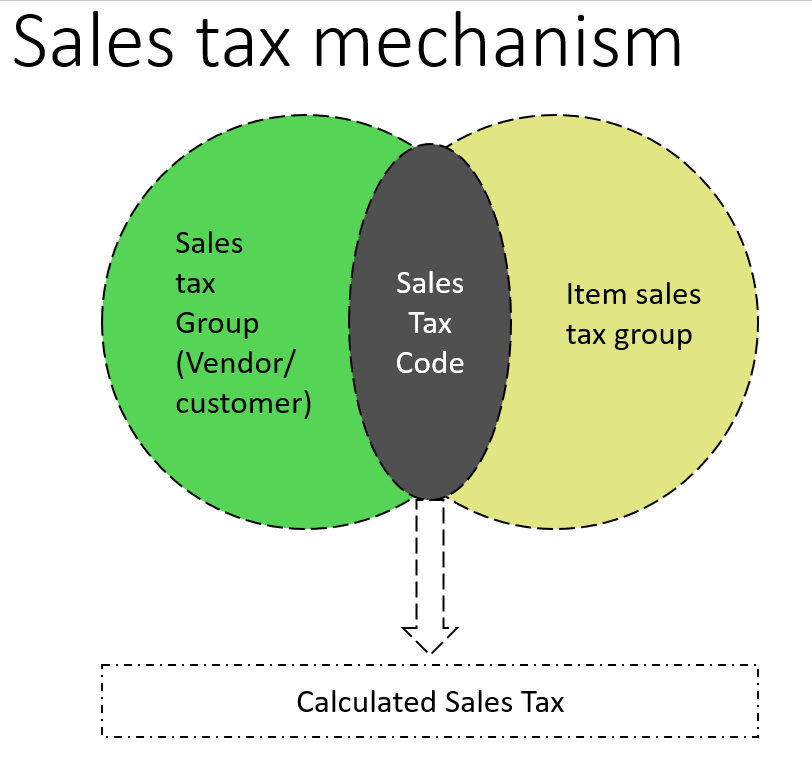

Sales tax is registered on both the vendor/customer level and the item level, to cope with international suppliers that show different tax rates for the same item. The system must recognize the same tax rate in the vendor/customer and item levels to process the transaction. The calculated sales tax on the finance module is shown in the following figure:

In order to create the sales tax code, navigate to Tax | Indirect taxes | Sales tax | Sales tax codes. In the General fast tab, assign the Settlement period and Ledger posting group. In the Calculation fast tab, assign the following parameters:

- Origin: This is the field that represents the origin from which the sales tax is calculated

- Marginal base: This represents the base of tax limits

- Calculation method: This represents whether the sales tax is calculated for the entire amount or for just part of it

These parameters are shown in the following screenshot:

To identify the sales tax percentage, go to SALES TAX CODE | Values. Enter a value in the Value field, as shown in the following screenshot:

In order to create a sales tax group, navigate to Tax | Indirect taxes | Sales tax | Sales tax groups. Under the Setup fast tab, add the Sales tax code value, as shown in the following screenshot:

In order to create an item sales tax group, navigate to Tax | Indirect taxes | Sales tax | Item sales tax groups. Under the Setup fast tab, click on Add and enter the Sales tax code value, as shown in the following screenshot:

In order to apply the sales tax in a general ledger transaction, navigate to General ledger | Journal entries | General journals. Create a new journal, and then move to voucher lines.

In the voucher line, select the Account type value as Vendor, select the vendor ID, enter 1,000 as the Credit amount, and select the Offset account value. Then, select the Sales tax group and Item sales tax group fields; the system will calculate the sales tax amount, as shown in the following screenshot: