This concept is valuable for the insight it provides, as well as the explicit help it can give in designing a research strategy.

This concept is valuable for the insight it provides, as well as the explicit help it can give in designing a research strategy.The art of investing is evolving into the science of investing. This evolution has been happening slowly and will continue for some time. The direction is clear; the pace varies. As new generations of increasingly scientific investment managers come to the task, they will rely more on analysis, process, and structure than on intuition, advice, and whim. This does not mean that heroic personal investment insights are a thing of the past. It means that managers will increasingly capture and apply those insights in a systematic fashion.

We hope this book will go part of the way toward providing the analytical underpinnings for the new class of active investment managers. We are addressing a fresh topic. Quantitative active management—applying rigorous analysis and a rigorous process to try to beat the market—is a cousin of the modern study of financial economics. Financial economics is conducted with much vigor at leading universities, safe from any need to deliver investment returns. Indeed, from the perspective of the financial economist, active portfolio management appears to be a mundane consideration, if not an entirely dubious proposition. Modern financial economics, with its theories of market efficiency, inspired the move over the past decade away from active management (trying to beat the market) to passive management (trying to match the market).

This academic view of active management is not monolithic, since the academic cult of market efficiency has split. One group now enthusiastically investigates possible market inefficiencies. Still, a hard core remains dedicated to the notion of efficient markets, although they have become more and more subtle in their defense of the market.1

Thus we can look to the academy for structure and insight, but not for solutions. We will take a pragmatic approach and develop a systematic approach to active management, assuming that this is a worthwhile goal. Worthwhile, but not easy. We remain aware of the great power of markets to keep participants in line. The first necessary ingredient for success in active management is a recognition of the challenge. On this issue, financial economists and quantitative researchers fall into three categories: those who think successful active management is impossible, those who think it is easy, and those who think it is difficult. The first group, however brilliant, is not up to the task. You cannot reach your destination if you don t believe it exists. The second group, those who don t know what they don t know, is actually dangerous. The third group has some perspective and humility. We aspire to belong to that third group, so we will work from that perspective. We will assume that the burden of proof rests on us to demonstrate why a particular strategy will succeed.

We will also try to remember that this is an economic investigation. We are dealing with spotty data. We should expect our models to point us in the correct direction, but not with laserlike accuracy. This reminds us of a paper called “Estimation for Dirty Data and Flawed Models.”2 We must accept this nonstationary world in which we can never repeat an experiment. We must accept that investing with real money is harder than paper investing, since we actually affect the transaction prices.

We have written this book on two levels. We have aimed the material in the chapters at the MBA who has had a course in investments or the practitioner with a year of experience. The technical appendices at the end of each chapter use mathematics to cover that chapter’s insights in more detail. These are for the more technically inclined, and could even serve as a gateway to the subject for the mathematician, physicist, or engineer retraining for a career in investments. Beyond its use in teaching the subject to those beginning their careers, we hope the comprehensiveness of the book also makes it a valuable reference for veteran investment professionals.

We have written this book from the perspective of the active manager of institutional assets: defined-benefit plans, defined-contribution plans, endowments, foundations, or mutual funds. Plan sponsors, consultants, broker-dealers, traders, and providers of data and analytics should also find much of interest in the book. Our examples mainly focus on equities, but the analysis applies as well to bonds, currencies, and other asset classes.

Our goal is to provide a structured approach—a process—for active investment management. The process includes researching ideas (quantitative or not), forecasting exceptional returns, constructing and implementing portfolios, and observing and refining their performance. Beyond describing this process in considerable depth, we also hope to provide a set of strategic concepts and rules of thumb which broadly guide this process. These concepts and rules contain the intuition behind the process.

As for background, the book borrows from several academic areas. First among these is modern financial economics, which provides the portfolio analysis model. Sharpe and Alexander’s book Investments is an excellent introduction to the modern theory of investments. Modern Portfolio Theory, by Rudd and Clasing, describes the concepts of modern financial economics. The appendix of Richard Roll’s 1977 paper “A Critique of the Asset Pricing Theory’s Tests” provides an excellent introduction to portfolio analysis. We also borrow ideas from statistics, regression, and optimization.

We like to believe that there are no books covering the same territory as this.

Quantitative active management is the poor relation of modern portfolio theory. It has the power and structure of modern portfolio theory without the legitimacy. Modern portfolio theory brought economics, quantitative methods, and the scientific perspective to the study of investments. Economics, with its powerful emphasis on equilibrium and efficiency, has little to say about successful active management. It is almost a premise of the theory that successful active management is not possible. Yet we will borrow some of the quantitative tools that economists brought to the investigation of investments for our attack on the difficult problem of active management.

We will add something, too: separating the risk forecasting problem from the return forecasting problem. Here professionals are far ahead of academics. Professional services now provide standard and unbiased3 estimates of investment risk. BARRA pioneered these services and has continued to set the standard in terms of innovation and quality in the United States and worldwide. We will review the fundamentals of risk forecasting, and rely heavily on the availability of portfolio risk forecasts.

The modern portfolio theory taught in most MBA programs looks at total risk and total return. The institutional investor in the United States and to an increasing extent worldwide cares about active risk and active return. For that reason, we will concentrate on the more general problem of managing relative to a benchmark. This focus on active management arises for several reasons:

■ Clients can clump the large number of investment advisers into recognizable categories. With the advisers thus pigeonholed, the client (or consultant) can restrict searches and peer comparisons to pigeons in the same hole.

■ The benchmark acts as a set of instructions from the fund sponsor, as principal, to the investment manager, as agent. The benchmark defines the manager’s investment neighborhood. Moves away from the benchmark carry substantial investment and business risk.

■ Benchmarks allow the trustee or sponsor to manage the aggregate portfolio without complete knowledge of the holdings of each manager. The sponsor can manage a mix of benchmarks, keeping the “big picture.”

In fact, analyzing investments relative to a benchmark is more general than the standard total risk and return framework. By setting the benchmark to cash, we can recover the traditional framework.

In line with this relative risk and return perspective, we will move from the economic and textbook notion of the market to the more operational notion of a benchmark. Much of the apparatus of portfolio analysis is still relevant. In particular, we retain the ability to determine the expected returns that make the benchmark portfolio (or any other portfolio) efficient. This extremely valuable insight links the notion of a mean/variance efficient portfolio to a list of expected returns on the assets.

Throughout the book, we will relate portfolios to return forecasts or asset characteristics. The technical appendixes will show explicitly how every asset characteristic corresponds to a particular portfolio. This perspective provides a novel way to bring heterogeneous characteristics to a common ground (portfolios) and use portfolio theory to study them.

Our relative perspective will focus us on the residual component of return: the return that is uncorrelated with the benchmark return. The information ratio is the ratio of the expected annual residual return to the annual volatility of the residual return. The information ratio defines the opportunities available to the active manager. The larger the information ratio, the greater the possibility for active management.

Choosing investment opportunities depends on preferences. In active management, the preferences point toward high residual return and low residual risk. We capture this in a mean/variance style through residual return minus a (quadratic) penalty on residual risk (a linear penalty on residual variance). We interpret this as “risk-adjusted expected return” or “value-added.” We can describe the preferences in terms of indifference curves. We are indifferent between combinations of expected residual return and residual risk which achieve the same value-added. Each indifference curve will include a “certainty equivalent” residual return with zero residual risk.

When our preferences confront our opportunities, we make investment choices. In active management, the highest value-added achievable is proportional to the square of the information ratio.

The information ratio measures the active management opportunities, and the square of the information ratio indicates our ability to add value. Larger information ratios are better than smaller. Where do you find large information ratios? What are the sources of investment opportunity? According to the fundamental law of active management, there are two. The first is our ability to forecast each asset’s residual return. We measure this forecasting ability by the information coefficient, the correlation between the forecasts and the eventual returns. The information coefficient is a measure of our level of skill.

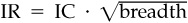

The second element leading to a larger information ratio is breadth, the number of times per year that we can use our skill. If our skill level is the same, then it is arguably better to be able to forecast the returns on 1000 stocks than on 100 stocks. The fundamental law tells us that our information ratio grows in proportion to our skill and in proportion to the square root of the breadth:  This concept is valuable for the insight it provides, as well as the explicit help it can give in designing a research strategy.

This concept is valuable for the insight it provides, as well as the explicit help it can give in designing a research strategy.

One outgrowth of the fundamental law is our lack of enthusiasm for benchmark timing strategies. Betting on the market’s direction once every quarter does not provide much breadth, even if we have skill.

Return, risk, benchmarks, preferences, and information ratios are the foundations of active portfolio management. But the practice of active management requires something more: expected return forecasts different from the consensus.

What models of expected returns have proven successful in active management? The science of asset valuation proceeded rapidly in the 1970s, with those new ideas implemented in the 1980s. Unfortunately, these insights are mainly the outgrowth of option theory and are useful for the valuation of dependent assets such as options and futures. They are not very helpful in the valuation of underlying assets such as equities. However, the structure of the options-based theory does point in a direction and suggest a form.

The traditional methods of asset valuation and return forecasting are more ad hoc. Foremost among these is the dividend discount model, which brings the ideas of net present value to bear on the valuation problem. The dividend discount model has one unambiguous benefit. If used effectively, it will force a structure on the investment process. There is, of course, no guarantee of success. The outputs of the dividend discount model will be only as good as the inputs.

There are other structured approaches to valuation and return forecasting. One is to identify the characteristics of assets that have performed well, in order to find the assets that will perform well in the future. Another approach is to use comparative valuation to identify assets with different market prices, but with similar exposures to factors priced by the market. These imply arbitrage opportunities. Yet another approach is to attempt to forecast returns to the factors priced by the market.

Active management is forecasting. Without forecasts, managers would invest passively and choose the benchmark. In the context of this book, forecasting takes raw signals of asset returns and turns them into refined forecasts. This information processing is a critical step in the active management process. The basic insight is the rule of thumb Alpha = volatility · IC · score, which allows us to relate a standardized (zero mean and unit standard deviation) score to a forecast of residual return (an alpha). The volatility in question is the residual volatility, and the IC is the information coefficient—the correlation between the scores and the returns. Information processing takes the raw signal as input, converts it to a score, then multiplies it by volatility to generate an alpha.

This forecasting rule of thumb will at least tame the refined forecasts so that they are reasonable inputs into a portfolio selection procedure. If the forecasts contain no information, IC = 0, the rule of thumb will convert the informationless scores to residual return forecasts of zero, and the manager will invest in the benchmark. The rule of thumb converts “garbage in” to zeros.

Information analysis evaluates the ability of any signal to forecast returns. It determines the appropriate information coefficient to use in forecasting, quantifying the information content of the signal.

There is many a slip between cup and lip. Even those armed with the best forecasts of return can let the prize escape through inconsistent and sloppy portfolio construction and excessive trading costs. Effective portfolio construction ensures that the portfolio effectively represents the forecasts, with no unintended risks. Effective trading achieves that portfolio at minimum cost. After all, the investor obtains returns net of trading costs.

The entire active management process—from information to forecasts to implementation—requires constant and consistent monitoring, as well as feedback on performance. We provide a guide to performance analysis techniques and the insights into the process that they can provide.

This book does not guarantee success in investment management. Investment products are driven by concepts and ideas. If those concepts are flawed, no amount of efficient implementation and analysis can help. If it is garbage in, then it’s garbage out; we can only help to process the garbage more effectively. However, we can provide at least the hope that successful and worthy ideas will not be squandered in application. If you are willing to settle for that, read on.

Krasker, William S., Edwin Kuh, and William S. Welsch. “Estimation for Dirty Data and Flawed Models.” In Handbook of Econometrics vol. 1, edited by Z. Griliches and M.D. Intriligator (North-Holland, New York, 1983), pp. 651-698.

Roll, Richard. “A Critique of the Asset Pricing Theory’s Tests.” Journal of Financial Economics, March 1977, pp. 129-176.

Rudd, Andrew, and Henry K. Clasing, Jr. Modern Portfolio Theory, 2d ed. (Orinda, Calif.: Andrew Rudd, 1988).

Sharpe, William F., and Gordon J. Alexander, Investments (Englewood Cliffs, N.J.: Prentice-Hall, 1990).