Daily operations may need to execute transactions in foreign currency, whether in general ledger transactions, vendor transactions, or customer transactions. Due to economy fluctuations in exchange rates, the company should reevaluate foreign currency transactions to reflect the current economic value for each currency, and this should be assigned to different ledger accounts for financial reporting. Microsoft Dynamics 365 for Finance and Operations differentiates between an exchange rate being realized or unrealized, and whether it is a gain or loss.

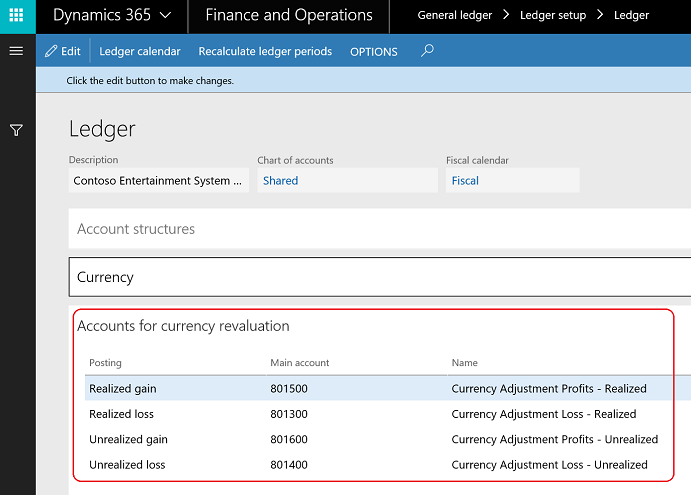

In order to set up accounts that are used in exchange rates, navigate to General ledger | Ledger setup | Ledger; in the form go to the Accounts for currency revaluation fast tab and identify the required accounts, as shown in the following screenshot:

The revaluation accounts shown in the preceding screenshot are used across all currencies. Microsoft Dynamics 365 for Finance and Operations has an option to identify different currency revaluation accounts per currency code. To use a separate account for each currency, navigate to General ledger | Currencies | Currency revaluation accounts setup and select the currency code and the legal entity, and then identify the accounts, as shown in the following screenshot:

The posting accounts for currency revaluation are as follows:

- Realized gain: The ledger account that is used for posting a realized gain in the current currency. This is calculated when settlement occurs.

- Realized loss: The ledger account that is used for posting a realized loss in the current currency. This is calculated when settlement occurs.

- Unrealized gain: The ledger account that is used for posting an unrealized gain in the current currency for open transactions.

- Unrealized loss: The ledger account that is used for posting an unrealized loss in the current currency for open transactions.

In this section, we will explore the foreign currency revaluation process on the general ledger, and accounts payable and receivable. Currency revaluation is a part of the monthly closing procedure, and it runs on the submodules first, then is executed on the general ledger; this is discussed in Chapter 2, Understanding the General Ledger. When running currency revaluation, the system generates the unrealized gain/loss transaction for transactions that are posted in a foreign currency. The unrealized gain/loss has different logic between the submodules and the general ledger:

- Unrealized gain/loss in submodules (accounts payable and accounts receivable): The previously posted revaluation is completely reversed, and a new revaluation transaction is posted as an unrealized gain/loss.

- Unrealized gain/loss in general ledger: The previous revaluation is not reversed, and a transaction is created for the delta between the balance of the main account, including any previous revaluation amounts.

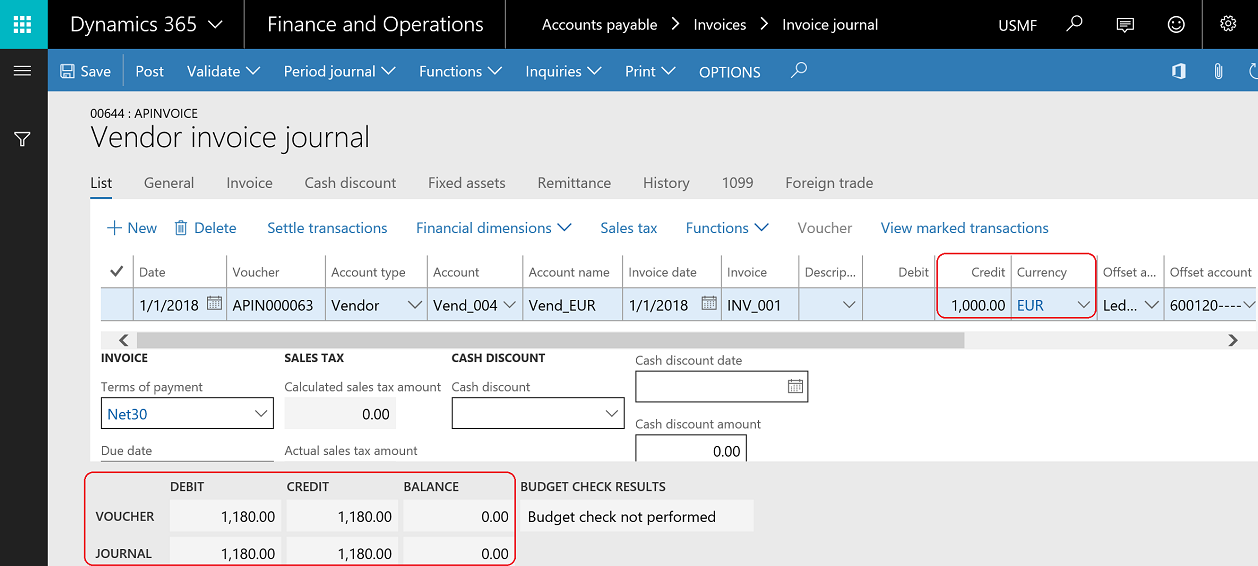

Assume a vendor invoice transaction is posted on January 1, 2018 in the EUR currency, the exchange rate is 1.18 USD, equal to 1.00 EUR:

- Transaction amount is 1,000 EUR

- Transaction in accounting currency is 1,180 USD

To navigate to the vendor invoice, go to Accounts payable | Invoices | Invoice journal, as shown in the following screenshot:

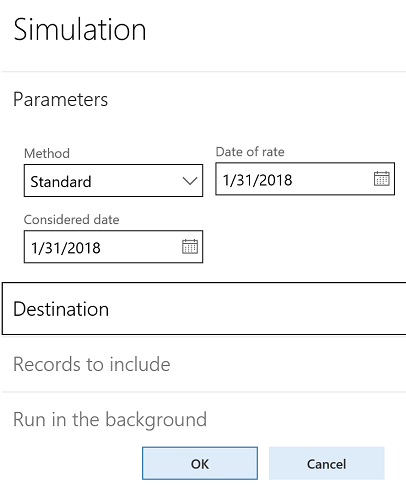

In order to run the foreign currency revaluation for accounts payable, navigate to Accounts payable | Periodic tasks | Foreign currency revaluation. As shown in the following screenshot, there is an option to run a simulation before posting: this important step enables the accountant to simulate the process before posting:

The Simulation dialog opens, as shown in the following screenshot:

Method: The applied method of foreign currency revaluation, whether it is standard or minimum:

- Standard: Post foreign currency revaluation based on the exchange rate used on the date specified on the date of rate; the currency revaluation will be posted whether the results are profit or loss

- Minimum: Post foreign currency revaluation only if the result is loss

Date of rate: The date representing the exchange rate that is used in the foreign currency revaluation

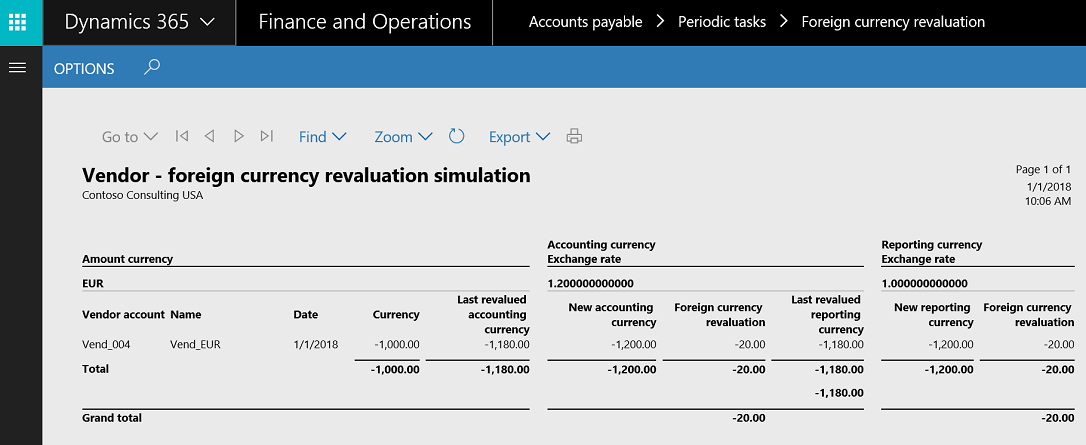

Assume the exchange rate on January 31, 2017 is 1.20 USD for 1 EUR, and the accountant runs the simulation while closing the month. The simulation report will be as shown in the following screenshot:

The normal step after running the submodule simulation for foreign currency is to post it to the submodule and general ledger accordingly. To run the foreign currency revaluation, navigate to Accounts payable | Periodic tasks | Foreign currency revaluation, as shown in the following screenshot:

The foreign currency revaluation dialog parameters have the following options:

- Use posting profile from: The posting profile that will be used during foreign currency revaluation:

- Posting: The posting profile that is assigned to the vendor/customer transaction will be used

- Select: Manually select a posting profile in this posting profile field

- Financial dimensions: The financial dimensions that are posted on the foreign currency revaluation entries:

- None: No financial dimensions are posted during the foreign currency revaluation process

- Table: The financial dimensions defined on the customer or vendor are posted during the foreign currency revaluation process

- Posting: The financial dimensions of posted transactions will be used during foreign currency revaluation

The generated unrealized transaction is as shown in the following screenshot:

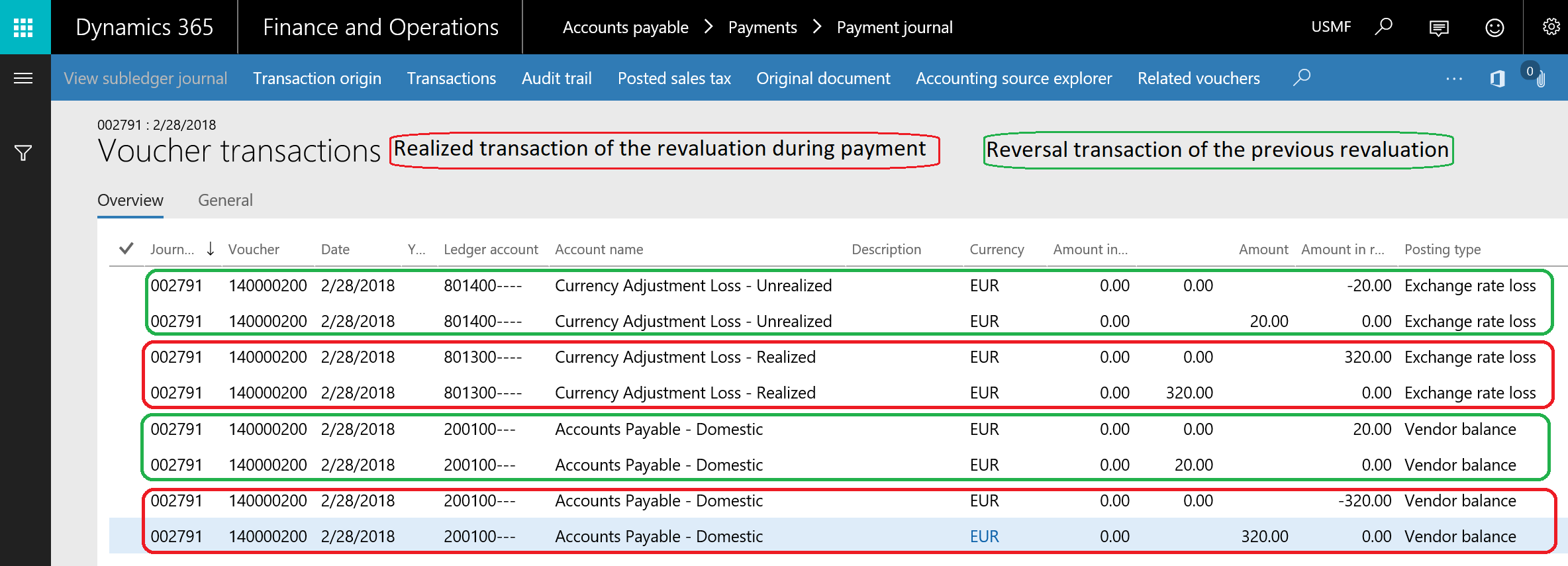

Assume the payment is posted on February 28, 2018 and the rate at this date is 1.50 USD for 1 EUR, the payment is posted from the vendor payment transaction. Go to Accounts payable | Payments | Payment journal, then go to Posted voucher then Related vouchers, the Voucher transactions; form opens, as shown in the following screenshot:

Moving to the general ledger revaluation process, enhancements were introduced in Microsoft Dynamics 365 for Finance and Operations; navigate to General ledger | Currencies | Foreign currency revaluation, select Foreign currency revaluation and a dialog window will open, as shown in the following screenshot:

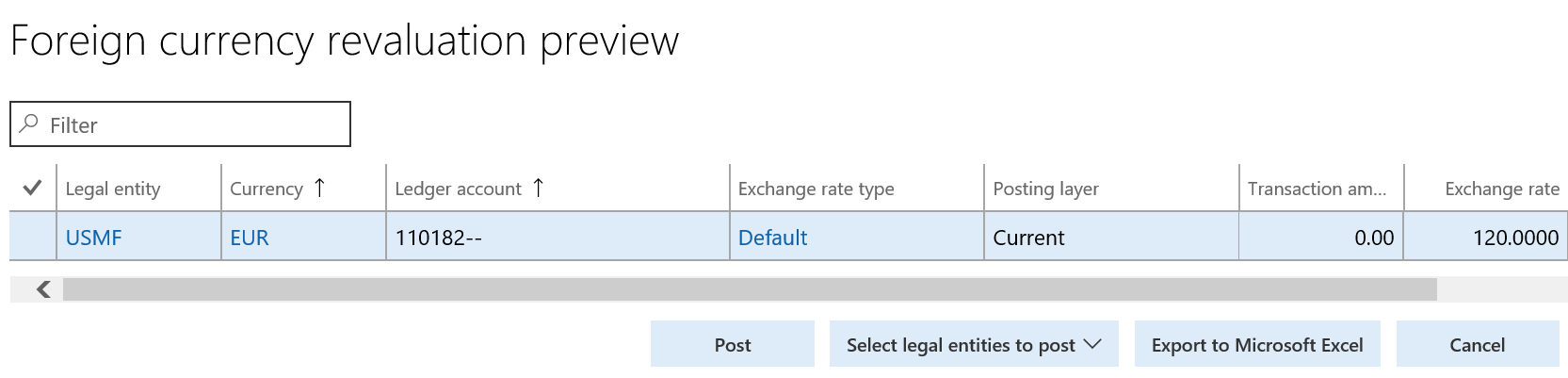

As presented in the preceding screenshot, an option, Preview before posting, simulates the revaluation process. In addition to that, the accountant has the option to run the revaluation for multiple legal entities without switching the legal entity. The currency revaluation preview opens, as shown in the following screenshot:

As presented in the preceding screenshot, there are options: Post, Select legal entity to post, Export to Microsoft Excel, or Cancel. The unrealized voucher is generated after posting the revaluation transaction, as shown in the following screenshot: