Finally, there is a residual amount of 1 USD, which will be remain in the asset net book value.

There is a common business requirement for fixed assets where you need to keep a specific amount as a net book value asset. This amount represents the estimated salvage value at the end of the asset's service life, also known as the fixed asset residual value.

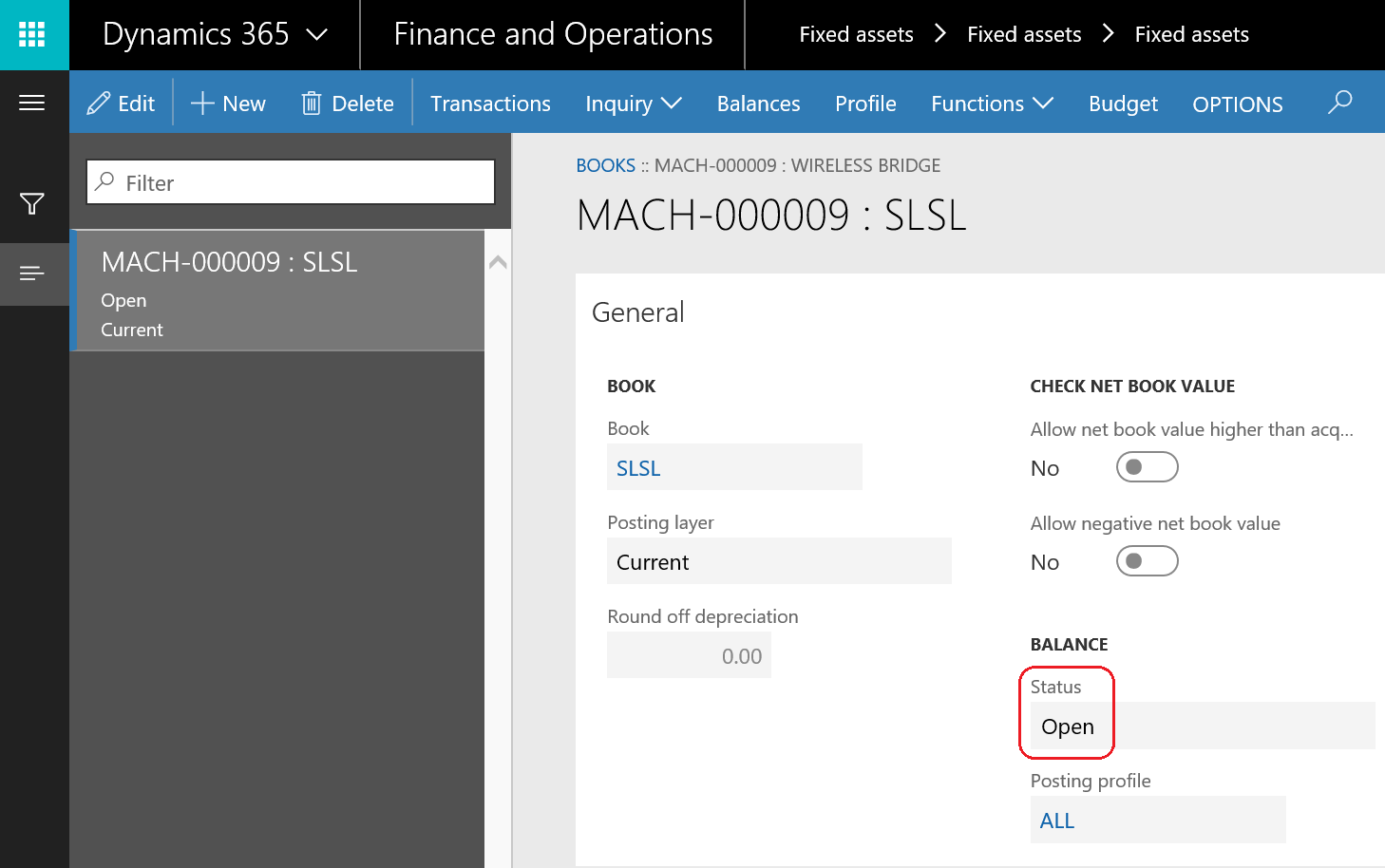

In order to consider this business requirement in Microsoft Dynamics 365 for Finance and Operations, it should be identified on the fixed asset book. Let's assume that there is a fixed asset with a depreciation profile called Straight line service life with a service life for 1 year, and 12 months as its depreciation period. The asset acquisition date is 1/1/2018 and the acquisition price is 1,200 USD, as shown in the following screenshot:

Here, under the Depreciation tab, identify the expected scrap value (also known as the salvage or residual value), which represents the estimated scrap value of the fixed assets. In this example, it is 1 USD:

In order to check the monthly depreciation, go to Inquiry | Profile.

The depreciation is calculated with the following equation:

Monthly depreciation = (Fixed asset acquisition price – salvage value)/fixed asset useful life

Monthly depreciation = (12000 – 1.00)/12

Monthly depreciation = 1199/12

Monthly depreciation = 99.92

Assume that the company needs to dispose of a fixed asset. The execution of disposal scrap can be done by going to Fixed assets | Journal entries | Fixed assets journal. Create a new journal, then move two lines, and then select the fixed asset ID and the transaction type as Disposal - scrap; the journal entry should have no amount, as shown in the following screenshot: