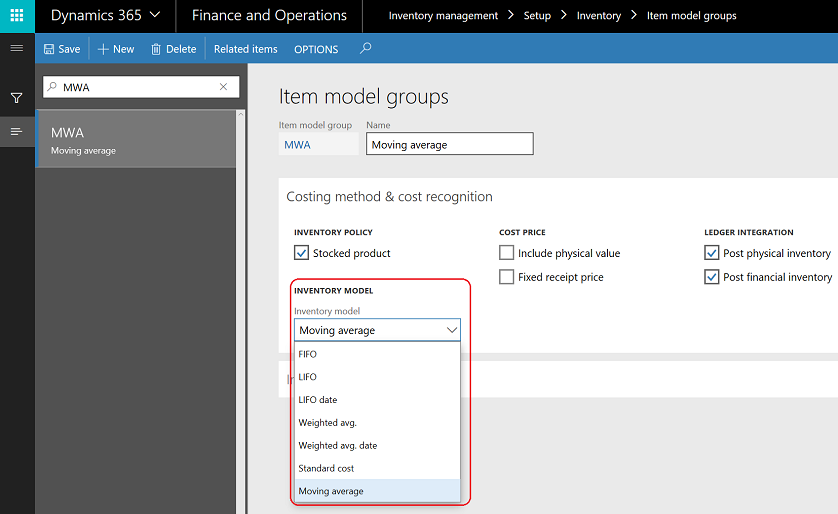

The main configuration and setup of inventory costing in Microsoft Dynamics 365 for Finance and Operations is in Item model groups, where we identify the inventory costing valuation method. For inventory model groups, navigate to Inventory management | Setup | Inventory | Item model groups. Microsoft Dynamics 365 for Finance and Operations supports the following inventory valuation methods:

- FIFO: This is first in, first out

- LIFO: This is last in, first out

- LIFO date: This is the last-in, first-out date

- Weighted avg.: This is the weighted average

- Weighted avg. date: This is the weighted average date

- Standard cost: This is the standard cost

- Moving average: This is the moving average cost

The following screenshot shows all the inventory valuation methods:

In the following section, we will highlight some of the item module group configurations:

- Inventory policy: This indicates whether the item or the service is stockable or non-stockable. Stockability indicates that the item will be tracked in the inventory transaction and included in the inventory costing and its calculation.

- Physical negative inventory: This is a control point that prevents the inventory quantities from being issued from the warehouse, if there is no available quantity. If the business needs to issue more quantities than is available in the warehouse, this should be coordinated with the controller and the stock manager, as the inventory balance will be in the negative.

- Financial negative inventory: This is allowed, by default, to issue quantities that are not financially updated yet. This is a control point that can prevent issuing inventory quantities from the warehouse without a financial update, which means the final cost must be known before issuing the items.

- Post physical inventory: This option posts the physical inventory to the General ledger module, and this requires a configuration on the accounts payable parameters and the accounts receivable parameters by checking the Post product receipt in ledger checkbox. If the Post physical inventory checkbox is unchecked, the physical transactions will not be posted in the ledger, regardless of the configuration in the AP/AR parameter setup forms.

- Post financial inventory: This option posts the financial inventory update to the General ledger module if this checkbox is checked. The posting will be as follows:

- Accrue liability on product receipt: If this checkbox is checked, the amount of the items cost is posted to the accrual account, this is a mandatory option for stocked products.

- Post to deferred revenue account on sales delivery: If this checkbox is checked, the amount of the items is posted to the accounts receivable not invoice and the accrued sales accounts; otherwise, no posting occurs in the item accrued revenue or the accounts receivable not invoices.

These fields are shown in the following screenshot: