CHAPTER 4

Investment Companies

Investment Company Philosophy

An investment company is organized as either a corporation or as a trust. Individual investor's money then is pooled together in a single account and used to purchase securities that will have the greatest chance of helping the investment company reach its objectives. All investors jointly own the portfolio that is created through these pooled funds and each investor has an undivided interest in the securities. No single shareholder has any right or claim that exceeds the rights or claims of any other shareholder regardless of the size of the investment. Investment companies offer individual investors the opportunity to have their money managed by professionals that may otherwise only offer their services to large institutions. Through diversification, the investor may participate in the future growth or income generated from the large number of different securities contained in the portfolio. Both diversification and professional management should contribute significantly to the attainment of the objectives set forth by the investment company. There are many other features and benefits that may be offered to investors that will be examined later in this chapter.

Types of Investment Companies

All investment company offerings are subject to the Securities Act of 1933 that requires the investment company to register with the Securities Exchange Commission and to give all purchasers a prospectus. Investment companies also are all subject to the Investment Company Act of 1940 that sets forth guidelines on how investment companies operate. The Investment Company Act of 1940 breaks down investment companies into three different types:

- Face-amount company (FAC)

- Unit investment trust (UIT)

- Management investment company (mutual funds)

Face-Amount Company/Face-Amount Certificates

An investor may enter into a contract with an issuer of a face-amount certificate to contract to receive a stated or fixed amount of money (the face amount) at a stated date in the future. In exchange for this future sum, the investor must deposit an agreed lump sum or make scheduled installment payments. Face-amount certificates are rarely issued today as most of the tax advantages that the investment once offered have been lost through changes in the tax laws.

Unit Investment Trust (UIT)

A unit investment trust will invest either in a fixed portfolio of securities or in a nonfixed portfolio of securities. A fixed UIT traditionally will invest in a large block of government or municipal debt. The bonds will be held until maturity and the proceeds will be distributed to investors in the UIT. Once the proceeds have been distributed to the investors, the UIT will have achieved its objective and will cease to exist. A nonfixed UIT will purchase mutual fund shares in order to reach a stated objective. A nonfixed UIT is also known as a contractual plan. Both types of UITs are organized as a trust and operate as a holding company for the portfolio. UITs are not actively managed and they do not have a board of directors or investment advisers. Both types of UITs issue units or shares of beneficial interest to investors which represent as undivided interest in the underlying portfolio of securities. UITs must maintain a secondary market in the units or shares to offer some liquidity to investors.

Management Investment Companies (Mutual Funds)

A management investment company employs an investment adviser to manage a diversified portfolio of securities designed to obtain its stated investment objective. The management company may be organized as either an open-end company or as a closed-end company. The main difference between an open-end company and a closed-end company is how the shares are purchased and sold. An open-end company offers new shares to any investor who wants to invest. This is known as a continuous primary offering. Because the offering of new shares is continuous, the capitalization of the open-end fund is unlimited. Stated another way, an open-end mutual fund may raise as much money as investors are willing to put in. An open-end fund must repurchase its own shares from investors who want to redeem them. There is no secondary market for open-end mutual fund shares. The shares must be purchased from the fund company and redeemed to the fund company. A closed-end fund offers common shares to investors through an initial public offering (IPO) just like a stock. Its capitalization is limited to the number of authorized shares that have been approved for sale. Shares of the closed-end fund will trade in the secondary market in investor-to-investor transactions on an exchange or in the over-the-counter market (OTC), just like common shares.

Open End vs. Closed End

Although both open-end and closed-end funds are designed to achieve their stated investment objective, the manner in which they operate is different. The following is a side-by-side comparison of the important features of both open-end and closed-end funds and shows how those features differ between the fund types.

| Feature | Open End | Closed End |

| Capitalization | Unlimited continuous primary offering | Single fixed offering through IPO |

| Investor may purchase | Full and fractional shares | Full shares only |

| Securities offered | Common shares only | Common and preferred shares and debt securities |

| Shares purchased and sold | Shares purchased from the fund company and redeemed to the fund company | Shares may be purchased only from the fund company during IPO, then secondary market transactions between investors |

| Share pricing | Shares priced by formula NAV + SC = POP | Shares priced by supply and demand |

| Shareholder rights | Dividends and voting | Dividends, voting, and preemptive |

Diversified vs. Nondiversified

Investors in a mutual fund will achieve diversification through their investment in the fund. However, in order to determine if the fund itself is a diversified fund, the fund must meet certain requirements. The Investment Company Act of 1940 laid out an asset allocation model that must be followed in order for the fund to call itself a diversified mutual fund. It is known as the 75-5-10 test and the requirements are as follows:

- 75%: 75% of the fund's assets must be invested in securities of other issuers. Cash and cash equivalents are counted as part of the 75%. A cash equivalent may be a T-bill or a money market instrument.

- 5%: The investment company may not invest more than 5% of its assets in any one company.

- 10%: The investment company may not own more than 10% of any company's outstanding voting stock.

Investment Company Registration

Investment companies are regulated by both the Securities Act of 1933 and by the Investment Company Act of 1940. An investment company must register with the SEC if the company operates to own, invest, reinvest, or trade in securities. A company also must register with the SEC as an investment company if the company has 40% or more of its assets invested in securities other than those issued by the U.S. government or one of the company's subsidiaries.

Registration Requirements

Before an investment company may register with the SEC, it must meet certain minimum requirements. An investment company may not register with the SEC unless it has the following:

- Minimum net worth of $100,000

- At least 100 shareholders

- Clearly defined investment objectives

An investment company may be allowed to register without having 100 shareholders and without a net worth of $100,000 if it can meet these requirements within 90 days.

Investment companies must file a full registration with the SEC before the offering becomes effective. The investment company is considered to have registered when the SEC receives its notice of registration. The investment company's registration statement must contain:

- Type of investment company (open-end, closed-end, etc.)

- Biographical information on the officers and directors of the company

- Name and address of each affiliated person

- Plans to concentrate investments in any one area (i.e., sector fund)

- Plans to invest in real estate or commodities

- Borrowing plans

- Conditions under which investment objective may be changed through a vote of shareholders

Once registered, the investment company may:

- Raise money through the sale of shares

- Lend money to earn interest

- Borrow money on a limited basis

An investment company obtains its investment capital from shareholders through the sale of shares. Once it's operating, it may lend money to earn interest such as by purchasing bonds or notes. An investment company, however, may not lend money to employees. An investment company may borrow money for such business purposes as to redeem shares. If the investment company borrows money, it must have $3 in equity for every dollar that it wants to borrow. Another way of saying that is that the investment company must maintain an asset-to-debt ratio of at least three-to-one or of at least 300%.

An investment company is prohibited from:

- Taking over or controlling other companies

- Acting as a bank or a savings and loan

- Receiving commission for executing orders or for acting as a broker

- Continuing to operate with less than 100 shareholders or less than $100,000 net worth

Unless the investment company meets strict capital and disclosure requirements, it may not engage in any of the following:

- Selling securities short

- Buying securities on margin

- Maintaining joint accounts

- Distributing its own shares

Regardless of the makeup of their investment holdings, all of the following are exempt from the registration requirements of an investment company:

- Broker dealers

- Underwriters

- Banks and savings and loans

- Mortgage companies

- Real estate investment trusts (REITs)

- Security holder protection committees

Investment Company Components

Investment companies have several different groups that serve specialized functions. Each of these groups plays a key role in the investment company's operation. They are the:

- Board of directors

- Investment adviser

- Custodian bank

- Transfer agent

Board of Directors

Management companies have an organizational structure that is similar to that of other companies. The board of directors oversees the company's president and other officers who run the day-to-day operations of the company. The board and the corporate officers concern themselves with the business and administrative functions of the company. They do not manage the investment portfolio. The board of directors:

- Defines investment objectives

- Hires the investment adviser, custodian bank, and transfer agent

- Determines what type of funds to offer, i.e., growth, income, etc.

The board of directors is elected by a vote of the shareholders. The Investment Company Act of 1940 governs the makeup of the board. The Investment Company Act of 1940 requires that a majority or at least 51% of the board be noninterested persons. A noninterested person is a person whose only affiliation with the fund is as a member of the board. Therefore, a maximum of 49% of the board may hold another position within the fund company or may otherwise be interested in the fund. An affiliated person is anyone who could exercise control over the company, such as an accountant. An affiliated person may also include:

- Broker dealer

- Attorney

- Immediate family of an affiliated person

- Anyone else the SEC designates

Both affiliated and interested parties are prohibited from selling securities or property to the investment company or any of its subsidiaries. Anyone who has been convicted of any felony or securities-related misdemeanor or who has been barred from the securities business may not serve on the board of directors.

Bonding of Key Employees

The investment company is required to obtain a bond to cover itself and each officer, director, and employee with access to the investment company's assets. The company may obtain a bond for each employee or may obtain a blanket bond for all employees that are required to be bonded. In the case of a blanket bond, the company must list the names of the employees to be covered. The bond only covers the employees for negligence. Any criminal acts or acts of bad faith are not covered.

Investment Adviser

The investment company's board of directors hires the investment adviser to manage the fund's portfolio. The investment adviser is a company, not a person, which must also determine the tax consequences of distributions to shareholders and ensure that the investment strategies are in line with the fund's stated investment objectives. The investment adviser's compensation is a percentage of the net assets of the fund, not a percentage of the profits, although performance bonuses are allowed. The investment adviser's fee is typically the largest expense of the fund and the more aggressive the objective, the higher the fee. The investment adviser may not borrow from the fund and may not have any security-related convictions.

Custodian Bank

The custodian bank or the exchange member broker dealer that has been hired by the investment company physically holds all of the fund's cash and securities. The custodian holds all of the fund's assets for safekeeping and provides other bookkeeping and clerical functions for the investment company, such as maintaining books and records for accumulation plans for investors. All fund assets must be kept segregated from other assets. The custodian must ensure that only approved persons have access to the account and that all distributions are done in line with SEC guidelines.

Transfer Agent

The transfer agent for the investment company handles the issuance, cancellation, and redemption of fund shares. The transfer agent also handles name changes and may be part of the fund's custodian or a separate company. The transfer agent receives an agreed fee for its services.

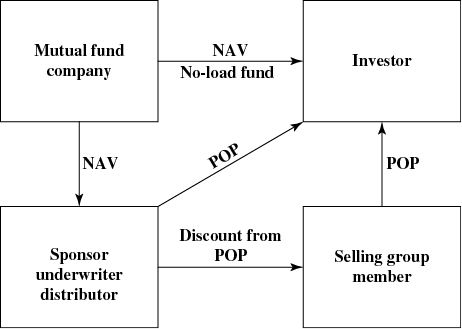

Mutual Fund Distribution

Most mutual funds do not sell their own shares directly to investors. The distribution of the shares is the responsibility of the underwriter. The underwriter for a mutual fund is also known as the sponsor or distributor. The underwriter is selected by the fund's board of directors and receives a fee in the form of a sales charge for the shares it distributes. As the underwriter receives orders for the mutual fund shares, it purchases the shares directly from the fund at the net asset value (NAV). The sales charge then is added to the NAV as the underwriter's compensation. This process of adding the sales charge to the NAV is responsible for the mutual fund pricing formula, which is NAV + SC = POP.

The underwriter may purchase shares from the mutual fund only to fill customer orders. They may not hold mutual fund shares in inventory in anticipation of receiving future customer orders.

Selling Group Member

Most brokerage firms maintain selling agreements with mutual fund distributors, which allow them to purchase mutual fund shares at a discount from the public offering price (POP). Selling group members may then sell the mutual fund shares to investors at the POP and earn part of the sales charge. In order to purchase mutual fund shares at a discount from the POP, the selling group member must be a member of FINRA. All non-FINRA members and suspended members must be treated as members of the general public and pay the public offering price.

Distribution of No-Load Mutual Fund Shares

No-load mutual funds do not charge a sales charge to the investors who invest in the mutual fund. Because there is no sales charge, the mutual fund may sell the shares directly to investors at the NAV.

Distribution of Mutual Fund Shares

Mutual Fund Prospectus

The prospectus is the official offering document for open-end mutual fund shares. The prospectus must be presented to all purchasers of the fund either before or during the sales presentation. The prospectus is the fund's full-disclosure document and provides details regarding:

- Fund's investment objectives

- Sales charges

- Management expenses

- Fund services

- Performance data for the past 1, 5, and 10 years or for the life of the fund

The prospectus, which is given to most investors, is the summary prospectus. If the investor wants additional information regarding the mutual fund, they may request a statement of additional information. The statement of additional information will include details regarding the following as of the date it was published:

- Fund's securities holdings

- Balance sheet

- Income statement

- Portfolio turnover data

- Compensation paid to the board of directors and investment advisory board

A summary prospectus that contains past performance data is known as an advertising prospectus. Requirements regarding updating and using a mutual fund prospectus are as follows:

A mutual fund prospectus:

- Should be updated by the fund every 12 months

- Must be updated by the fund every 13 months

- May be used by a representative for up to 16 months

- Should be discarded after 16 months from publication

Mutual funds also are required to disclose either in the prospectus or in its annual report to shareholders:

- A performance comparison graph showing the performance of the fund

- Names of the officers and directors who are responsible for the portfolio's day-to-day management

- Disclosure of any factors that materially affected performance over the latest fiscal year

Characteristics of Open-End Mutual Fund Shares

All open-end mutual fund shares are sold through a continuous primary offering and each new investor receives new shares from the fund company. The new shares are created for investors as their orders are received by the fund. Investors purchase shares from the fund company at the public offering price and redeem them to the fund company at the net asset value. The mutual fund has seven calendar days to forward the proceeds to an investor after receiving a redemption request. If the investor has possession of the mutual fund certificates, the fund then has seven calendar days from the receipt of the certificate by the custodian to forward the proceeds. Suspension of the seven-day rule may be allowed only if:

- The NYSE is closed for an extraordinary reason.

- The NYSE's trading is restricted or limited.

- The liquidation of the securities would not be practical.

- An SEC order has been issued.

Additional Characteristics of Open-End Mutual Funds

- Diversification

- Professional management

- Low minimum investment

- Easy tax reporting, Form 1099

- Reduction of sales charges through breakpoint schedule, letter of intent, and rights accumulation

- Automatic reinvestment of dividends and capital gains distributions

- Structured withdrawal plans

Mutual Fund Investment Objectives

Equity Funds

The only investment that will meet a growth objective is common stock. Growth funds seeking capital appreciation will invest in the common stock of corporations whose business is growing more rapidly than other companies and more rapidly than the economy as a whole. Growth funds seek capital gains and do not produce significant dividend income.

Equity Income Fund

An equity income fund will purchase both common and preferred shares that have a long track record of paying consistent dividends. Preferred shares are purchased by the fund for their stated dividend. Utility stocks also are purchased because utilities traditionally pay out the highest percentage of their earnings to shareholders in the form of dividends. Other common shares of blue-chip companies also may be purchased.

Sector Funds

Mutual funds that concentrate 25% or more of their assets in one business area or region are known as sector funds. Technology, biotech, and gold funds would all be examples of sector funds that concentrate their investments in one business area. A northeast growth fund would be an example of a sector fund that concentrates its assets geographically. Sector funds traditionally carry higher risk reward ratios. If the sector does well, the investor may enjoy a higher rate of return. If, however, the sector performs poorly, the investor may suffer larger losses. The high-risk reward ratio is due to the funds concentration in one area.

Index Funds

An index fund is designed to mirror the performance of a large market index such as the S&P 500 or the Dow Jones Industrial Average. An index fund's portfolio is comprised of the stocks that are included in the index that the fund is designed to track. The fund manager does not actively seek out which stocks to buy or sell, making an index fund an example of a fund that is passively managed. If the stock is in the index, it will usually be in the portfolio. Portfolio turnover for an index fund is generally low, which helps keep the fund's expenses down.

Growth and Income (Combination Fund)

A growth and income fund, as the name suggests, invests to achieve both capital appreciation and current income. The fund will invest a portion of its assets in shares of common stock that offer the greatest appreciation potential and will invest a portion of its assets in preferred and common shares that pay high dividends, in order to produce income for investors.

Balanced Funds

A balanced fund invests in both stocks and bonds, according to a predetermined formula. For example, the fund may invest 70% of its assets in equities and 30% of its assets in bonds.

Asset Allocation Funds

Asset allocation funds invest in stocks, bonds, and money market instruments, according to the expected performance for each market. For example, if the portfolio manager feels that equities will do well, they may invest more money in equities. Alternatively, if they feel that the bond market will outperform equities, they may shift more money into the debt markets.

Other Types of Funds

There are other types of equity funds, such as foreign stock funds that invest outside the United States, and special situation funds that invest in takeover candidates and restructuring companies. A final type of fund is an option income fund that purchases shares of common stock and sells call options against the portfolio in order to generate premium income for investors. Because the fund has sold call options on the shares it owns, it will limit the capital appreciation of the portfolio.

Bond Funds

Investors who invest in bond funds are actually purchasing an equity security that represents their undivided interest in a portfolio of debt. Corporations, U.S. government, or state and local municipalities may have issued the debt in the portfolio. Bond funds invest mainly to generate current income for investors through interest payments generated by the bonds in the portfolio.

Corporate Bond Funds

Corporate bond funds invest in debt securities that have been issued by corporations. The debt in the portfolio could be investment grade or it could be speculative, such as in a high-yield or junk-bond fund. Dividend income that is generated by the portfolio's interest payments is subject to all taxes.

Government Bond Funds

Government bond funds invest in debt securities issued by the U.S. government such as Treasury bills, notes, and bonds. Many funds also invest in the debt of government agencies such as those issued by the Government National Mortgage Association also known as Ginnie Mae. Government bond funds provide current income to investors, along with a high degree of safety of principal. Dividends based upon the interest payments received from direct treasury obligations are only subject to federal taxation.

Municipal Bond Funds

Municipal bond funds invest in portfolios of municipal debt. Investors in municipal bond funds receive dividend income, which is free from federal taxes because the dividends are based on the interest payments received from the municipal bonds in the portfolio. Investors are still subject to taxes for any capital gains distributions or for any capital gains realized through the sale of the mutual fund shares.

Money Market Funds

Money market funds invest in short-term money market instruments such as banker's acceptances, commercial paper, and other debt securities with less than one year remaining to maturity. Money market funds are no-load funds that offer the investor the highest degree of safety of principal along with current income. The NAV for money market funds is always equal to $1, however, this is not guaranteed. Investors use money market funds as a place to hold idle funds and to earn current income. Interest is earned by investors daily and is credited to their accounts monthly. Most money market funds offer check writing privileges and investors must receive a prospectus prior to investing or opening an account.

Money Market Guidelines

Money market funds must adhere to certain guidelines in order to qualify as a money market fund, such as:

- The prospectus must clearly state on its cover that the fund is not insured or guaranteed by the U.S. government and that the fund's net asset value may fall below $1.

- Securities in the portfolio may have a maximum maturity of 13 months.

- The average maturity for securities in the portfolio may not exceed 90 days.

- No more than 5% of the fund's assets may be invested in any one issuer's debt securities.

- Investments are limited to the top two ratings awarded by a nationally recognized ratings agency, i.e., S&P and Moody's.

- 95% of the portfolio must be in the top ratings category with no more than 5% being invested in the second tier.

Alternative Funds

Alternative funds, also known as alt funds or liquid alts, invest in nontraditional assets or illiquid assets and may employ alternative investment strategies. There is no standard definition for what constitutes an alt fund, but alt funds are often marketed as a way for retail investors to gain access to hedge funds and actively managed programs that will perform well in a variety of market conditions. These funds claim to reduce volatility, increase diversification, and produce higher returns when compared to long-only equity funds and income funds while still providing liquidity. Recommendations for alt funds must be based on the specific strategies employed by the fund, not merely as one overall investment. Retail communication must accurately and fairly detail each fund's operations and objectives in line with the information in the prospectuses. A significant concern is that investment advisers and retail investors will not understand how these funds will react in certain market conditions or how the fund manager will approach those market conditions. These funds must be reviewed during the new product review process even if the firm has a selling agreement with the fund.

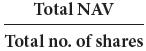

Valuing Mutual Fund Shares

Mutual funds must determine the net asset value of the fund's shares at least once per business day. Most mutual funds will price their shares at the close of business of the NYSE (4:00 PM EST). The mutual fund prospectus will provide the best answer as to when the fund calculates the price of its shares. The calculation is required to determine both the redemption price and the purchase price of the fund's shares. The price, which is received by an investor who is redeeming shares, and the price that is paid by an investor who is purchasing shares, will be based upon the price, which is next calculated after the fund has received the investor's order. This is known as forward pricing. To calculate the fund's NAV, use the following formula:

To determine the NAV per share, simply divide the total net asset value by the total number of outstanding shares.

Changes in the NAV

The net asset value of a mutual fund is constantly changing as security prices fluctuate and as the mutual fund conducts its business. The following illustrates how the NAV per share will be affected given certain events.

Increases in the NAV

The net asset value of the mutual fund will increase if the:

- Value of the securities in the portfolio increase

- Portfolio receives investment income, such as interest payments from bonds

Decreases in the NAV

The net asset value will decrease if the:

- Value of the securities in the portfolio fall in value

- Fund distributes dividends or capital gains

No Effect on the NAV

The following will have no effect on the net asset value of the mutual fund share:

- Investor purchases and redemptions

- Portfolio purchases and sales of securities

- Sales charges

Sales Charges

The maximum allowable sales charge that an open-end fund may charge is 8.5% of the POP. The sales charge that may be assessed by a particular fund will be detailed in the fund's prospectus. It is important to note that the sales charge is not an expense of the fund; it is a cost of distribution, which is borne by the investor. The sales charges pay for all of the following:

- Underwriters commission

- Commission to brokerage firms and registered representatives

Closed-End Funds

Closed-end funds do not charge a sales charge to invest. An investor who wants to purchase a closed-end fund will pay the current market price plus the commission their brokerage firm charges them to execute the order.

EXCHANGE-TRADED Funds (ETFs)

In recent years, exchange-traded funds or ETFs have gained a lot of popularity. ETFs are created through the purchase of a basket of securities that are designed to track the performance of an index or sector. ETFs are not actively managed; provide investors with lower costs; and the ability to buy, sell, and sell short the ETF at any point during the trading day, and may be purchased on margin. Certain types of ETFs are designed to provide returns and performance characteristics of positions that take on the leverage. Such ETFs are often known as “ultra” or double ETFs. These ETFs may provide returns that are double or more of the return of an index, or double or more the inverse return of an index.

ETFs THAT TRACK ALTERNATIVELY WEIGHTED INDICES

Investing in ETFs that track indices has become a popular investment strategy. As a result, new products have come to market that track the performance of alternative indices. Equally weighted, alternatively weighted, fundamentally weighted, and volatility weighted ETFs offer exposure to other investment styles and may provide enhanced performance. These ETFs present additional risk factors that both investment advisers and investors need to understand. These funds are sometimes marketed as having better performance than other indices, which could be cause for concern as the ETFs that track these indices may be complex, thinly traded, and hard to understand for both advisers and retail investors. The lack of liquidity can lead to wider spreads causing the product to be expensive to buy and sell for investors. The portfolios often have high turnover, which can lead to increased transaction costs for ETF.

Front-End Loads

A front-end load is a sales charge that the investor pays when they purchase shares. The sales charge is added to the NAV of the fund and the investor purchases the shares at the POP. The sales charge, in essence, is deducted from the gross amount invested and the remaining amount is invested in the portfolio at the NAV. Shares that charge a front-end load are known as “A” shares.

Back-End Loads

A back-end load is also known as a contingent differed sales charge (CDSC). An investor in a fund that charges a back-end load will pay the sales charge at the time of redemption of the fund shares. The sales charge will be assessed on the value of the shares that have been redeemed and the amount of the sales charge will decline as the holding period for the investor increases. The following is a hypothetical back-end load schedule:

| Years Money Left in Portfolio | Sales Charge |

| 1 | 8.5% |

| 2 | 7% |

| 3 | 5% |

| 4 | 3% |

| 5 | 1.5% |

| 5 years or more | 0% |

The mutual fund prospectus will detail the particular schedule for back-end load sales charges. Mutual fund shares that charge a back-end load are also known as “B” shares.

Other Types of Sales Charges

There are other ways in which a mutual fund assesses a sales charge. Shares, which charge a level load based on the NAV, are known as level-load funds or “C” shares. Shares, which charge an asset-based fee and a back-end load, are known as “D” shares.

Recommending Mutual Funds

Mutual funds are designed to be longer-term investments and are generally not used to time the market. When determining suitability for investors, the investment advisers must first make sure that the investment objective of the mutual fund matches the investor's objective. Once several funds have been selected that meet the client's objective, the adviser must then compare costs, fees, and expenses among the funds. Priority should be given to any fund company with whom the investor maintains an investment. If the client's objective has changed then fund most likely offers conversion privileges that will allow the investor to move into another portfolio without paying any sales charge. If the investor is committing new capital then the fund company most likely offers combination privileges and rights of accumulation, which will help the investor reach a sale charge reduction. Switching fund companies and/or spreading out investment dollars among different fund companies are red flags for breakpoint sales violations and abusive sales practices. The amount of time the investor is seeking to hold the investment will be a determining factor as to which share class is the most appropriate. Investors who have longer holding periods may be better off in B shares that assess a sales charge upon redemption based on their holding period. Investors who have shorter time horizons will be better of choosing A shares over B shares as the expenses associated with B shares tend to be higher. Important to note is that making a large investment in class B shares is a red flag for a breakpoint sales violation as the large dollar amount would have most likely resulted in a reduced sales charge for the investors. Investors with relatively short holding periods or who want to actively move money between funds to try to time the market would be best off with C shares that charge a level load each year.

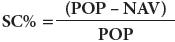

Calculating a Mutual Fund's Sales Charge Percentage

There are many times when an investor may know only the NAV and the POP for a given mutual fund and not the sales charge percentage that is charged by the fund. To determine the sales charge percentage given the NAV and the POP, use the following formula.

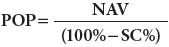

Finding the Public Offering Price

There also will be times when an investor knows the NAV of a fund and the sales charge percentage but does not know the POP that they must pay to invest in the fund. To calculate the POP given the sales charge percentage and the NAV, use the following formula:

Sales Charge Reductions

The maximum allowable sales charge that may be assessed by an open-end mutual fund is 8.5% of the public offering price. If a mutual fund charges 8.5%, they must offer the following three privileges to investors:

- Breakpoint sales charge reductions that reduce the amount of the sales charge based on the dollar amount invested

- Rights of accumulation that will reduce the sales charge on subsequent investments based on the value of the investor's account

- Automatic reinvestment of dividends and capital gains at the NAV

If a mutual fund does not offer all three of these benefits to investors, the maximum allowable sales charge that may be charged drops to 6.25%. Although a mutual fund that charges 8.5% must offer these features, most mutual funds that charge less than 8.5% also offer them.

Breakpoint Schedule

As an incentive for investors to invest larger sums of money into a mutual fund, the mutual fund will reduce the sales charge based upon the dollar amount of the purchase. Breakpoint sales charge reductions are available to any person including corporations, trusts, couples, and accounts for minors. Breakpoint sales charge reductions are not available to investment clubs or to parents and their adult children investing in separate accounts. The following is an example of a breakpoint schedule that a family of funds might use:

| Dollar Amount Invested | Sales Charge |

| $1–$24,999 | 8.5% |

| $25,000–$74,999 | 7% |

| $75,000–$149,999 | 5% |

| $150,000–$499,999 | 3% |

| $500,000 or greater | 1% |

A breakpoint schedule benefits all parties, the fund company, the investor, and the representative.

Letter of Intent

An investor who might not be able to reach a breakpoint with a single purchase may qualify for a breakpoint sales charge reduction by signing a letter of intent. A letter of intent will give the investor up to 13 months to reach the dollar amount to which they subscribed. The letter of intent is binding only on the fund company, not on the investor. The additional shares that will be purchased as a result of the lower sales charge will be held by the fund company in an escrow account. If the investor fulfills the letter of intent, the shares are released to them. Should the investor fail to reach the breakpoint to which they subscribed, they will be charged an adjustment to their sales charge. The investor may choose to pay the adjusted sales charge by either sending a check or by allowing some of the escrowed shares to be liquidated.

Backdating a Letter of Intent

An investor may backdate a letter of intent up to 90 days to include a prior purchase and the 13-month window starts from the back date. For example, if an investor backdates a letter of intent by the maximum of 90 days allowed, then the investor has only 10 months to complete the letter of intent.

Breakpoint Sales

A breakpoint sale is a violation committed by a registered representative who is trying to earn larger commissions by recommending the purchase of mutual fund shares in a dollar amount that is just below the breakpoint that would allow the investor to qualify for a reduced sales charge. A breakpoint violation also may be considered to have been committed if a representative spreads out a large sum of money over different families of funds. A registered representative must always notify an investor of the availability of a sales charge reduction, especially when the investor is depositing a sum of money that is close to the breakpoint.

Rights of Accumulation

Rights of accumulation allow the investor to qualify for reduced sales charges on subsequent investments by taking into consideration the value of the investor's account, including the growth. Unlike a letter of intent, there is no time limit and, as the investor's account grows over time, they can qualify for lower sales charges on future investments. The sales charge reduction is not retroactive and does not reduce the sales charges on prior purchases. To qualify for the breakpoint, the dollar amount of the current purchase is calculated into the total value of the investor's account.

Automatic Reinvestment of Distributions

Investors may elect to have their distributions automatically reinvested in the fund and use the distributions to purchase more shares. Most mutual funds will allow the investor to purchase the shares at the NAV when they reinvest distributions. This feature has to be offered by mutual funds charging a sales charge of 8.5%. However, it is offered by most other mutual funds as well.

Other Mutual Fund Features

Combination Privileges

Most mutual fund companies offer a variety of portfolios to meet different investment objectives. The different portfolios become known as a family of funds. Combination privileges allow an investor to combine the simultaneous purchases of two different portfolios to reach a breakpoint sales charge reduction.

Conversion or Exchange Privileges

Most mutual fund families will offer its investors conversion or exchange privileges that allow the investor to move money from one portfolio to another offered by the same fund company without paying another sales charge. Another way of looking at this is that the fund company allows the investor to redeem the shares of one portfolio at the NAV and use the proceeds to purchase shares of another portfolio at the NAV. The IRS sees this as a purchase and a sale and the investor will have to pay taxes on any gain on the sale of portfolio shares. Other exchange conditions are as follows:

- Dollar value of purchase may not exceed sales proceeds

- Purchase of new portfolio must occur within 30 days

- Sale may not include a sales charge refund

- No commission may be paid to a registered representative of broker dealer

An investor who moves money between portfolios that carry back-end loads under the exchange privilege will not pay the sales charge on the shares of the portfolio redeemed. The investor's holding period used to determine the ultimate amount of the back-end sales charge will be based on the date of the original purchase. That is to say, the investor's holding period carries over to the subsequent portfolio.

30-Day Emergency Withdrawal

Many mutual funds will provide investors with access to their money in a time of unexpected financial need. If the investor needs to liquidate mutual fund shares for emergency purposes, the investor will be able to reinvest an equal sum of money at the portfolio's NAV if they reinvest the money within 30 days. This is usually a one-time privilege and the NAV used to purchase the shares is the NAV on the day of the reinvestment.

Dollar Cost Averaging

One of the more popular methods to accumulate mutual fund shares is through a process known as dollar cost averaging. An investor purchases mutual fund shares through regularly scheduled investments of a fixed dollar amount. An investor may elect to invest $100 a month into a mutual fund by having the fund company debit their checking account. As the share price of the mutual fund fluctuates, the investor's $100 investment will purchase fewer shares when the market price of the mutual fund share is high and will purchase more shares when the market price is low. As the market price of the mutual fund share continues to fluctuate over time, the investor's average cost per share should always be lower than their average price per share, allowing the investor to liquidate the shares at a profit. Dollar cost averaging does not, however, guarantee a profit because a mutual fund share could continue to decline until the share price hits zero. All Series 6 candidates should be able to determine an investor's average cost and average price per share.

Mutual FUnds Voting Rights

Mutual fund investors have the right to vote on major issues regarding the fund. All votes are won by a simple majority; that is, 51% of the outstanding shares will win the vote. It is important to distinguish that shares vote, not shareholders. An investor with 5,000 shares has five times as many votes as an investor with 1,000 shares, even though they are both shareholders. Among the major issues to be voted on are:

- Changing capitalization (going from an open-end to a closed-end fund)

- Changing sales load (going from a loaded fund to a no-load fund)

- Changing or terminating business

- Changing investment objectives

- Lending money

- Entering into real estate transactions

- Issuing or underwriting other securities

- Changing borrowing policies

- Electing the board of directors

- Electing the investment adviser

- 12B-1 fees

Mutual Fund Yields

A mutual fund's current yield is found by dividing its annual dividends by its current market price or POP. The higher the yield, the more income the fund produces for every dollar invested. A mutual fund's current yield may be based on dividends only, not on capital gains distributions.

Portfolio Turnover

Portfolio turnover rates will tell you how long the fund holds its securities. The higher the rate, the shorter the fund's holding period. Higher portfolio turnover causes the fund to incur additional expenses in the form of execution charges. A turnover rate of 100% means that the fund replaces its portfolio annually.

Chapter 4

Pretest

Investment Companies

- An investor with $20,000 invested in the XYZ growth fund is:

- A stockholder in XYZ

- An owner of XYZ

- An owner of an undivided interest in the XYZ growth portfolio

- Both an owner of XYZ and an owner of an undivided interest in the XYZ growth portfolio

- All of the following benefit an investor, except:

- Combination privileges

- Emergency withdrawal privileges

- Breakpoint sale

- Form 1099

- A mutual fund investor has 500 shares of XYZ growth fund, which has an NAV of 22.30 and a POP of 23.05. The investor wants to invest the money in the biotech fund offered by XYZ, which has an NAV of 17.10 and a POP of 18. If XYZ offers conversion privileges, how many shares will the investor be able to purchase of the biotech fund?

- 652

- 619

- 640

- 605

- A mutual fund's custodian bank does which of the following?

- Holds customer's securities

- Cancels certificates

- Maintains records for accumulation plans

- Issues certificates

- A no-load mutual fund may charge a 12B-1 fee that is:

- Up to .25 of 1% of the NAV

- Less than .25 of 1% of the NAV

- Up to .25 of 1% of the POP

- Less than .25 of 1% of the POP

- The ex-dividend date on a closed-end mutual fund is set by the:

- Board of directors

- SEC

- Board of governors

- FINRA/NYSE

- A mutual fund has been seeking to attract new customers to invest in its growth fund. They have been running an advertising campaign that markets them as a diversified mutual fund. How much of any one company may they own?

- 15%

- 5%

- 10%

- 9%

- An investor wires $10,000 into his mutual fund on Tuesday, March 11, and the money is credited to his account at 3 pm. He will be the owner of record on:

- Friday, March 14

- Wednesday, March 12

- Tuesday, March 11

- Tuesday, March 18

- As it relates to the bonding of mutual fund employees, which of the following is true?

- All fund employees are required to be listed on the bond coverage.

- Only key employees are required to be listed on the bond coverage.

- All employees must have an individual bond posted for them.

- All employees with access to assets must be listed on the bond coverage.

- A long-term growth fund has a portfolio turnover ratio of 25%. How often does the fund replace its total holdings?

- Every four years

- Once a year

- Every four months

- Every six months