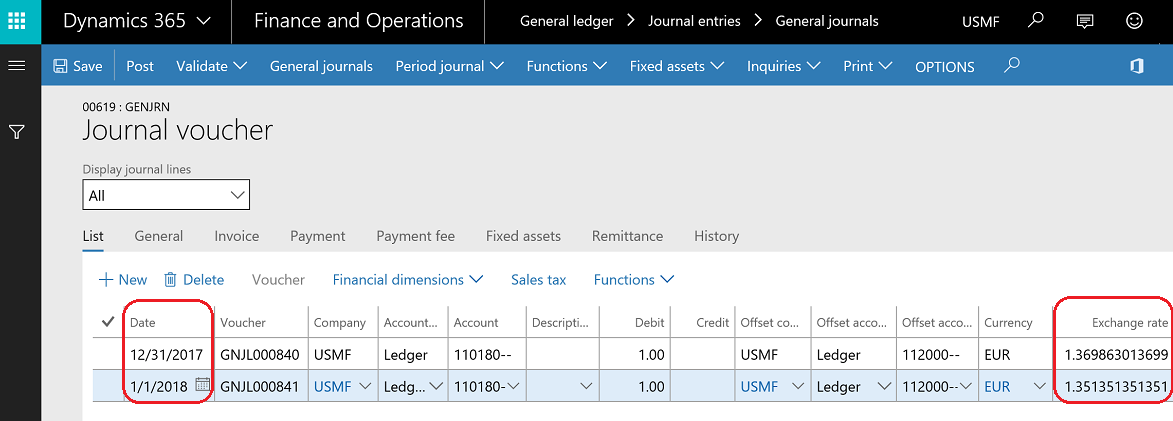

Based on the preference of the company's CFO and controller, From, To, and Conversion factor are configured. As shown in the preceding screenshot, 1.00 USD is equal to 0.7400 EUR for January 2018. In the course of the transaction with the EUR currency, the system fetches the exchange rates from the exchange rate table, based on the transaction date. The following screenshot shows the exchange rate on different dates in the General journals entry; to navigate to the General journals form go to General ledger | Journal entries | General journals:

The exchange rate on December 2017 is equal to 1.3698630136 (1/0.73).

The exchange rate on January 2018 is equal to 1.351351351351 (1/0.74).

The posted voucher represents the transaction currency, the accounting currency, and the reporting currency in three different columns, as shown in the following screenshot:

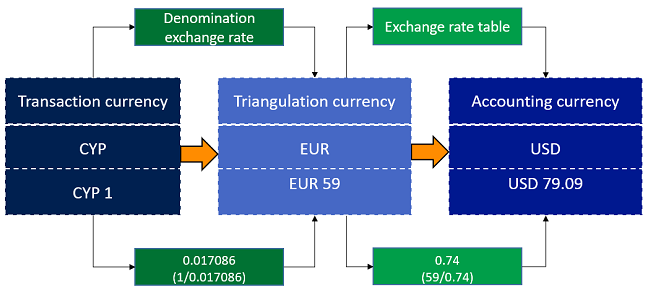

If the company is operating in a country that is transitioning economically to the EURO zone, this is identified on the Currency form by marking Reference currency for triangulation. If a country is converting its local currency to EUR during a specific period of time based on a fixed rate, this is known as a denomination currency. Transactions using the denomination currency will be translated to EUR then converted to USD, and this is known as triangulation. To access the denomination currency, go to General ledger | Currencies | Denomination currencies, as shown in the following screenshot:

As an example, if an accountant is posting a transaction in Cyprus Pounds, which is the denomination currency, and assuming the transaction amount is 1 CYP, the system fetches the defined exchange rate on the denomination currency from CYP to EUR, as shown in the following screenshot of the General journals form. To access the General journals form, navigate to General ledger | Journal entities | General journals:

In the generated voucher for the preceding entry, the transaction currency is CYP and equals 1, and the amount in the accounting currency is 79.09 USD. The calculation is done as illustrated in the following diagram:

The exchange rate update frequency is based on the company requirements or country regulations. In Microsoft Dynamics 365 for Finance and Operations, exchange rates can be updated manually or automatically. A manual update is done by the accountant keying in the exchange rates for a specific date in the currency exchange rate form. The automatic update is done by feeding the exchange rates from an external provider, automatically. In order to configure exchange rate providers, navigate to General ledger | Currencies | Configure exchange rate providers and create a new record by pressing Alt + N. Microsoft Dynamics 365 for Finance and Operations is shipped with three providers, as shown in the following screenshot:

If the customer needs to use different exchange rate providers other than the out-of-the-box providers, this can be customized through development with the partner or the customer.

To import the exchange rate, navigate to General ledger | Currencies | Import currency exchange rates; the accountant will need to identify the Exchange rate type, Exchange rate provider, and Import as of, as shown in the following screenshot:

After completion of the process, a message will pop up in the message center indicating that the process is finished.

Moving to the main account configuration for multi-currency, we have three options on the main account form related to currencies:

- Foreign currency revaluation: This indicates whether the account is subject to be considered in the general ledger foreign currency revaluation process or not. If this option is cleared (set as No), this means that this particular account will be excluded from the general ledger foreign currency revaluation process.

- Exchange rate type: This indicates the exchange rate type that will be used when running the general ledger exchange rate revaluation process.

- Financial reporting exchange rate type: This indicates the exchange rate that will be used when generating financial reporting, and then identifies if the translation type is weight average, average, current, or transactions date.

To navigate to the main account form, go to General ledger | Chart of accounts | Accounts | Main accounts, as shown in the following screenshot: