Chapter 3: Preparation and Interpreting Financial Statements

Now, we have the section where we prepare and analyze all the above-mentioned financial statements. Since I promised to make your work as simple as possible, we may use shortcuts and simple examples to make everyone understand how each of the important financial statements is prepared. From the chapters above, we have already established that the main financial statements entail the balance sheet, the income statement, and the cash flow statement. However, for the sake of making the process of accounting much easier, we will include other documents in this chapter, such as the trial balance and the statement of owner's equity.

Preparing and Interpreting the Trial Balance

Although the trial balance is not classified as a major financial statement, it is the basis for preparing all the financial statements. Essentially, the general ledger is the basis for preparing all the other financial statements. However, a general ledger might have errors. Preparing the trial balance will help us deal with any errors that may have occurred in the general ledger. The main reason I have included the trial balance on this list is to help you see how financial statements are developed from one piece of information to another. My assumption is that you already have a bookkeeper and a well-organized ledger book. The entire process of accounting starts with a bookkeeper recording all transactions in specialty accounts. Once the transactions accumulate, they are summarized and recorded in the general ledger. The general ledger transactions are then summarized under specific accounts at the close of the trading period. It is at this point where we have to prepare a trial balance to verify whether the information recorded in the general ledger is up to date. If the information is not accurate, we may never be able to prepare an accurate income statement, which will mean that we won't arrive at the right statement of owner's equity and, consequently, an erroneous balance sheet.

In the simplest terms possible, the trial balance lists the closing balances of credit and debit transactions over a given trading period. For instance, if your business has been operating from January to December, the trial balance tries to compare the transactions over this period to see whether they balance. The equation for the trial balance states that

Assets + Expenses + Drawings = Liabilities + Revenue + Owners Equity

This equation shows that the assets of a business summed up with expenses and withdrawals from the business must add up to the liabilities, revenue, and owner's equity. In other words, all the assets and expenses of the business can only be funded by money borrowed (liability), money earned (revenue), or money invested (owners’ equity/ capital).

As you can see from the sample trial balance above, all the credit entries sum up with all the debit entries; hence the equation works.

The first step to preparing a trial balance is to consolidate all the balances in the ledger accounts and cash book.

Once you have all the information you need, prepare a 3 column worksheet. The first column should hold the account name, the second column debit, and the third column credit balances.

Now fill out the account name and the corresponding balances in the appropriate debit or credit column.

In the end, total the credit balances and the debit balances. They should be equal.

For simplicity, arrange the balances of the following accounts on the debit side of your trial balance:

Assets

Expense Accounts

Drawings Account

Cash Balance

Bank Balance

Any losses

For the credit side of the trial balance, arrange the following accounts balances:

Liabilities

Income Accounts

Capital Account

Profits

If the trial balance does not balance well, chances are that there are some mistakes in your data. Some of the mistakes that may lead to failure of the trial balance from balancing include:

An error made when transferring the information from the general ledger to your trial balance.

An error in adding up the sum of the amounts on either side of the trial balance.

An error in recording the amounts in the general ledger.

Making an entry in the wrong column. I.e., making a credit entry in the debit column.

A mistake made in the general ledger or subsidiary books of entry.

Benefits of the Trial Balance

The trial balance offers plenty of benefits to the business owner. This document is mostly used internally and is rarely required by external parties. Some of the benefits of the document include:

1. To verify that debits are equal to credits: If the debits and credits are not equal, there are chances that there are some errors in the accounting or bookkeeping process. It is the work of the accountant and bookkeeper to find such errors and correct them.

2. To find the uncovered errors in journalizing: This document will help you detect any errors occurring in subsidiary books of entry. If you cannot balance the accounts, errors must be tracked back to the root.

3. To find the uncovered errors in posting: The trial balance also helps the accountant detect errors occurring due to wrong entries or posting.

4. To make financial statements: The trial balance is the primary document that lays the ground for preparing the other financial statements. It is not recognized as a financial statement, but it must be present for you to prepare the other financial statements.

5. To list the accounts at a single place: The trial balance helps reconcile all the accounts in one place. In most cases, accounts are recorded in specialty books, which can be hard to track.

Shortcomings of the Trial Balance

With all the benefits offered by the trial balance, the statement also has a lot of shortcomings. This document is vital for the internal correction of errors, but it may not be helpful in some instances due to the following shortcomings.

1. The trial balance cannot prove that all transactions have been recorded. For instance, if you omit a transaction on both credit and debit sides, the trial balance will still balance, even though a crucial transaction is missing.

2. It does not prove whether the ledger entries are wrong or correct. For instance, if you make an entry error such that, instead of recording $400, you enter $4000, the trial balance will balance well as long as the figure is recorded on both sides.

3. It cannot find any missing entries from the journal.

Preparing and Interpreting the Income Statement

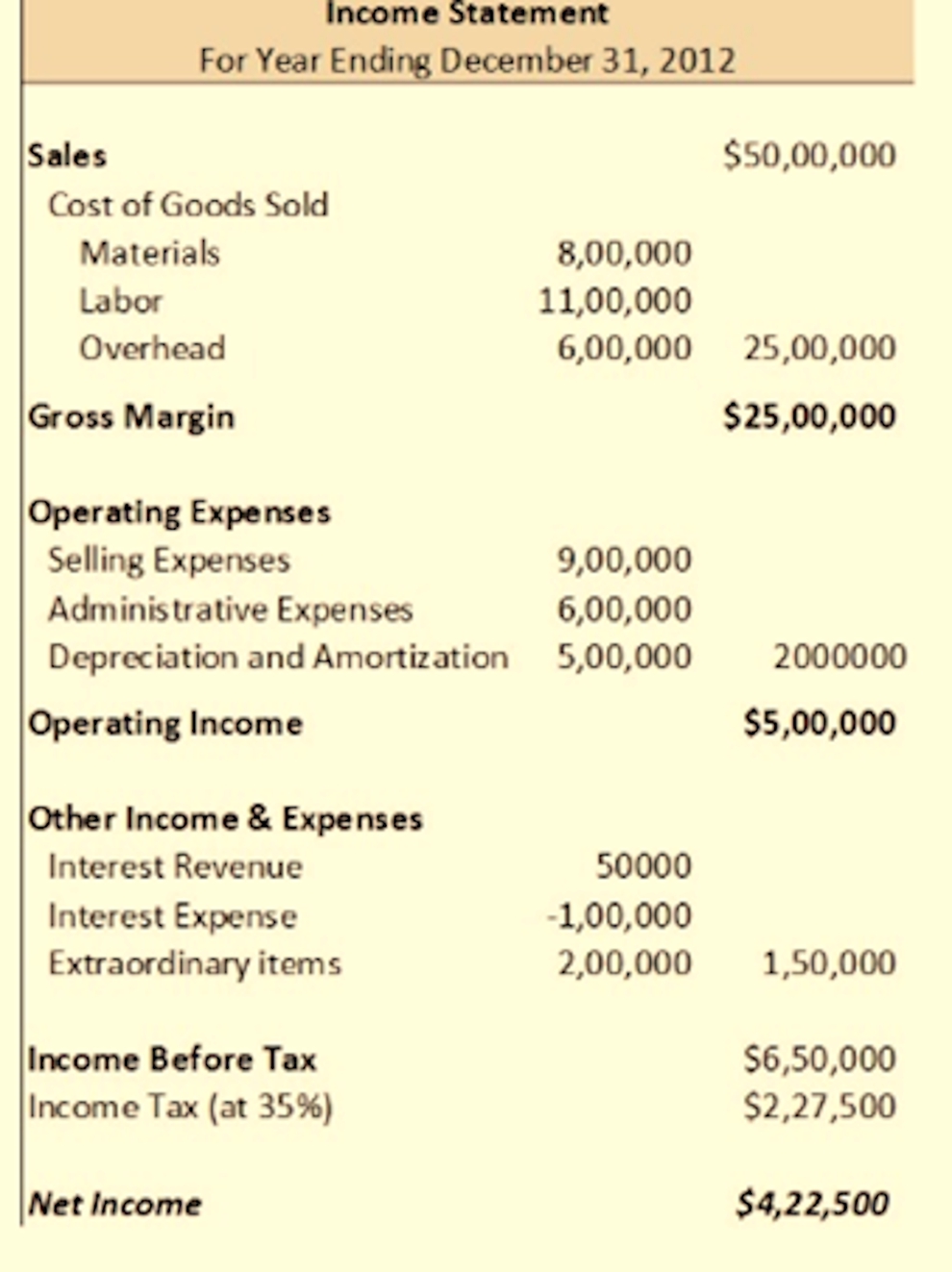

The income statement or the profit and loss statement is a summary of the income and expenditure of a business over a trading period. As we have already seen, the income statement summarizes the financial performance of a business over a given period of time. We have already established that the data needed to prepare the income statement is obtained from the general ledger. From your recorded transactions, determine the expenses and the revenues and compile them in a table to determine your net incomes. Here is a step by step guide on how to prepare the income statement.

Step 1: Calculate the Gross Profit

The first step in preparing the income statement is determining the gross profit. When preparing the income statement, the items are systematically arranged on a template. The first item at the top of your list is the total revenue. As we have already seen, you can calculate the total revenue by adding revenue from the sale of goods and services with revenues from other sources such as interests or sales of assets. Once you have the total revenue subtract direct costs from it to determine the gross profit.

Gross Profit = Gross Revenue- Direct Costs

The gross profit is the income made by the company before deducting indirect expenses such as operational costs, taxes, etc. You can express the gross profit in percentage, which is known as the gross margin.

Gross Margin = Gross profit/Gross Revenue

For example, if you sell t-shirts in an uptown shop and you purchase 100 t-shirts at the cost of $10 each. Your direct expenses would be $1000. If you were to sell all the t-shirts at the price of $12 each, your total income would be $120. Your gross profit, in this case, would be $120- $100=$20, and the gross margin would be ($20/$120) x 100 =16.6%

The gross margin indicates the financial stability of the business. If your business has a higher gross margin, it is performing well and is likely to remain afloat for a longer period. However, a low gross margin might mean that you need to change some aspects of your operations to reduce expenses or increase revenue.

Step 2: Calculate Earnings Before Interest and Taxes(EBIT)

On your income sheet template, you are also going to calculate the earnings before interest and taxes. This value represents the income the company would have made if it were not required to pay taxes or interest on loans. This value is arrived at by deducting the cost of goods and operational expenses from the gross revenue. Since we have already subtracted the cost of goods from the gross revenue to determine the gross profit, the simplest way to determine EBIT is by subtracting operational expenses from your gross profit. Operational costs are the normal daily expenses of a business, such as rent, electricity, etc.

EBIT= Gross Profit - Operational Costs

Step 3: Calculate the Earnings Before Tax (EBT)

Once you have obtained your EBIT value, you should determine the earnings of the company before tax. Most small business owners make the mistake of assuming that the EBIT is the true income of business before tax. In reality, the true earning of business before tax must account for depreciation. Through day to day operations, a business is likely to lose some value from its assets. You must, therefore, calculate the value of depreciation and subtract from the EBIT value to determine the earnings before tax.

EBT= EBIT- Depreciation

Step 4: Calculate the Net Income

Lastly, calculate the net income of the business to determine whether the company makes a profit or loss during the trading period in question. The EBT value above does not show the true earnings of your business. To determine the net income, you have to subtract indirect expenses from the earnings before taxes. Some of the indirect expenses include taxes and insurance costs.

Net profit/loss =EBT- Indirect expenses

The main purpose of preparing the income sheet is to determine whether the business is making profits or losses. The formula above gives a final value of your income, and that will be your net income or loss. It is important to note that the value you get will depend on your accuracy. If you fail to include some expenses or revenues in your income sheet, you are likely to get a false value. Businesses operate based on different models. In other words, you should try to understand your business model and use your best judgment to ensure that all the sources of revenue and expenses are accounted for in the income sheet.

If you are new to accounting, you may find using an accounting software complex. For those who do not know how to use complex accounting tools, just stick to using the basic MS excel. Microsoft's excel provides easy to use income sheet templates that you can use to prepare your income sheet.

Here is an example of a simple income sheet.

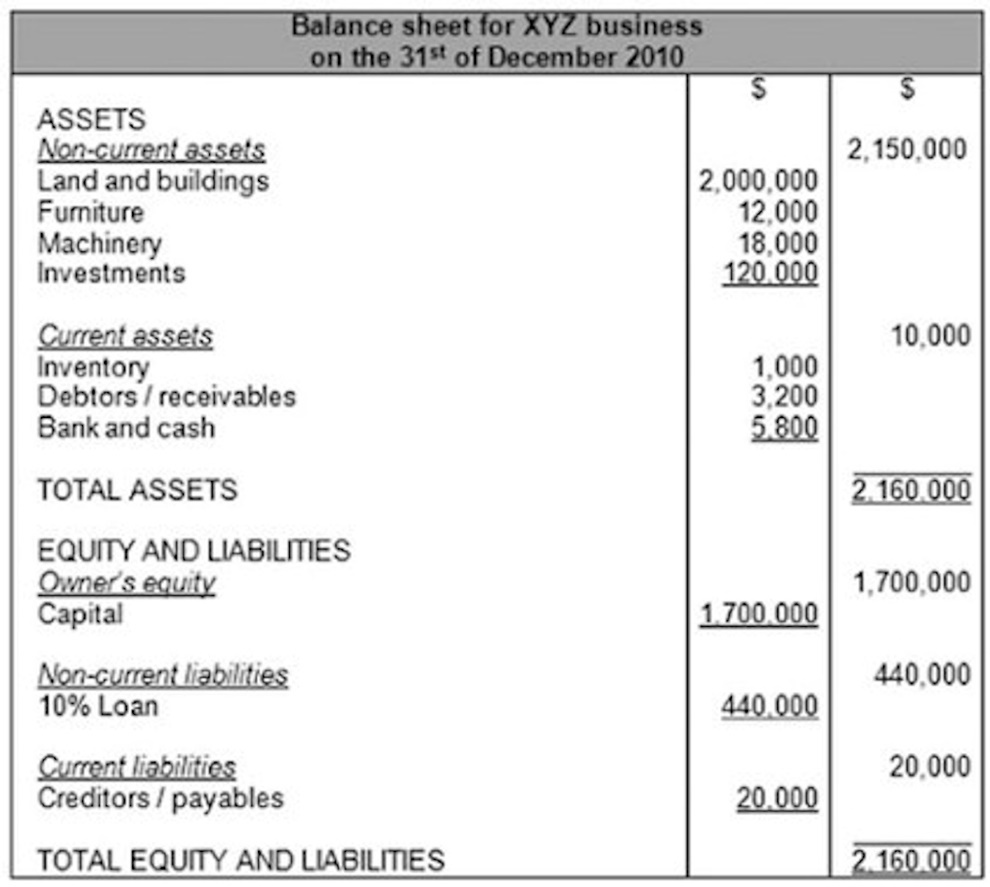

Preparing and Interpreting the Balance Sheet

The balance sheet is a statement that shows the book value of a business. As we have already mentioned, you can even prepare a balance sheet on the first day of your business. However, once your business starts operating, the value of your business starts changing due to profit and losses being made from daily operations. For this reason, it is necessary to prepare the income statement before you think about preparing the balance sheet.

As we have already seen, the balance sheet is made up of 3 key items; the assets, liabilities, and owners' equity. The reason why I recommend preparing the income sheet before preparing the balance sheet is that you must first calculate your owner's equity to be able to balance your balance sheet.

The balance sheet is very important to the owners of the business as well as the external users. For the owner of the business, the balance sheet makes it possible to determine the assets of the company. It is through reviewing the assets of the company that the owners can plan for the future. The balance sheet also provides a vivid picture of the liabilities and the value of the company as a whole. As we have seen, the formula for the balance sheet states that.

Assets = Liabilities + Shareholders’ Equity

Step1: Determine the Reporting Date and Period

The first step when it comes to preparing the balance sheet is determining the reporting date. As we have mentioned, a balance sheet is prepared at a snapshot of time. In other words, it is used to show the value of a company on a specific date. When preparing the balance sheet, you need to account for assets, liabilities, and owner's equity on the date of preparation. The date you choose is usually referred to as the reporting date. For most businesses, a balance sheet can be prepared quarterly, semi-annually, or annually. For those who prepare quarterly, they have to prepare 4 balance sheets in a year. This type of reporting provides the best platform for reviewing the growth of the business. The quarterly approach is used to review the growth of the business closely, especially for those who run small businesses.

Companies that use the annual approach usually review their books on 31st December. However, you may choose a date that you find ideal for your business. On the specific date, compile your business's assets, liabilities, and owner's equity to determine the value of your business.

Step 2: Identify Your Assets

Once you have selected your reporting date, start by reviewing all your assets on the date of balance sheet preparation. Usually, we list each asset in its line then sum up the assets, as you can see from the balance sheet below. We have provided entries for cash, stock, accounts receivable, etc. All these components are assets and must be listed individually. The value for most of the assets can be obtained from your ledger book. At the start of every trading period, all balances from the previous trading period are brought forward into the new trading period ledger book. This means that your general ledger should contain all the information you need to prepare your balance sheet.

To simplify your work when preparing the balance sheet, list your item as current assets and long-term assets. The items to include among the current assets are cash and cash equivalents, accounts receivable, marketable securities, inventory, and other current assets. Under the long term assets section, you may list items such as company property, long term market securities, goodwill, etc.

When we prepare a balance sheet, we use a template that is divided into two main sections. One section will total the assets, and the other section will total the liabilities and owner's equity. If you don't know how to format the template for a balance sheet, just use the MS Excel balance sheet template shown below.

Step 3. Identify Your Liabilities

Once you are done with identifying and listing your assets, it is time to identify and list all your liabilities. Just like we did with assets, you should list your liabilities as current and long term. The items to include among current liabilities are accrued expenses, accounts payable, deferred revenue, the current value of long-term loans, etc. Under the long term liabilities section, you can include items such as deferred revenue, long term lease obligations, long term liabilities, among others. Include the subtotal for current liabilities and long term liabilities, then provide the final figure on the total liabilities.

Step 4: Calculate Shareholders’ Equity

Once you are done with listing and calculating the value for current and long term assets and liabilities, you need to calculate the owner's equity. If you are running a sole proprietorship, calculating the owner's equity is simple and direct. However, for a publicly-traded company, a lot of factors have to be considered when calculating the owner's equity. Some of the items to include to your shareholder's equity section are common stock, preferred stock, treasury stock, and retained earnings.

If you have the balance sheet prepared for the previous reporting date, you can use it to calculate the owner's equity easily. In a sole proprietorship, the owner's equity can simply be calculated by adding retained earnings to the previous owner's equity.

Owners’ equity = Owners equity from previous period + Retained earnings

This means that, before you prepare your balance sheet, you must first determine the value of retained earnings. I will show you later how to calculate retained earnings when we look at preparing the statement of owner's equity.

Step 5: Compare the sum of Assets with that of Liabilities and Owner's Equity

Once you have arrived at the value of the owner's equity, you should compare the sums of assets to that of liabilities and owner’s equity. If the value of the two does not balance, chances are that there are errors in your calculations. You may either have used the wrong figures, or you may have imported the wrong figures from the general ledger.

As you can see from the balance sheet above, the section for assets is summed up differently. The sum of the assets equals the sum of liabilities and the owner's equity.

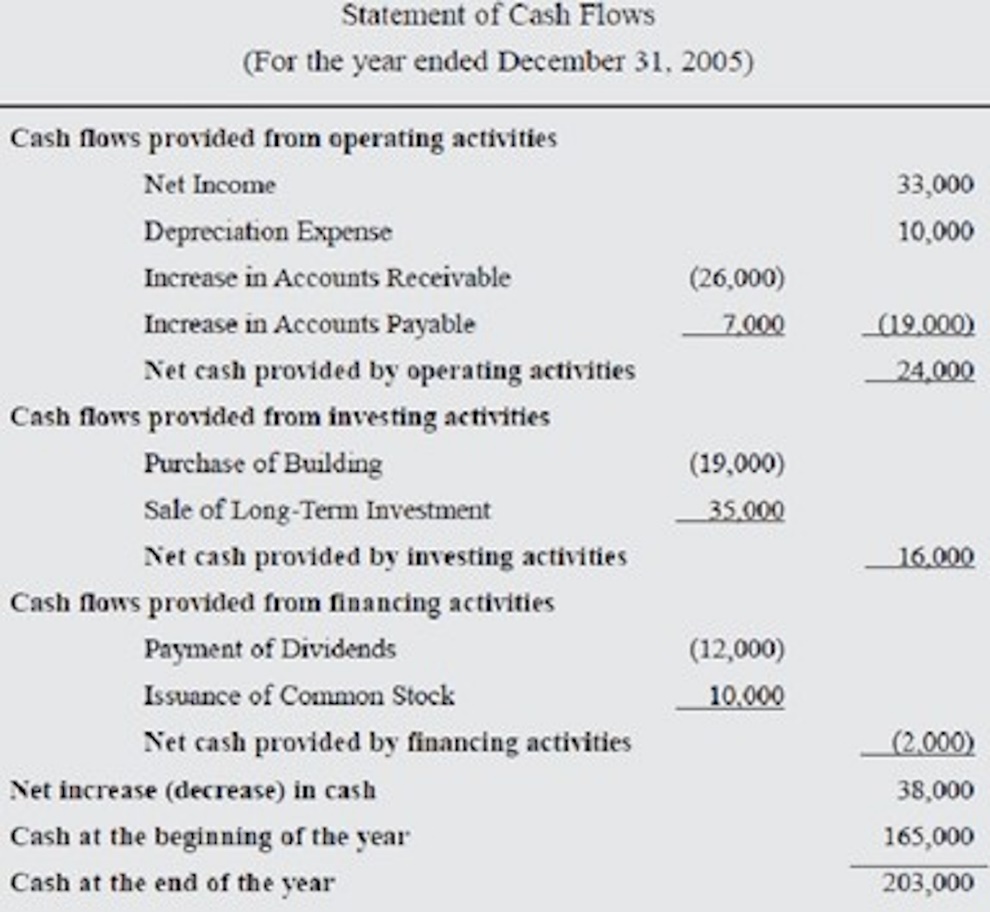

Preparing and Interpreting the Statement of Cash Flows

The next most important financial statement is the statement of cash flows. The statement of cash flows helps us determine the ability of a business to continue running its day to day business operations. When preparing the statement of cash flows, we divide the template into three sections. This is because the statement of cash flows is divided into cash flows from investing activities, financing activities, and operation activities, as we have already seen in the chapters above.

1. Operating activities cash flow: This refers to the money that the business spends on running day to day operations. Some of the activities to include under the operating cash flows include the money obtained from the selling of goods and services, money spent on paying rent, salaries, etc. Negative cash flows are subtracted from the positive cash flows when preparing the statement of cash flows. For instance, the money used in paying salaries has to be subtracted from the money earned from selling goods and services.

2. Investing activities cash flow: This refers to the money earned or spent from market securities or long term assets. For instance, money earned from selling and buying of fixed assets and marketable securities, among others. In simple terms, the money spent or earned from other investment activities apart from day to day business operations fall under this category.

3. Financing activities cash flow: The other section of the cash flow statement will include money earned or spent on financing activities. This includes the amount of money earned or spent due to cash or cash related transactions between the company and its owners, investors, or lenders. For instance, if the owners of the business take dividends from the business, it will be listed under the financing activities. At the same time, owners injecting capital or borrowing money from lenders can also fall under investing activities.

Step 1: Gather Cash Flows from Operations

The first step involves gathering and listing all the cash flows from operations. Cash Flows from operations are easy to gather, given that all the information is already available in your profit and loss statement. Any information that you may lack in your profit and loss document should be available in your ledger books.

The first item to list on your cash flow from operations is the earnings before interest and Taxes EBIT. You will also have to calculate the value for depreciation and include it on your cash flow statement. To get a clear picture of your cash flows, you must calculate the value for depreciation so that you do not end up overestimating the financial capacity of your business. Once you have obtained the value of depreciation, calculate the cash flows from operating activities using the formula.

Cash flow from operating activities = EBIT + Depreciation

As you can see from the example provided below, some of the values are in brackets while others are not. In most cases, the value of cash flows can be either positive or negative. The positive values represent cash flow activities that bring money into the business. On the other hand, negative cash flows represent activities that take money outside the business. Normally, we place the negative values in brackets instead of using a negative sign. For instance, if your EBIT value is $4000 and the depreciation value is $500, we will still use the formula shown above when listing the items, but in reality, we will subtract depreciation from the EBIT value. This is how we will represent the items on our statement of cash flows.

EBIT $4000

Depreciation ($500)

Operating cash flows ($3500)

This shows that, although we add depreciation to EBIT value, we are supposed to subtract because the depreciation takes money from the business.

Step 2: Calculate Cash Flow from Investing Activities

Once you are done with calculating the cash flows from operating activities, follow the same process to calculate cash flows from investing activities. As we have already seen, investing activities are those that add money to the business for investments or money that is drawn out of the business to investments. Activities that can be categorized under-investing include selling of long term assets, collecting settlement, loaning out money, collecting loans, etc.

Although we classify giving out loans and collecting loaned money under investing activities, loans received by your business from lenders are classified under financing activities. At the same time, money used on paying loans should also be classified under financing activities.

To calculate your investing activities cash flows, simply list the items in this section as we did with the operating activities above and subtract the negative cash flows from the positive cash flows.

Step 3: Calculate Cash Flow from Financing Activities

Lastly, calculate the cash flows from financing activities. In this section, just list the positive financing activities and list the negative ones. As we have seen, financing activities are those that add money to the business or remove money from the business to the business owners, creditors, or investors. For instance, if an investor were to pump money into the business to facilitate its running, that amount can be classified as a financing activity. The items to include in your financing activities cash flows are long term loans and payment for such loans, capital injection by owners, and collection of dividends, among others.

Once you have prepared the various cash flows, compile them in a final summary document. You will have to add the cash flows from the operating activities to that from investing and financing activities. If any of the cash flows are negative, deduct it instead of adding. For instance, if you have more money going out in the investing activities section than the money coming in, the chances are that your cash flows from investing activities will be negative. If the final value of cash flows from investing activities is negative, you will have to deduct it from the sum of the other two sections to determine the final value. If the cash flows from all the three investing activities are negative, you will have to add them together and place the final value in brackets to indicate that they are negative.

Preparing and Interpreting the Statement of Owner's Equity

Finally, we have to prepare and interpret the statement of owner's equity. The statement of owner's equity is an important document that helps determine the value of the company that is owned by the owners of the business. However, before we calculate the owner's equity, we must first calculate retained earnings. Look at our balance sheet above, and you will see how the owner's equity is calculated.

In the simplest terms, retained earnings are a portion of the earnings that the company does not distribute to shareholders. It can be used to grow the business in the outlined ways. The value of retained earnings increases if the business makes a profit and reduces if a business makes a loss. Since stakeholders' equity is a key part of the balance sheet, retained income must be shown as a component of stakeholder's equity.

The statement of retained earnings is used to determine the portion of a company's earnings that are retained in the business from the profit made. The retained earnings of a company are calculated by adding the retained earnings for the period in question to the retained earnings from the previous trading period. In other words, retained earnings of a company are compounded over a long period. If the company retained 30% of its profits during the first year of operation, the retained earnings for the second year of operations would be the value of the money that has to be retained from profits during that year plus the amount of retained earnings in the first year. This means that the value of retained earnings can grow or decrease depending on whether the company makes profits or losses in a given trading period. Retained earnings at the end of a trading period are calculated by the formula.

Retained Earnings = Beginning Balance of RE + Net (Profit/loss) - Dividends

As you can see from the formula, the amount of retained earnings brought forward must be used to arrive at the current retained earnings.

Once you get the value for retained earnings, use it to calculate the owner's equity. The owner's equity of any company is the portion of the company that can be claimed by the owners. Just like it is the case with retained earnings, owner's equity is compounded. To determine the owner's equity, you will have to determine the beginning balance of the owner's equity, then add investments by owners and retained earnings.

Owner's Equity = Beginning Balance + Investments by Owners ± Retained earnings