3

The New Centralization

The flow of money and creation of new money for a nation are governed by its Central Bank. In times of crisis, central banks can either save or destroy the economy with good or bad policies.

Central banks are established to conduct the monetary policy and control the money supply of nations. On a macro‐scale, they do this by adjusting interest rates and facilitating operations on the open market, taking charge of the flow of cash in the economy and loans of the nation.

Central banks also work on a micro‐scale by setting the reserve ratio of commercial banks, meaning they set the percentage of deposits a commercial bank is required to keep as cash. Once a commercial bank's reserves dips below this level, they may turn to their central bank to bail them out.

As mentioned in the previous chapter, money is not printed out of thin air – it is supposed to be backed by the economic growth and prospects of a nation, after we left behind the Gold Standard. Thus, increasing a nation's money supply by releasing new cash into the economy must be guided by an independent entity that is free from the influence of the ruling regime.

Mandated with keeping a low, predictable inflation rate and steady GDP growth, central banks can effectively reject and amend the government's fiscal budget if it is bloated or favors corporate profit over the public's interest.

We can think of central banks as the government's bank. As currency is backed by a government's promise of a better tomorrow, central banks have the duty of being a reality check on government spending. Printing more money will lead to more inflation; however, the justification is that printing more money is needed to stimulate GDP growth, which creates more jobs as the economy grows. Therefore, it is crucial that central banks ensure the government spends the money wisely and does not print it in excess as if it comes out of thin air.

In 1668, Sweden's parliament founded the Riksens Ständers Bank (the Estates of the Realm Bank), arguably one of the world's oldest central banks, to regulate commercial banks and the nation's economy. Almost three centuries later in 1913, the Federal Reserve System – the central banking system of the United States – was created after a series of financial panics led to the need for central control of the nation's monetary system.

After World War II, at the Bretton Woods conference, the world decided to use the US dollar as the global trading currency as the United States owned the majority of the world's gold reserves. However, when President Nixon decided to unpeg the US dollar from gold, the boundaries that limited the printing of the US dollar were somewhat removed.

One of the chief criticisms of the Gold Standard that caused its demise was that the supply of newly minted gold was not flexible enough to keep up with the growing global economy. A country might not be able to keep up with inflation as well, like following World War II, when additional loans were needed chiefly by Europe and Asia, where war had ravaged whole cities and economies, and other nations across the seas that were affected by proxy as the colonies of Western powers that depended on the Western economy.

By unpegging gold, Nixon gave the Federal Reserve (Fed) and the US government more power to steer the global economy by printing the currency the world trades in, the US dollar, without the restrictions of the Gold Standard. The US dollar is now worth what the US government says it is worth based on its GDP and other movable parameters of the economy.

Although the Gold Standard had its weak points, paper money was linked to a physical asset that could control inflation by limiting the supply of money printed, and there would be a tangible cap to how much a government could print before risking accelerated inflation.

With the responsibility of being the sole regulator of the world's trading currency, the Fed needs to be run independently from the influence of the US government.

Due to its complexities, many conspiracy theories have arisen on who is really behind the Fed. However, finding out the truth might just be digging a deeper hole…

Who Owns the Fed?

Since the Civil War, the US economy had gone through several periods of depression after nationwide panics led people to withdraw their money all at once. Commercial banks weren't backed by a central bank, so no one could save them if they went bust. Due to this, rumors of insolvency ruined and bankrupted otherwise healthy banks.

It was obvious that a central bank was needed to unite the banks in the country and bail them out if needed but that was the only thing everyone could agree on.

After Congress passed legislation to create a central bank, it took another five years of heated debates and negotiations for a conclusion to be reached. Bankers were concerned about interference from politicians and wanted it to be as independent as possible from Washington. Meanwhile, the government, needing funds for its fiscal budget and foreign policy spending, did not exactly trust the bankers as well.

Gathering on a resort on Jekyll Island in Georgia, hundreds of miles away from Capitol Hill, an elite club of the wealthiest American bankers, industrialists, and businessmen led by John Morgan conceived the idea of what America's first central bank would look like, and it was unlikely any power structure that any central bank had seen. Finally, in 1913, the Federal Reserve was born.

Source: Board of Governors

Devised so that policymakers could hear from all sides, including the American public, the Federal Reserve System, or the Fed, is governed by the Federal Reserve Board of Governors, regional reserve banks, and the Federal Open Market Committee (FOMC). The Federal Reserve Bank is made of 12 regional reserve banks governed by local bankers and businessmen.

Although the Fed is not owned by anyone, it works with the government via the Board of Governors in Washington D.C., an agency of the federal government that reports to and is directly accountable to Congress.

The Board, which comprises seven governors, is appointed by the president and confirmed by the Senate. The seven governors make up the voting majority in the FOMC, with the remaining five votes coming from regional reserve bank presidents.

The FOMC sets monetary policy for the United States. Among its current tasks is a long‐run inflation target of 2%.

To limit the president's power, they can only appoint one governor of the Board every two years with a 14‐year term. The Board provides general guidance for the Federal Reserve System and oversees the 12 regional reserve banks, which serve as bankers for commercial banks in their regions. Each of the 12 reserve banks of the Federal Reserve System is owned by its member banks, who originally gave capital in exchange for shares in these reserve banks.

Testifying before Congress, the Board submits the Monetary Policy Report on recent economic developments and their plans for monetary policy twice a year. Independently audited financial statements of the System are disclosed publicly, as are the minutes from FOMC meetings.

Every bank in America is required by law to keep 6% of its capital in its regional reserve bank. Their capital is exchanged for shares which cannot be sold. Instead, these shares give the shareholder the right to vote on about two‐thirds of the Board of Directors of their regional reserve bank. Larger banks will have larger surpluses of capital and naturally more shares and influence.

So who owns the Fed? Basically, every big bank in America. The full list is 150 pages long, but a few names stand out.

With Wall Street under its jurisdiction, the New York Fed is the most important regional reserve bank and component of the Federal Reserve Bank's network in America. Apart from open market operations, the New York Fed conducts transactions in foreign exchange markets for the Federal Reserve System and US Treasury. Due to this, the New York Fed president, who also serves as FOMC vice chair, is the only regional reserve bank president who serves as a permanent voting member of the FOMC.

Take a guess how many commercial banks own the majority of shares in the New York Fed?

The answer is just two – Citibank holds 42.8% of shares, while JP Morgan has 29.5% of the total. This majority percentage of ownership held by these two giants has not changed much since 2007, when JP Morgan owned 41.7% and Citibank had 36.6%.

To quote George Selgin, director of the Center for Monetary and Financial Alternatives at the Cato Institute in Washington D.C., in a report by Institutional Investor, “The Fed is facing a difficult challenge. It's trying to become more transparent while its operations become more complex. That's a difficult trick to pull off.”

The Fed was created for the American public, to bring stability, but has it been creating more inflation and distress globally?

To Teach the World to Sing in Perfect Harmony

Almost every nation in the world today uses a central bank to make their monetary policies. The handful of countries that don't have central banks are island nations with low populations that mostly trade with the US dollar and euro.

Central banks often purchase assets to help back their financial system. As of 2016, approximately 75% of the world's central bank assets are held by China, the United States, Japan, and some European countries.

It can be said that the whole world now operates on a centralized monetary system that revolves around the United States and its allies. But is the situation really that bad, with the International Monetary Fund (IMF) acting as regulator and the World Bank bailing out countries that have fallen into poverty?

An excerpt taken from the book US Relations with the World Bank, 1945–1992 by Catherine Gwin reads: “Throughout the history of the International Bank for Reconstruction and Development (the World Bank), the United States has been the largest shareholder and the most influential member country. US support for, pressure on, and criticisms of the Bank have been central to its growth and the evolution of its policies, programs, and practices.”

Working as if they are instruments of the US government and its allies, the World Bank and IMF have, for borrowings, subjugated nations in the past and supported dictatorships that violated international pacts on human rights. On the other hand, the US government can pressure these financial institutions to impose trade tariffs or stop giving loans to certain ruling parties – such as when it refused to grant loans to France due to the French Communist Party (PCF) being in the government, post‐World War II.

Gwin elaborates the relationship of the United States and the World Bank in these excerpts taken from her book, The World Bank, Its First Half Century, Volume 2:

The top management of the [World] Bank spends much more time meeting with, consulting, and responding to the United States than it does with any other member country. Although this intense interaction has changed little over the years, the way the United States mobilizes other member countries in support of its views has changed considerably. Initially, it was so predominant that its positions and the decision of the board were virtually indistinguishable.

Going as far as to state that “The United States has viewed all multilateral organizations, including the World Bank, as instruments of foreign policy to be used for specific US aims and objectives” and “is often impatient with the processes of consensus building on which multilateral cooperation rests,” the book rips apart any preconceived notion of justice that the US government should hold as regulators of the world's financial institutions.

The book entails how the relationship between the United States and the World Bank changed over the years: “A preoccupation with containing communism, and the change in the relative US power in the world explain much of the evolution in US relations with the World Bank over the past fifty years,” adding that, “The debt crisis in the south and the collapse of communism in eastern Europe led to renewed US interest in the Bank.”

It may look as if the financial system we have now is the best we can ask for under the circumstances; however, things are going to get even more centralized as the world embraces digital currency.

Central Bank Digital Currencies and Data Collection

If cryptocurrency is meant to liberalize finance, as we've seen happening within the decentralized finance (DeFi) movement, then Central Bank Digital Currencies (CBDCs) conversely are meant to bring us closer centralization and give central banks more power than anyone has seen before in the history of finance. Blockchain got rid of the middleman, but CBDCs will inevitably give the middleman access to all our financial data. We are about to begin a new age of unrelentless financial surveillance and control.

While CBDCs will make criminal activities like money laundering more difficult, what is pushing this new digital currency forward is the promise of GDP growth as a result of faster transactions. Some financial institutions like the Bank of England (the UK's central bank) thinks it can be bullish against inflation, while others speak of the pooled liquidity that will benefit nations that adopt a CBDC.

However, what we will be giving up is whatever that is left of our financial privacy. A CBDC is reportable, unchangeable, traceable, and accessible to anyone with an internet connection. There will be no dodging taxes as all your income and expenses will be viewable at the click of a button.

Digital currency controlled by central banks will no doubt bring us closer to a Big Brother scenario, where every digital wallet will contain information that will be pulled into a database for governments to analyze and even be given credit scores, just like how banks use your information to fulfill Know Your Customer guidelines to identify suitability and risks involved in a business relationship.

Secrecy laws might still exist in this future, but how far will the law go to protect someone who is incriminated by government agencies? Currently, most nations' laws require a court order for government agencies to investigate financial data. In the future, governments will no longer require court orders as they will have full access to your data.

From creating financial policies to controlling the entire transaction highway of an economy, there is much public fear regarding the limitless power that we are handing over to our governments.

Just like crypto, CBDCs will run on the blockchain.

Part of the rationale behind governments allowing cryptocurrencies to operate and trade within their nations in the past decade is that they needed to see the experiment live. A nationwide switch from paper money to digital money would not have been possible before the emergence of cryptocurrency as it would have been too much of a shock for the public.

Considering cybersecurity at the time, hacking was a concern as there was no network of computers doing verifications with distributed ledger technology as we have now with blockchain. A single hack could destabilize a whole nation's economy if CBDCs had been introduced in the past.

Today's world is far more tech‐savvy. We have non‐fungible tokens (NFTs), gaming currencies, and other forms of digital value with liquidity that are commonly traded. A change from paper money to CBDCs will be almost effortlessly supported by the public.

Is Anything Real Anymore?

We would appear alien to our ancient ancestors who carried out trading activities with rare shells and minerals, but just 20 years ago, it would have been hard to explain the concept of digital currency to the man on the street.

It is likely that we will see CBDCs take over world trade in the coming years; some countries like China have already started.

However, CBDCs still function like paper money at the end of the day, with all its shortcomings. Not being backed by real‐world assets, a CBDC is still fiat currency tied in value to the government's promise.

The irony now is that Web 3.0 tools meant to bring freedom and level the field are being turned against us by the same people who we entrusted to keep the economy safe. And the more the public catches on to what is happening with the global financial system, the more distrust arises. Hence, there is consensus that the value of money is only safe when we convert it into something tangible with utility, like land or stocks. However, even these assets can be inflated and can crash when the market panics.

Standing as an intermediary currency are stablecoins. Backed by real‐world assets, stablecoins are cryptocurrencies designed to be protected from the volatility that challenges the use of crypto for payments or as a store of value.

Stablecoins are the antithesis to the hype around crypto investors' wild gains and losses as they attempt to maintain a constant exchange rate with fiat currencies.

Much like how commercial banks operate, centralized stablecoins like Tether (USDT), USD Coin (USDC), and Zytara USD (ZUSD) make money through lending and investing. This is done by fractional reserve banking where only a fraction of deposits are required to be backed by physical cash that can be withdrawn by investors at any given time.

All three of these stablecoins are pegged to the US dollar and redeemable on a 1:1 basis.

Backed “100% by Tether's reserves,” as stated on its website, Tether is owned by iFinex, a Hong Kong‐registered company that also owns crypto exchange BitFinex. Most of Tether's reserves are cash and common cash equivalents. In their latest assurance opinion, Tether revealed that over 55% of their reserves are now US Treasuries and that commercial paper now makes up less than 29% of their vault. Tether helps investors move funds between cryptocurrency markets and the traditional financial system.

USDC, on the other hand, only holds cash and short‐term US government bonds, according to its monthly report. Its reserves are held in the custody and management of US financial institutions, including BlackRock and BNY Mellon. Conceived by CENTRE, an open‐source fintech project funded by contributions from Circle and Coinbase, USDC is governed by this organization whose goal is to connect the public and all merchants, financial institutions, and currencies across the globe into one independent and stable financial system.

With aspirations to make cryptocurrency more user‐friendly, USDC was developed to be used by smaller businesses and individuals as well, not just big corporations. USDC provides an open‐source smart contract, allowing companies to create and develop their own blockchain products like wallets and exchanges.

Built on Ethereum Blockchain, ZUSD is a digital currency that can be easily sent and received like email. Issued by a regulated financial institution, each ZUSD is redeemable through Prime Trust at a 1:1 ratio to the US dollar and subject to audits by an independent accounting firm, with reports made publicly available on a regular basis.

Designed for the future of finance, esports, gaming, and a host of other applications, ZUSD and other blockchain‐based assets seek to enable financial connectivity within this global community, solving the industry's many pain points with transactions while simultaneously promoting financial inclusion and literacy.

Since the fall of TerraUSD (UST) in mid‐2022, the US government has come down hard with a legal framework around how stablecoins should operate. A newly introduced bill by the US Congress will set requirements for the amount of backing assets stablecoin issuers are required to hold, among other things. The latest regulator to step in is the New York State Department of Financial Services (DFS), which made a public guidance on the issuance of stablecoins backed by US dollars.

Although some are preoccupied with the market news of UST, with these new checks put in place by regulating agencies, US dollar backed stablecoins look more promising as an alternative for transactions and put some distance between your financial information and the government.

What stablecoins promise, apart from stability and acting as a go‐between for digital and fiat currencies, is that there will always be other options to CBDCs as we move forward in a world that is not only getting smaller but also less private.

You Can't Always Get What You Want…

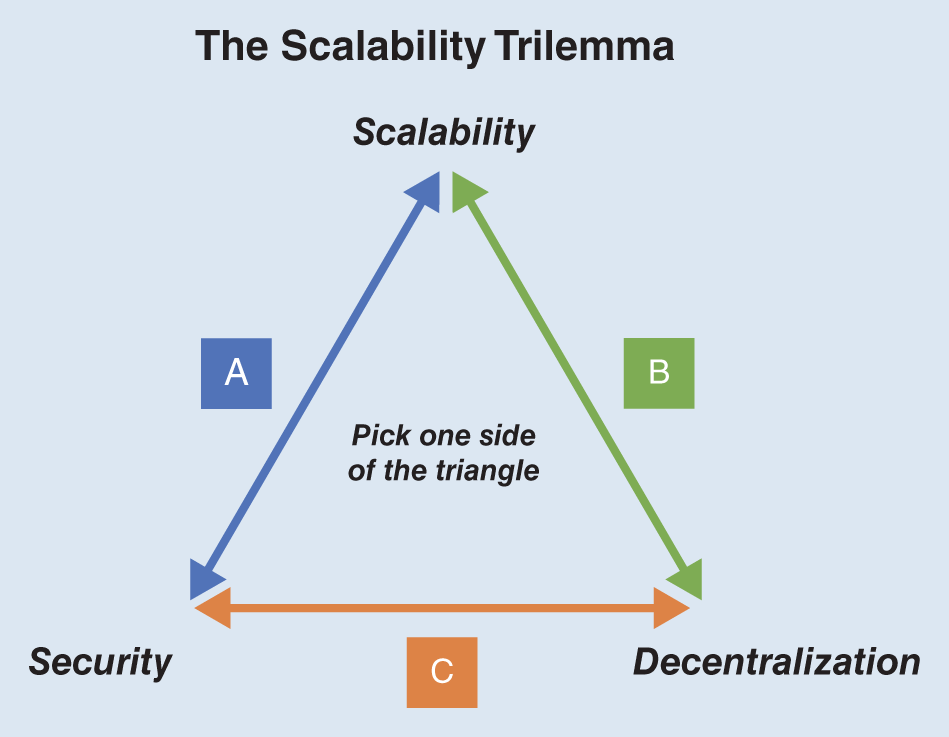

Decentralization, security, and scalability are three variables that persistently strive to function in harmony so that DeFi can work for the world at large. But in reality, these factors work against each other in their designs.

The “Blockchain Trilemma” is a term used to conceptualize the tricky act of enforcing each of these variables without compromising or diminishing the strength of the other. People often use the analogy of balancing your work life with play and sleep, or even the infamous conundrum of the service industry where clients want everything delivered fast, cheap, and with quality.

Source: Medium Michael Zochowski / https://medium.com/logos-network/everything-you-know-about-the-scalability-trilemma-is-probably-wrong-bc4f4b7a7ef

The first variable, decentralization, is the act of distributing power in a bid to be free of central authority. In terms of blockchain, we have individual nodes (a network of supercomputers around the world) powering the system. The more nodes we have, the more decentralized the blockchain becomes, which is the whole purpose of decentralization. However, the time it takes to process transactions increases as more nodes take more time to come to a consensus to authenticate a transfer.

Scalability is affected because we have to wait for the entire network to collectively agree, although decentralized and secure, it is also inefficient if compared to transactions validated by a single entity. Visa can process as many as 1700 TPS (transactions per second), while Bitcoin is capable of only processing up to 5 TPS.

Blockchains that use Proof‐of‐Work (PoW) mechanisms, where computers consume energy in a race to randomly create a unique hash in a bid to process the transaction, are secured in a sense that a hacker needs to take control of over 51% of the network to manipulate the results. They are, however, not scalable and, thus, not entirely practical for the everyday citizen.

Ethereum's move to a Proof‐of‐Stake (PoS) mechanism, where nodes do not have to solve complex mathematical equations but instead require validators to stake a certain amount of crypto as collateral, can be seen as a step forward in solving the Blockchain Trilemma and also furthering blockchain's goal of decentralization.

As only validators that can afford to put up the collateral can have a stake in processing transactions, fewer nodes will qualify, hence, reducing the time it takes and increasing scalability. Ethereum 2.0 will reportedly be able to handle up to 100 000 TPS, dwarfing Visa's processing power several 100‐fold. Security is also tightened in PoS, as a hacker would require 51% of the total staked cryptocurrencies to initiate a hijack.

PoS' weakness is its compromise, decentralization. With the power to validate transactions in the hands of a few, many argue that this defeats the purpose of decentralization.

Developers have been cracking their heads for more than a decade trying to figure out a way for all three variables that make the Blockchain Trilemma to be addressed. Many blockchain companies have implemented Layer 1 and Layer 2 changes to their systems in an effort to create the perfect system of consensus that can be safely adopted by everyone.

The Algorand blockchain, for example, is attempting to make PoS more decentralized by randomizing the selection of validators.

Tackling scalability, blockchains like Zilliqa and Ethereum 2.0, is using a technology known as “sharding,” where groups of transactions are broken down into “shards” and then processed in parallel by the network, speeding up the process by allowing nodes to validate transactions in batches.

Layer 2 solutions complement and exist as a separate layer on top of the foundation of the blockchain. These are upgrades that do not necessarily solve the Trilemma, but help to make existing processes more efficient. For example, Bitcoin has introduced a Layer 2 upgrade known as the Lightning Network which enables the crypto‐pioneer to handle more transactions, improving the main weakness in Bitcoin's current form: scalability.

Among the most exciting developments is the potential for blockchains to work together. There are currently more than 20 000 blockchain companies in the world and they do not have interoperability. This means they pretty much exist in their own bubbles with few to no avenues of communication between each other.

If blockchains could unite, they could capitalize on each other's strengths and complement solutions to their weaknesses. Chains could operate independently in governance, the same way they are doing now, but team up to bring the world closer to mass decentralization.

The idea of interoperability is championed by many within the DeFi movement. Notably, Polkadot is a protocol trying to achieve blockchain cooperation with a “relay chain” integrated into its core programming for higher scalability. Designed to support multiple chains on a single network, Polkadot uses “parachains,” which are independent blockchains connected to the main relay chain. The chains that reside on Polkadot's network will gain paramount added security but still operate independently.

An evolved PoS concept is used in Polkadot's validating mechanism. Nominated Proof of Stake (NPoS) is different from PoS in that NPoS has validators and nominators who are both rewarded for their role in decentralization and security.

The validators are actual nodes that stake DOT (Polkadot's native token) tokens to assess transactions on the Relay Chain, while the nominators who do not have to put in a stake help to secure the Relay Chain by nominating trustworthy validators. It is like having two sets of validation instead of one – for the transaction itself and another for the validator.

Without developers truckin' on in the face of the Trilemma, the blockchain industry would not have been able to progress to the level it is at now. The future will see the integration of more blockchain platforms as the community realizes that cooperation and consensus are needed to overcome fundamental problems and create the bankless world of the future that we all desire to witness someday.