2. The valuation of ecosystem services

3. Ecosystem service externalities

4. Economic instruments for ecosystem externalities

Why does ecosystem change matter? Why should non-ecologists care about trends that alarm most ecologists? The answers to questions like these lie in the economics of the ecosystem change. For many ecologists, however, such a statement is itself part of the problem because they understand the “economics of ecosystem change” to mean “the money that people make from ecosystem change.” Of course that is part of the story. The money people make from ecosystem change does in part drive that change. But economics is not just about money. Economics is about the decisions that people make, the factors that drive those decisions, and their consequences for human well-being. The economics of the environment has much to say not just about the reasons why the pursuit of self-interest leads to undesirable ecosystem change but about why this matters to people and what can be done about it.

The following brief definitions cover some of the terms commonly used by economists that may not be familiar to readers of this book.

complementarity. Two goods are said to be complements if an increase in the price of one induces demand for the other to fall—formally, when the cross elasticity of demand is negative.

existence value. This is intended to capture peoples’ willingness to pay for the mere existence of something. It is often used loosely, though, to refer to spiritual or aesthetic values, and sometimes as a substitute for intrinsic value (see below).

externality. External economies or diseconomies of production and consumption are called externalities. An externality is a third-party effect of a transaction that is not taken into account by the parties to the transaction. External effects may be positive or negative and drive a wedge between the private and social net benefits of a transaction.

intrinsic value. This is not a term in general use by economists. Noneconomists use the term to refer to the value that other species have independent of their value to people. As with existence value, the term is often used very loosely and in practice may refer to anthropocentric spiritual or aesthetic values.

joint product. When a production function (see below) generates multiple outputs, they are said to be joint products.

nonuse value. This is the value of an allocation that benefits someone other than the user. It derives from the fact that the user cares for the beneficiary. Note that the beneficiary may be some other species or a member of a future generation.

option value. The value of the option to use a resource in the future.

private optimum. The allocation that optimizes a private decision maker’s objective function. If there are externalities, this will be different from the social optimum (see below).

production function. A function relating the inputs to and outputs of a production process. It embeds both the technological and the biogeochemical aspects of the production process.

renewable resources. Resources are said to be renewable when they regenerate themselves within a time-frame that is relevant to the decision process.

shadow price. This is the social opportunity cost of a resource—its true value to society. If there are externalities, implying that markets are incomplete, the shadow value will be different from the market price. Formally, it is the value of the co-state-variable along the optimal path in the solution to a state-space optimization problem.

social optimum. The allocation that optimizes the social welfare function or index of social well-being.

substitutability. Two goods are said to be substitutes if an increase in the price of one induces demand for the other to rise—formally, when the cross elasticity of demand is positive.

use value. This is the value of resources when used by the valuer. The value of resources that are used by someone other than the valuer are said to be nonuse values (see above).

Ecosystem services were defined by the Millennium Ecosystem Assessment (MA) as the benefits people obtain from ecosystems (MA, 2005). It recognized that people care about the environment because of the services it offers. These services include not just the provision of foods, fuels, and fibers but a range of non-consumptive benefits such as recreation, amenity, and spiritual renewal. Where the MA went much further than earlier studies was in identifying the indirect supporting services provided by ecosystems, including the regulation of environmental stresses and shocks, such as emergent zoonotic diseases and the role of ecosystem processes in supporting all other services.

From an economic perspective, the provisioning and cultural services together describe the environmentally derived goods and services that enter final demand—that people consume in some sense. Provisioning services comprise what have traditionally been called “renewable resources”: foods, fibers, fuels, water, biochemical compounds, medicines, pharmaceuticals, and genetic material. Many of these products are directly consumed and are subject to reasonably well-defined property rights. They are priced in the market, and even though there may be important externalities in their production or consumption, those prices bear some relation to the scarcity and value of resources. Cultural services, on the other hand, define many of the nonconsumptive uses of the environment such as recreation, tourism, education, science, and learning. They include, for example, the spiritual, religious, aesthetic, and inspirational well-being that people derive from the “natural” world; their sense of place and the cultural importance of particular landscapes and species, and the traditional and scientific information, awareness, and understanding offered by functioning ecosystems. One modern expression of cultural services—ecotourism—involves well-developed markets. Most others do not. Although intellectual property rights in biochemical and genetic material drawn from ecosystems are increasingly well defined, many cultural services are still regulated by custom and usage or by traditional taboos, rights, and obligations. Nevertheless, because they are directly used by people, they are also amenable to valuation by methods designed to reveal people’s preferences.

The third major category of ecosystem services identified by the MA, the regulating services, is in many ways the most interesting. For the MA, the category includes the following:

What these all have in common is that they affect the impact of stresses and shocks on the system. More particularly, the regulating services moderate the impact of perturbations on the provisioning or cultural services. By changing the potential cost associated with a given shock, they influence the environmental risks people face. It follows that the regulating services will be more or less valuable depending on which of the provisioning and cultural services people value, the regime of shocks to those services, and peoples’ aversion to risk.

Finally, the category of support services captures the main ecosystem processes that underpin all other services. Examples offered by the MA include soil formation; photosynthesis; primary production; and nutrient, carbon, and water cycling. These services typically play out at different spatial and temporal scales. For example, nutrient cycling involves the maintenance of the roughly 20 nutrients essential for life in different concentrations in different parts of the system. It is often localized and is therefore at least partially captured by the price of the land on which it takes place. Carbon cycling, on the other hand, operates at a global scale and is very poorly captured in any set of prices. Because the supporting services are embedded in the other services, however, they are captured in the value of those services, whether or not that value is expressed in market prices.

This chapter reviews the economics of ecosystem services in the light of the MA. The MA (2005) noted that although the supply of a number of the provisioning services has been increasing over the last 50 years, the supply of many of the cultural, regulating, and supporting services has been declining. It also noted that this reflects the failure of markets to allocate resources efficiently and drew attention to the implications this has for human well-being, particularly in poorer countries. There are three dimensions to the economics of ecosystem services, each of which is explored in the following sections. The first is the measurement of their impact on production, consumption, and human well-being. The second is the identification of the gap between the socially optimal level of services relative to the level of services actually provided—i.e., the measurement of the extent to which markets fail to allocate ecological resources either efficiently or equitably. The third is the development of policies (instruments and institutions) that will close the gap.

A number of studies before the MA drew attention to the changes in ecosystem services and the importance of quantifying the value of these changes to human societies in terrestrial, marine, and agroecosystems. There were also attempts to identify and value ecosystem services. However, most of these failed simply because of our limited understanding of the role of ecosystem services in the production of things that people recognize and value. In part this is because ecosystem services are themselves what economists would call the “joint products” of ecosystems. Daily et al. (1997) had emphasized that most ecosystem services were the result of a complex interaction between natural cycles operating over a wide range of space and time scales. Waste disposal, for example, depends on both highly localized life cycles of bacteria and the global cycles of carbon and nitrogen. The same cycles are implicated in the provision of a range of other services. By ignoring multiple services and the interdependence among services, many early valuation studies underestimated the importance of the ecosystem stocks to the economy (Turner et al., 2003).

Another problem with many valuation studies stems from the fact that they elicit peoples’ preferences for the asset being valued. When the object of valuation is familiar—is directly consumed or experienced by the person whose preferences are being elicited—this can lead to reasonably reliable estimates. But many early studies of the value of ecosystem services elicited preferences for environmental stocks from people who had little conception of the role and importance of those stocks. The problem here is that ecosystems and the services they provide are, for the most part, intermediate inputs into goods and services that are produced or consumed by economic agents. As with other intermediate inputs, their value derives from the value of those goods and services but may not be transparent to the end users (Heal et al., 2005).

In this case, the use of derived demand (“production function”) methods are appropriate, and there are a growing number of studies of value of ecosystem services that use such an approach (e.g., Barbier, 2007). When output of the goods and services that enter final demand is measurable and either has a market price or one can be imputed, and when the connections among ecological functioning, ecosystem services, and human production processes are well understood, then determining the marginal value of the resource is relatively straightforward.

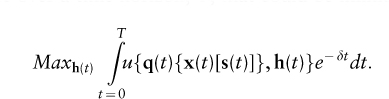

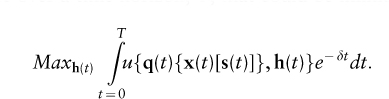

To illustrate, consider the following simplified description of an archetypal decision problem. The decision maker chooses a time path for the level of effort made in exploiting a number of resources, given by the vector h(t). The objective is to maximize some index of well-being, captured by the function u (.). This is done over a time horizon, T, that could be infinite.

The flow of net benefits depends on a vector of produced goods, q(t), which in turn depends on vectors of marketed inputs, x(t), the state of the environment, s(t), and effort, h(t). This flow is discounted at the rate δ.

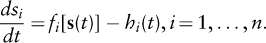

The index of well-being is maximized subject to the capacity of the resources of the natural environment to grow or to regenerate, which is summarized in the equations of motion:

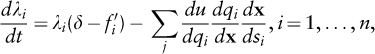

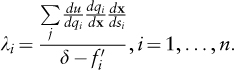

Now the value of the n ecosystem stocks in this problem is their social opportunity cost, measured by the “shadow price” obtained from the solution to the optimization problem. Specifically, if the shadow prices in the solution to the problem are denoted λi, then they will evolve as follows:

and in the steady state, take the value:

So the value of the ith ecosystem stock depends (1) on its regeneration rate relative to the yield on produced capital, indicated by the discount rate, and (2) on its marginal impact on the production of the set of marketed outputs, q(t), through the effect it has both on other ecosystem stocks, s(t), and on marketed inputs, x(t).

If output cannot be measured directly but there is a marketed substitute for it, or the complementarity or substitutability between ecosystem services and one or more marketed inputs is understood, the same general approach can be used. If output can be measured, but there is no market for it, then stated preference non-market valuation techniques can be used in combination with a production function approach to derive the value of ecosystem services. Allen and Loomis (2006) use such an approach to derive the value of species at lower trophic levels from the results of surveys of willingness to pay for the conservation of species at higher trophic levels. Specifically, they derive the implicit willingness to pay for the conservation of prey species from direct estimates of willingness to pay for top predators. They make the point that it is not necessary for consumers to understand the trophic structure of an ecosystem because their willingness to pay for top predators effectively captures their willingness to pay for the whole system.

The attributes of valued ecosystems are reflected in the constituents of what some economists have defined as “total economic value” (Turner et al., 2003). In this literature, “use value” refers to benefits deriving from consumptive or nonconsumptive use by the individual, whereas “nonuse value” comprises benefits from consumptive or nonconsumptive use by others. The important point here is that an ecosystem service may have value to people even if it is not part of their consumption bundle, providing that the consumer cares about the people or species who do consume it. Moreover, even if an ecosystem service is not currently used, it may still have what is referred to as an “option value.” So, for example, the option value of existing species may lie in their role in combating a currently unknown disease or pest or in ensuring ecosystem functions in currently unknown environmental conditions or in providing opportunities for future generations. Where ecosystem services have option value, and where there is a high level of uncertainty about future potential uses of biodiversity, economists have shown that it is frequently optimal to postpone irreversible decisions (such as those that might lead to extinction) in order to learn more (Heal et al., 2005).

Many economists have argued that some ecosystem attributes, including some species, have what they term “existence value.” This was originally defined as people’s willingness to pay to ensure the continued existence of biodiversity irrespective of any actual or potential use by present or future generations of humans. In practice, it is a form of ethically or religiously motivated altruism toward other species. In this respect, it is identical to another category of value favored by noneconomists: “intrinsic value.” Intrinsic value, like existence value or many of the so-called nonuse values, reflects human preferences for the rights and well-being of other species. It is not—and cannot be—independent of peoples’ preferences, including their perceptions of their own roles and responsibilities.

To return to our central argument, however, all these values refer to end uses. They can therefore be used to derive the value of the ecosystem services that support them. This applies to all of the MA services. So, for example, the regulating services such as storm protection or flood mitigation may be valued through the expected damage (losses of goods and services that enter final demand) avoided or more generally through the impact on well-being of a change in the distribution of the provisioning and cultural services.

Part of the problem identified by the MA is that the true value of many ecosystem services—their social opportunity cost—is ignored by decision makers. Economists typically refer to the values ignored in normal market transactions as externalities. Externalities of the kind described in the MA (2005) are often referred to as “ecosystem externalities,” by which is meant the unintended effects of market transactions on human well-being through changes in biodiversity, ecological functioning, or ecosystem services. That is, an ecosystem externality involves a change in ecosystem services that impacts the well-being of others but that is ignored by the parties to a market transaction. It follows that the measurement of ecosystem externalities depends on an understanding of the biogeochemical processes involved as well as the sources of market failure. To model ecosystem externalities, economists accordingly combine human behavioral models with models of biodiversity–ecosystem functioning–ecosystem services relationships (Watzold et al., 2006).

For example, nitrogen compounds emitted from coal-fired power plants and mobile sources directly impact human health but also significantly change ecosystems. In aquatic systems, nitrogen leads to algae blooms that consume oxygen, lower dissolved oxygen levels, and work their way up food chains to reduce fish and shellfish densities. In terrestrial systems, nitrogen decreases species diversity and changes community composition. In both systems, the altered ecosystem functions generate fewer ecosystem services in the form of reduced fishing and grazing opportunities and reduced cultural values. Maximizing social well-being requires understanding of the trade-offs between the net benefits from consumptive and nonconsumptive use of ecosystem services and the costs that consumptive and nonconsumptive uses have in terms of future ecosystem services.

Economists approach this problem by distinguishing between the choices of private decision makers in existing conditions and the socially optimal outcome when all interactions are taken into account. By comparing the two decision problems, it is possible to show how and when the decisions of private agents deviate from the social optimum and hence to develop mechanisms to close the gap.

There are numerous examples of ecosystem externalities at all spatial scales. Many are a product of the disposal of wastes generated in the process of production and consumption, i.e., a consequence of emissions to land, air, and water. Others are a product of the use made of land, air, and water, i.e., result from the conversion of ecosystems for the production of foods, fuels, fibers, domestic dwellings, transport, water or power infrastructure, recreation, or amenity. In all cases, externalities are evidence of incomplete markets. Because they lie outside the set of property rights defined by society, they are not taken into account in the transactions between people. There are several reasons why markets fail to evolve to deal with scarce environmental resources, including (1) the public good nature of many environmental assets (because public goods are nonexclusive by definition, it is not possible for individuals to assert rights to them), and (2) the lack of an institutional framework within which to identify and enforce property rights, as is the case with environmental assets in areas beyond national jurisdiction. However, even where markets do exist and are reasonably complete, there are many reasons why they do not function effectively. The most serious of these are the effect of distortionary macroeconomic policies and the pervasive use of subsidies (Barbier, 2007).

The existence and persistence of international ecosystem externalities depend on the way that international markets and the rules of international trade are structured. They also depend on the incentive effects of different property right regimes. It has, for example, been argued that firms exploit the international advantages offered by relaxed labor and environmental laws and that countries will use the lack of environmental protection to induce inward investment. By this argument, ecosystem externalities are not just an incidental product of market failures. They are the outcome of strategic decisions by governments and firms seeking a competitive advantage. The claim is that where the General Agreement on Tariffs and Trade (GATT) and other trade agreements make it impossible either to induce inward investment or to protect domestic agriculture or industry through trade policy, countries use environmental policies to the same effect. Specifically, they either allow ecological dumping by relaxing environmental protection measures or use environmental regulation as trade protection measures.

The evidence for this is ambiguous, however. The relocation of polluting industries from high-income to low-income countries is certainly a part of the explanation for changes in environmental indicators observed in the literature. But studies of the incentive effects of environmental regulation in the 1990s concluded that environmental compliance costs were not generally important enough to drive location decisions. On the other hand, the environmental impacts of trade are one of the few acceptable justifications for imposing trade restrictions under GATT. The exceptions allowable under Article XX of GATT, along with the Sanitary and Phytosanitary (SPS) Agreement, authorize countries to impose restrictions on trade in order to protect human, animal, and plant life.

Nevertheless, it is the case that the liberalization of international trade through successive renegotiations of GATT has done little to address many existing international environmental market failures and has created many more. The solution to the problem has been the development of multilateral environmental agreements (MEAs) to address specific environmental problems; the most important of which are the Convention on Biological Diversity and the Convention on International Trade in Endangered Species, which deals specifically with international markets for biological resources. Beyond this there are a range of agreements dealing with particular regional issues or with particular species. In general, bilateral agreements are more effective than multilateral agreements. Although some MEAs—such as the Montreal Protocol— have been credited with making a significant difference to environmental quality, most economic research on the problem suggests that agreements with many signatories are unable to address the most important global ecosystem externalities (Barrett, 2003).

A third important aspect of the economics of ecosystem services is the development of policies and instruments to internalize ecosystem externalities and to eliminate market distortions. The most important point here is that if markets can be created, and if they include all relevant effects, they will signal the social opportunity cost of local resource uses and so will ensure that the full effects of local decisions are taken into account. They will also make it possible for those who are willing to pay for the conservation of ecosystems to do so. In other words, if properly structured, such instruments can close the gap between private and social interests.

The development of markets for ecosystem services other than the provisioning services and a few cultural services (ecotourism) is still in its infancy, but economists have evaluated a number of options. One example is transferable development rights. These are similar to cap-and-trade schemes to limit pollution emissions but involve rights to develop land in one location in exchange for conservation in another location. In Brazil, for instance, agricultural landowners not currently complying with the National Forest Code are offered the opportunity to meet conservation targets by acquiring forest reserves in other areas. A second example would be auction contracts for conservation (ACCs). These are helpful when there is an information asymmetry between farmers and conservation agencies regarding, respectively, the financial costs and ecological benefits of conservation. Landholders submit bids to win conservation contracts from the government, thereby revealing their willingness to accept compensation for taking land out of production. A pilot auctioning system for biodiversity conservation contracts in Victoria, Australia, known as BushTender, provides 75% more conservation than comparable fixed-price payment schemes (Stoneham et al., 2007).

Two other examples are payments for the provision of ecosystem services (PES) and direct compensation payments (DCPs). Like ACCs, PES offer compensation, in cash or kind, for ecosystem services. Services to which this has already been applied include provision of water, soil conservation, and carbon sequestration by upland farmers who manage forest lands in upper watersheds. For example, Costa Rica’s 1996 Forestry Law instituted payments for four ecosystem services: mitigation of greenhouse gas emissions, watershed protection, biodiversity conservation, and scenic beauty. The National Forestry Financial Fund enters into contracts with landowners agreeing to forest preservation. DCPs are a variant of PES. They offer direct compensation to landholders for putting private land into conservation. It should be noted that in all cases, standards (establishment of levels of protection, or for the amount of money to be expended in auction) are needed in addition to the markets.

Where the creation of markets is not an option, but there exists a sovereign authority, alternative measures to internalize ecosystem externalities include both regulation and pricelike mechanisms. Regulations, including emissions standards, harvest restrictions, proscriptions, and so on, are still the mechanism of choice in many countries. However, they are not generally as efficient as the alternative, and economists typically favor either mixed regulation/market instruments, such as cap-and-trade mechanisms, or pure market instruments such as taxes, subsidies, grants, compensation payments, user fees, access fees, and charges. The best-known examples are carbon taxes, but there are a wide range of instruments of this kind currently applied. In all cases, the principle is the same. The user of a resource is confronted with the social opportunity cost—the marginal external cost—of his or her (in the case of a corporation, its) actions. This induces the socially optimal response, and that response is independent of whether the user is aware of the environmental implications of those actions.

At the international level, the lack of any sovereign authority precludes many of these instruments, and the only options for addressing ecosystem externalities are bilateral or multilateral agreements and defensive tariffs. Some of the difficulties with MEAs have already been alluded to. There are similar difficulties with defensive tariffs. Although tariffs are justified when trade carries with it some risk that is not reflected in the price of traded goods, GATT makes it difficult to implement tariffs for this purpose. Indeed, despite Article XX and the SPS agreement, many economists argue that GATT is simply too blunt an instrument to deal with the environmental effects of trade (Barrett, 2000).

There are ultimately two problems to be addressed in the optimal provision of ecosystem services. The first is the problem of local market failure. The solution to this lies in the development of local or national policy responses on the provision of environmental public goods and the internalization of ecosystem externalities. The second is the problem of international market failure. It includes both the undersupply of global environmental public goods and the externalities of international trade. Both require the development of (1) incentives to decision makers to take the full costs of their actions into consideration, (2) institutions for the regulation of access to ecosystem services, and (3) an appropriate financial mechanism. The incentive problem requires both the generation of the correct incentives for biodiversity conservation and the discouragement of perverse incentives that work against conservation.

At the international level, the incentive problem requires institutions that will enable host countries to “capture” the global values associated with the provision of ecosystem services that offer global benefits. Existing institutions include both the MEAs and a financial mechanism, the Global Environment Facility. Other emerging institutions include joint implementation, bioprospecting contracts, global overlays, environmental funds, and debt-for-nature swaps. Although the Convention on Biological Diversity and the International Plant Protection Convention are critical to the development of new biodiversity institutions and mechanisms, there is limited scope for solving the problem of declining ecosystem services by negotiating cooperative outcomes in multilateral agreements of this type (Barrett, 2003).

Nonetheless, the development of appropriate incentives remains the best hope for arresting and reversing the decline in the supply of important ecosystem services identified by the MA. In this, economics has a critical role to play—both in the identification and measurement of ecosystem externalities and in the development of mechanisms to internalize those externalities. Far from being part of the problem, the economics of ecosystem services, along with the ecology of biodiversity–ecosystem functioning–ecosystem services, lies at the heart of the solution to the global crisis described by the MA.

Allen, B. P., and J. B. Loomis. 2006. Deriving values for the ecological support function of wildlife: An indirect valuation approach. Ecological Economics 56: 49–57.

Barbier, E. 2007. Valuing ecosystem services as productive inputs. Economic Policy, January: 177–229.

Barrett, S. 2003. Environment and Statecraft. Oxford: Oxford University Press.

Daily, G. C., S. Alexander, P. R. Ehrlich, L. Goulder, J. Lubchenco, P. A. Matson, H. A. Mooney, S. Postel, S. H. Schneider, D. Tilman, and G. M. Woodwell. 1997. Ecosystem services: Benefits supplied to human societies by natural ecosystems. Issues in Ecology 1(2): 1–18.

Heal, G. M., E. B. Barbier, K. J. Boyle, A. P. Covich, S. P. Gloss, C. H. Hershner, J. P. Hoehn, C. M. Pringle, S. Polasky, K. Segerson, and K. Shrader-Frechette. 2005. Valuing Ecosystem Services: Toward Better Environmental Decision Making. Washington, DC: National Academies Press.

Millennium Ecosystem Assessment (MA). 2005. Ecosystems and Human Well-Being: Synthesis. Washington, DC: Island Press.

Stoneham, G., V. Chaudhri, L. Strappazzon, and A. Ha. 2007. Auctioning biodiversity conservation contracts. In A. Kontoleon, U. Pascual, and T. Swanson, eds. Biodiversity Economics. Cambridge, UK: Cambridge University Press.

Turner, R. K., J. Paavola, P. Cooper, S. Farber, V. Jessamy, and S. Georgiou. 2003. Valuing nature: Lessons learned and future research directions. Ecological Economics 46: 493–510.

Wätzold, F., M. Drechsler, C. W. Armstrong, S. Baumgärtner, V. Grimm, A. Huth, C. Perrings, H. P. Possingham, J. F. Shogren, A. Skonhoft, J. Verboom-Vasiljev, and C. Wissel. 2006. Ecological–economic modeling for biodiversity management: Potential, pitfalls, and prospects. Conservation Biology 20: 1034–1041.