11

A Brave New World

It's true what they say: it gets lonely at the top. So, what does the future hold for the strongest nation in the world today?

With the United States dictating global trade through its sanctions and veto power, directly stirring the course of history for over half a century in its favor, the country does not have many friends.

The US's foreign policy has made a lot of enemies for the nation. Hostilities toward the United States will never end as long as it continues to bully other nations. However, the country is approaching a fork in the road.

Shoddy alliances from the Middle East to Europe are beginning to fall apart due to pressure from rising powers in Asia and parts of the Global South.

Meanwhile, the war in Ukraine that diminishes global food supply and disrupts Russian oil pipelines to Europe has already caused a politically chaotic situation, including the election of three different prime ministers in the United Kingdom in this year alone (2022).

As the United States and its allies go up against a burgeoning East, more opportunities will arise to use blockchain as an equalizer in the face of unfair political pressure from both sides.

Alternative methods to settle payments will ultimately be used to bypass sanctions, which will become useless as economic warfare for central powers. Nations will no longer suffer from crippling economies brought upon by these instruments of monetary imperialism. International pressure will amount to the United States changing its policy to solely use sanctions on individuals such as dictators and top brass members of regimes, terrorists, and international criminals, instead of being used on an entire country's poverty‐stricken population.

Particularly where Society for Worldwide Interbank Financial Telecommunication (SWIFT) is not prominent, governments and banks will use the blockchain to overcome distance issues, allowing about 1.4 billion people (according to the World Bank) to join the global Web 3.0 economy.

With last‐mile connectivity issues in banking addressed, the un‐banked will be able to participate in trade. Countries that once had to support these disparate communities will experience a boom in economic activity as a result.

An increase in global participation in trade will result in more demand for energy. The ongoing energy crisis has already tested the relationship of the United States with its closest ally in the Middle East: Saudi Arabia. The Organization of the Petroleum Exporting Countries (OPEC) will continue to put pressure on the United States as China and other rising industrial nations seek alternative currencies to purchase oil.

The Petrodollar will fall sooner or later, and the US dollar will lose prominence as the global currency of trade, but it will not be soon until or if complete dedollarization happens. The dollar is too entrenched in the global financial system at the moment for any significant change in trading currency.

However, the pressure on the Federal Reserve Bank to balance the US economy for the strength of the dollar to persist will prompt the nation to create its own Central Bank Digital Currencies (CBDCs). Even though the US government will do everything in its power to delay the degrading of the dollar's prominence and promise of stability, there will eventually be a digital dollar to facilitate America's entry into the developing digital market which could be worth as much as US$37 trillion by 2040, according to some researchers, as reported by the World Economic Forum.1

Source: Hootsuite Inc

The United States is at yet another turning point in history. It has the chance to redeem itself, to acknowledge the role it played in the setting up and destruction of various regimes, the politically motivated sanctions it slapped on nations that place them at a disadvantage, and the endless and pointless wars it has fought based on “American interests.”

The United States can join the world in fair trade in the digital economy or it can do the opposite and oppose the advancement of nations attempting to break away from the dollar.

How the United States repositions itself will greatly matter in the years to come. New alliances will be forged, yesterday's bickering leaders will be tomorrow's bromances, and vice versa. Politics will always be a merry‐go‐round of blame and deceit, but at least we should see more diplomatic decision‐making when it comes to larger nations negotiating terms relating to world trade. With equitable distribution of power among economic powerhouses, maybe one day, just maybe, every nation in the United Nations would be able to put aside past conflicts and be friendly with each other, in terms of fair trade for the benefit of their economies and the people.

In the coming years, America could become the United States of Isolation once again, as it did when the nation sanctioned the whole world in the late 1800s, or it could drop the e‐dollar into the basket of CBDCs that will become the next Bretton Woods and join the group of new currencies that would facilitate most of the world's trade.

I'm Still Walking, So I'm Sure I Can Dance

If what doesn't kill you only makes you stronger, then Africa is coming back with a vengeance.

Already singled out as the next booming economy, the continent is removing the remnants of colonialism such as the CFA, and introducing their own CBDCs for financial sovereignty.

5G broadband access will become cheaper with companies like Starlink entering the continent to capitalize on the market while it is still in its infancy. Wired to 5G connectivity, the digital gig or freelancer economy is expected to benefit the most, as with the service industry.

In the past, countries like China and Korea – manufacturing giants that have integrated themselves with the latest tech developments and innovations, with huge middle‐class populations to test and support tech growth – had to go through an industrial phase to get where they are now.

Too much competition in industrial development would spell doom for the planet. Scientists and climate change researchers have predicted droughts that last for over 300 days annually in some parts of the world within the next 20 years. Conversely, rising water levels have been reported globally. Catastrophic events are on the cards if we do not take sustainability seriously.

Source: World Bank/Bloomberg https://www.bloomberg.com/opinion/articles/2019-04-24/africa-s-only-way-out-of-poverty-is-to-industrialize

If Africa goes through a phase of industrialization with over‐development of farming land and mining industries, the whole world will experience dire consequences. Brazil's Amazon rainforest that has been blazing for over a decade – most notably in 2019 when images of cauldron‐black smoke turned midday into night in the city of São Paulo – is a prime example of what could happen should Africa industrialize in a traditional sense on a mass scale.

This does not need to necessarily happen if the Web 3.0 digital economy is adopted across Africa.

Access to credit will create a new middle class that will bypass this industrial phase. Access to the digital economy will give anyone with an internet connection the chance to be part of the new middle class.

Services that can be offered over the internet will blossom, and those who can integrate traditional skills with tech skills will be able to move forward. Education, communications, marketing and advertising, data analytics, programming, engineering, architecture, web design, bank services, and more, including established brands and multinational companies seeking employees, will soon be available on Web 3.0, making it the place to be to engage service providers around the globe.

New service platforms will arise, creating more higher paying jobs and a skilled labor force. This will lead to more use cases for all digital currencies in a Web 3.0 environment.

The fact that many nations are still standing today, despite centuries of foreign oppression, means that there's a chance that they will be dancing come tomorrow.

The First Days are the Hardest Days

It is still pretty much the Wild West for the decentralized finance (DeFi) movement today. There are over 20 000 blockchain projects that exist on the market, and there is not as much cooperation as there should be. In fact, most of these companies are in direct competition with each other for market share and dominance.

To tame the unpredictable frontier of blockchain fintech, tools for regulated growth must be put in place by governments and users of Web 3.0 platforms themselves.

It is crucial that the process of verification stays the way it was intended to be when Satoshi Nakamoto wrote the white paper that conceptualized Bitcoin and solved the Byzantium Generals Problem once and for all.

With CBDCs, we see governments attempting to co‐opt the power of blockchain to capitalize on its capabilities and the metadata that follows.

Verification must always stay decentralized as central powers have the tendency to use our data against us. To deal with security effectively, our data needs to be decentralized as much as possible. As it is, there are already too many red flag cases that are allowed to proliferate freely online.

Catfishing, burner accounts, trolls, fake news, scams, and toxic behavior lurk at every corner of the internet of today and have led to disturbing trends such as recruitment for terrorist organizations and other extreme ideological groups.

Identity theft by hackers is rampant on social media as well. In the first quarter of 2022, Facebook took action on 1.6 billion fake accounts. While many believe that most fake accounts are bots created to execute malicious activity or at the very least, data hacking, a report this year by Tech News World claimed that a third of US‐based social media users surveyed by USCasinos.com created fake accounts for various reasons.2 It does not matter what information is displayed on a profile, anyone could be anyone.

Trust will always be at the center of everything. Without trust, we cannot move forward. Conversations on how to create decentralized trust for Web 3.0 economic activities will get more interesting as we strive to create a productive, efficient internet society.

Despite the lack of security at present, the internet has flourished as an alternative platform to conduct business and with the COVID‐19 pandemic, work‐from‐home culture has accelerated. New web‐based tools for various industries are being created every day as the meaning of the New Normal evolves from being associated with lockdown‐fueled paranoia to remote‐work productivity.

Smart contracts on the blockchain that address the issue of trust will see added global GDP that will make China's double‐digit GDP growth seem like a molehill.

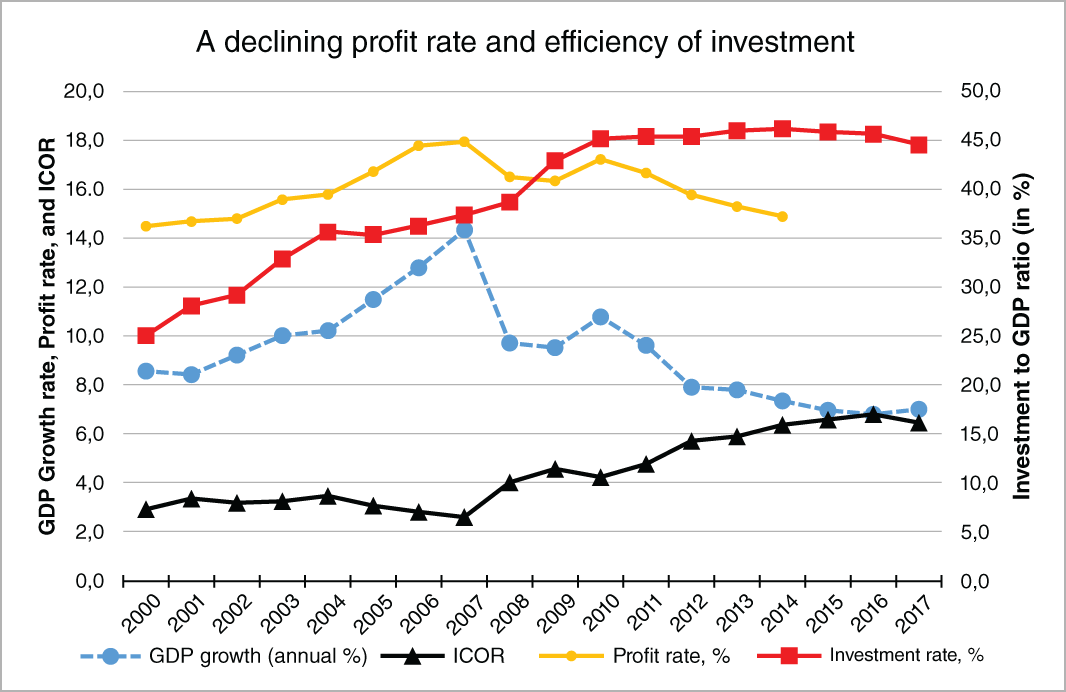

Since initiating free‐market reforms in 1979, China has been among the world's fastest‐growing economies. When the country's GDP growth averaged 9.5% through 2018, the World Bank described it as “the fastest sustained expansion by a major economy in history” but it was nothing compared to China's 14.2% GDP leap in 2007.

China's GDP growth, on average, doubles every eight years and has so far helped to raise about 800 million people out of poverty. In addition to being a major commercial partner of the United States, China is also the largest foreign holder of US Treasury securities, helping Uncle Sam fund federal debt and keeping US interest rates low.

Now, imagine what would happen if all international trade barriers were removed, and every nation could trade freely without the interference of policies and regulations that stagnate GDP growths and isolate economies?

No economist can accurately predict or model the potential GDP of the world today, what more in the years to come? We are looking at a dynamic world where exchange of different forms of digital currency, whether CBDCs, cryptocurrencies, stablecoins or even NFTs, would be the norm in our daily routines.

Source: Visual Capitalist https://www.visualcapitalist.com/china-economic-growth-history/

Source: CADTM https://www.cadtm.org/A-Little-History-of-Chinese-Economy

You Speak My Language

The internet was officially born on 1 January 1983. Computer networks did not have a standard way to talk to each other before this. A new communications protocol, Transfer Control Protocol/Internetwork Protocol (TCP/IP), was created to enable interfacing among different kinds of computers on different networks.

This meant that all networks could now be connected by a universal language.

Much like how people today ignore the potential of blockchain to eliminate trust issues and prefer to focus on the daily highs and lows of cryptocurrency trading, the early internet was equally misunderstood.

At its infancy, the internet's potential led to hype and exaggeration which in term brought about the Dot‐Com bubble burst of the early 2000s, just barely 20 years after the internet was conceived. Many people lost huge sums of money along the way and people today continue to get scammed, but there is no stopping the progress of web‐based transactions. Life online will only continue to grow and so will the digital economy.

Various tech giants were, once upon a time, babies in a wild frontier. Today their share prices are among the most expensive on Wall Street and international exchanges, and their CEOs among the richest men in the world. But ask anyone who was using the internet when Facebook launched to the general public in 2006, and they would say that there were other similar social media platform competitors, and almost no one could tell the difference between them.

From the tens of thousands of blockchain companies that exist today, only a few will remain. Reputational evaluation will weed out the weak. After years of assurance, the remaining blockchain companies with good track records will expand and even merge with each other. In the true spirit of decentralization, blockchain will continue to be a crowdsourced development.

Gas fees are currently required to support the current state of the blockchain ecosystem. As more developers get roped into the field, gas fees will go down and it might even be subsidized or free in the future.

Open blockchains will become a utility; something that people in cities and modern societies would need, like WiFi, to do business in the new world. Governments would want to support their local digital economies by reducing gas fees involved in certain transactions, like purchasing goods and services in support of local businesses and dealing with government‐related transactions and taxes.

At some stage, the blockchain will be a standard part of the tech stack in any organization like the data cloud and servers we have today. The blockchain will be a crucial component in running any organization that involves seamless transactions.

In this future, the new generation of school‐leavers will be confronted with complex decision‐making chores, but they will be prepared. Just like how non‐English speaking parents in the past knew that their children would have to learn English to be able to interact with the world, future generations will be pushed to take up coding.

Knowledge of the basis of coding would be something like the ability to converse in English in today's world. The higher one's level of proficiency, the easier it gets to move around and do business.

With the trend of humans having less physical interaction and more digital interaction, the new generation will be a generation that is able to interact with computers that have functions beyond what we can imagine today. At the moment, user experience (UX) might be structured in a way that is friendly to the computer‐illiterate but the future of UX will see more complex interactions between man and machine.

Just like those who could not speak English were held back economically, the computer‐illiterate will be unable to access the Web 3.0 economy of the future and hence, unable to move forward.

No one should be left behind in this future that we are working so hard to create. Fair trade must remain a basic human right, even though it is nowhere close to reality these days. It defeats the purpose of DeFi if the world has more disparity out of digitization. This is not the utopia we want.

It is important for us – you, me, anyone reading this book – to set the right tone in the decades and for the generations to come. Let the youth of tomorrow know that the world is still in their hands, that they still have the power to change it for the better just like how their parents, grandparents, and ancestors did.

Let us not fear the future because it is unknown but embrace it by getting familiar with it now.

As travelers in the journey of life we will come across many hurdles and roadblocks that will test our humanity. Remember to be kind.

There's a long way to go and a lot to do, but if we start now, the journey will be an interesting one.

Until then, just keep truckin' on…