Capitalization rate (or cap rate, as it is more commonly called) is the rate at which you discount future income to determine its present value. For a related measure, see also net income multiplier (Part II, Calculation 11).

In practice, you will typically use cap rate to express the relationship between a property’s value and its net operating income (NOI) for the current or coming year.

You can use the cap rate formula, discussed below, to serve three useful purposes:

1. Obviously, you can use it to calculate a property’s cap rate. You’ll want to do so when you know its NOI and what is presumably its value—probably a seller’s asking price. What you’re really doing in this situation is finding out if the property exhibits a cap rate that’s in line with other similar properties in the area if you purchase it at the asking price.

2. If you know what is an appropriate cap rate for this type of property in this area, then you can transpose the formula to calculate a reasonable estimate of value. In other words, forget about the seller’s asking price; given the NOI and the prevailing cap rate, what should it be worth?

3. Finally, you can transpose it yet again to calculate the NOI. For example, if you know the prevailing cap rate and the seller’s asking price, what NOI should you expect to hear when you call the listing broker?

Mathematically, a property’s simple or market capitalization rate is the ratio between its NOI and its value:

Capitalization Rate = Net Operating Income / Value

As discussed above, you can transpose the formula to solve for any of the variables:

Value = Net Operating Income / Capitalization Rate

and

Net Operating Income = Value × Capitalization Rate

1. A property has an NOI of $30,000. If you buy it for $250,000, you’ll be purchasing it at what cap rate?

Capitalization Rate = Net Operating Income / Value

Capitalization Rate = 30,000 / 250,000 = 0.12, or 12%

2. The prevailing cap rate for small office buildings in your city is 11%. You own a building with a current NOI of $66,000. What is a reasonable estimate of its value?

Value = Net Operating Income / Capitalization Rate

Value = 66,000 / 0.11

Value = 600,000

3. You see another small office building advertised for sale at $900,000. When you obtain the owner’s statement of income and expenses and then reconstruct that statement to your satisfaction, what NOI would you expect to find?

Net Operating Income = Value × Capitalization Rate

Since this is the same type of property in the same location, you would use the same 11% cap rate.

Net Operating Income = 900,000 × 0.11

Net Operating Income = 99,000

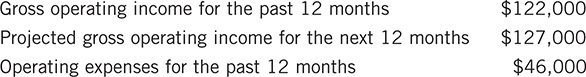

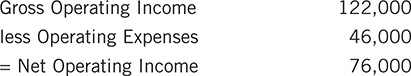

You are considering the purchase of a particular property. You receive the following information from the seller:

You examine the source information (leases, expense records, etc.) and are satisfied that the owner’s representations are accurate and reasonable.

The prevailing cap rate for properties of this type in your area is 11.5%. Using income capitalization as your method of estimating value, answer the following:

1. The seller bases his asking price on the following: Next year’s gross operating income (GOI), last year’s operating expenses, and a cap rate of 11%. To this he adds 10% extra for negotiating room. What is his asking price?

2. If you were to look at the property using this year’s GOI and operating expenses, what cap rate would the property yield at the full asking price?

3. What do you believe is a fair price to pay for this property?

4. Why do you think the seller chose to use next year’s GOI and a cap rate 0.5% lower than the market rate?

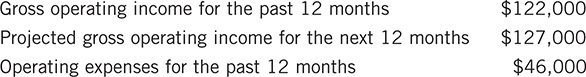

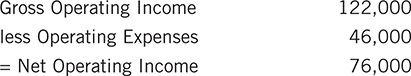

1. You must first calculate the NOI. Recall from the chapter on NOI:

Gross Operating Income

less Operating Expenses

= Net Operating Income

Remember that the seller has chosen to use next year’s NOI.

The seller now ascribes a value to the property using one of the transposed versions of the cap rate formula. Recall that he chooses to use a rate of 11%:

Present Value = Net Operating Income / Capitalization Rate

Present Value = 81,000 / 0.11

Present Value = 736,364

To this amount he adds 10% negotiating room:

736,364 × 1.10 = 810,000

The seller sets an asking price of $810,000.

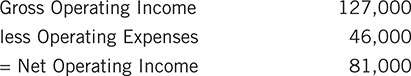

2. Now you want to look at the property using this year’s GOI and operating expenses:

The question asks you to calculate the cap rate using this NOI and the seller’s asking price; you need another version of the formula:

Capitalization Rate = Net Operating Income / Present Value

Capitalization Rate = 76,000 / 810,000

Capitalization Rate = 9.39%

3. To estimate what you believe will be a fair price for the property using income capitalization, you must decide what you will use for the cap rate and for the NOI.

The choice of cap rate is easy. You’ve already determined that 11.5% is the rate other properties of this type in this location are achieving. There is no reason to use the seller’s choice of 11.0%. Go with 11.5%.

In this example, you’ve been given the GOI for both the past 12 months and the next 12. Which do you use in order to calculate the NOI? If you’re the buyer, your likely attitude is that the property’s performance in the future is not certain and that you shouldn’t be paying for it as if it were. Further, that uncertain future also represents a degree of risk that you are taking off the shoulders of the seller and placing on yourself. You don’t intend to pay for the privilege of relieving the seller of risk. Hence, you’ll pay for what has occurred, not for what might occur. To put this less operatically, you’ll use the GOI from the past 12 months:

Now you calculate the present value:

Present Value = Net Operating Income / Capitalization Rate

Present Value = 76,000 / 0.115

Present Value = 660,870

4. The seller chose to use next year’s GOI because it is higher. Since you’re estimating the value by capitalizing the income, the higher the income, the higher the value. His rationale is that you are buying the income stream that begins when you take ownership, so the price should be based on that income. Notice that while he remembered to assert that the income would rise next year, he neglected to mention anything about the operating expenses and assumed instead that they would remain constant.

The choice of the lower cap rate also nudges the estimate of value upward. Given a constant NOI, the lower the cap rate, the higher the value. Compare the seller’s suggested 81,000 NOI at his 11% and at the market’s 11.5%:

Present Value at 11% Cap Rate = 81,000 / 0.11 = 736,364

Present Value at 11.5% Cap Rate = 81,000 / 0.115 = 704,348

A 1/2% difference in the cap rate doesn’t sound like much, but the seller is trying to play the old salami game here. One slice at a time, and pretty soon he’s got the whole salami. By using next year’s GOI (just $5,000 more), last year’s operating expenses, and a cap rate 0.5% below market—all seemingly small items—the seller was able to come up with an estimate of value, before negotiating room, of:

$736,364, $75,000 higher than yours

Clearly, there is no substitute for doing your own number crunching.