![]()

Chapter 21: Management of Operational Costs and Supplies

The preceding chapters described in detail only the costs that pertain directly to the product being sold. In computing the cost of menu items, only food costs were analyzed. When projecting the average cost of each cocktail, only the cost of the liquor poured and the miscellaneous expense were considered. The total wine cost was the wholesale price at which the bottle was purchased. Obviously, there are many other costs involved in presenting food, liquor, and wine products to the public. These additional costs are called operational costs. Operational costs are all of the non-food, non-liquor, and non-wine supplies that are used in preparing these items.

Labor and the cost of equipment are not considered direct operational expenses under this scenario. Labor is computed as a separate cost. Equipment is a capital expenditure and may be depreciated over several years. The operational supplies and costs considered here are only those products that must be continuously renewed each month as they are used up, lost, or broken.

Operational supplies and cost are divided into separate categories so that each may be broken down and analyzed. A cost for each operational category will be projected at the end of each month. Accurately setting up each category is crucial, as this information will be used in projecting budgets and profit and loss statements.

OPERATIONAL CATEGORIES

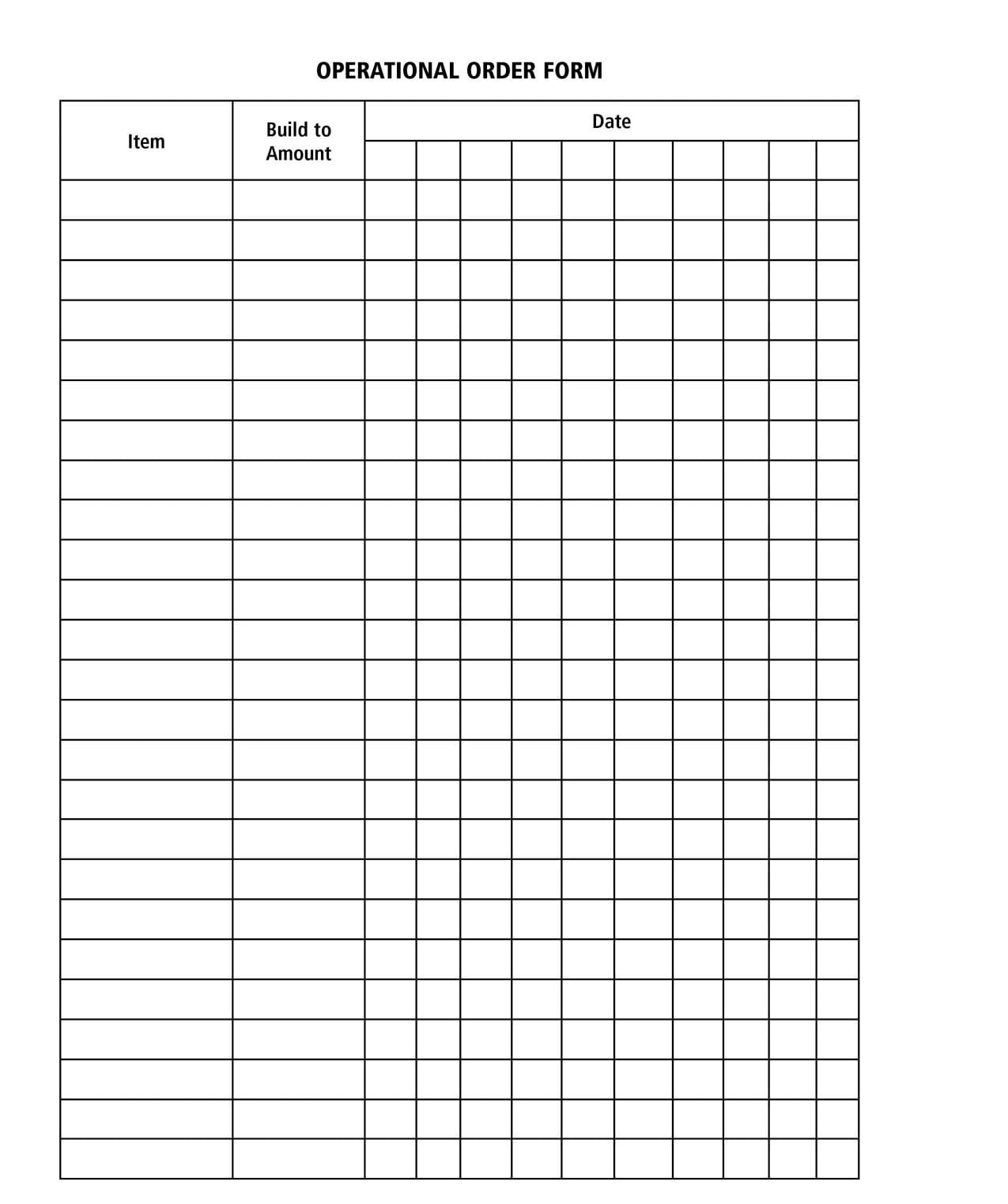

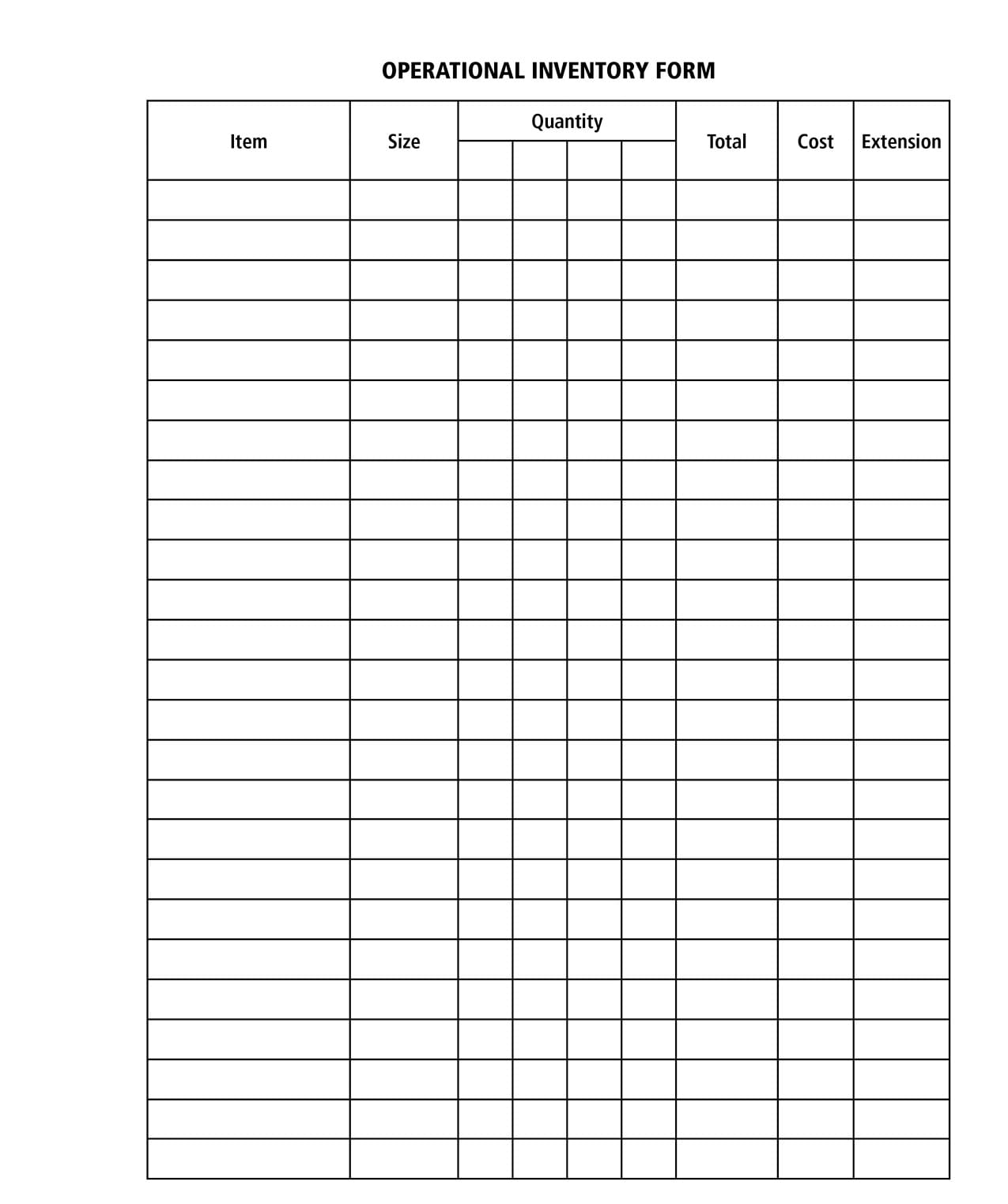

The following pages list each operational category and some examples of the type of supplies that belong to each. Based on the examples given, list on the Operational Order Form and the Operational Inventory Form all of the operational supplies the restaurant will need. An example of each form can be found at the end of this chapter. Separate each page by category and clearly label it in the space provided on the form.

Always keep the order and inventory forms up to date. Whenever a new product is ordered, enter the new item on both forms. When it comes time to do the weekly order and monthly inventory you will not miss anything. Certain items may fit into two categories because they are used in several areas of the restaurant. Place the item in the category where it is used the most. It will not affect the cost projection as long as the item is listed in only one category.

CHINA AND UTENSILS

All plates, coffee cups, saucers, silverware, etc.

WNA combines style, quality, and performance with the widest variety of single-service tableware. The company also offer cutlery, straws, and stirrers in some locations. And when you require custom products, WNA has the flexibility and knowledge to offer print and packaging solutions. From Concept to Completion®, WNA strives to enhance your brand image. Visit www.wna-inc.com/products/custom/index.php for the full line of disposable and one use products.

GLASSWARE

All bar glasses, wineglasses, water glasses, carafes, decanters, etc.

KITCHEN SUPPLIES

All of the non-food materials used in preparing food items, such as kitchen utensils, spatulas, scales, trays, measuring cups, skewers, foil, plastic wrap, fry-o-lator filter paper, etc.

BAR SUPPLIES

All of the miscellaneous supplies used at the bar, such as mixing spoons, straws, swords, napkins, pour spouts, corkscrews, etc.

DINING ROOM SUPPLIES

All of the miscellaneous supplies used in the dining room, such as candles, matches, menus, salt and pepper shakers, sugar bowls, tent-card holders, coffeepots, creamers, flower vases, etc.

Cal Mil Products offers a full line of dining room essentials for your restaurant. These items include display shelves, silver ware containers, salt and pepper shakers, and much more. Visit www.calmil.com for the full selection and for custom quotes.

Browne-Halco offers a wide selection of cookware and bakeware accessories. These products are invaluable in your recipe preparation. The full line of products can be seen at www.halco.com or you can call 888-289-1005.

CLEANING SUPPLIES

All of the miscellaneous cleaning supplies used by both the staff and the maintenance company, such as soap, paper towels, chemicals, vacuum bags, garbage bags, etc.

OFFICE SUPPLIES

All of the supplies used in the offices, such as tape, rubber bands, paper, stationery, etc.

UNIFORMS

Encompasses the cost of purchasing employee uniforms: aprons, smocks, hats, pants, dresses, etc.

Aprons Etc. offers a selection of aprons, chef, and dining room uniforms. Aprons, Etc. originally began as a manufacturer/supplier to retail outlets and expanded its business by adapting practices highly suited to the advertising specialty market. In the 19-plus years of operation, the major growth of the company has been through the development of strong relationships within the ad specialty trade and by growing a niche in the textile promotional market. The company’s strengths are in their production time, creativity, quality well-priced promotional products, and professional and courteous customer service. Visit www.apronsetc.com for all the items Aprons Etc. offers.

Imagen offers a fine selection of restaurant uniforms. Their uniform selection can be seen at http://anncarol.trustpass.alibaba.com/product/11285659/Restaurant_Uniforms.html. Fully lined jackets and pants are available in a 55% polyester/45% wool blend or your selection of fabric composition and weight. Ask for price with your fabric selection. View more styles on the web site. They will make ten uniforms or tens of thousands for your restaurant needs.

LAUNDRY AND LINEN

It includes all napkins, tablecloths, kitchen towels, bar towels, and soap purchased by the restaurant from a laundry service or for an in-house system. It does not include the cost of services of a laundry company, as this is computed separately.

It is no coincidence that the Hilden Group is one of the world-leaders in the table linen industry. An in-depth understanding of the latest interior design trends has helped the company to develop a range of table linens to meet every individual need. Visit www.hilden.co.uk for more information.

ORDERING OPERATIONAL SUPPLIES

All of the procedures for storing, ordering, and receiving food, liquor, and wine also apply to operational supplies. Ordering operational supplies must be carefully thought out. Too large of an inventory (back-stock) will tie up capital at expensive interest rates. One careless bus person or waiter who drops a tray of glasses can destroy what little reserve you have, so there must be a large enough inventory to cover the unexpected. One to two cases of each item in the storeroom should suffice. Portion control items such as scales, scoops, and ladles are often difficult to obtain; when you find a supplier that has the size and type you desire, order several and keep them in reserve. A common excuse for not portion-controlling products is that the employee does not have access to the right type of utensil. It is management’s responsibility to provide the employees with proper tools to do their jobs.

Allow a lead time of several weeks when ordering china. Your distributor probably does not stock all the types of china and must purchase specially from the manufacturer. Insufficient quantities of place settings will result in extra work, slow service, and a slow turnover in the dining room. Always maintain an adequate supply of stock out of the storeroom. The storeroom should be a separate room or closet and the manager must be the only person with a key. Do not create a situation where it is easier for an employee to run to the storeroom for a new case of water glasses than to help the dishwasher catch up.

BEGINNING INVENTORY

Computing beginning inventory is similar to computing the beginning amount for food, liquor, and wine. However, there is one difference. The beginning inventory amount for each operational category is the dollar amount that is in storage when the restaurant is totally set up, meaning that all the tables are set and there is plenty of stock in the kitchen and bar. The reason for this beginning inventory is that operational supplies are projected for each month. The cost of setting up the restaurant is considered a one-time start-up cost. Operational costs are measures of how well you controlled these costs following start-up. Separating this start-up cost may have some additional tax advantages. Your accountant will be able to advise you on this possibility.