FIGURE 4.1 EUR/USD Spread on FXPRIMUS Market Watch

Source: Created with FX Primus Ltd, a PRIME Mantle Corporation PLC company. All rights reserved.

There are many reasons why retail traders are jumping on the forex bandwagon at an accelerated pace. This chapter lists the top 17 advantages. One of the biggest attractions lies in the market’s unparalleled liquidity. The forex market is the largest market in the world and is open 24 hours a day, 5 days a week. Traders can also go short at any time and take advantage of the massive leverage available, sometimes as high as 500:1.

Brokers provide other advantages. Some of these advantages include free tools, quality resources, free practice accounts, and the beauty of starting live trading with a low capital outlay. This chapter also discusses the biggest advantage in trading the forex market: It gives you a firm grip on global finance and other asset classes because it deals with the lowest common denominator in every country: the currency.

There are a myriad of reasons to explain why ordinary folks and fellow traders are jumping on board the forex market at an accelerated pace. Here we discuss 17 of these reasons.

One of the biggest draws of the forex market is its 24-hour accessibility, Mondays to Fridays. This accessibility is possible because markets around the world open and close at different times to facilitate cross-border global trade. Trading starts in Sydney, Australia, on Monday morning, and as the day goes on, more financial markets open for business: Japan, Singapore, and other parts of Asia. The Middle East, Europe, and finally the Americas follow.

When the U.S. market starts to close, Australia begins again, and the process goes on 24 hours a day until the markets close at 5 p.m. New York time on Friday. Today, at any point of time, there is always a major financial center open where commercial banks, hedge funds, corporations, and retail traders engage in trading currencies.

The 24-hour availability means that traders can trade virtually any time of the day, without waiting for markets to open. This accessibility is particularly helpful to people who hold a day job. In contrast, the stock or futures market is opened for about eight hours a day only.

The next table shows the opening and closing times of the top three financial markets in the world: London, New York, and Tokyo.

| Forex Market | Greenwich Mean Time |

| Tokyo open | 23:00 |

| Tokyo close | 08:00 |

| London open | 07:00 |

| London close | 16:00 |

| New York open | 12:00 |

| New York close | 21:00 |

The forex market today is undisputedly the largest financial market in the world. According to the 2010 Triennial Survey from the Bank for International Settlements, the official forex daily turnover was already USD4.0 trillion.

With such an immense amount of money in the financial system, there are always ready buyers and sellers to transact any amount at any price, especially the currencies of the major economies. Traders never have to worry about the inability to exit a trade once they enter.

Other asset classes, such as stocks, futures, options, and commodities, do not enjoy such massive liquidity. In fact, their illiquidity tends to restrict traders, especially during after hours.

The most liquid hours of the trading cycle occur when two major financial centers are open, such as during the period of Asia closing/Europe opening and Europe closing/U.S. opening.

“Slippage” is defined as the difference between the expected price of a trade and the price the trade actually executes at. However, due to the market’s liquidity, slippage is almost a non-issue as most brokers honor instantaneous trade executions from real-time quotes that are displayed on the traders’ screens. Slippage is inversely proportional to the volume available at each price level—the more volume there is, the less slippage a trader experiences.

During normal market conditions, there is usually no slippage. The only time slippage becomes an issue is when economic news is released. Such times lead to higher volatility than usual, and slippage may occur when markets move too fast.

When slippage does occur, a trader ends up paying more than the quoted spread. As an example, if the quoted spread for the EUR/USD is 2 pips and the trader gets slipped an additional 2 pips, the entire cost for the transaction becomes 4 pips.

In the United States, the Securities and Exchange Commission (SEC) introduced a rule that disallowed selling short in the equity market, except on an uptick. This rule limits traders who are able to spot opportunities in the market when prices fall fast.

Such restrictions are not confined to the equity market. In the futures market, a limit-down/limit-up rule prevents prices from moving beyond a certain percentage from the previous day’s settlement price. However, no such rules apply in the forex market. You can short a currency pair as much as you want at any time, without needing to wait for any upticks.

The main reason forex traders can go short at any time is because forex is traded in currency pairs. This means that in every currency transaction, there will always be one currency that gains over another.

As an example, when you go short on USD/CAD, you are in fact selling U.S. dollars and buying Canadian dollars. When you go long on USD/CAD, you are in fact buying U.S. dollars and selling Canadian dollars.

Depending on how the market moves, one currency will always be losing value over the other. It is for this reason that forex traders are able to go short at any time.

The forex market is considered an over-the-counter (OTC) market, where trading is done via an interbank network. OTC trading is the opposite of exchange trading, which occurs on futures exchanges or stock exchanges.

When trading is done on an exchange, rules apply. Here’s an example:

On August 12, 2011, four European countries—Italy, France, Spain, and Belgium—banned the short selling of stock in their markets to try to halt the precipitous plunge in value of troubled European banks. The move was similar to the decision made by the SEC when it banned the shorting of stocks in the United States during the 2008 financial crisis.

Such exchange-enforced rules do not apply to the forex market simply because, as an OTC market, forex is not traded on any exchange, and thus it is not governed by the rules of any exchange.

The forex market offers the highest leverage available for any financial instrument. Today, brokers offer leverage as high as 500:1. This means that traders can control $100,000 worth of currencies with only $200. Traders also have the flexibility to select the right amount of leverage to suit their style of trading.

Leverage is essential for retail traders to make good money from forex trading. This is because the average daily percentage move of a major currency is less than 1%, whereas a stock can easily have a 10% price move on any given day. With decent leverage, you do not need to fork out a huge amount to trade one standard lot.

Comparatively, high leverage is not available in the equity market. This means that equity traders have to fork out more margin to trade. Leverage is further reduced when the trader decides to short. Again, these restrictions do not exist in the forex market.

When you trade the forex market, the only transaction cost you pay is the spread. As discussed in Chapter 2, the spread is the difference between the buy price and the sell price, and it is the only fee charged by the broker for executing your trade.

In comparison, when equity traders execute a trade, both spread and commission are incurred as fees. Due to the intense competition from thousands of brokers worldwide, spreads have dropped dramatically in the last few years. That is good news for retail traders like you and me.

Today, most brokers offer a spread of only 2 to 3 pips on the EUR/USD, the most widely traded currency pair in the forex market.

Figure 4.1 shows a 2 pip spread for EUR/USD on FXPRIMUS.

FIGURE 4.1 EUR/USD Spread on FXPRIMUS Market Watch

Source: Created with FX Primus Ltd, a PRIME Mantle Corporation PLC company. All rights reserved.

As an OTC market, the forex market has no physical location; all trading is done electronically. All you need is an Internet connection and your favorite device and you can execute a trade anywhere in the world.

With the explosion of technology, almost everyone is connected to the Internet, and brokers have made it easy to access their platform via laptops, mobile phones, iPhones, iPads, and BlackBerrys.

I know many forex traders who travel the world while staying connected to their business of making money online. This freedom is truly something which the forex market can offer to anyone.

Every good broker offers a free practice or demo account. The practice account means two things: You trade with virtual money but you see live prices. Practice accounts allow new traders to get a taste of the forex market before jumping in with real funds.

Practice accounts are useful because they help both new and advanced traders alike. For new traders, practice accounts help them to build confidence and familiarity. For advanced traders, practice accounts help them to refine or test new strategies before using those exact systems to trade live.

Figure 4.2 shows a $50,000 demo account on FXPRIMUS.

FIGURE 4.2 $50,000 Demo Account on FXPRIMUS

Source: Created with FX Primus Ltd, a PRIME Mantle Corporation PLC company. All rights reserved.

Whenever governments, central bank chiefs, or finance ministers make economic/monetary policies that affect currencies, the announcements are readily available on almost every media imaginable within a few minutes. The bonus is that in most cases, warning signals or hints about future actions are dropped in advance. Here’s an example:

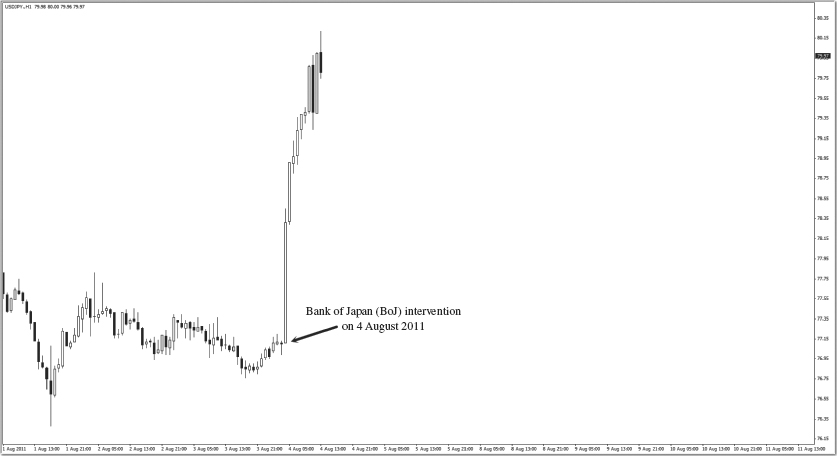

On August 4, 2011, the Bank of Japan (BOJ) sold 4.5 trillion yen to weaken its currency. This caused the USD/JPY to shoot up 300 pips in one day.

On October 31, 2011, Japan intervened again, selling a record 8 trillion yen. This move caused the yen to plunge more than 4% and caused the USD/JPY to shoot up over 350 pips in just three hours.

The fact of the matter is this: Prior to the interventions, BOJ governor Masaaki Shirakawa and the two finance ministers who were in charge at the time—Yoshihiko Noda on August 4 and Jun Azumi on October 31, 2011—had been preparing the markets for the move weeks before they acted.

They had dropped strong hints of an upcoming intervention to combat one-sided speculative trades on the Japanese yen. The reason why they were so transparent with their intentions was to signal the traders to stand on the same side as them and collectively go long on USD/JPY.

When traders participate in a coordinated action, chances of a sustainable rally become higher, and the central bank does not have to spend as much money to weaken the yen.

Market transparency in stocks or commodities, however, is a lot lower. For example, no large institution will signal its intention to acquire a stock at a certain price. If word gets out and traders take part in a similar coordinated action and start bidding up the stock price, the stock would become more expensive for the institution to acquire.

As shown in this report:

“Finance Minister Yoshihiko Noda said that the yen is “strongly overvalued” and made it clear he has been in touch with overseas authorities on currency matters, fueling speculation the government may act to stem the yen’s steady rise.”

Wall Street Journal, August 2, 2011

Due to its sheer size, no single entity, not even a central bank, can control the market price for an extended period. Take a look at Figure 4.3, which shows the intervention by the BoJ on August 4, 2011. Within four days, the price of USD/JPY had floated back down to the pre-intervention price. This is one of the main reasons why central banks are becoming less and less inclined to intervene and manipulate market prices.

FIGURE 4.3 USD/JPY Intervention Took Place

Source: Created with FX Primus Ltd, a PRIME Mantle Corporation PLC company. All rights reserved.

Figure 4.4 shows a chart on USD/JPY coming back down to pre-intervention price in just five days.

FIGURE 4.4 USD/JPY Coming Back Down to Pre-Intervention Price

Source: Created with FX Primus Ltd, a PRIME Mantle Corporation PLC company. All rights reserved.

Most forex brokers today provide a plethora of resources for traders to access. These include breaking news, trade alerts, live webinars, videos, and tutorials just to name a few. Traders today have a wide range of resources to get them up to speed to trade profitably.

In my experience, to be consistently profitable in the forex market, you need:

Some brokers offer resources that fulfill part or all three of these requirements. This is great news for new and experienced traders alike because getting a world-class education enables you to achieve consistent profits in the forex market.

Additionally, some brokers offer the ability to trade several asset classes all on the same platform. As you mature as a trader, it is only natural that you become more aware of capital flows and how they move into gold, oil, and commodities. You will appreciate the convenience of monitoring several markets all on one platform provided by the broker.

You don’t have to pick up a phone to tell someone on the other end to execute or close a trade for you. Although you are trading through your broker’s platform, you are in total control of the transaction the entire time.

You decide when you would like to go long on the GBP/USD or short on the NZD/USD. You have full control and autonomy over your account, which puts you in the driver’s seat to achieve consistent profits in the forex market.

One of the biggest advantages of getting started in forex trading is the low barrier to entry. Ten years ago, it was rare for someone to open a forex trading account for under USD100,000. However, with the explosion of forex brokers all over the world, you no longer have to lay out a lot of cash when you start trading live. Today, some brokers offer you the opportunity to open a real account with as little as USD100. Additionally, you won’t incur any setup fees, monthly payments, or software rental fees.

The brokers provide the trading software for free, and it comes with the practice account that we discussed earlier. Most forex brokers worldwide use the Meta Trader 4 platform, which is the most popular trading software loved by traders all around the world.

I speak from personal experience when I say that I could never really understand global finance until the day I started trading forex. As a trader, understanding market sentiment is key and knowing when risk is on or off helps me tremendously in my trading decisions.

Let’s take a look at an example. When you trade forex, you will be privy to the interest rates attached to each currency. Generally the currencies with higher interest rates are categorized as the risk currencies while those with lower interest rates are termed the safe haven currencies.

When risk appetite is strong in the markets, currencies with low interest rates—the low yielders—will be sold off in preference for the risk currencies, which give a better return. This trade is commonly known as the carry trade.

Conversely, when risk is off, the opposite effect happens. Risk currencies are sold off, and money moves back to the low yielders. The distinction is subtle but important: Currencies with high interest rates do not climb all the time.

In times of fear and panic, risk is off and traders are more concerned with parking their money in a safe place as opposed to earning a higher return. Trading the forex market helps you to decode such sentiment.

One of my earliest mentors told me an important money lesson that I’ll never forget: “Mario, if you want to be rich, you’ve got to get yourself on a platform that is recession-proof.” Knowing what I know now, I believe that trading the forex market is the best recession-proof platform to generate consistent income.

Why is this true? There is always an opportunity to go long or short. There is always an opportunity to make money. Forex traders are never affected by recessions, market cycles, or downturns.

This last point is the most important. It also takes slightly longer to explain. Trading the forex market gives you insights into other financial markets, such as stocks, oil, gold, commodities, and fixed income securities like bonds.

When you trade currencies, you are trading a unit of a country. This gives you the ability to see global capital flows.

Here’s an example of how forex helps in trading the stock market. Let’s take an example of a trader who is based in Singapore but decides to buy shares in global giant Apple, which is based in the United States.

To do this, the trader needs to exchange Singapore dollars (SGD) to U.S. dollars before using U.S. dollars to buy the Apple stock. In this regard, the trader is already exposed to the forex market through the USD/SGD exchange rate.

Fast forward three months. Our trader makes a 20% gain from the Apple stock. To realize the profit, the trader sells off the shares and converts the U.S. dollars back into Singapore dollars. However, during the three months, the Singapore dollar actually strengthened against the U.S. dollar.

Although our trader made 20% gains from Apple stock, the stronger Singapore dollar would have eroded a portion of his cash. Knowledge of the forex market could have induced the trader to take a short position on the USD/SGD currency pair so that he would not be susceptible to the wild swings of the USD/SGD exchange rate.

Three factors affect the price of commodities worldwide:

The U.S. dollar is used in vast amounts in international trade, and almost all global commodities are priced in U.S. dollars. Hence, understanding its role in the commodities arena is key. In general, the price of commodities is inversely proportional to the value of the U.S. dollar. This means that when the value of the U.S. dollar goes down, the price of commodities tend to rise.

There are two reasons for this. First, a weak dollar makes U.S. exports cheaper for foreign countries, which boosts sales of commodities, such as corn, wheat, and soybeans, and causes their prices to rise.

Understanding the nature of the U.S. dollar as a safe haven and a reserve currency helps us with the second reason—when risk is on, fund managers move money out of safe haven assets and into risk assets. This causes the U.S. dollar to be sold off (causing it to fall in value) in favor of risk assets, such as commodities. When speculation on commodities is rife in the futures market, price tends to rise.

We discuss strategies for other commodities in Chapter 8.

The key driver of bond prices is the prevailing interest rate in the country. Trading the forex market helps keep us abreast of the interest rate environment because it’s one of the drivers of currency flows.

It also helps us to be ahead of the curve. Here’s an example:

In Chapter 2, we discussed how high inflation normally brings about expectations for higher interest rates. Forex traders are among the first to take advantage of any impending rate hikes because rate hikes tend to strengthen the currency, and forex traders do not want to miss out on the chance to go long.

Once interest rates are hiked, the natural path is for bond prices to drop. Armed with this information ahead of time, forex traders can make calculated decisions on the benefits of owning a cheaper bond when prices drop. This is how forex trading helps with the buying and selling of bonds.

With a daily trading volume in excess of USD4 trillion, the forex market offers unparalleled advantages. Due to the sheer size of the forex market, its immense liquidity offers three advantages:

Another important aspect of the forex market is that it is the only financial market in the world that is open 24 hours a day, five days a week. International trade takes place continuously between countries, and the ability to buy and sell currencies must be available.

As quotes are given in currency pairs, traders have the ability to go long or short at any time, with absolutely no restrictions on going short. Considered an OTC market, the forex market also enjoys the privilege of not falling under the jurisdiction of any financial exchange.

When instruments are traded on an exchange, rules and regulations of both the country and the exchange apply. This sometimes can be more of a hindrance than a help to retail traders.

High leverage is also another advantage when trading the forex market. Leverage is provided by brokers. The higher the leverage employed, the less margin needed to control one standard lot of currencies.

To date, the leverage available on the forex market far outweighs the leverage available on either the equities or the futures market. Other benefits that brokers provide include low transaction costs, low account start-ups, free practice accounts, and free tools and resources. As the retail forex brokerage space becomes more and more competitive, brokers start to compete with one another to offer the best products and services to retail traders.

All this is good news for traders, who now have a wide array of choices to consider when starting on a forex journey.

Today, the forex market continues to attract retail traders all over the world at an unprecedented pace for three reasons: