Chapter 1

Thinking about Real Estate

IN THIS CHAPTER

Taking a look at real estate investments

Taking a look at real estate investments

Determining whether you have the makings of a real estate investor

Determining whether you have the makings of a real estate investor

Examining what goes into real estate investing

Examining what goes into real estate investing

Making real estate a part of your investment strategy

Making real estate a part of your investment strategy

Owning land has been a status symbol for generations. It once gave people a right to vote and a degree of independence from the demands of the world. Today, it promises financial independence, which amounts to the same thing for most people. Land is tangible; you can stand on it and live on it, things you can’t do with investments bought and sold online, and represented by numbers on a page. Whether you have a handful of homes you rent to university students, renovate a run-down character house to be sold at a profit, or buy the local strip mall and make it a gathering point for the neighbourhood, you’ve got opportunities for making money as well as making a contribution to your community.

Real estate is everywhere: the apartment or house you call home, the mall where you go shopping for groceries and clothes, and the office where you work. Even the park where you take your kids and walk your dog is property with potential investment value. But like any other investment, real estate has its risks, too. Remember the old saying “land rich, cash poor”? There’s real wealth in land but some equally real financial dangers, too, if you don’t have a strategy for making the most of it. What kind of real estate interests you most? Have you considered the skills — and weaknesses — you bring to your role as an investor? Successful investment in real estate means becoming land rich in order to become cash rich, too. You want to do it right!

This chapter discusses the various opportunities awaiting you as an investor and some of the risks associated with real estate. It looks at the considerations worth bearing in mind as you’re sizing up the different investment tools available. Finally, this chapter investigates how real estate can fit into a long-term financial plan and the implications that it can have for your retirement and your estate.

Investigating Real Estate Investing

So what’s the real deal about real estate? What makes it such a hot topic and critical investment for everyone from the government honchos who manage the Canada Pension Plan down to the tech nerd from school who’s making oodles of money as a programmer? This section checks out the advantages of real estate and compares property relative to other kinds of investments you may consider as part of your portfolio.

Discovering the opportunities

Statistics from the Canadian Real Estate Association (CREA) indicate that residential real estate has increased in value by an average of more than 5 percent a year over the past 30 years. Even though there have been some significant dips during that period, and not every property will make the same gains in every year or from city to city, the trend is unmistakable: The long-term potential for your real estate investment to appreciate is significant. Several reasons support the argument that an investment in real estate makes sense.

Leverage opportunities

Some of the basics of setting your limits as an investor so you can avoid the sale of your properties due to default of payment are discussed in the later section “Figuring Out Whether You’re Right for Real Estate Investing.” Chapter 4 in Book 7 discusses financing at greater length.

Equity opportunities

By paying down a mortgage, you’re paying the purchase value of the property and making its value your own over several years. Real estate is therefore unlike many other investments because it gives you a chance to build equity — your share of the property’s net worth at the time of sale — over the course of the investment rather than invest everything up front and hope for the best. Because the value of a property will change while you’re paying down the original value, you have two ways to build wealth, not just one.

To some investors, negative cash flow is a bigger concern than negative equity because negative cash flow leaves them short of cash to cover immediate expenses. However, negative equity is an unrealized loss that could turn into positive equity when the market improves. The key to successful investing in both cases is avoiding overleveraging, which means having more debt than you can handle. It implies excessive risk-taking, which most investors consider an imprudent investment strategy.

Return opportunities

When investors talk about returns, they’re talking about the money they’ll see — not the option to return their property for a refund! You’re quite right to ask for your money back when you invest in real estate, but the smart investor will get to keep the property, too. In fact, our calculations estimate that it’s not impossible to enjoy a net return of more than 75 percent annually on your investment. How do we figure that? Here’s the math.

If you buy a $300,000 property with a $30,000 down payment and the property increases in value by half over five years, the increase in equity is $150,000. That amounts to approximately $112,500 after the government taxes the appreciation in the property’s value, or capital gain. This would represent a return of 375 percent over five years, or at least 75 percent annually on your original investment of $30,000. Assuming the debt you incurred to buy the property decreased over the course of the five years, and the property generated rental income, you would enjoy an even greater return on your investment.

Tax opportunities

Real estate offers several tax advantages for you as an investor, especially if you’ve developed an investment strategy that accounts for taxes. Taxes erode the return you’ll see on investments yielding a fixed return, such as bank accounts, bonds, and guaranteed investment certificates (GICs), but not Tax-Free Savings Accounts (TFSAs). Stocks and other equities put your principal at risk. Real estate investments, however, frequently enjoy a reduced tax rate. Between tax-free capital gains on your principal residence to savings of up to 50 percent on taxes levied on capital gains from investment properties, there are many tax advantages to investing in real estate. You’re also able to deduct investment expenses and write off any depreciation in property values on your real estate purchases.

Hedge opportunities

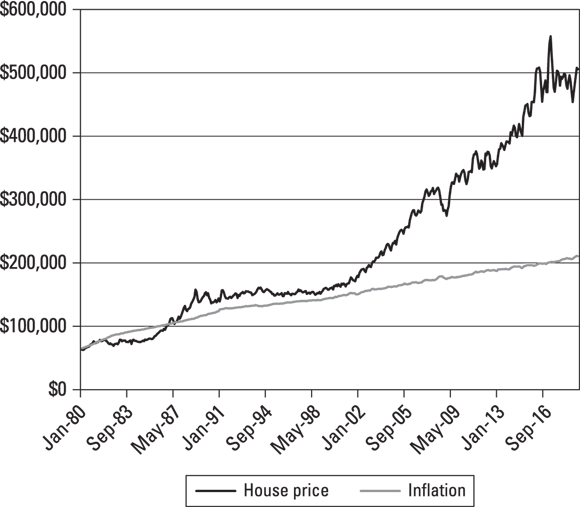

No, don’t hide from your creditors in a bush! The kind of hedging discussed here means taking shelter from the effects of inflation, which works to erode your buying power. The rate of inflation varies from month to month, year to year, and even country to country. But real estate typically appreciates at a rate 3 to 5 percentage points above the inflation rate. So if inflation is running at 3 percent, look for your investment in real estate to appreciate at 6 to 8 percent. If you choose wisely, your investment stands a good chance of increasing at a rate greater than that of inflation, as Figure 1-1 shows.

Flexibility opportunities

Real estate offers a variety of investment options that give you flexibility in terms of how much attention they demand and the amount of risk you’ll bear. By investing in just one property rather than several, or in partnership with family or friends, you can limit (or increase) your involvement to the level that suits you.

Source: Canadian Real Estate Association

FIGURE 1-1: Average home prices haven’t always increased at the same rate as inflation, but long-term gains have steadily outpaced the inflation rate.

Learning opportunities

Most investments entail some sort of learning process. Real estate is no different. Prior involvement in buying property, such as a home, may make it easier, but don’t underestimate the need to find out about the particular dynamics of investing in real property. Real estate investment also offers opportunities to discover community issues and economic trends at work in neighbourhoods. And, if you’re game for the role of landlord, you’ll also have a chance to improve your people-management skills.

Considering alternatives

But wait! Do you really want to buy a patch of dirt or a stack of bricks? Why not let someone else worry about the paperwork associated with ownership and the hassles of managing an investment property? You have better things to do and better places to put your money, right?

True enough — and if these are your nagging doubts, you’ll do well to consider other types of investments. Fear not, though: Some investments even let you enjoy indirect benefits from the fortunes of the real estate business without direct exposure to the risks! The three main alternatives to investing in real estate include

- Fixed-term investments

- Equities

- Direct investment in businesses

Real estate typically stands out from other investments because of its stable and long-term nature and the chance to derive a steady income from assets month by month. These three characteristics make it a preferred choice for many, but if you’re not up for the risks inherent in real estate investments, you might be safer with an alternative.

Fixed-term investments

Guaranteed investment certificates (GICs) and bonds are stable investments with minimal risk and a guaranteed return. Fixed-term investments are great if you don’t have a lot of cash to play with or need readily accessible funds, but if you’re holding a lot of them, consider real estate a step up to a more sophisticated form of investing.

The difference in return can be significant, with the appreciation in real estate values often outpacing inflation. And unlike real estate earnings, interest received on term deposits and bonds is fully taxable as income and also subject to inflation. A GIC may offer a 4 percent return on your cash, but if inflation is 3 percent, you’re seeing an effective return of just 1 percent on those dollars. Even if you’re in the lowest tax bracket, you’re probably just breaking even.

Equities

Not to be confused with the equity you build by paying down your mortgage, equities such as stocks trade on the open market and expose investors to fluctuations in value on a per-share or per-unit basis. The return is never guaranteed, though depending on your portfolio you may do better at some points than others. The stock market can offer good returns to dedicated, savvy investors; it’s also subject to downturns that can wipe out the value of your investment. Although the past 10 years have seen the longest bull market in history, boosting the fortunes of many, it followed the financial crisis of autumn 2008 when equity markets staged a significant correction and many stocks lost at least a fifth of their value.

Mutual funds, though not strictly speaking equities, also fluctuate in value in response to market conditions but tend to be more diversified, reducing exposure to market volatility and in turn minimizing risk.

Direct investment in businesses

Supporting a business venture you believe in by providing it with a start-up loan may be one of the most rewarding investments you make, but it also comes with the uncertainties associated with the company’s business. Though the return isn’t guaranteed, if the business succeeds, you can be paid back handsomely depending on the terms of the financing arrangement (which should be in your favour, because you get to have a hand in writing them).

Figuring Out Whether You’re Right for Real Estate Investing

If you’re serious about real estate investing (and if you’re reading Book 7, you probably are), the first thing you need to do is determine whether you and real estate are a good investment match. This determination is key to your financial future. This section helps you figure that out.

Real estate, like other investment options, demands that you have a plan for building your portfolio. Just as you’re careful not to contribute too much in a given month or year to your Registered Retirement Savings Plan (RRSP), you don’t want to sink too much of your available cash resources into a real estate investment you may not be able to sell for several years. Why own a palace if you can’t live like royalty?

Knowing your financial limits is just one aspect of determining your capacity for investing in real estate. Assessing your appetite for risk is equally important.

Risks are both real and perceived. For example, buying a property when the market is at its peak entails a real risk that the property could fall in value, leaving you open to a loss. Or you may be tempted to buy a property on the grounds that City Hall will let you renovate it. You might have reasonable grounds for believe this, but your success will depend on how well you or your representatives make the case to the local planning department. Other variables in the success of your investment include whether you’re able to work within local zoning bylaws or can obtain a variance from the bylaws to achieve your goals. The potential is there, but you’ll need to ensure that you can make the desired alterations to a property as part of your due diligence before the purchase.

Determining how much you can invest

Getting a handle on your personal finances is an important part of financing your real estate investment (something discussed at greater length in Chapter 4 of Book 7). Financing the actual purchase is just one part of the picture. Costs that crop up every day — from necessities such as shoes for the kids to luxuries like your gym membership or a night out on the town — determine how much cash you have available for investment purposes. Don’t forget to take into account unexpected expenses such as an interruption in employment income. These factors each affect the amount you can invest, and the amount of risk you’re willing to take on.

Assessing your risk tolerance

The risks associated with real estate stem from its disadvantages. Chances are you’re attracted to real estate and the stability it offers; after all, land isn’t about to get up and walk away, and they’re not making a whole lot more of it. But land also has its own limitations that can affect how you can use it and its value to investors. Some common risks include

-

Changes to surrounding properties and the local neighbourhood: More than likely, you know houses where the grass has grown long and shaggy, the curtains are faded, and newspapers sit yellowing on the front step. Now, imagine that house is right next door to your investment property. Or perhaps a few of them stand in the neighbourhood where you’re thinking of buying. Chances are you won’t find the neighbourhood as appealing. Changes in the condition of other properties can seriously affect the value of your own real estate, and may prompt you to try selling a property earlier than you had intended.

On the other hand, positive changes to nearby properties can boost the value of your property and even prompt you to make improvements that will keep up not only with the Joneses but also with the broader market.

- Changes in the political climate and government policies: Regardless of who forms the government, real estate investments may be subject to policy changes. A city council may need extra funding and pass a bylaw requiring owners of apartment buildings to pay significantly more for city services than homeowners. Some cities have introduced speculation and vacancy taxes, unheard of a decade ago. Or perhaps city staff are about to rezone the lot down the street for commercial development; depending on whether they allow a tea boutique or a bar with exotic dancers, your property is likely to see a change in value. Whether you can make the most of such changes will determine the success of your investment.

- Changes in the local economy: You’ve probably heard of ghost towns. When companies pack up and takes the jobs with them, property values are sure to follow. A sudden change in the local economy can mean boom or bust for your portfolio. Are you able to anticipate the changes or find ways to meet them head-on when they occur?

Are you ready for the long haul?

Real estate isn’t usually a form of investment that yields a quick profit, though some investors have been known to flip properties (selling them at a gain shortly after buying them). Instead, most investors hold real estate for at least one cycle of the real estate market. A market cycle is the period in which a market goes from high to low, from a buyer’s market to a seller’s market (this concept is discussed at length in Chapter 3 of Book 7). A standard cycle in the real estate market typically lasts as few as 5 and as many as 12 years. Some observers believe market cycles are actually lengthening, which means longer holding periods before you’ll be able to realize a return.

Determining your readiness for a long-term investment and establishing realistic financial goals will help you select the kind of property that will suit your needs.

Are you ready for a soft market?

A soft market occurs when demand is slack for a product or service. Think of it as kind of like a soft-boiled egg: If you don’t know what you’re dealing with before you crack into it, you’ll find yourself with a mess on your hands. As an investor, a soft market is an opportunity to pick up properties at a lower price than you might otherwise. If you’ve already got property, you may find yourself unable to sell at the price you expected. The situation will force you to make some hard choices: Are you comfortable holding the property a bit longer, or are you willing to accept a slightly lower return in exchange for a quick sale? This is worth thinking about, in case your financial circumstances change and you need to access the equity that’s accumulated in your property since you bought it.

Getting into Real Estate Investing

After you examine the alternatives and determine your limits, if you still think real estate investing is for you, you’ll need to decide what sort of investment you want and where to invest. Your motivation for investing will influence where you search, so be sure to prioritize the criteria you want in an investment property so you can focus your search and have a better view to what you’re seeking. Your interests will also influence the goals you set in the financial plan supporting your investment strategy.

Knowing your needs

Before you start looking at prospective locations, figure out what your investment intentions are. For example:

- You want a property close to your current home so that you can address tenants’ needs (and admire your purchase on a daily basis).

- You want a vacation getaway you can rent out when you’re not there or a home for your retirement.

- You want a property you can renovate and resell, a strategy that could take you into older communities or run-down neighbourhoods poised for revival.

Keeping your goals in mind

Any interest you have in using the property should mesh with your long-term goals. Don’t move to a city just because you enjoyed a visit you once had. A recreational property may seem an attractive investment today but lose its appeal after the novelty of the locale wears off and your preferences change. In this case, even if the market where you’ve bought offers the best prospects for resale in the world, the property won’t have lived up to at least one of your original expectations.

Say, for example, you live in Calgary but have dreams of retiring in 10 to 15 years. Vancouver Island, the Okanagan Valley, or the outskirts of Calgary are three areas that appeal to you as potential retirement locales. Although Vancouver Island and the Okanagan would require a significant amount of travel time to visit over the next 15 years, you’re not that keen on staying in Calgary. Maybe you found a great deal on a property on Vancouver Island and your research indicates strong potential for an appreciation in its value. But wait — you’ve found an equally promising property in the Okanagan, and strong local demand for housing means you can rent the house to a local family until you’re ready to take occupancy. Weighing the merits of each, you eventually decide on the Okanagan: You’ve set your heart on eventually leaving Calgary, the Okanagan is closer than Vancouver Island, and you’re certain cash flow from the Okanagan property will be steady. Chapter 3 in Book 7 talks more about meshing your investment strategy with your goals.

Understanding your limitations

Your ability to afford a property, both the basic purchase price and the carrying cost of the mortgage, factor into where you scout opportunities. If you’re financing your purchase by selling off a parcel of land in rural Saskatchewan, chances are that purchasing the same-sized parcel in an industrial park on the outskirts of Edmonton won’t be in the cards (unless you can obtain additional financing). But if you sell a summer home in the Laurentians with dreams of buying a seaside cottage in Nova Scotia, your potential investment options will probably be greater. Chapter 4 in Book 7 helps you take a cold, hard look at your resources and how they’ll affect your investing strategy.

And don’t forget, time is money, so you’ll probably want to factor in travel time for visiting and administering your prospective purchase. An investment shouldn’t be a burden, so be sure you can effectively manage it without the task consuming too much of your time.

Looking for locations

If you’re new to real estate investing, you might have a hard time figuring out where you should invest. The following questions should help you put your finger on it:

- What are demographic trends for the area you’re looking at? Are people moving in or out, and why?

- What are the economic indicators for the region? Are the prospects for employment growth and residential development strong?

- What have land values been doing in the areas where you’re looking?

- Is the kind of property you’re buying in short supply in the area? Why or why not?

- What are observers, both inside and outside the real estate industry, saying about the prospects for the various areas where you’re considering making an investment?

The fortunes of the region can affect your fortunes as an investor. A region that seems unfavourable in the near term may offer investors some good opportunities as the economy improves or your imagination (and research) find ways to adapt your investment to meet local needs. Such opportunities will be less obvious if you don’t understand the local dynamic. And they could be more difficult to sell when the time comes for you to move on, because you’ll have to attract the attention of a buyer and educate them on the property’s merits and potential. Chapter 5 in Book 7 discusses the search for a property at greater length.

Fitting Real Estate into a Financial Plan

Before you charge ahead with real estate investing, make a plan, because the day will likely come when you want to retire, relaxing with a cool beverage on a beach instead of talking to your real estate agent. A financial plan is about how you’ll get to that beach with a drink in your hand. Financial planning includes five basic steps:

- Select your professional advisers (see Chapter 3 in Book 7).

- Assess your current and future financial situation (see Chapter 4 in Book 7).

- Establish your goals and priorities.

- Develop a financial plan.

- Evaluate your progress toward your goals.

An objective plan, prepared with the assistance of professional advisers, will equip you to develop a portfolio of real estate that will ultimately see you sipping umbrella drinks in the sand (see Chapter 3 in Book 7 for all you need to know about assembling your crack team of advisers). The plan should address the following:

- Personal insurance coverage

- Your entire investment portfolio

- Debts

- Tax considerations of your particular situation

- Your retirement strategy

- Estate plans

The following sections focus on the latter two aspects, which have a direct impact on how you manage your real estate investments.

Considering when to sell

An investment not only helps you to make more of your resources in the present, it promises to help you do more in the future. Many people invest with a view to funding their retirement, so drafting a strategy for the sale of your portfolio that helps achieve your financial goals should be integral to the financial plan you develop.

Major reasons for disposing of assets include rebalancing your portfolio in favour of more liquid or higher yielding investments, or securing funds for retirement or in accordance with your estate plan.

Regular renewal of your portfolio, either through maintenance of the existing assets or trading up to new or higher yielding properties, is a standard strategy. Consider the strategy of pyramiding. Not to be confused with pyramid schemes, pyramiding involves the purchase of one or two select assets on a regular basis, and the sale of others, ensuring that your portfolio constantly renews itself and doesn’t become stale.

Planning for retirement

With an average life expectancy of just over 82 years, Canadians are living longer and enjoying healthier retirements than ever before. Planning for increased life expectancy will affect how quickly you divest your real estate portfolio. Fortunately, real estate isn’t like your Registered Retirement Savings Plan (RRSP), which must be converted to a Registered Retirement Income Fund (RRIF) by the time you turn 71. Other means exist to ensure real estate provides the stable retirement income that will make your golden years golden in fact as well as in name.

Common options include the following:

- Reverse mortgage

- Line of credit

- Sale and lease-back arrangement

- Living trust

Wills and (real) estate planning

Don’t kid yourself — you’re not immortal. You will need a will, if only to preserve the good memories people have of you. Not having a will invites frustration for the administrators of your estate, and could result in your paying a lot more tax, essentially defeating your best efforts to be a successful real estate investor. A will ensures that your investments are efficiently and promptly distributed as you wish, not by a government formula.

Leverage is all about using a small amount of your own money and letting someone else’s cash do the rest of the work. Because real estate provides the loan’s security — a guarantee of repayment if you’re unable to pay off the loan — the risk is low. If you run into financial trouble and your creditors, the people who’ve loaned you cash, demand immediate repayment and call your loan, your property could be subject to proceedings that lead to its sale. Providing that the property sells for more than the amount owing, you stand to emerge relatively unscathed. The nature of a forced sale of your property depends on the province and the mortgage documents you have signed. For example, in Ontario, the power-of-sale process doesn’t require court approval, whereas in some other provinces, the foreclosure and sale process requires the court to be involved throughout.

Leverage is all about using a small amount of your own money and letting someone else’s cash do the rest of the work. Because real estate provides the loan’s security — a guarantee of repayment if you’re unable to pay off the loan — the risk is low. If you run into financial trouble and your creditors, the people who’ve loaned you cash, demand immediate repayment and call your loan, your property could be subject to proceedings that lead to its sale. Providing that the property sells for more than the amount owing, you stand to emerge relatively unscathed. The nature of a forced sale of your property depends on the province and the mortgage documents you have signed. For example, in Ontario, the power-of-sale process doesn’t require court approval, whereas in some other provinces, the foreclosure and sale process requires the court to be involved throughout. Beware of negative equity! Although real estate is a convenient way to build equity (and that’s a good thing), a drop in the market can bring destruction and result in negative equity, a situation in which the market value of a property is less than the mortgage it secures. This typically happens when an investment is financed with too much debt, a condition known as being overleveraged. This was a common scenario in the United States during the subprime mortgage crisis of 2006 when interest rates on some high-risk mortgages saddled buyers with payments they couldn’t afford. The financial crisis of 2008 brought further trouble, when some lenders called loans on borrowers suddenly considered to be poor risks.

Beware of negative equity! Although real estate is a convenient way to build equity (and that’s a good thing), a drop in the market can bring destruction and result in negative equity, a situation in which the market value of a property is less than the mortgage it secures. This typically happens when an investment is financed with too much debt, a condition known as being overleveraged. This was a common scenario in the United States during the subprime mortgage crisis of 2006 when interest rates on some high-risk mortgages saddled buyers with payments they couldn’t afford. The financial crisis of 2008 brought further trouble, when some lenders called loans on borrowers suddenly considered to be poor risks. Soft markets are also periods during which you can invest in property with a view to preparing it for sale when markets improve.

Soft markets are also periods during which you can invest in property with a view to preparing it for sale when markets improve.