CHAPTER 7

Economic Fundamentals

Gross Domestic Product

A country's gross domestic product (GDP) measures the overall health of a nation's economy. The GDP is defined as the value of all goods and services produced in a country including consumption, investments, government spending, and exports minus imports during a given year.

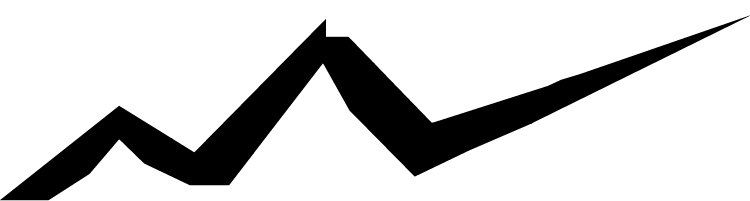

Economists chart the health of the economy by measuring the country's GDP and by monitoring supply and demand models, along with the nation's business cycle. A country's economy is always in flux. Periods of increasing output are always followed by periods of falling output. The business cycle has four distinct stages:

- Expansion

- Peak

- Contraction

- Trough

Expansion

During an expansionary phase, an economy will see an increase in overall business activity and output. Corporate sales, manufacturing output, wages, and savings will all increase while the economy is expanding or growing. An economy cannot continue to grow indefinitely and GDP will top out at the peak of the business cycle. An economic expansion is characterized by:

- Increasing GDP

- Rising consumer demand

- Rising stock market

- Rising production

- Rising real estate prices

Peak

As the economy tops out, the GDP reaches its maximum output for this cycle as wages, manufacturing, and savings all peak.

Contraction

During a contraction, GDP falls, along with productivity, wages, and savings. Unemployment begins to rise, the stock market begins to fall, and corporate profits decline as inventories rise.

Trough

The economy bottoms out in the trough as GDP hits its lowest level for the cycle. As GDP bottoms out, unemployment reaches its highest level, wages bottom out, and savings bottom out. The economy is now poised to enter a new expansionary phase and start the cycle all over again.

Recession

A recession is defined as a period of declining GDP, which lasts at least six months or two quarters. Recessions may vary in degree of severity and in duration. Extended recessions may last up to 18 months and may be accompanied by steep downturns in economic output. In the most severe recessions falling prices erode businesses' pricing power, margins, and profits as deflation takes hold. Recessions are generally triggered by an overall decrease in spending by businesses and consumers. As businesses and consumers pull back spending, overall demand falls. Businesses and consumers will often reduce spending as a cautionary measure in response to an economic event or shock, such as a financial crisis, or the busting of a bubble in an inflated asset class, such as real estate or the stock market.

Depression

A depression is characterized by a decline in GDP, which lasts at least 18 months or six consecutive quarters. GDP often falls by 10% or more during a depression. A depression is the most severe type of recession and is accompanied by extremely high levels of unemployment and frozen credit markets. The steep fall in demand is more likely to lead to deflation during a depression.

Economic Indicators

There are various economic activities that one can look at to try to identify where the economy is in the business cycle. An individual can also use these economic indicators as a way to try and predict the direction of the economy in the future. The three types of economic indicators are:

- Leading indicators

- Coincident indicators

- Lagging indicators

Leading Indicators

Leading indicators are business conditions that change prior to a change in the overall economy. These indicators can be used as a gauge for the future direction of the economy. Leading indicators include:

- Building permits

- Stock market prices

- Money supply (M2)

- New orders for consumer goods

- Average weekly initial claims in unemployment

- Changes in raw material prices

- Changes in consumer or business borrowing

- Average work week for manufacturing

- Changes in inventories of durable goods

Coincident Indicators

Changes in the economy cause an immediate change in the activity level of coincident indicators. As the business cycle changes, the level of activity in coincident indicators can confirm where the economy is. Coincident indicators include:

- GDP

- Industrial production

- Personal income

- Employment

- Average number of hours worked

- Manufacturing and trade sales

- Nonagricultural employment

Lagging Indicators

Lagging indicators will only change after the state of the economy has changed direction. Lagging indicators can be used to confirm the new direction of the economy. Lagging indicators include:

- Average duration of unemployment

- Corporate profits

- Labor costs

- Consumer debt levels

- Commercial and industrial loans

- Business loans

Schools of Economic Thought

The study of economics is a social science with many different schools of thought. Economics has been referred to as the dismal science as it is largely focused on the study of shortages. Economists all generally believe that low inflation and low unemployment are signs of a healthy economy. However, the different schools of economic thought believe that economic prosperity can be restored or maintained through very different approaches.

Classical Economics

The classical economic theory also known as supply side economics believes that lower taxes, and less government regulation will stimulate growth and increase demand through higher employment. Less regulation of business creates lower barriers to entry for employers and allows employers to produce goods at lower prices and to create more jobs. As a result of the lower prices, lower taxes, and higher employment, aggregate demand in the economy will increase, positively impacting the nation's gross domestic product.

Keynesian Economics

John Maynard Keynes first published his theories on economics in 1936 during the Great Depression. The Keynesian economic model believes that a mixed economy based on private and public sector efforts will produce desired economic conditions. Keynesians believe that the decisions made in the private sector can lead to supply and demand imbalances and that an active policy response from the public sector in the form of government spending (fiscal policy) and adjustments to the money supply (monetary policy) is required.

The Monetarists

Economists who subscribe to monetary economics believe that the supply of money in the economy can influence the direction of the economy and prices as a whole. During times of low demand and high unemployment the economy can be stimulated by increasing the money supply. As more money enters the system interest rates fall increasing demand. As more money enters the system the value of the currency tends to decline and during times of expansionary monetary policy inflation may increase. Milton Friedman the founder of the monetarist movement believed that the main focus of central banks should be on price stability.

Economic Policy

The government has two tools that it can use to try to influence the direction of the economy. Monetary policy, which is controlled by the Federal Reserve Board, determines the nation's money supply, while fiscal policy is controlled by the president and Congress and determines government spending and taxation.

Tools of the Federal Reserve Board

The Federal Reserve Board will try to steer the economy through the business cycle by adjusting the level of money supply and interest rates. The Fed may:

- Change the reserve requirement for member banks

- Change the discount rate charged to member banks

- Set target rates for federal fund loans

- Buy and sell U.S. government securities through open-market operations

- Change the amount of money in circulation

- Use moral suasion

INTEREST RATES

Interest rates, put simply, are the cost of money. Overall interest rates are determined by the supply and demand for money, along with any upward price movement in the cost of goods and services, known as inflation. There are several key interest rates upon which all other rates depend:

- Discount rate

- Federal funds rate

- Broker call loan rate

- Prime rate

THE DISCOUNT RATE

The discount rate is the interest rate that the Federal Reserve Bank charges on loans to member banks. A bank may borrow money directly from the Federal Reserve by going to the discount window, and the bank will be charged the discount rate. The bank is then free to lend out this money at a higher rate and earn a profit, or it may use these funds to meet a reserve requirement shortfall. Although a bank may borrow money directly from the Federal Reserve, this is discouraged, and the discount rate has become largely symbolic.

FEDERAL FUNDS RATE

The federal funds rate is the rate that member banks charge each other for overnight loans. The federal funds rate is widely watched as an indicator for the direction of short-term interest rates.

BROKER CALL LOAN RATE

The broker call loan rate is the interest rate that banks charge on loans to broker dealers to finance their customers' margin purchases. Many broker dealers will extend credit to their customers to purchase securities on margin. The broker dealers will obtain the money to lend to their customers from the bank, and the loan is callable or payable on demand by the broker dealer.

PRIME RATE

The prime rate is the rate that banks charge their largest and most creditworthy corporate customers on loans. The prime rate has lost a lot of its significance in recent years because mortgage lenders are now basing their rates on other rates, such as the 10-year Treasury note. The prime rate is, however, very important for consumer spending, because most credit card interest rates are based on prime plus a margin.

Reserve Requirement

Member banks must keep a percentage of their depositors' assets in an account with the Federal Reserve. This is known as the reserve requirement. The reserve requirement is intended to ensure that all banks maintain a certain level of liquidity. Banks are in business to earn a profit by lending money. As the bank accepts accounts from depositors, it pays them interest on their money. The bank, in turn, takes the depositors' money and loans it out at higher rates, earning the difference. If the Fed wanted to stimulate the economy, it might reduce the reserve requirement for the banks, which would allow the banks to lend more. By making more money available to borrowers, interest rates will fall and, therefore, demand will increase, helping to stimulate the economy. If the Fed wanted to slow down the economy, it might increase the reserve requirement. The increased requirement would make less money available to borrowers. Interest rates would rise as a result and the demand for goods and services would slow down. Changing the reserve requirement is the least-used Fed tool.

Changing the Discount Rate

The Federal Reserve Board may change the discount rate in an effort to guide the economy through the business cycle. Remember, the discount rate is the rate that the Fed charges member banks on loans. This rate is highly symbolic, but as the Fed changes the discount rate, all other interest rates change with it. If the Fed wanted to stimulate the economy, it would reduce the discount rate. As the discount rate falls, all other interest rates fall with it, making the cost of money lower. The lower interest rate should encourage borrowing and demand to help stimulate the economy. If the Fed wanted to slow the economy down, it would increase the discount rate. As the discount rate increases, all other rates go up with it, raising the cost of borrowing. As the cost of borrowing increases, demand and the economy slow down.

Federal Open Market Committee

The Federal Open Market Committee (FOMC) is the Fed's most flexible tool. The FOMC through open-market operations will buy and sell U.S. government securities in the secondary market in order to control the money supply. If the Fed wants to stimulate the economy and reduce rates, it will buy government securities. When the Fed buys the securities, money is instantly sent into the banking system. As the money flows into the banks, more money is available to lend. Because there is more money available, interest rates will go down and borrowing and demand should increase to stimulate the economy. If the Fed wants to slow the economy down it will sell U.S. government securities. When the Fed sells the securities, money flows from the banks and into the Fed, thus reducing the money supply. Because there is less money available to be loaned out, interest rates will increase, slowing borrowing and demand. This will have a cooling effect on the economy. The FOMC also issues statements that can “jawbone” investors to take certain actions and sets a benchmark for what it believes the fed funds rate should be. However, the marketplace is the ultimate factor in setting the fed funds rate.

Money Supply

Prior to determining an appropriate economic policy, economists must have an idea of the amount of money that is in circulation, along with the amount of other types of assets that will provide access to cash. Economists gauge the money supply using three measures. They are:

- M1

- M2

- M3

M1

M1 is the largest and most liquid measure of the nation's money supply and it includes:

- Cash

- Demand deposits (Checking accounts)

M2

Includes all the measures in M1 plus:

- Money market instruments

- Time deposits of less than $100,000

- Negotiable CDs exceeding $100,000

- Overnight repurchase agreements

M3

Includes all of the measures in M1 and M2 plus

- Time deposits greater than $100,000

- Repurchase agreements with maturities greater than 1 day

Disintermediation

Disintermediation occurs when people take their money out of low yielding accounts offered by financial intermediaries or banks and invest money in higher yielding investments.

Moral Suasion

The Federal Reserve Board often will use moral suasion as a way to influence the economy. The Fed is very powerful and very closely watched. By simply implying or expressing their views on the economy, they can slightly influence the economy.

Monetarists believe that a well-managed money supply, with an increasing bias, will produce price stability and will promote the overall economic health of the economy. Milton Friedman is believed to be the founder of the monetarist movement.

Fiscal Policy

Fiscal policy is controlled by the president and Congress and determines how they manage the budget and government expenditures to help steer the economy through the business cycle. Fiscal policy may change the levels of:

- Federal spending

- Federal taxation

- Creation or use of federal budget deficits or surpluses

Fiscal policy assumes that the government can influence the economy by adjusting its level of spending and taxation. If the government wanted to stimulate the economy, it may increase spending. The assumption here is that as the government spends more, it will increase aggregate demand and, therefore, productivity. Additionally, if the government wanted to stimulate the economy, it may reduce the level of taxation. As the governme\nt reduces taxes, it leaves a larger portion of earnings for the consumers and businesses to spend. This should also have a positive impact on aggregate demand. Alternatively, if the government wanted to slow down the economy, it may reduce spending to lower the level of aggregate demand or raise taxes to reduce demand by taking money out of the hands of the consumers. John Maynard Keynes believed that it was the duty of the government to be involved with controlling the direction of the economy and the nation's overall economic health.

As both the Federal Reserve Board and the government monitor the overall health of the U.S. economy, they look at various indicators some of which are:

- Consumer price index

- Inflation/deflation

- Real GDP

Consumer Price Index (CPI)

The consumer price index is made up of a basket of goods and services that consumers most often use in their daily lives. The consumer price index is used to measure the rate of change in overall prices. A CPI that is rising would indicate that prices are going up and that inflation is present. A falling CPI would indicate that prices are falling and deflation is present.

Inflation/Deflation

Inflation is the persistent increase in prices, while deflation is the persistent decrease in prices. Both economic conditions can harm a county's economy. Inflation will eat away at the purchasing power of the dollar and results in higher prices for goods and services. Deflation will erode corporate profits as weak demand in the marketplace drives prices for goods and services lower.

Real GDP

Real GDP is adjusted for the effects of inflation or deflation over time. GDP is measured in constant dollars so that the gain or loss of the dollar's purchasing power will not show as a change in the overall productivity of the economy.

Both monetary policy and fiscal policy have a major effect on the stock market as a whole.

The following are bullish for the stock market:

- Falling interest rates

- Increasing money supply

- Increase in government spending

- Falling taxes

The following are bearish for the stock market:

- Increasing taxes

- Increasing interest rates

- Falling government spending

- Falling money supply

International Monetary Considerations

The world has become a global marketplace. Each country's economy is affected to some degree by the economies of other countries. Currency values relative to other currencies will impact a country's international trade and the balance of payments. The amount of another country's currency that may be received for a country's domestic currency is known as the exchange rate. The balance of payments measures the net inflow (surplus) or outflow (deficit) of money. The largest component of the balance of payments is the balance of trade. As the exchange rates fluctuate, one country's goods may become more expensive, while another county's goods become less expensive. A weak currency benefits exporters, while a strong currency benefits importers.

London Interbank Offered Rate / LIBOR

LIBOR is the most widely used measure of short-term interest rates around the world. The LIBOR rate is the market-driven interest rate charged by and between financial institutions, similar to the fed funds rate in the United States. LIBOR loans range from 1 day to 1 year and the rate is calculated by the British Banker's Association in a variety of currencies including euros, U.S. dollars, and yes.

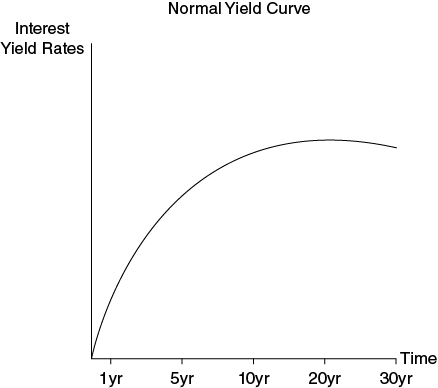

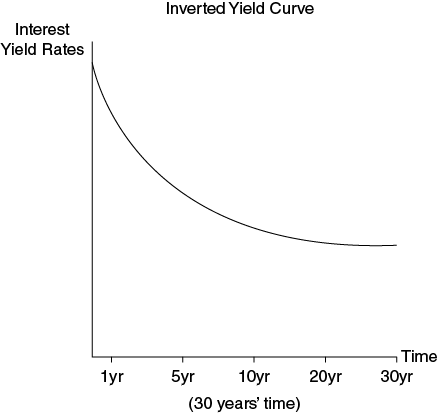

Yield Curve Analysis

Economists and investors may analyze both the cost of borrowed funds given various maturities and the general health of the economy by looking at the shape of the yield curve. With a normal, ascending, positive, or upward sloping yield curve, the level of interest rates increases as the term of the maturity increases. Simply put, lenders are going to demand higher interest rates on longer-term loans. The longer the lenders have to wait to be repaid and the longer their money is at risk, the higher the level of compensation (interest) required to make the loan. Higher interest rates also compensate the lenders for the time value of money. The dollars received in 10, 20, or 30 years will be worth less than the value of the dollars loaned to borrowers today. An upward slopping curve is present during times of economic prosperity and depicts the expectation of increased interest rates in the future. The yield curve will also graphically demonstrate investor's expectations about inflation. The higher the expectations are for inflation, the higher the level of corresponding interest rates for the period of high inflation. Occasionally the yield curve may become inverted, negative, or downward sloping during times when demand for short-term funds are running much higher than the demand for longer-term loans or in times where the Federal Reserve Board has increased short-term rates to combat an economy that is growing too quickly and threatening long-term price stability. With an inverted yield curve, interest rates on short-term loans far exceed the interest rates on longer-term loans. An inverted yield curve tends to normalize quickly and is often a precursor to a recession. The yield curve may also flatten out when the interest rates for both short-term and long-term loans are approximately equal to one another.

Chapter 7

Pretest

Economic Fundamentals

- During an inflationary period, the price of which one of the following will fall the most?

- Preferred stock

- Treasury bills

- Treasury bonds

- Common stock

- All of the following are bullish for the stock market, except:

- Falling taxes

- Increasing government spending

- Increasing money supply

- Increasing interest rates

- Economic theories believe all of the following to be true, except:

- As supply rises, prices tend to fall.

- As supply rises, prices tend to rise.

- A moderately increasing money supply promotes price stability.

- As demand rises, prices tend to rise.

- Which one of the following interest rates is controlled by the Federal Reserve Board?

- Prime rate

- Federal funds rate

- Broker call loan rate

- Discount rate

- All of the following indicate a downturn in the business cycle, except:

- Rising inventories

- High consumer debt

- Falling inventories

- Falling stock prices

- A bank with a shortfall meeting their reserve requirement could borrow money from another bank and pay the:

- Federal funds rate

- Broker call loan rate

- Prime rate

- Discount rate

- The government has two tools it can use to try to influence the direction of the economy; they are:

- Monetary policy and fiscal policy

- Prime rate policy and fiscal policy

- Monetary policy and prime rate policy

- Fiscal policy and money market policy

- Fiscal policy is controlled by:

- I. President

- II. FOMC

- III. Congress

- IV. FRB

- I and IV

- I and II

- II and IV

- I and III

- The Federal Reserve Board sets all of the following except:

- Monetary policy

- Reserve requirement

- Governmental spending

- Discount rate

- A decline in the GDP must last at least how long to be considered a recession?

- Two quarters

- One quarter

- Six quarters

- Four quarters