![]()

Chapter 35: Internal Bookkeeping

Internal bookkeeping is the area that ties all departments of the restaurant together into one efficient, airtight operation. Internal bookkeeping is the keystone from which all financial transactions may be monitored, analyzed, and reconciled. Management involvement in this department can never be enough.

The preceding chapters have introduced various means of controlling and securing specific areas of the operation. This chapter will cover:

1. The owner/manager’s role in these controls systems.

2. Basic principles of accounting.

3. A system of checks and balances to ensure maximum efficiency and profit.

The internal bookkeeping procedures described in this chapter are simple. To ensure complete accuracy, a couple of hours each day must be devoted to them. It is recommended that a part-time bookkeeper be employed. The bookkeeper need not be highly trained or experienced but must be very accurate and thorough.

Because your bookkeeper will only be required for a few hours each morning, he must be well compensated for his efforts. The ideal candidate for this position might be a stay-at-home parent wishing to work a few hours each morning while children are at school or day care. Additional hours may be supplemented if the bookkeeper is able to assist with basic office and administrative functions such as taking reservations, booking private parties, or typing. A distinction must be made between the bookkeeper and an outside public accountant.

The bookkeeper’s primary responsibility is to ensure that all sales and products are accurately recorded and balanced. An outside public accountant should be used from time to time to audit the records, prepare financial and tax statements, and lend management advisory services.

It is recommended that the bookkeeper not be used in any other capacity in the restaurant (other than office administrative duties), as he will be auditing the money and work of the other employees. The bookkeeper must understand and appreciate the confidential nature and importance of the work he is doing. It may be difficult finding a person suitable for this job. Do not settle for just anyone in this crucial position. Once a competent person is located, make every effort to compensate and satisfy him, as he will be one of your most valuable employees.

This chapter on internal bookkeeping is divided into three separate sections. The first section, Accounts Payable, outlines a unique system for paying and accounting for purchases. The second section, Revenue Accounts and Reconciliation, explains in detail how to account for and reconcile the sales and products from the previous day. The third section describes the steps and procedures used in preparing the payroll.

ACCOUNTING SOFTWARE

As I described in previous chapters, I highly recommend the use of a basic accounting program, such as QuickBooks (www.quickbooks.com) or Peachtree (www.peachtree.com). These programs are inexpensive and easy to use and will save time, money, and countless errors. The procedures detailed below are for a manual system, but they can be easily (and wisely) brought into a computerized environment. Please note that the use of a POS system may also make some of these activities obsolete.

SECTION 1: ACCOUNTS PAYABLE

Accounts payable represents the money the restaurant owes its purveyors. Although there are various ways to record the restaurant’s transactions, the procedures and systems described here will become an integral part of the restaurant’s budgeting, controls, and financial management. Therefore, the adoption and use of these procedures is highly recommended.

INVOICES

The start of the accounts payable process begins when the invoices are brought to the manager’s office at the end of each day. As I mentioned before, the employees handling the invoices must do so with the utmost of care and concern. Should an invoice become lost or mutilated, it will throw a “monkey wrench” into the bookkeeping records. Ideally, all invoices should be processed on a daily basis so that the transactions are still fresh in everyone’s mind and can be easily referred to. The following are the suggested steps for invoice processing:

1. Make certain the invoice is actually addressed to the restaurant.

2. Make certain the invoice is signed by one of your employees. A signature ensures that the items were received intact and accounted for.

3. Verify the delivery date.

4. Check the price and quantity to make certain the amount delivered was the amount ordered and at the price quoted.

5. Check the extensions on the invoice total for accuracy.

6. If everything appears to be in order, stamp the invoice “Approved.”

CODING THE INVOICE

Every cost the restaurant incurs is assigned a code number. Coding each invoice is an integral part in setting up and establishing bookkeeping and budgeting procedures. Breaking down each invoice and cost into separate categories helps to analyze cost problems later and aids in preparing tax and financial statements. Following is a standard Chart of Accounts for restaurants, provided by the National Restaurant Association (www.restaurant.org), of every expenditure the restaurant will normally incur during monthly operations:

|

BALANCE SHEET OF ACCOUNTS |

|

|

ASSETS |

LIABILITIES & EQUITY |

|

Current Assets Cash on Hand Cash in Bank - General Checking Cash in Bank - High-Yield Checking Accounts Receivable - Trade Accounts Receivable - Owner/Employee Accounts Receivable - Credit Cards Food Inventory Beverage Inventory Prepaid Taxes Prepaid Insurance Prepaid Miscellaneous Expenses Note Receivable - Current Portion |

Current Liabilities Accounts Payable - Trade Accounts Payable - Other Gift Certificates Outstanding Deposits Held Sales Tax Payable Payroll Taxes Payable Other Taxes Payable Accrued Insurance Accrued Payroll Accrued Rent Accrued Miscellaneous Expenses Note/Loan Payable - Current Portion Note/Loan Payable - Current Portion |

|

Fixed Assets Leasehold Improvements Accumulated Amortization - UH Imp Furniture, Fixtures & Equipment Accumulated Depreciation - FF&E China, Glass, Flatware Par Small Equipment Par |

Long Term Liabilities Note/Loan Payable - Long Term Portion Note/Loan Payable - Long Term Portion Other Liabilities Other Notes Shareholder Notes |

|

Other Assets Deposits Paid Liquor License Organizational Expenses Logo/Artwork Note Receivable - Long Term Portion |

Shareholders’ Equity Capital Stock Retained Earnings - Prior Years Current Profit/Loss(-) |

|

INCOME AND EXPENSE ACCOUNTS |

|

|

Revenue Food Sales Cost of Sales Food Cost Salaries & Wages Administrative Wages |

Occupancy Costs Rent/Lease (Premises) Repairs & Maintenance Grounds/Gardening |

|

Employee Benefits Employer Payroll Tax Expense Direct Operating Expenses Auto/Gas Expense - Operations |

Depreciation & Amortization Depreciation Expense Other (Income)/Expense Interest Income Interest & Non-Operating Expense Interest Expense |

|

Music & Entertainment (see detail list) Marketing Complimentary Food & Beverage (cost) Utility Service Electricity |

Income Taxes State Income Tax Administrative & General Auto/Mileage Allowance |

|

BALANCE SHEET FORMAT |

|

|

ASSETS |

LIABILITIES & EQUITY |

|

Current Assets Cash on Hand XXX Cash in Bank - General Checking XXX Cash in Bank - High-Yield Checking XXX Accounts Receivable - Trade XXX Accounts Receivable - Owner/Employee XXX Accounts Receivable - Credit Cards XXX Food Inventory XXX Beverage Inventory XXX Prepaid Taxes XXX Prepaid Insurance XXX Prepaid Miscellaneous Expenses XXX Note Receivable - Current Portion XXX TOTAL Current Assets XXX |

Current Liabilities Accounts Payable - Trade XXX Accounts Payable - Other XXX Gift Certificates Outstanding XXX Deposits Held XXX Sales Tax Payable XXX Payroll Taxes Payable XXX Other Taxes Payable XXX Accrued Insurance XXX Accrued Payroll XXX Accrued Rent XXX Accrued Miscellaneous Expenses XXX Note/Loan Payable - Current Portion XXX Note/Loan Payable - Current Portion XXX TOTAL Current Liabilities XXX |

|

Fixed Assets Leasehold Improvements XXX Accumulated Amortization - UH Imp XXX Furniture, Fixtures & Equipment XXX Accumulated Depreciation - FF&E XXX China, Glass, Flatware Par XXX Small Equipment Par XXX TOTAL Fixed Assets XXX |

Long Term Liabilities Note/Loan Payable - Long Term Portion XXX Note/Loan Payable - Long Term Portion XXX TOTAL Long Term Liabilities XXX Other Notes/Loans Payable XXX TOTAL Liabilities XXX |

|

Other Assets Deposits Paid XXX Liquor License XXX Organizational Expenses XXX Logo/Artwork XXX Note Receivable - Long Term Portion XXX TOTAL Other Assets XXX TOTAL Other Assets XXX |

Shareholders’ Equity Capital Stock XXX Retained Earnings - Prior Years XXX Current Profit/Loss(-) XXX TOTAL Shareholders’ Equity XXX TOTAL Liabilities AND |

|

SUMMARY INCOME STATEMENT FORMAT |

||||

|

Current Period |

% of Sales |

Year-To-Date |

% of Sales |

|

|

Revenue Food Sales Total Revenue |

XXX XXX XXX |

XX XX XX |

XXX XXX XXX |

XX XX XX |

|

Cost of Sales Food Cost Total Cost of Sales |

XXX XXX XXX |

XX XX XX |

XXX XXX XXX |

XX XX XX |

|

Gross Profit |

XXX |

XX |

XXX |

XX |

|

Operating Expenses Salaries & Wages Employee Benefits Direct Operating Expenses Music & Entertainment Marketing Utility Services Occupancy Costs Repairs & Maintenance Depreciation & Amortization Other (Income)/Expense General & Administrative Total Operating Expenses |

XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX |

XX XX XX XX XX XX XX XX XX XX XX XX |

XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX |

XX XX XX XX XX XX XX XX XX XX XX XX |

|

Income Before Interest & |

XXX |

XX |

XXX |

XX |

|

Interest Interest Expense Other Expenses Total Interest & Non-Op Expenses |

XXX XXX XXX |

XX XX XX |

XXX XXX XXX |

XX XX XX |

|

Income Before Income Taxes |

XXX |

XX |

XXX |

XX |

|

Income Taxes |

XXX |

XX |

XXX |

XX |

|

Net Profit (or Loss) |

XXX |

XX |

XXX |

XX |

After approving each invoice, code the invoice to its appropriate category. A rubber stamp for processing invoices may be prepared at most office-supply stores. It should contain a space for the following information:

1. Date

2. Code

3. Amount due

4. Bookkeeper’s initials

After stamping the invoice, simply fill in the appropriate blank with the required data. Some invoices may list purchases or costs that must be entered into the expenditure ledger under different codes. A food purveyor’s invoice might list 50 pounds of flour and one case of pineapple juice. The cost of the flour would be coded to the cost of food and the cost of the pineapple juice would be coded to the cost of liquor. If you ask them, most purveyors that deliver products for more than one code will be glad to make out a separate invoice for each code.

Every invoice must be copied and filed according to its respective code number and purveyor’s company name. Invoices containing two or more codes should have two or more copies prepared, one for each appropriate file. The original invoices should also be filed by code numbers and by the month in which the transaction occurred. Store the originals in a fireproof cabinet.

Most purveyors will issue a monthly statement itemizing all the invoices and the total amount due. Payment may then be made once a month on the total amount rather than with a separate check for each invoice received. Paying purveyors on a monthly-statement basis is advantageous. The restaurant’s cash flow will be utilized more effectively and there will be less administrative work. Prior to issuing the check, be certain that the monthly statement is accurate by cross-checking the statement against the invoices in the file. Staple the received invoices to the monthly statement for future reference.

Accounts must be closed out on the last day of each month to accurately compute monthly profits and costs. Most monthly statements will not arrive until the fourth or fifth day of the following month. Thus, the bookkeeper must realize that, even though some bills may be paid in the following month, the cost of the goods and services will be applied to the month they were delivered to the restaurant. It will be a crucial point in the following two chapters when profits and costs will be computed.

To accurately record purchases delivered to the restaurant, you must record these expenditures in a separate ledger, called a Purchase Ledger. An example of a Purchase Ledger can be found at the end of this chapter. Use a loose-leaf binder to store all the Purchase Ledger pages. Separate Purchase Ledger pages are required for each of the following categories:

1. Food Costs

2. Liquor Costs

3. Wine Costs

4. Each operational category: Services, Utilities, etc.

5. Other Expenses

All invoices must be recorded in the Purchase Ledger under the date the items were delivered to the restaurant. (This is a hard-and-fast rule, regardless of whether goods and services are paid for in cash or by credit or other terms.) This process pertains to all expenses, regardless of whether or not you intend to use the items during that particular month.

In summation, this system will provide a record of expenses when they are paid. The Purchase Ledgers will record all invoices when they are received. The ending inventories, discussed in the following chapters, will make the necessary adjustments to determine the actual amount used over the month. It is necessary so that actual costs may be accurately projected. The crucial consideration now is to record every invoice in the Purchase Ledger under the correct expense category. It must be done on the date the material was received to ensure the cost projections calculated at the end of the month will be accurate.

To post the Purchase Ledger, simply determine which type of expense account it should be credited to and enter the invoice amount on the appropriate ledger page. Record the invoice number, amount, and the date received under the purveyor’s column. “Paid Outs” are recorded as cash purchases even if recorded on the Cashier’s or Bartender’s Report. Determine which expense account the Paid Out should be credited to and record the transaction in the “Paid Out” column on the proper page.

TOTAL MONTHLY PURCHASES

To compute the total expenditure for each code over the month, simply add each expenditure column then each page total on the Purchase Ledger. Credits are subtracted out of the restaurant’s total purchases on the monthly statement.

The cut-off time for each month is the close of business on the last day of the month. Transactions after midnight on the last day of the month are still to be included in the month’s totals, as they are a part of the business for that previous month. (The measure of one day, for our purposes, is one complete business day or cycle.) To reiterate an important concept from the last section, costs are to be applied to the month the products were received at the restaurant, regardless of when they were paid for or used.

Some hints on preparing the Purchase Ledger:

• Enter all figures in pencil.

• Enter all credits in red and in parentheses.

• Have purveyors that deliver products for more than one code make out a separate invoice for each code.

MANAGING THE RESTAURANT’S CASH FLOW

Daily involvement and analyses of your financial records are necessary if the restaurant is to take full advantage of the credit terms and discounts offered by suppliers. Simply managing the restaurant’s cash flow and utilizing its enormous purchasing power can acquire substantial savings.

After you have been operating for a few months, most purveyors will extend “30-day net” terms if you request them. This situation is advantageous; through proper management, the restaurant’s inventory may be turned over as many as five or six times in a 30-day period. In effect, the purveyors will be financing your operations. Few businesses can turn their inventories over this quickly, so they are forced to pay interest or finance charges. Quick turnover is one of the blessings of the restaurant business. Careful planning and synchronization between the purchasing and bookkeeping departments is needed to obtain maximum utilization of the cash flow. The savings are well worth the additional effort.

SECTION 2: REVENUE ACCOUNTS AND RECONCILIATION

Revenue is the sales received for the restaurant’s products: primarily food and beverages. The procedures in this section for setting up revenue accounts are the basis of the restaurant’s controls. Every transaction will be checked and balanced. When the procedures are completed, there will be no margin for error and no loss of revenue.

PREPARING AND AUDITING SALES REPORTS

The procedures for preparing and auditing sales reports are listed below in numerical order — the order in which the bookkeeper should begin to record and reconcile the previous day’s transactions. It is advisable to have the bookkeeper review the other control sections in the restaurant so that he will become familiar with how the controls fit together and how they work.

1. Remove the cash drawer, tickets, charge forms, Cook’s Forms, and reports from the safe where the manager placed them at the close of the previous business day.

2. Separate the cashier and bartender drawers, tickets, and forms into their respective piles. Work in a closed, locked office while the cash is out of the safe.

3. Begin by verifying the Cashier’s and Bartender’s Reports. Count out and separate the cash by denomination. The total amount taken in must equal the difference between the new and old cash-register readings. These figures should all be in order, as the manager checked and verified the sales of the previous day with the cashier and bartender. Any discrepancies should be immediately brought to the manager’s attention.

4. Using new Cashier’s and Bartender’s Report forms, enter the new register readings in the space provided on the reports.

5. Make up new cash drawers for each register. Enter the total and itemized amounts on the reports in the “Cash In” sections. Sign the reports and place them in the cash drawers. Place the drawers back into the safe. Return the remaining cash, charges, and checks to the safe. Later on you will need all these items to make up the daily deposit.

6. Using the Ticket Issuance Form and the bottom part of the Bartender’s Report, verify that all tickets have been turned in. The total number issued must equal the amount used and returned. Should there be any tickets missing, determine which ticket number is missing and, using these two forms, you can determine which employee was issued the missing ticket. Notify the manager immediately. The manager should have verified that all tickets were turned in the previous day. This, again, is a double check.

7. From the unused tickets issue new cocktail and bar tickets. Issue the same number of tickets to each employee. Thirty is an average number for each shift. Using the employee schedule, write on the appropriate forms the name of each wait person and bartender working. Write in the total number of tickets issued and the number sequences of each employee’s tickets. Place a rubber band around each pile of tickets. On the top ticket write in the employee’s name so that the manager knows to whom they should be issued. When completed, place everything in the safe.

8. Take the used tickets from the previous business day and separate wait staff and bar tickets. Starting with the wait staff tickets, check each for accuracy. Make certain that:

A. The correct price was charged. (This is a double check on the cashier.)

B. The ticket was added correctly and sales tax was computed and entered correctly. Wait staff and cashiers may be charged for these mistakes in some states. Regardless of the legality, they must be notified of their errors and correct them in the future. Write up all mistakes and post the sheet on the bulletin board at the completion of each day. Mistakes in writing tickets are caused by careless employees and can be a great expense to the restaurant. Management should use whatever action is necessary to resolve and limit the problem.

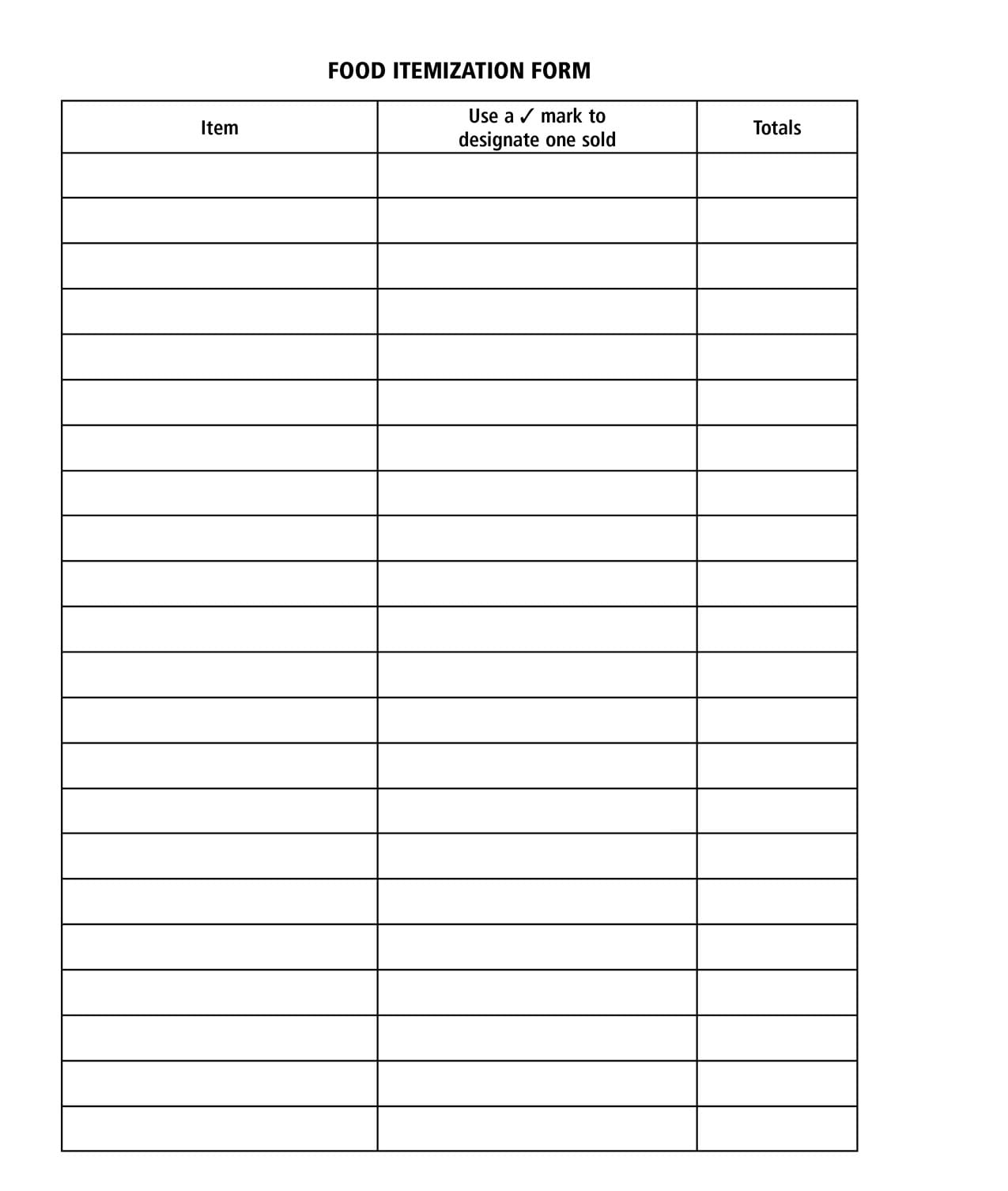

9. On the Food Itemization Format found at the end of this chapter, place an “X” in the appropriate column for each menu item sold. Using the Wine Itemization Form, itemize any wine sold from the tickets. List any housed, managerial, or complimentary product in the itemization, but also list them separately on the back of the form in their respective categories; this information will be used later.

10. Check the wait staff, bar and, if utilized, cocktail tickets for accuracy. Any wine or food item listed on these tickets must also be added to the Food and Wine Itemization Forms. Cocktails and liquor are not itemized.

11. Take the credit-card sales drafts and separate them into piles by company. Each employee is responsible for her own credit-card charges, but they should be double-checked by the cashier. Verify the accuracy of each charge:

A. Make sure the charge slip is signed.

B. If the card was imprinted manually, make sure the slip was imprinted clearly, the right charge form was used, the expiration date is good, the slip is dated correctly and the total amount was added correctly.

C. If the tip was charged, a “Cash Paid Out” from the cashier or bartender should have been given to the employee. The Cash Paid Out is not a purchase because, when the charge goes through, the restaurant will be reimbursed. Set up a cash reserve or special account and reimburse the cash drawer for this Cash Paid Out. When the check or electronic deposit from the credit card company comes in, put the Paid Out amount back into the reserve or special account.

D. Be sure an approval code is on the charge, in case the floor limit of the charge card was exceeded.

12. Separate and examine for accuracy any checks received. The manager should have approved personal checks. The customer’s driver’s license number and telephone number should be listed on the back. Also, only the manager should approve traveler’s checks. The manager must witness the second signature and compare it to the first.

13. Total and verify all the charge and check amounts on both reports.

14. Total the Food and Wine Itemization Forms. Multiply the total number sold by the selling price (without sales tax).

15. Compare the itemized number of menu items sold against the daily Cook’s Form and the Ticket Itemization Form. It will ensure that every food item is now accounted and paid for. Should there be a discrepancy, recheck both your figures and the cook’s calculations. If everything still appears to be in order, refigure the Cook’s Form using the carbon-copy tickets. It is possible a ticket may have been changed after the carbon copy was given to the cook.

16. Total the food sales on the Food Itemization Form. This figure must match the total food sales entered on the Cashier’s and Bartender’s Reports.

17. Total the wine sales on the Wine Itemization Form. This figure must match the total wine sales entered on the Bartender’s and Cashier’s Reports.

18. Add the itemized wine and food sales together.

19. The difference between the total itemized food and wine sales and the total sales taken in must equal the liquor sales.

20. The total sales multiplied by the percentage of sales tax must equal the total sales tax taken in. After this step, all sales will be completely checked and balanced by three different individuals and against every other transaction that occurred in the restaurant. There is no possible way items or money could be stolen, undetected, unless every single employee — including the manager — was in collusion.

21. Send the Wine Itemization Form to the manager so that he may reconcile and restock the wine for the next day.

22. Make up the daily deposit. Use indelible ink and prepare two copies of the deposit form. Stamp all checks with the restaurant’s account number and “For Deposit Only.” Put the appropriate employee’s name on the back of each check so that, if it is returned, the manager can go back to the employee who accepted it.

23. Sort the bills and wrap as many of the coins as possible. Charge card sales receipts can usually be deposited along with your cash deposit or electronically, direct from the terminal. If your bank does not offer this service, you will have to mail the receipts directly to the credit card company. The manager should personally bring the deposit to the bank every day. Change or small bills needed for the following day should be picked up at this time.

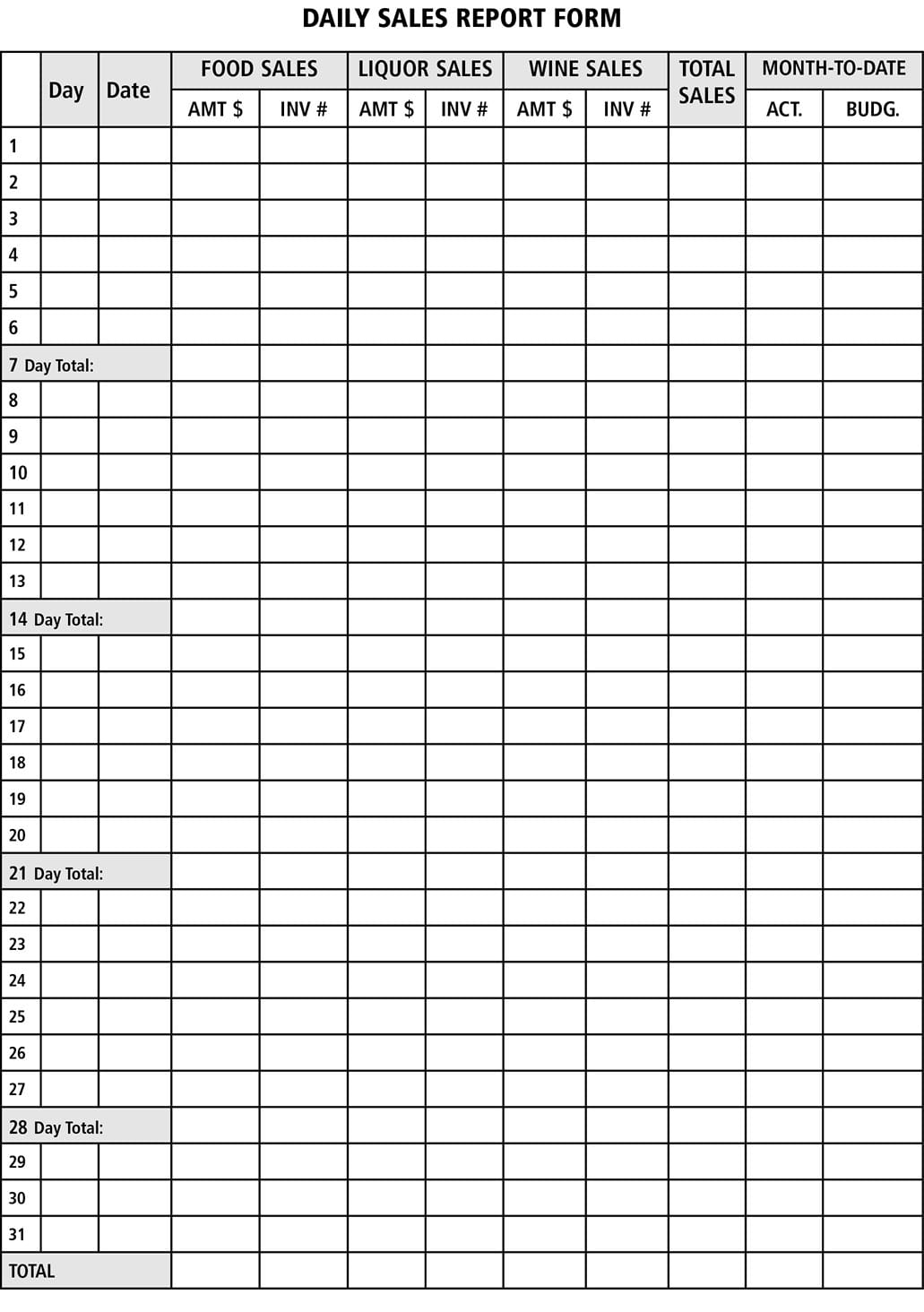

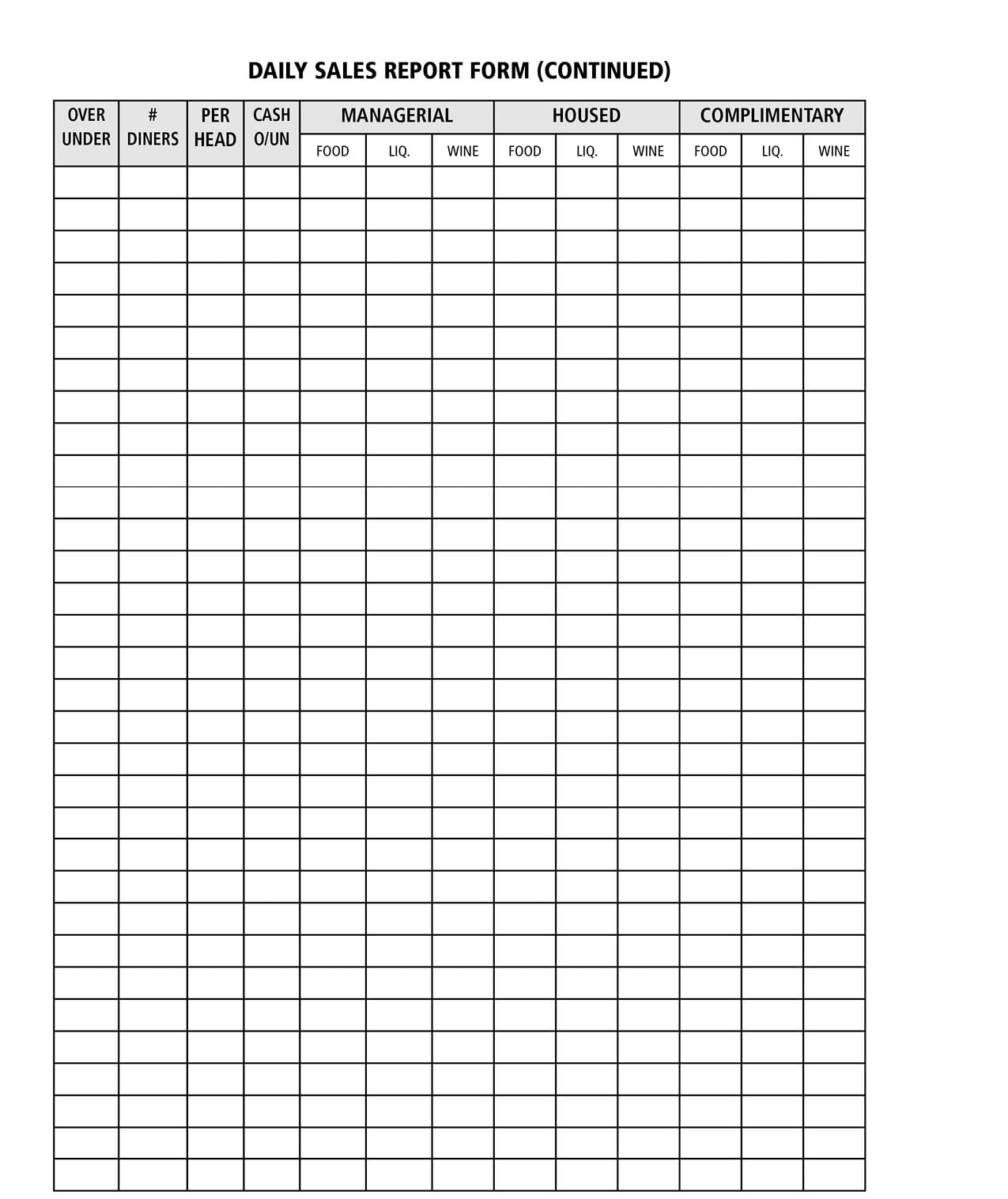

24. Never let two days’ worth of receipts sit in the safe. Make certain the deposit receipt is returned and filed in a fireproof box. Check the duplicate deposit stub against the deposit receipt to make sure the correct amount was deposited. Enter the deposit amount, date, and source onto the check register. Enter the verified figures for the day on the Daily Sales Report Form (see example at the end of this chapter).

To compute individual category percentages, divide the category sales by the total daily sales. “Actual Month-to-Date Sales” is a tally of the daily sales. The budget sections will be explained in detail in the next chapter. “Dinner Count” refers to the number of daily customers served. “Cash, Over/Short” refers to any mistakes made at the register. Complimentary, house, and manager figures are recorded from when you itemized the food and bar tickets in Step 9. Break down the food, liquor, and wine sales for each category and enter at full price.

This concludes the reconciliation part of the revenue accounts. Every item and sale is accounted for and reconciled against every other transaction in the restaurant. Keep all of these forms for at least five years in a fireproof storage file. All forms used during the month may be kept in loose-leaf binders in the bookkeeper’s office. The Daily Sales Report should be left at the manager’s desk at the end of the day. Remember that all this information is strictly confidential and should never be the subject of idle conversation.

SECTION 3: PAYROLL

As stated earlier, preparing the payroll is best left to a computerized payroll program, such as QuickBooks® or Peachtree® or to a payroll service.

TAXES AND TIPS

One of the biggest challenges facing restaurant owners and managers in regard to payroll is getting employees to report and pay taxes on their tips, as required by the IRS. Complying with the intricacies of the tip reporting and allocation rules can be difficult and confusing. Tip tax laws are constantly changing. There are at least five legal suits involving tip regulations that are currently pending. You must use extreme caution in this area; get assistance from your accountant, attorney, state restaurant association, or the National Restaurant Association (www.restaurant.org).

U.S. Supreme Court Decides Tip-reporting Case

United States v. Fior d’Italia Inc., 01-463: The Internal Revenue Service can use estimates to make sure it is collecting enough taxes on cash restaurant tips, the Supreme Court said Monday, June 17, 2002. The ruling is a defeat for the estimated 350,000 restaurants with tipped workers. The court said the IRS can estimate the amount of cash tips given to employees based on tips shown on credit card receipts. The estimate is used to determine taxes. This case pitted one of the nation’s oldest Italian restaurants against U.S. tax collectors. The restaurant contends the IRS formula does not take into account stingy cash tips, take-out meals, or tip-sharing among hostesses and other staff.

Justice Stephen Breyer, writing for the 6-3 court, said, while the practice is not illegal, “we recognize that Fior d’Italia remains free to make its policy-related arguments to Congress.” The ruling is a follow-up to the Supreme Court’s 1973 decision that the IRS can make an educated guess about employees’ tip taxes when records are inadequate. Fior d’Italia, operating in San Francisco for 116 years, had challenged an extra $22,000+ bill that was calculated with estimates. Using credit card receipts, the IRS had calculated that workers were tipped about 14 percent on meals. The San Francisco-based 9th U.S. Circuit Court of Appeals said the IRS could not prove that people who paid with cash tipped 14 percent and that the IRS therefore should stop using the estimates.

Other Tip Tax Cases

Since the IRS first began pursuing employer-only and employer-first restaurant audits in the mid-1990s to collect taxes from employers on tips employees allegedly failed to report, the restaurant industry has mounted several major court challenges. Several of these challenges have made it to the federal appeals court level. In the Fior d’Italia case, the 9th Circuit (San Francisco) ruled in the restaurant’s favor. Three other federal appeals courts have sided with the IRS.

Get more details on all the rulings:

• 9th Circuit (California), in Fior d’Italia, Inc. v. United States (March 2001);

• 11th Circuit (Florida), in Quietwater Entertainment, Inc. v. United States (June 2000; no published opinion);

• 11th Circuit (Alabama), in Morrison Restaurants, Inc. v. United States of America (August 1997); and

• Federal Circuit (Washington, DC): Bubble Room, Inc. v. United States (Pending).

Tipped Employees

The Supreme Court ruling of June 25, 2002, states that the Internal Revenue Service can use aggregate tip estimates to ensure that the employer is paying enough FICA taxes on allegedly unreported tips. This essentially means the IRS can look at the restaurant’s records, come up with a total amount of tips it thinks employees should have reported, and bill the restaurant business for the employer’s share of FICA taxes (currently 7.65%) on any allegedly unreported tips. Under the new ruling, the IRS does not need to examine individual employees’ records or credit employer FICA tax payments to individual employees’ Social Security accounts. It is permissible for the IRS to estimate the amount of cash tips given to employees based on tips included on credit card receipts.

Potentially, a restaurant could face a tax bill for FICA taxes on allegedly unreported tips going as far back as 1988, when Congress first began requiring employees to pay FICA taxes on all tips. As an employer of tipped employees you are essentially being forced to protect yourself from IRS audits and aggregate FICA tax assessments.

So what is the restaurant owner to do? In 2000, the IRS announced it was lifting a five-year moratorium on its employer-only audits. We recommend restaurant owners at least consider signing the Tip Reporting Alternative Commitment (TRAC) with the IRS.

Through the TRAC (under a more customized employer-created approach, EmTRAC), a restaurant business agrees to assume greater responsibility for training, educating, and getting employees to report their tips. In exchange, the IRS agrees that it will not bill the restaurant for FICA taxes on allegedly unreported tips unless it has first examined which employees had not reported tips accurately. The TRAC program essentially allows you a release from employer-only assessments if you comply with the program. This is the only remedy, albeit a partial one, unless Congress acts on the subject. The National Restaurant Association, as well as other trade group associations, has vowed to take the fight over tip reporting to Congress. In the meantime, you must govern yourself accordingly and seek the advice of your CPA.

The Tip Rate Determination And Education Program

The Tip Rate Determination and Education Program was developed by the Internal Revenue Service in 1993 to address the concern of widespread underreporting of tip income in the food-and-beverage industry. The goal was to involve employers in monitoring their employees’ tip-reporting practices.

There are two different IRS programs available: the Tip Rate Determination Agreement (TRDA) and the Tip Reporting Alternative Commitment (TRAC). Participation in one of these programs is voluntary and the restaurant may only enter into one of the agreements at a time. Please note that 1998 tax legislation specifies that IRS agents cannot threaten to audit you in order to convince you to sign a TRAC or TRDA agreement.

The benefit for you as an employer is that you will not be subject to unplanned tax liabilities. Those who sign a TRAC or TRDA agreement receive a commitment from the IRS that the agency will not examine the owner’s books to search for withheld or underpaid payroll taxes on tip income. There are benefits to employees, also, including increases in their Social Security, unemployment compensation, retirement plan, and workers’ compensation benefits.

Under TRDA, the IRS works with you to arrive at a tip rate for your employees. Then, at least 75 percent of your tipped workers must agree in writing to report tips at the agreed-upon rate. If they fail to do so, you are required to turn them in to the IRS. If you do not comply, the agreement is terminated and your business becomes subject to IRS auditing.

The TRAC is less strict but requires more work on your part. There is no established tip rate, but you are required to work with employees to make sure they understand their tip-reporting obligations. You must set up a process to receive employees’ cash tip reports and they must be informed of the tips you are recording from credit card receipts.

Tip Credits For Employers Are Possible

As an employer, you may also be eligible for credit for taxes paid on certain employee tips (IRS Form 8846). The credit is generally equal to the employer’s portion of Social Security and Medicare taxes paid on tips received by employees. You will not get credit for your part of Social Security and Medicare taxes on those tips that are used to meet the federal minimum wage rate applicable to the employee under the Fair Labor Standards Act (as detailed later in this chapter). This is also subject to state laws. You must also increase the amount of your taxable income by the amount of the tip credit. Note the following changes to this credit:

1. The credit is effective for your part of Social Security and Medicare taxes paid after 1993, regardless of whether your employees reported the tips to you or when your employees performed the services.

2. Effective for services performed after 1996, the credit applies to the taxes on tips your employees receive from customers in connection with providing, delivering, or serving food or beverages, regardless of whether the customers consume the food or beverages on your business premises.

Employee Tip Reporting “Frequently Asked Questions”

Because you are an employee, the tip income you receive — whether it is cash or included in a charge — is taxable income. As income, these tips are subject to federal income tax and Social Security and Medicare taxes and may be subject to state income tax as well.

|

Employee Tip Reporting Frequently Asked Questions |

|

|

QUESTION |

ANSWER |

|

What tips do I have to report? |

If you received $20 or more in tips in any one month you should report all your tips to your employer so that federal income tax, Social Security and Medicare taxes — maybe state income tax, too — can be withheld. |

|

Do I have to report all my tips on my tax return? |

Yes. All tips are income and should be reported on your tax return. |

|

Is it true that only 8 percent of my total sales must be reported as tips? |

No. You must report to your employer all (100 percent) of your tips except for the tips totaling less than $20 in any month. The 8-percent rule applies to employers. |

|

Do I need to report tips from other employees? |

Yes. Employees who are indirectly tipped by other employees are required to report “tip-outs.” This could apply to bus persons, for instance. |

|

Do I have to report tip-outs that I pay to indirectly tipped employees? |

If you are a directly tipped employee, you should report to your employer only the amount of tips you retain. Maintain records of tip-outs with your other tip income (cash tips, charged tips, split tips, tip pool). |

|

What records do I need to keep? |

You must keep a running daily log of all your tip income. |

|

What can happen if I do not keep a record of my tips? |

Underreporting could result in owing substantial taxes, penalties, and interest to the IRS and, possibly, other agencies. |

|

If I report all my tips to my employer, do I still have to keep records? |

Yes. You should keep a daily log of your tips so that, in case of an examination, you can substantiate the actual amount of tips received. |

|

Why should I report my tips to my employer? |

When you report your tip income to your employer, the employer is required to withhold federal income tax, Social Security and Medicare taxes, and, maybe, state income tax. Tip reporting may increase your Social Security credits, resulting in greater Social Security benefits when you retire. Tip reporting may also increase other benefits to which you may become entitled, such as unemployment or retirement benefits. Additionally, a greater income may improve financing approval for mortgages, car loans, and other loans. |

|

I forgot to report my tip income to my employer, but I remembered to record it on my federal income tax return. Will that present a problem? |

If you do not report your tip income to your employer, but you do report the tip income on your federal income tax return, you may owe a 50 percent Social Security and Medicare tax penalty and be subject to a negligence penalty and, possibly, an estimated tax penalty. |

|

What about indirectly tipped employees? |

You are required to report all your tips to your employer. |

|

What is my responsibility as an employee under the Tip Rate Determination Agreement (TRDA)? |

You are required to file your federal tax returns. You must sign a Tipped Employee Participation Agreement proclaiming that you are participating in the program. To stay a participating employee, you must report tips at or above the tip rate determined by the agreement. |

|

What can happen if I do not report my tips to the IRS? |

If the IRS determines through an examination that you underreported your tips, you could be subject to additional federal income tax, Social Security and Medicare taxes and, possibly, state income tax. You will also be charged a penalty of 50 percent of the additional Social Security and Medicare taxes and a negligence penalty of 20 percent of the additional income tax, plus any interest that may apply. |

|

If I report all my tips, but my taxes on the tips are greater than my pay from my employer, how do I pay the remaining taxes? |

You can either pay the tax when you file your federal income tax return or you can reach into your tip money and give some to your employer to be applied to those owed taxes. |

|

What is my responsibility as an employee under the Tip Reporting Alternative Commitment (TRAC)? |

Directly tipped employee: Your employer will furnish you with a written statement (at least monthly) reflecting your charged tips: 1. You are to verify or correct this statement. 2. You are to indicate the amount of cash tips received. 3. When reporting your cash tips, keep in mind that there is a correlation between charged tips and cash tips. 4. You may be asked to provide the name and amount of any tip-outs you have given to indirectly tipped employees. |

Employer’s Tip Records

It is in your company’s best interest to insist that all employees accurately report their income from tips. The IRS will hold you responsible. Establishments that do not comply are subject to IRS audit and possible tax liabilities, penalties, and interest payments. As a precaution, if you have any employees who customarily receive tips from customers, patrons, or other third parties, we recommend you keep the following additional information about tipped employees:

1. Indicate on the pay records — by a symbol, letter, or other notation placed next to his or her name — each tipped employee.

2. Weekly or monthly amount of tips reported by each employee.

3. The amount by which the wages of each tipped employee have been increased by tips.

4. The hours worked each workday in any occupation in which the employee does not receive tips and the total daily or weekly earnings for those times.

5. The hours worked each workday in any occupation in which the employee receives tips and the total daily or weekly straight-time earnings for those times.

Large Food or Beverage Establishments Need to File Form 8027 with the IRS. You may meet the definition of a “large food or beverage establishment” if you employ more than 10 employees. If you do, the law requires that you file Form 8027, Employer’s Annual Information Return of Tip Income and Allocated Tips, with the IRS. If you meet the definition, the law requires that you report certain tip information to the IRS on an annual basis. You should use Form 8027 to report information such as total charged tips, charged receipts, total reported tips by employees, and gross receipts from food-and-beverage operations. Also, employers must allocate tips to certain directly tipped employees and include the allocation on their employees’ W-2 forms when the total of reported tips is less than 8 percent.

The IRS offers a program that business owners can enter into to help them educate their employees about tip reporting and tax obligations. This is the “Tip Rate Determination and Education Program.” There are two arrangements under the program that a food- and-beverage employer can enter into: TRDA, the Tip Rate Determination Agreement, or TRAC, Tip Reporting Alternative Commitment.

To find out more about these programs and about whether you should be filing Form 8027, contact the Tip Coordinator of your local IRS office. Check your telephone directory for the IRS office in your area. They can provide the mailing address and phone number for the Tip Coordinator.

You can get a copy of Form 8027 and its instructions by calling 800-TAX-FORM (800-829-3676). You can also get copies of most forms by dialing 703-368-9694 from your fax machine.

For More Information On Tip Reporting

The following IRS forms and publications relating to tip income reporting can be downloaded directly from the government website www.irs.gov/forms_pubs/index.html. Look under the heading “Forms and Publications by Number.”

• Pub 505 — Tax Withholding and Estimated Tax

• Pub 531 — Reporting Tip Income

• Form 941 — Employer’s Quarterly Federal Tax Return

• Form 4137 — Social Security and Medicare Tax on Unreported Tip Income

• Form 8027 — Employer’s Annual Information on Tip Income and Allocated Tips

“THE IRS TIP AGREEMENTS REALLY HELP EMPLOYERS AND WORKERS” FROM THE IRS

The IRS is continuing its emphasis on a multiyear strategy to increase tax compliance by tipped employees. Originally developed for the Food and Beverage industry, this program has now been extended to the Gaming (casino) and Hairstyling industries.

There are two arrangements under this program that, depending on their business, employers in specific industries can agree to enter into: The Tip Rate Determination Agreement (TRDA), which is available to the Gaming and the Food and Beverage industries, and the Tip Reporting Alternative Commitment (TRAC), which is available to the Food and Beverage and the Hairstyling industries.

First introduced in 1993, the TRDA set the stage for a new way of doing business at the IRS. This arrangement emphasizes future compliance by tipped employees in the Food and Beverage industry by utilizing the tip rates individually calculated for each restaurant. In addition, as long as the participants comply with the terms of the agreement and accurately report their tip income, the IRS agrees not to initiate any examinations during the period the TRDA is in effect. When TRDA was first introduced in 1993, initial response from the industry was mixed. Today the TRDA is a viable option for many restaurants.

The second arrangement, TRAC, grew out of a collaborative effort between the IRS and a coalition of restaurant industry representatives. It was first introduced in June 1995.

TRAC emphasizes educating both employers and employees to ensure compliance with the tax laws relating to tip income reporting. Employees are provided tip reports detailing the correlation that exists between an employee’s charged tip rate and the cash tip rate. In general, the District Director will not initiate any examinations on either the employer or employees while the agreement is in effect if participants comply with the provisions of the agreement.

The overall response to TRDA and TRAC has been very positive among employers who seek to foster compliance by their employees in a manner that is relatively simple and that makes good business sense. In addition, there are benefits for both the employer and the employees.

Employer Benefits — After Congress passed a law in 1988 requiring employers to match and pay assessments made against employees, the IRS performed significant amounts of tip audits. The IRS expended a significant amount of resources to conduct these examinations. Some employers found themselves in a financial crisis, having to come up with the tax being assessed against them when there had not been any financial planning for this. Employees were being hit just as hard. Under the Tip Rate Determination Agreement (TRDA), the IRS agrees not to perform any tip audits while either a Tip Rate Determination Agreement or a Tip Reporting Alternative Commitment is in effect. The employer is granted a credit allowance (Code Section 45B) for Social Security taxes paid on tips in excess of minimum wage reported by employees. The employer is then in compliance with the law.

Employee Benefits — The employee receives several benefits. Greater Social Security benefits accrue based on the tip earnings reported. Increased tip earnings translates to increased proof of income when applying for mortgage, car, and other loans. There is an increase in unemployment benefits, retirement plan contributions (if applicable), and to workers’ compensation. There will not be any subsequent tip examinations of the employee’s tax returns as long as the terms of the arrangement have been met and all tips have been reported.

As of June 30, 1998, the IRS has received more than 8,000 TRAC agreements representing over 25,000 establishments nationwide. The number of TRDAs is nearly 1,100, representing over 2,400 establishments. Please note many of the agreements encompass multiple unit locations. The IRS is continuing its efforts to raise the compliance level in this industry and to promote consistency across the country. IRS employees have been receiving updated training in this area.

As part of an outreach effort, IRS employees will be making field calls to businesses where tipping is customary, explaining both arrangements and providing business owners with copies of written material to aid them in educating themselves and their workers. But you do not have to wait for an IRS representative to visit you to get more information about TRDA or TRAC. Information is available through the Tip Coordinator at your local IRS office and the IRS’s “Tips on Tips” brochures (employer and employee versions). These and other publications relating to tip income can be ordered by calling the IRS at 800-829-3676.

PAYROLL ACCOUNTING

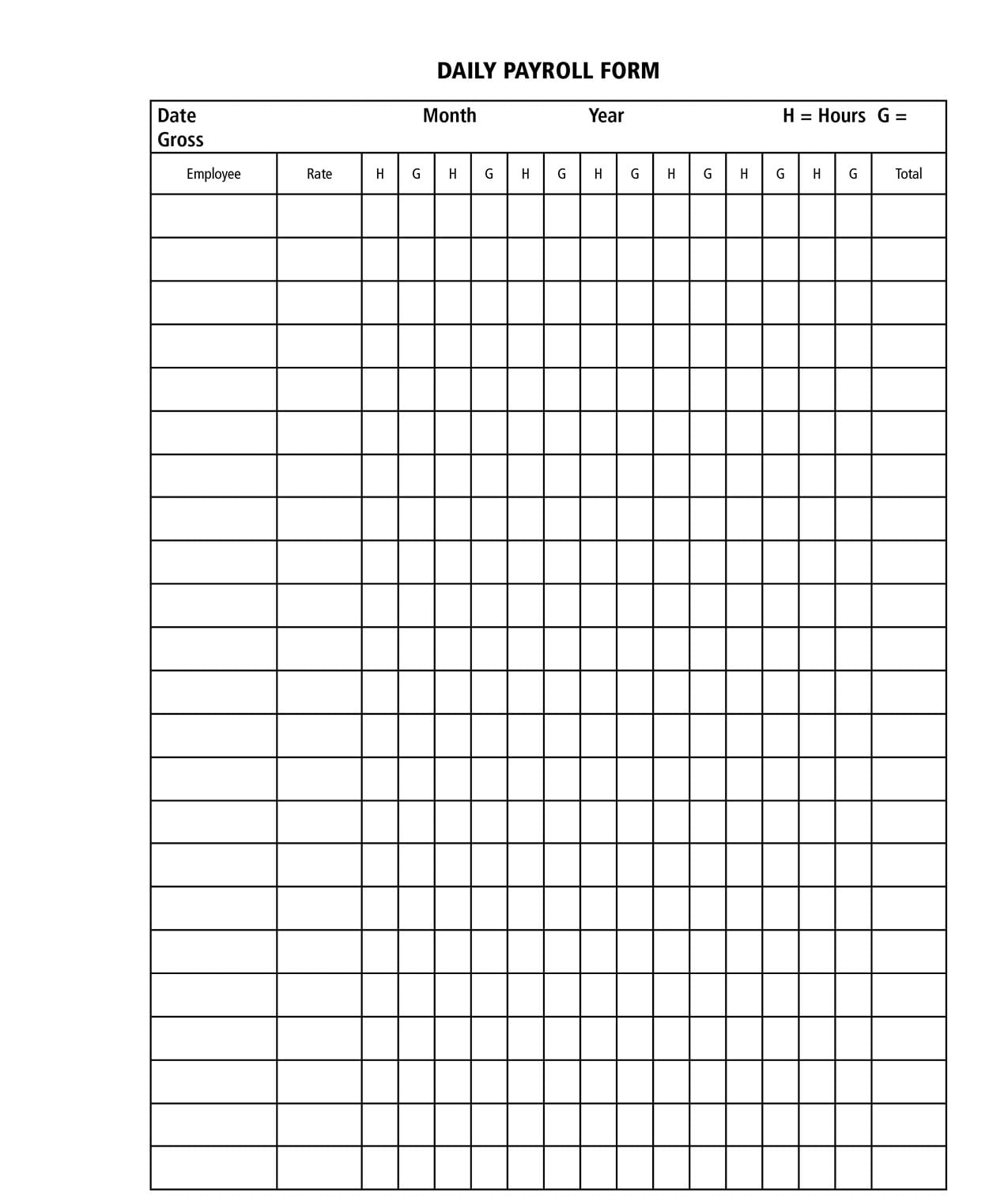

Although you may decide to use an outside payroll service or a software program, your bookkeeper must still be involved in the computation of the daily labor costs. After each pay period, the bookkeeper will need to compute each employee’s time card and call the information to the payroll service company or key the information into the accounting software. There are time clocks available that can link employee scheduling, time clock administration, and accounting all into one foolproof system. Described in this section are the procedures used to compute and analyze by manual system daily and monthly labor costs. On a daily basis the bookkeeper should:

1. Gather all of the employees’ time cards.

2. Using the posted schedule, ensure that each employee punched in at the scheduled time.

3. Compute the number and fraction of hours worked.

4. Enter hours worked on the time card and on the Daily Payroll Form. An example of this form can be found at the end of this chapter. Any overtime should be written in red on a separate line. Notify the manager of any overtime or of any employee who is approaching overtime status. She may be able to rearrange the schedule to avoid paying overtime.

5. Fill in the hourly rate of pay. If the employee performs more than one job, make sure the rate of pay corresponds to the job performed.

6. Extend the gross amount to be paid.

7. Divide each salaried employee’s total monthly salary by the number of days in the month. Enter this figure in the “Gross Paid” column for each day. Although the employee will be paid the same each week, the salary is broken down this way so that labor may be analyzed and budgeted accurately.

8. The manager and owner’s salaries should be listed separately at the bottom of the Daily Payroll Form. These costs are separated, as they will be budgeted differently in an upcoming chapter. Also, by separating them out you may get some additional tax advantages.

9. Total the gross amount payable for each day at the bottom of the form. When the week is completed (seven days) total each employee’s hours worked and total gross pay. Check your calculations by cross-checking all of the figures against each other.

10. Enter the daily sales and labor costs on the Labor Analysis Form. An example of this form can be found at the end of this chapter. Remember that manager and owner salaries are computed separately and are not in the total labor cost computations. The Labor Analysis Form is divided into two sections: the daily payroll and the month-to-date payroll. These are computed by adding each day’s transactions to the previous day’s balance. Budget figures will be explained in the next chapter.

The month-to-date payroll percentage is computed by dividing month-to-date sales by the month-to-date actual payroll costs. The budget figures are the budgeted total labor costs divided by the number of days in the month. The month-to-date payroll column is the prorated budgeted amount.

ADDITIONAL PAYROLL AND TIP TAX INFORMATION: EXCERPT FROM IRS PUBLICATION #334

The following pages contain various excerpts pertaining to withholding procedures for restaurants, courtesy of the Internal Revenue Service and the U.S. Department of Labor.

TIPPED EMPLOYEES UNDER THE FAIR LABOR STANDARDS ACT (FLSA)

This fact sheet provides general information concerning the application of the FLSA to employees who receive tips. Use caution: This document was last revised in November 2001; unless otherwise stated, the information reflects requirements that were in effect, or would take effect, as of January 1, 2002.

CHARACTERISTICS

Tipped employees are those who customarily and regularly receive more than $30 a month in tips. Tips actually received by tipped employees may be counted as wages for purposes of the FLSA, but the employer must pay not less than $2.13 an hour in direct wages.

REQUIREMENTS

If an employer elects to use the tip credit provision the employer must:

1. Inform each tipped employee about the tip credit allowance (including amount to be credited) before the credit is utilized.

2. Be able to show that the employee receives at least the minimum wage when direct wages and the tip credit allowance are combined.

3. Allow the tipped employee to retain all tips, whether or not the employer elects to take a tip credit for tips received, except to the extent the employee participates in a valid tip pooling arrangement. If an employee’s tips combined with the employer’s direct wages of at least $2.13 an hour do not equal the minimum hourly wage — $4.75 an hour effective 10/1/96; $5.15 an hour effective 9/1/97 — the employer must make up the difference.

Youth Minimum Wage

The 1996 Amendments to the FLSA allow employers to pay a youth minimum wage of not less that $4.25 an hour to employees who are under 20 years of age during the first 90 consecutive calendar days after initial employment by their employer. The law contains certain protections for employees that prohibit employers from displacing any employee in order to hire someone at the youth minimum wage.

Dual Jobs

When an employee is employed concurrently in both a tipped and a non-tipped occupation, the tip credit is available only for the hours spent in the tipped occupation. The Act permits an employer to take the tip credit for time spent in duties related to the tipped occupation, even though such duties are not by themselves directed toward producing tips, provided such duties are incidental to the regular duties and are generally assigned to such occupations. Where tipped employees are routinely assigned to maintenance, or where tipped employees spend a substantial amount of time (in excess of 20 percent) performing general preparation work or maintenance, no tip credit may be taken for the time spent in such duties.

Retention of Tips:

The law forbids any arrangement between the employer and the tipped employee whereby any part of the tip received becomes the property of the employer. A tip is the sole property of the tipped employee. Where an employer does not strictly observe the tip credit provisions of the Act, no tip credit may be claimed and the employees are entitled to receive the full cash minimum wage, in addition to retaining tips they may/should have received.

Service Charges:

A compulsory charge for service, for example, 15 percent of the bill, is not a tip. Such charges are part of the employer’s gross receipts. Where service charges are imposed and the employee receives no tips, the employer must pay the entire minimum wage and overtime required by the Act.

Tip Pooling:

The requirement that an employee must retain all tips does not preclude tip splitting or pooling arrangements among employees who customarily and regularly receive tips, such as waiters, waitresses, bellhops, counter personnel (who serve customers), busboys/girls, and service bartenders. Tipped employees may not be required to share their tips with employees who have not customarily and regularly participated in tip pooling arrangements, such as dishwashers, cooks, chefs, and janitors. Only those tips that are in excess of tips used for the tip credit may be taken for a pool. Tipped employees cannot be required to contribute a greater percentage of their tips than is customary and reasonable.

Credit Cards:

Where tips are charged on a credit card and the employer must pay the credit card company a percentage on each sale, then the employer may pay the employee the tip, less that percentage. This charge on the tip may not reduce the employee’s wage below the required minimum wage. The amount due the employee must be paid no later than the regular payday and may not be held while the employer is awaiting reimbursement from the credit card company.

TYPICAL PROBLEMS

Minimum Wage Problems:

Employee does not qualify as a “tipped employee;” tips are not sufficient to make up difference between employer’s direct wage obligation and the minimum wage; employee receives tips only — so the full minimum wage is owed; illegal deductions for walk-outs, breakages and cash register shortages; and invalid tip pools.

Overtime Problems:

Failure to pay overtime on the full minimum wage; failure to pay overtime on the regular rate including all service charges, commissions, bonuses, and other remuneration.

WHERE TO OBTAIN ADDITIONAL INFORMATION

This publication is for general information and is not to be considered in the same light as official statements of position contained in the regulations. Copies of Wage and Hour publications may be obtained by contacting the nearest office of the Wage and Hour Division listed in most telephone directories under U.S. Government, Department of Labor Employment Standards Administration/Wage and Hour Division.

MINIMUM HOURLY CASH WAGES FOR TIPPED EMPLOYEES UNDER MINIMUM WAGE LAWS

The Department of Labor is providing this information as a public service to enhance public access to information relating to state wage and hour laws that supplement the federal wage and hour laws administered by the Department of Labor. This is a service that is continually under development. The user should be aware that, while we try to keep the information timely and accurate, there might be a delay between the date when a change in state law takes place and the modification of these pages to reflect the change. Therefore, we make no express or implied guarantees. We will make every effort to correct errors brought to our attention.

The statutes, regulations, and court and administrative decisions of each of the states should be relied upon as the official statement of a state’s law. In some instances, county or municipal law also may affect wage and hour standards applicable to employers, employees, and other persons.

Some documents on the Department’s website contain hypertext pointers to information created and maintained by other public and private organizations. Please be aware that we do not control or guarantee the accuracy, relevance, timeliness, or completeness of this outside information. Further, the inclusion of pointers to particular items in hypertext is not intended to reflect their importance, nor is it intended to endorse any views expressed or products or services offered by the author of the reference to the organization operating the server on which the reference is maintained.

This document was last revised in November 2001; unless otherwise stated, the information reflects requirements that were in effect, or would take effect, as of January 1, 2002.

Use Caution: Regulations and laws on tips and tip reporting are constantly changing.