While the Japanese have used this charting and analysis technique for centuries, only in recent years has it become popular in the West. The term, candlesticks, actually refers to two different, but related subjects. First, and possibly the more popular, is the method of displaying stock and futures data for chart analysis. Secondly, it is the art of identifying certain combinations of candlesticks in defined and proven combinations. Fortunately, both techniques can be used independently or in combination.

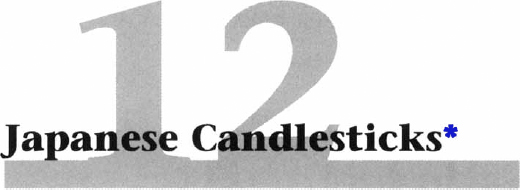

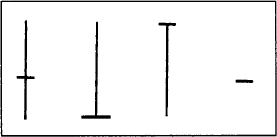

Charting market data in candlestick form uses the same data available for standard bar charts; open, high, low, and close prices. While using the exact same data, candlestick charts offer a much more visually appealing chart. Information seems to jump off the page (computer screen). The information displayed is more easily interpreted and analyzed. The box below is a depiction of of a single day of prices showing the difference between the bar (left) and the candlestick(s). (See Figure 12.1.)

Figure 12.1

You can see how the name “candlesticks” came about. They look somewhat like a candle with a wick. The rectangle represents the difference between the open and close price for the day, and is called the body. Notice that the body can be either black or white. A white body means that the close price was greater (higher) than the open price. Actually, the body is not white, but open (not filled), which makes it work better with computers. This is so that it will print correctly when printing charts on a computer. This is one of the adaptations that have occurred in the West; the Japanese use red for the open body. The black body means that the close price was lower than the open price. The open and close prices are given much significance in Japanese candlesticks. The small lines above and below the body are referred to as wicks or hairs or shadows. Many different names for these lines appear in Japanese reference literature, which is odd since they represent the high and low prices for the day and are normally not considered vital in the analysis by the Japanese. (See Figure 12.2.)

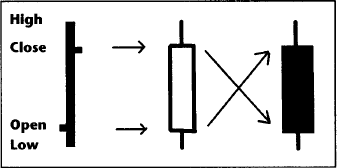

Figure 12.2 shows the same data in both the popular bar chart and in a Japanese candlestick format. You can quickly see that information not readily available on the bar chart seems to jump from the page (screen) on the candlestick chart. Initially, it takes some getting use to, but after a while you may prefer it.

Figure 12.2

The different shapes for candlesticks have different meanings. The Japanese have defined different primary candlesticks, based upon the relationship of open, high, low, and close prices. Understanding these basic candlesticks is the beginning of candlestick analysis.

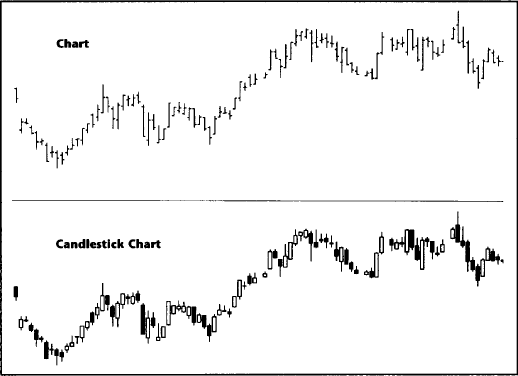

Different body/shadow combinations have different meanings. Days in which the difference between the open and close prices is great are called Long Days. Likewise, days in which the difference between the open and close price is small, are called Short Days. Remember, we are only talking about the size of the body and no reference is made to the high and/or low prices. (See Figure 12.3.)

Spinning Tops are days in which the candlesticks have small bodies with upper and lower shadows that are of greater length than that of the body. The body color is relatively unimportant in spinning top candlesticks. These candlesticks are considered as days of indecision. (See Figure 12.4.)

Figure 12.3

Figure 12.4 Spinning tops.

When the open price and the close price are equal, they are called Doji lines. Doji candlesticks can have shadows of varying length. When referring to Doji candlesticks, there is some consideration as to whether the open and close price must be exactly equal. This is a time when the prices must be almost equal, especially when dealing with large price movements.

There are different Doji candlesticks that are important. The Long-legged Doji has long upper and lower shadows and reflects considerable indecision on the part of market participants. The Gravestone Doji has only a long upper shadow and no lower shadow. The longer the upper shadow, the more bearish the interpretation. The Dragonfly Doji is the opposite of the Gravestone Doji, the lower shadow is long and there is no upper shadow. It is usually considered quite bullish. (See Figure 12.5.)

Figure 12.5 Doji candlesticks.

The single candlestick lines are essential to Japanese candlestick analysis. You will find that all Japanese candle patterns are made from combinations of these basic candlesticks.

A Japanese candle pattern is a psychological depiction of traders’ mentality at the time. It vividly shows the actions of the traders as time unfolds in the market. The mere fact that humans react consistently during similar situations makes candle pattern analysis work.

A Japanese candle pattern can consist of a single candlestick line or be a combination of multiple lines, normally never more than five. While most candle patterns are used to determine reversal points in the market, there are a few that are used to determine trend continuation. They are referred to as reversal and continuation patterns. Whenever a reversal pattern has bullish implications, an inversely related pattern has bearish meaning. Similarly, whenever a continuation pattern has bullish implications, an opposite pattern gives bearish meaning. When there is a pair of patterns that work in both bullish and bearish situations, they usually have the same name. In a few cases, however, the bullish pattern and its bearish counterpart have completely different names.

A reversal candle pattern is a combination of Japanese candlesticks that normally indicate a reversal of the trend. One serious consideration that must be used to help identify patterns as being either bullish or bearish is the trend of the market preceding the pattern. You cannot have a bullish reversal pattern in an uptrend. You can have a series of candlesticks that resemble the bullish pattern, but if the trend is up, it is not a bullish Japanese candle pattern. Likewise, you cannot have a bearish reversal candle pattern in a downtrend.

This presents one of the age-old problems when analyzing markets: What is the trend? You must determine the trend, before you can utilize Japanese candle patterns effectively. While volumes have been written on the subject of trend determination, the use of a moving average will work quite well with Japanese candle patterns. Once the short term (ten periods or so) trend has been determined, Japanese candle patterns will significantly assist in identifying the reversal of that trend.

Japanese literature consistently refers to approximately forty reversal candle patterns. These vary from single candlestick lines to more complex patterns of up to five candlestick lines. There are many good references on candlesticks, so only a few of the more popular patterns will be discussed here.

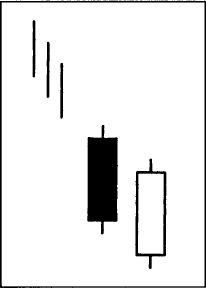

Dark Cloud Cover. This is a two day reversal pattern that only has bearish implications. (See Figure 12.6.) This is also one of the times when the pattern’s counterpart exists but has a different name (see Piercing Line). The first day of this pattern is a long white candlestick. This reflects the current trend of the market and helps confirm the uptrend to traders. The next day opens above the high price of the previous day, again adding to the bullishness. However, trading for the rest of the day is lower with a close price at least below the midpoint of the body of the first day. This is a significant blow to the bullish mentality and will force many to exit the market. Since the close price is below the open price on the second day, the body is black. This is the dark cloud referred to in the name.

Piercing Line. The opposite of the Dark Cloud Cover, the Piercing Line, has bullish implications. (See Figure 12.7.) The scenario is quite similar, but opposite. A downtrend is in place, the first candlestick is a long black day which solidifies traders’ confidence in the downtrend. The next day, prices open at a new low and then trade higher all day and close above the midpoint of the first candlestick’s body. This offers a significant change to the downtrend mentality and many will reverse or exit their positions.

Figure 12.6 Dark cloud cover -.

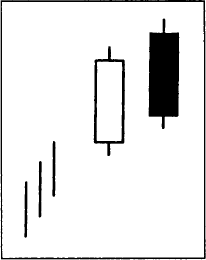

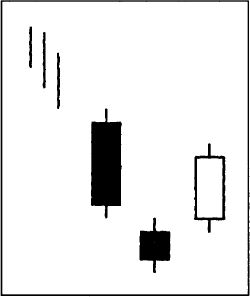

Evening Star and Morning Star. The Evening Star and its cousin, the Morning Star, are two powerful reversal candle patterns. These are both three day patterns that work exceptionally well. The scenario for understanding the change in trader psychology for the Evening Star will be thoroughly discussed here since the opposite can be said for the Morning Star. (See Figures 12.8 and 12.9.)

Figure 12.7 Piercing line +.

Figure 12.8 Evening star -.

Figure 12.9 Morning star +.

The Evening Star is a bearish reversal candle pattern, as its name suggests. The first day of this pattern is a long white candlestick which fully enforces the current uptrend. On the open of the second day, prices gap up above the body of the first day. Trading on this second day is somewhat restricted and the close price is near the open price while remaining above the body of the first day. The body for the second day is small. This type of day following a long day is referred to as a Star pattern. A Star is a small body day that gaps away from a long body day. The third and last day of this pattern opens with a gap below the body of the star and closes lower with the close price below the midpoint of the first day.

The previous explanation was the perfect scenario. Many references will accept as valid, an Evening Star which does not meet each detail exactly. For instance, the third day might not gap down or the close on the third day might not be quite below the midpoint of the first day’s body. These details are subjective when viewing a candlestick chart, but not when using a computer program to automatically identify the patterns. That is because computer programs require explicit instructions to read the candle chart, and don’t allow for subjective interpretation.

Each trading day, a decision needs to be made, whether it is to exit a trade, enter a trade, or remain in a trade. A candle pattern that helps identify the fact that the current trend is going to continue is more valuable than may first appear. It helps answer the question as to whether or not you should remain in a trade. Japanese literature refers to 16 continuation candle patterns. One continuation pattern and its related opposite cousin are particularly good at trend continuation identification.

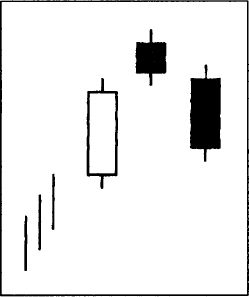

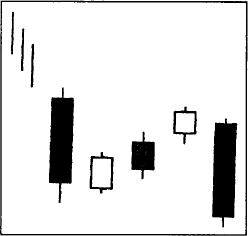

Rising and Falling Three Methods. The Rising Three Methods continuation candle pattern is the bullish counterpart to this duo and will be the subject of this scenario building. A bullish continuation pattern can only occur in an uptrend and a bearish continuation pattern can only occur in a downtrend. This restates the required relationship to the trend that is so necessary in candle pattern analysis. (See Figures 12.10 and 12.11.)

Figure 12.10 Rising Three Methods +.

Figure 12.11 Falling Three Methods -.

The first day of the Rising Three Methods pattern is a long white day which fully supports the uptrending market. However, over the course of the next three trading periods, small body days occur which, as a group, trend downward. They all remain within the range of the first day’s long white body and at least two of these three small-bodied days have black bodies. This period of time when the market appears to have gone nowhere is considered by the Japanese as a “period of rest.” On the fifth day of this pattern, another long white day develops which closes at a new high. Prices have finally broken out of the short trading range and the uptrend will continue.

A five day pattern such as the Rising Three Methods requires a lot of detail in its definition. The above scenario is the perfect example of the Rising Three Methods pattern. Flexibility can be applied with some success and this only comes with experience. For example, the three small reaction days could remain within the first day’s high-low range instead of the body’s range. The small reaction days do not always have to be predominantly black. And finally, the concept of the “period of rest” could be expanded to include more than three reaction days. Don’t ignore the Rising and Falling Three Methods pattern; it can give you a feeling of comfort when worrying about protecting profits in a trade.

A personal computer with software designed to recognize candle patterns is a great way to remove emotion, especially during a trade. However, there are a couple of things to keep in mind when viewing candlesticks on a computer screen. A computer screen is made up of small light elements called pixels. There are only so many pixels on your computer screen, with the amount based upon the resolution of your video card/monitor combination. If you are viewing price data that has a large range of prices in a short period of time, you may think that you are seeing many Doji days (open and close price are equal) when in fact, you are not. With a large range of prices on the screen, each pixel element will have a price range of its own. A computer software program that identifies patterns based on a mathematical relationship will overcome this visual anomaly. Hopefully, the above explanation will keep you from thinking that your software isn’t working.

A revolutionary concept developed by Greg Morris in 1991, called candle pattern filtering, provides a simple method to improve the overall reliability of candle patterns. While the short term trend of the market must be identified before a candle pattern can exist, determination of overbought and oversold markets using traditional technical analysis will enhance a candle pattern’s predictive ability. Concurrently, this technique helps eliminate bad or premature candle patterns.

One must first grasp how a traditional technical indicator responds to price data. In this example, Stochastics %D will be used. The stochastic indicator oscillates between 0 and 100, with 20 being oversold and 80 being overbought. The primary interpretation for this indicator is when %D rises above 80 and then falls below 80, a sell signal has been generated. Similarly, when it drops below 20 and then rises above 20, a buy signal is given. (See Chapter 10 for more on Stochastics.)

Here is what we know about stochastics %D: When it enters the area above 80 or below 20, it will eventually generate a signal. In other words, it is just a matter of time until a signal is given. The area above 80 and below 20 is called the presignal area and represents the area that %D must get to before it can give a trading signal of its own. (See Figure 12.12.)

Figure 12.12

The filtered candle pattern concept uses this presignal area. Candle patterns are considered only when %D is in its presignal area. If a candle pattern occurs when stochastics %D is at, say 65, the pattern is ignored. Also, only reversal candle patterns are considered using this concept.

Candle pattern filtering is not limited to using stochastics %D. Any technical oscillator that you might normally use for analysis can be used to filter candle patterns. Wilder’s RSI, Lambert’s CCI, and Williams’ %R are a few that will work equally as well. (These oscillators are explained in Chapter 10.)

Japanese candlestick charting and candle pattern analysis are essential tools for making market timing decisions. One should use Japanese candle patterns in the same manner as any other technical tool or technique; that is, to study the psychology of market participants. Once you become used to seeing your price charts using candlesticks, you may not want to use bar charts again. Japanese candle patterns, used in conjunction with other technical indicators in the filtering concept, will almost always offer a trading signal prior to using other price-based indicators.

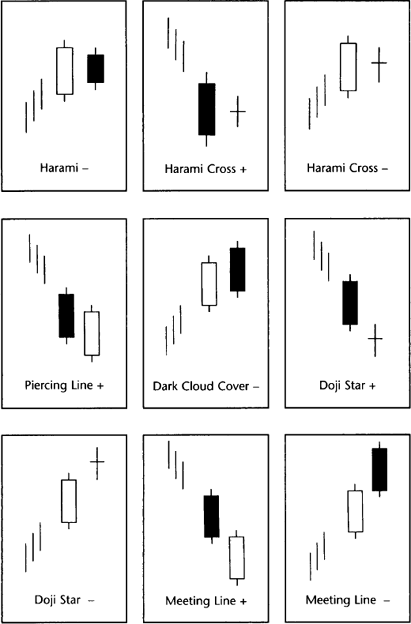

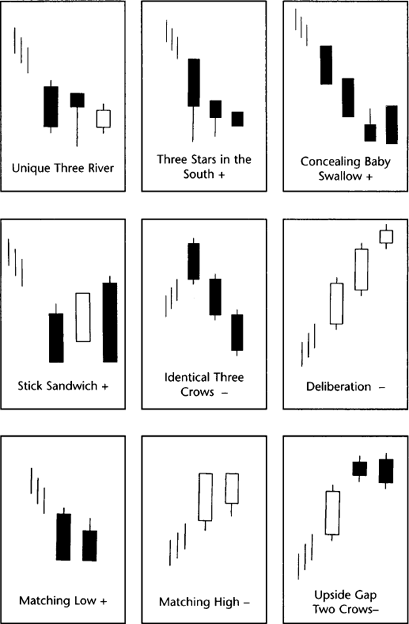

CANDLE PATTERNS

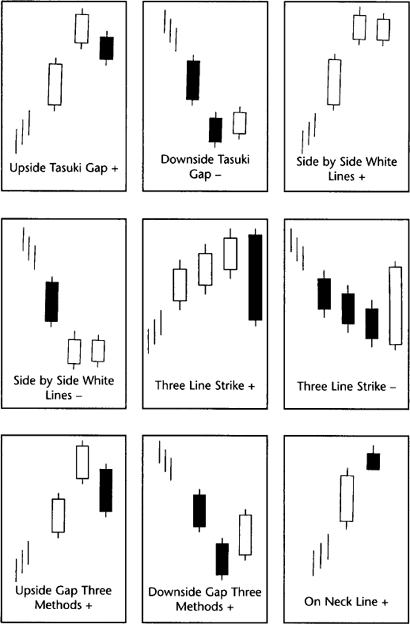

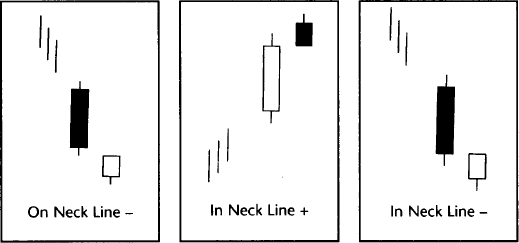

The candle patterns listed below comprise the library that is used to identify candlestick signals. The number in parentheses at the end of each name represents the number of candles that are used to define that particular pattern. The bullish and bearish patterns are divided into two groups signifying either reversal or continuation patterns.

| Bullish Reversals | Bearish Reversals |

| Long White Body (1) | Long Black Body (1) |

| Hammer (1) | Hanging Man (1) |

| Inverted Hammer (1) | Shooting Star (1) |

| Belt Hold (1) | Belt Hold (1) |

| Engulfing Pattern (2) | Engulfing Pattern (2) |

| Harami (2) | Harami (2) |

| Harami Cross (2) | Harami Cross (2) |

| Piercing Line (2) | Dark Cloud Cover (2) |

| Doji Star (2) | Doji Star (2) |

| Meeting Lines (2) | Meeting Lines (2) |

| Three White Soldiers (3) | Three Black Crows (3) |

| Morning Star (3) | Evening Star (3) |

| Morning Doji Star (3) | Evening Doji Star (3) |

| Abandoned Baby (3) | Abandoned Baby (3) |

| Tri-Star (3) | Tri-Star (3) |

| Breakaway (5) | Breakaway (5) |

| Three Inside Up (3) | Three Inside Down (3) |

| Three Outside Up (3) | Three Outside Down (3) |

| Kicking (2) | Kicking (2) |

| Unique Three Rivers Bottom (3) | Latter Top (5) |

| Three Stars in the South (3) | Matching High (2) |

| Concealing Swallow (4) | Upside Gap Two Crows (3) |

| Stick Sandwich (3) | Identical Three Crows (3) |

| Homing Pigeon (2) | Deliberation (3) |

| Ladder Bottom (5) | Advance Block (3) |

| Matching Low (2) | Two Crows (3) |

| Bullish Continuation | Bearish Continuation |

| Separating Lines (2) | Separating Lines (2) |

| Rising Three Methods (5) | Falling Three Methods (5) |

| Upside Tasuki Gap (3) | Downside Tasuki Gap (3) |

| Side by Side White Lines (3) | Side by Side White Lines (3) |

| Three Line Strike (4) | Three Line Strike (4) |

| Upside Gap Three Methods (3) | Downside Gap Three Methods (3) |

| On Neck Line (2) | On Neck Line (2) |

| In Neck Line (2) | In Neck Line (2) |

*This chapter was contributed by Gregory L. Morris.