Now, we will cover the fixed asset reclassification functionality. This function is used to reclassify a fixed asset to another fixed asset from two perspectives; the first perspective is accounting, and the second perspective is the fixed asset group. The reclassification function incorporates changing the asset group by canceling the old one and creating a new fixed asset, and this will generate the necessary financial entries.

Let's assume that there is a fixed asset in an acquired status, and this asset should be reclassified to a new fixed asset ID. The main account, which represents the acquisition, will also be reclassified to another account. The execution of this process will close the original fixed asset, reverse the acquisition entry of the original fixed asset, and create a new entry representing the new asset acquisition.

The following diagram illustrates the reclassification process between the original and new asset:

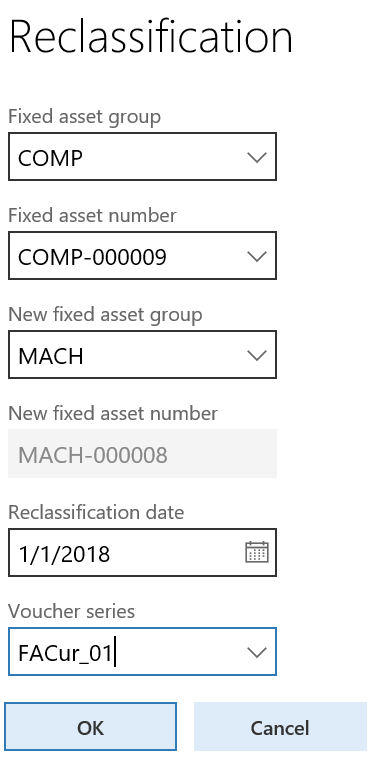

In order to reclassify an acquired fixed asset, go to Fixed assets | Periodic tasks | Reclassification. A dialog box will open, as shown in the following screenshot:

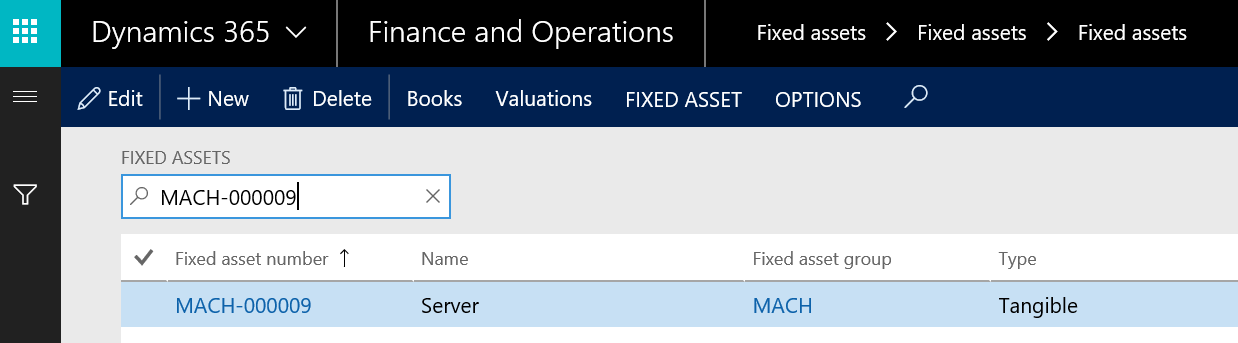

The system will create a new fixed asset record, as shown in the following screenshot:

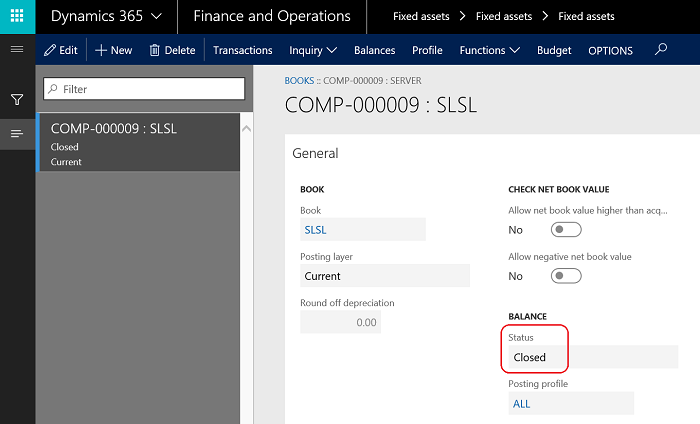

The original fixed asset status is changed to closed, the acquisition entry is reversed, and the newly created fixed asset is acquired. The following screenshot shows the original fixed asset status, under fixed assets book:

The following screenshot shows the new asset status, under fixed asset book:

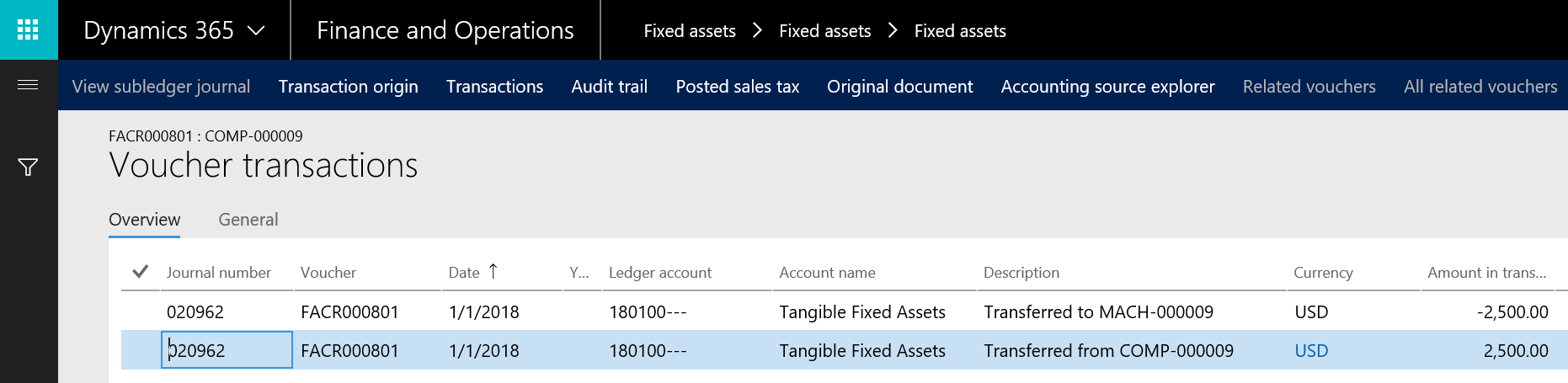

The following screenshot shows the original fixed asset acquisition transaction, and the reversed transaction as well:

The following screenshot shows that the new asset is an acquisition transaction:

The reversal of the original fixed asset entry and the acquisition entry of the newly created fixed asset are in the same voucher. The debit and credit side are represented as follows: the debit side represents the acquisition account of the newly created fixed asset, while the credit side represents the acquisition account of the original fixed asset: