A knowledge of standard property accounting practices can help an appraiser detect unreliable financial statements. Request financial statements, preferably prepared by independent accountants, for the year-to-date and the two previous years if possible. Also check the footnotes and fine print for any disavowals of responsibility for the accuracy of the numbers. It is common practice for lenders to request tax return schedules for a property and some, burned by counterfeit tax returns, are even requiring borrowers to sign and submit IRS Form 4506T, which permits the lender to contact the IRS directly to request a copy of the borrower’s actual tax returns. An appraiser should ask lender clients to supply them with these tax returns when available.

In this chapter, we’ll discuss some “tricks” to watch out for when analyzing financial statements.

The Numbers Are Too Round

Professional property management reports are typically exact to the penny, as are utility bills and property taxes. Round numbers for every line item of income and expenses tells you that actual numbers were not used. When actual numbers are not used, it is often because the owner is using pro forma estimates or relying on memory, perhaps an incomplete memory.

Rent-controlled apartments are experiencing high foreclosure rates in some parts of Los Angeles. Controlled rents are typically uneven and based on the application of legally set limits. For instance, a $500-per-month apartment that is allowed a 3% increase per year will go up to $515 the next year, $530.45 the following year, and $546.36 the year after. A rent roll for a rent-controlled apartment should have uneven amounts for tenants who have been in place for two years or more.

The Numbers Are Too Consistent

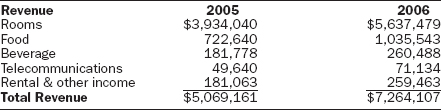

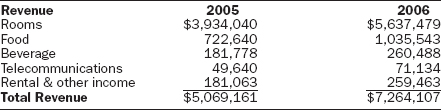

The following is part of an operating statement submitted by a struggling hotelier who had supposedly “fired” his Choice Hotels franchise. What clues can we find that suggest that the 2006 figures are fictitious?

Here are some clues that suggest the numbers are made up:

Not All Obligated Payments Are Being Made

When tenants get into trouble, they may stop paying escalation income, expense recoveries, or percentage rental income before they stop paying their base rent. Some landlords allow them to get away with it, particularly if the property is listed for sale. Remember to verify collected income, as a deadbeat tenant can be worse than no tenant at all.

Revenue That Is Not Related to the Property Is Included

Operating statements may sometimes include revenues from other properties, activities, or businesses not being appraised. For example, the owner of a strip mall in Texas supplied deceptive operating statements that included “capital infusions” as actual income and double-counted “common area maintenance” (CAM) reimbursements in “base rents” and as a separate line item of income. Also, an unusually high percentage of revenues came from late fees, which may have been uncollected. As a result of this deception, the reported net operating income had been inflated from $67,000 to $178,500. (Three of the eight leases were also pocket-to-pocket leases.)

Some owners even pay themselves management fees and include these as revenues. Most appraisal assignments, however, employ a definition of market value that presumes a sale of the appraised property, so what the owners claim to collect is immaterial if it is not a custom of that market.

Operating statements may also include revenues that cannot be expected to be consistent. Apartment owners, for instance, typically include “late fee” income in their financial statements. An apartment owner in Tulsa, Oklahoma, reported so much “late fee” income that it was apparent he had a big collection problem. These late fees were probably being accrued, but not collected.

Watch out for one-time sources of income, such as a legal award or the sale of a part of the property. One apartment building owner in Utah applied for refinancing after an unsuccessful condominium conversion, representing sales of condominium units as rental income.

A property owner may also be operating a business out of the appraised property, and one must be able to distinguish between property-related revenues and business revenues. The following business-related revenues are not real property items and require a high amount of labor and business or marketing expertise:

“Pocket-To-Pocket” Rental Income Is Included

If a landlord is paying rent to himself just for occupying space, this is not rental income that can be counted on if the property goes into default. This is an extra reason for the appraiser to try to know who each tenant is in commercial properties such as office buildings or retail centers.

Necessary Expenses Are Excluded

The owner of a 30-year-old Houston-area apartment property reported expenses 28% below the market average, which he considered to be evidence of his superior management ability. However, the property inspection indicated significant deferred maintenance, with extensive termite and water damage to structural wood, potholes in the parking lot, and over 200 original condensing units needing replacement. Skimping on maintenance only increases the amount of future expenses an investor can expect to incur.

To determine actual expenses, request bank statements and cancelled checks. One can also compare reported expenses with expense comparables or expense data from the Institute of Real Estate Management (IREM), Building Owners and Managers Association (BOMA) International, and the International Council of Shopping Centers (ICSC).1 These three groups organize operating data in many ways, such as by region, property size, building age, or property type.

Conclusion

Income and expense statements should not necessarily be taken at face value. They should be scrutinized for common types of misrepresentation, such as overly round numbers, the inclusion of non-realty revenue or management fees as a source of income, the exclusion of customary expenses, or patterns that do not make sense with respect to the operating performance of the property (such as increasing revenues in a situation of increasing vacancies). Whenever possible—particularly when appraising for a lender—request to see the property owner’s tax returns, as they may indicate rent collection problems or understated expense items. Bear in mind, too, that property owners wishing to commit fraud often do so through the use of false financial statements.

1. More information on these organizations can be found at www.irem.org, www.boma.org, and www.icsc.org.