If collection letters are sent out and the customer still does not pay, the company may want to charge interest on the late payments. For each interest calculation, a fee can be charged and is added to a customer. To create an interest code, navigate to Credit and collections | Interest | Set up interest codes, as shown in the following screenshot:

Assume that a customer has a past due invoice on January 3 and the accounts receivable accountant runs the interest notes process: navigate to Credit and collections | Interest | Create interest notes.

An interest calculation dialog will pop up, as shown in the following screenshot:

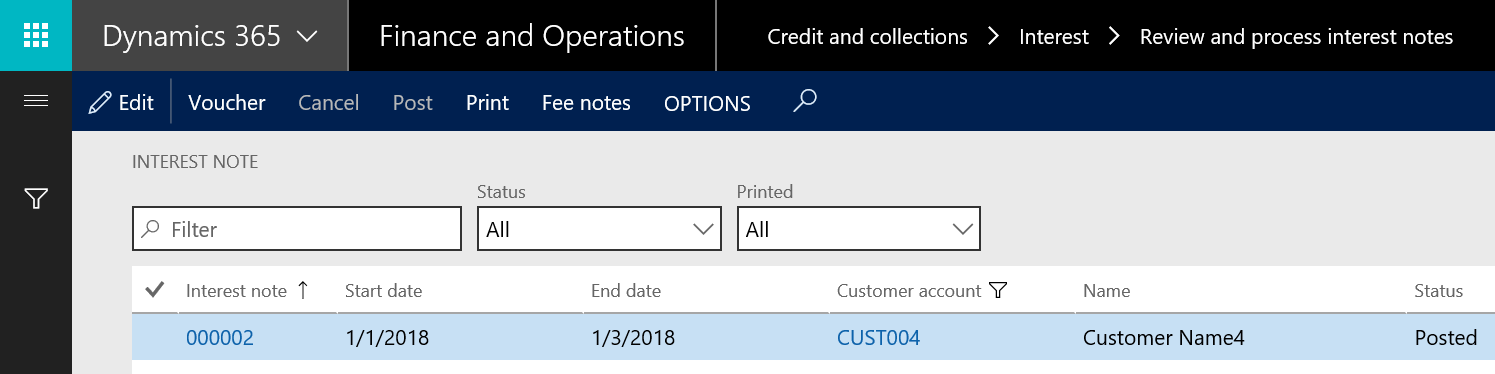

The accounts receivable accountant can review and process the interest note by navigating to Credit and collections | Interest | Review and process interest notes. Here, the accountant can print and post the interest note, as shown in the following screenshot:

The system posts an interest fee and adds it to customer transactions. Navigate to Credit and collections | Customers | All customers, then move to the CUSTOMER ribbon and select Transactions, as shown in the following screenshot: