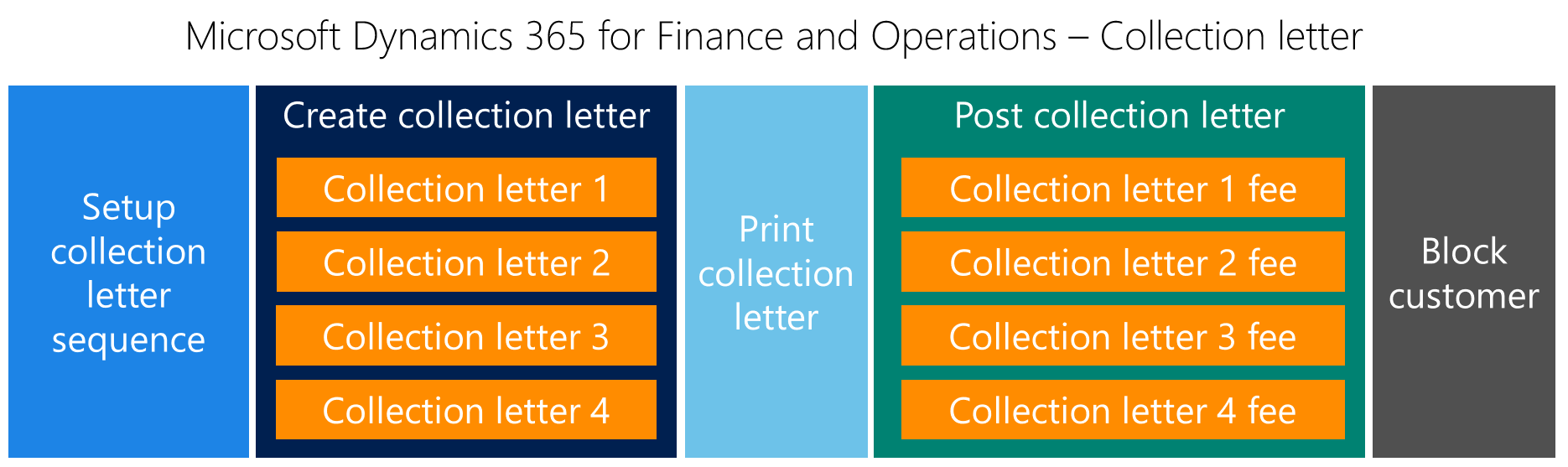

When a customer does not pay an invoice, depending on company policy it usually sends a collection letter to that customer. In addition to that, the company has the ability to add fees to be charged on each generated collection letter, in addition to that, the customer could be blocked from invoice transactions. The following diagram illustrates the main building blocks for the collection letter:

To set up the collection letter sequence, navigate to Credit and collections | Collection letter | Set up collection letter sequence; the Collection letters form contains a collection letter sequence ID, collection letter code, main account (optional), fee in currency (optional), days, and block check box, as shown in the following screenshot:

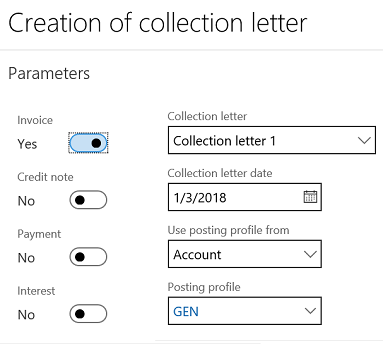

Assume that a customer has a past due invoice on January 2, with the amount at 1,000 USD; the accounts receivable accountant will run the collection letter process, and the system will create the first collection letter for this customer. To create a collection letter, navigate to Credit and collections | Collection letter | Create collection letters; a dialog will pop up, as shown in the following screenshot:

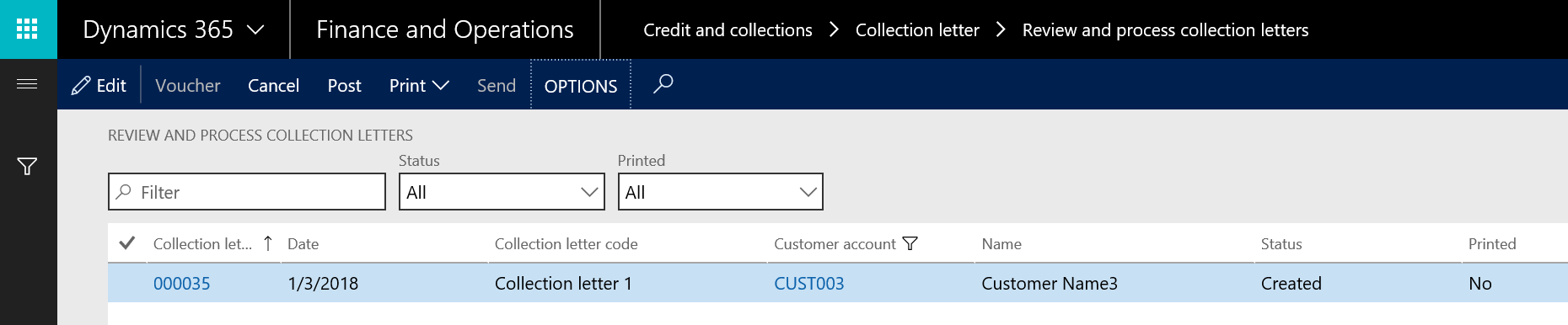

Then, move to REVIEW AND PROCESS COLLECTION LETTERS; this form allows the Accounts receivable accountant to print, send, and post collection letters. Navigate to Credit and collections | Collection letter | Review and process collection letters, as shown in the following screenshot:

Then, print and post the collection letter, as shown in the following screenshot:

Assume that the customer payment is due on January 5 and the accounts receivable accountant runs the second collection letter and posts it; at this stage the system posts a fee to the customer's open transactions. Navigate to Accounts receivable | Customers | All customers, select the customer record and move to the COLLECT ribbon, and select Settle transactions; a dialog form will pop up as shown in the following screenshot: