In this section, we will explore fixed assets transactions starting from acquisition transactions by acquisition journal, acquisition through purchase order, depreciation, disposal scrap, and fixed assets reversal transactions. In order to record and post an acquisition journal, go to Fixed assets | Journal entries | Fixed assets journal, as shown in the following screenshot. Create a new journal by pressing Alt + N on the journal line, go to Proposals and select Acquisition proposal, and then go on to select a filter to identify the asset number, which will be acquired, as shown in the following screenshot:

In order to acquire fixed assets through a purchase order, a parameter must be activated first. This gives the company the control to acquire the assets through the procurement department and enables it to apply the segregation of duties between the procurement, reception, invoicing, and payment processes. As shown in the following screenshot, go to Fixed assets | Setup | Fixed assets parameters and then click on Purchase orders:

The following options are available under the Purchase orders tab:

- Allow asset acquisition from Purchasing

- Restrict asset acquisition posting to user group

- Create asset during product receipt or invoice posting

- Check for fixed assets creation during line entry

In the course of the execution of a fixed asset acquisition through a purchase order, go to Procurement and sourcing | Purchase orders | All purchase orders. Then, create a new record by pressing Alt + N, select vendor, go to purchase lines, select service item, and then enter warehouse and price details. Now, go to the Fixed assets tab, as shown in the following screenshot:

If the fixed asset is new, check the New fixed asset checkbox and select a Fixed asset group. If this transaction is to capitalize on already created fixed assets, uncheck the New fixed asset checkbox, select Fixed asset group and Fixed asset number, and identify whether the Transaction type is Acquisition or Acquisition adjustment. The Book field is populated automatically. The process of the purchase order normally goes from confirmation to product receipt to invoice. After posting the purchase order invoice, the fixed asset record will be created and the asset acquisition transaction will be posted.

An acquisition transaction has the following accounting entry:

- Dr. Fixed assets

- Cr. Vendor balance

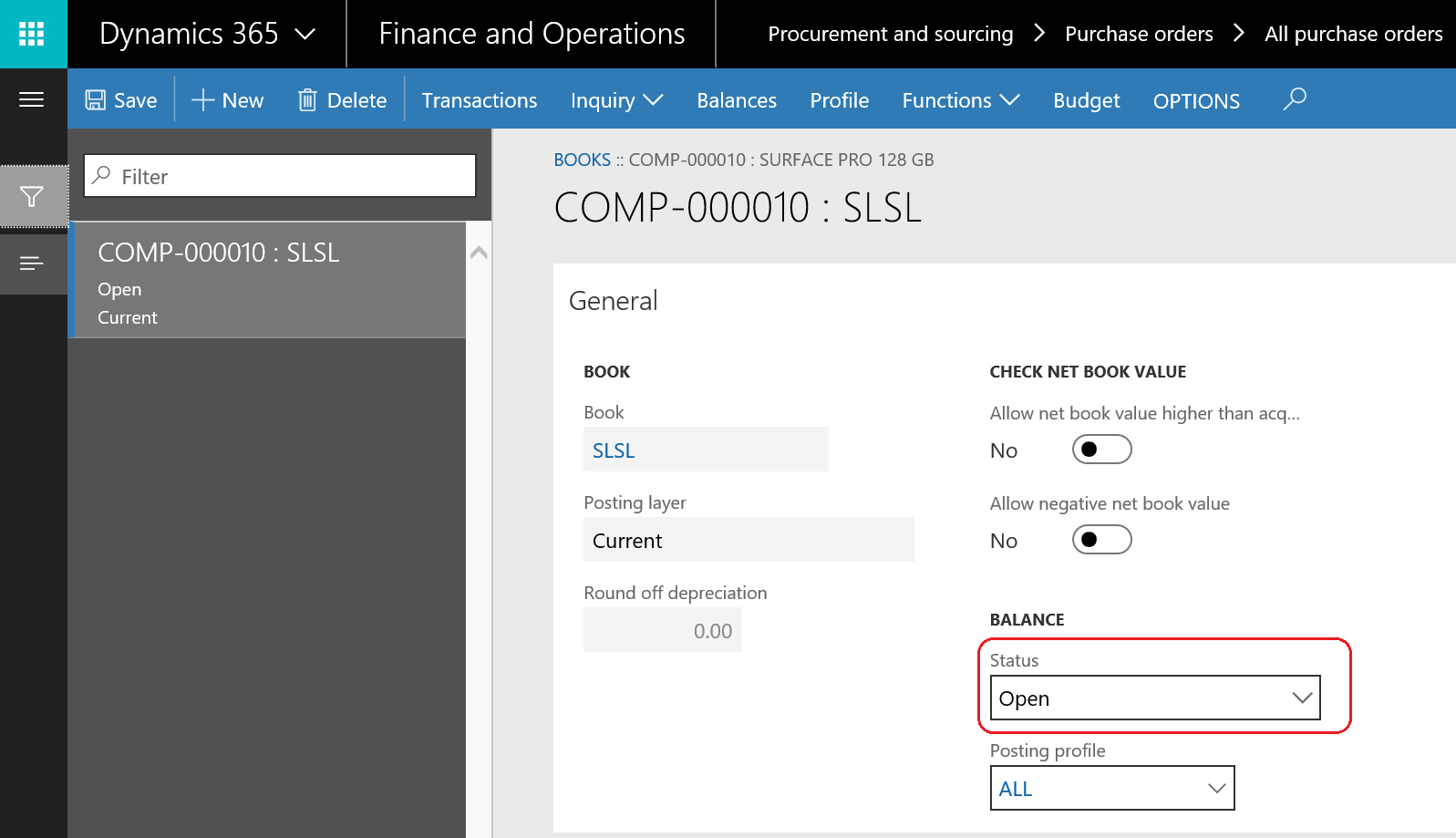

As shown in the following screenshot, select the purchase order line after posting the invoice, then go to the Book asset by clicking on the hyperlink on the asset number, and then click on Books in asset. Now, click on the Book in the fixed asset form:

The next step is new to Microsoft Dynamics 365 for Finance and Operations. To create an acquisition proposal journal, go to Fixed assets | Journal entries | Create acquisition proposal; a dialog will open to identify the asset that needs to be acquired.

Then, we move to fixed assets depreciation transactions. As shown in the following screenshot, in order to run fixed assets depreciation, go to Fixed assets | Journal entries | Fixed assets journal, create a new record, and go to Lines. Then, go to Proposals and select Depreciation proposal. Now, identify the depreciation date, find the asset number by clicking on the Select button, and decide whether to summarize the depreciation in one line or via separate lines for each month:

Assume that the acquired fixed assets price is 1,200 USD, the acquisition date is January 1, 2018, and the depreciation period is 12 months. The depreciation for each month is calculated as 1,200 USD divided by 12 months, which is equal to 100 USD. The depreciation will run on till December 31, 2018. The following screenshot illustrates the depreciation for each month:

If the Summarize depreciation option is set to Yes, the depreciation will be created in one line on December 31, 2018 as 1,200 USD.

The depreciation transaction has the following accounting entry:

- Dr. Depreciation expense

- Cr. Accumulated depreciation

Posted transaction of fixed assets are located on the Book, and in order to inquire about a posted transaction, go to Fixed asset, select a particular asset ID, go to the Book ribbon, and then click on Transactions. As shown in the following screenshot, updates have occurred on the Date when depreciation was last run field, and the Depreciation periods remaining field, which represents the equation. As you can see, depreciation periods minus ran depreciation periods, which is 12 minus 7, equals 5:

The Transactions button shows the posted transactions on the asset depending on whether the transaction type is acquisition or depreciation:

As shown in the following screenshot, the inquiry illustrates the acquisition price, depreciation, and net book value. The net book value represents the equation acquisition price minus depreciation, that is, 1,200 USD minus 700 USD, which equals 500 USD:

The next feature is new to Microsoft Dynamics 365 for Finance and Operations. You can create a depreciation proposal journal; go to Fixed assets | Journal entries | Create depreciation proposal; a dialog will open to identify the asset that needs to be depreciated.