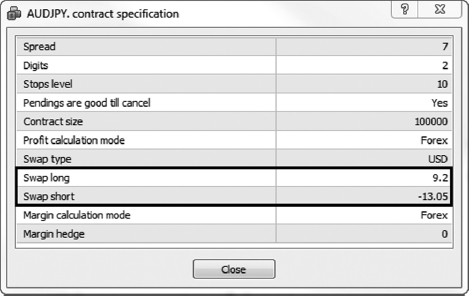

FIGURE 9.1 Positive Swap for Long Trades on AUD/JPY

Source: Created with FX Primus Ltd, a PRIME Mantle Corporation PLC company. All rights reserved.

Three characteristics define you as a position trader:

Two advantages come into play for position traders. The first point is that interest can be earned. This is because interest or swap is paid on the currency that is borrowed and earned on the one that is bought. This amount can be significant when trades are held for long periods of time.

Secondly, correlations between other financial instruments can be brought into play. In the financial world, capital flows in a fairly predictable manner. Position traders who have a great feel for the market can use their knowledge to predict how other markets will correlate to the flow of money in the forex market.

A great example is the commodity market. When risk is on, commodity currencies, such as the Australian dollar, the New Zealand dollar, and the Canadian dollar, tend to do well. Over time, the strengthening of these 3 currencies also translate into higher prices for the actual commodities involved. Examples include gold and oil.

This chapter explores three strategies with time frames of either the daily or weekly charts. The two aspects of position trading—swap and commodity correlation—are also explored to allow position traders to achieve maximum gains across several asset classes.

Every forex transaction involves the borrowing of one currency to buy another. This transaction also forms the basis of why traders can go long or short at any time.

As an example, if you are buying a currency with a higher interest rate than the one you are borrowing, the net interest rate differential will be positive, and you earn interest for every day that the trade remains open. Conversely, if the interest rate differential is negative, you will have to pay interest for every day that the trade remains open. You may know this as the carry trade.

Five P.M. in New York is considered the beginning and end of the forex trading day. Hence, any trading positions that are open beyond 5 P.M. are considered to be held overnight—or rolled over—and are subject to swap rates. The forex market is closed on Saturdays and Sundays, so no swap rate is incurred or earned over the weekend. However, most liquidity providers still apply the swap rules over the weekend.

To balance the effect of non-trading activities over the weekend, the forex market books three days of swap on Wednesday. Hence, if you hold a trade over 5 P.M. on a Wednesday evening, you will either incur or earn three times the normal rates.

The swap and fly strategy is a slow but steady technique that helps you to accumulate interest every day. You can even come out with a positive return after a period of time, even though the trade exits at breakeven.

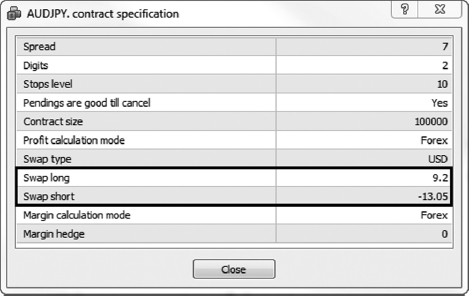

Figures 9.1 and 9.2 show how you can track which currency pairs give positive swap when you execute a long or short position in the currency market. Do note, however, that figures may be different for different brokers.

FIGURE 9.1 Positive Swap for Long Trades on AUD/JPY

Source: Created with FX Primus Ltd, a PRIME Mantle Corporation PLC company. All rights reserved.

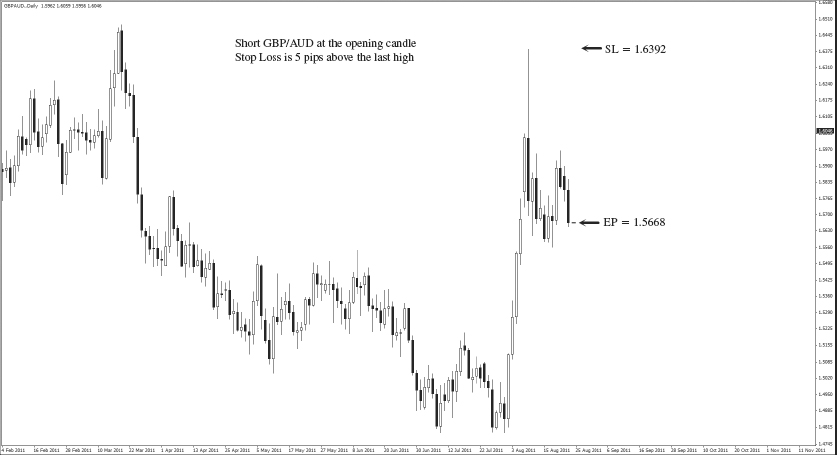

FIGURE 9.2 Positive Swap for Short Trades on GBP/AUD

Source: Created with FX Primus Ltd, a PRIME Mantle Corporation PLC company. All rights reserved.

The swap and fly method works with the daily candle (D1) and weekly candle (W1). This means that each candle on the chart represents 1 day or 1 week of price movement.

No indicators are used for this strategy.

This strategy is suitable for all currency pairs listed on the broker’s platform that have positive swaps for either long or short positions.

The main aim of this strategy is to earn as much interest as we can. Hence the first step is to find out which currency pairs on the broker’s platform offer the highest swap rates for both long and short positions.

If a positive swap is given on a long position, we look for a suitable long entry on the chart. If a positive swap is given on a short position, we look for a suitable short entry on the chart.

The next milestone is to shift the stop loss dynamically to the entry price, also known as the break-even price. This step is done when the market moves favorably in our direction. After a period of time, even if our “new” stop-loss level is hit, the trade is exited with a profit because of the swap earned.

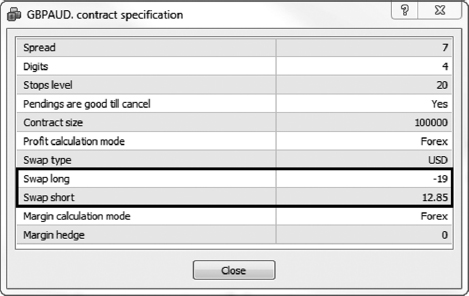

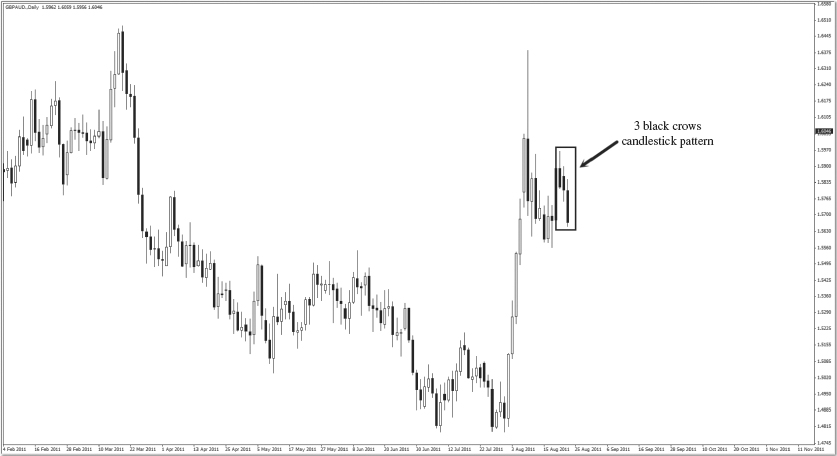

This strategy can be used in conjunction with any other high-time frame strategies. To illustrate the effect of this strategy, I am going to use common candlestick patterns, such as three white soldiers and three black crows, to illustrate a long and a short trade.

Three white soldiers is a bullish candlestick pattern consisting of three consecutive bull candles. Three black crows is a bearish candlestick pattern consisting of three consecutive bear candles.

We use the AUD/JPY on the daily time frame to illustrate the long setup. Here are the steps to execute the swap and fly strategy for long:

FIGURE 9.3 Identify a Three White Soldiers Candlestick Pattern

Source: Created with FX Primus Ltd, a PRIME Mantle Corporation PLC company. All rights reserved.

FIGURE 9.4 Set Stop Loss and Profit Target

Source: Created with FX Primus Ltd, a PRIME Mantle Corporation PLC company. All rights reserved.

FIGURE 9.5 Stop Loss Shifted to Entry Price

Source: Created with FX Primus Ltd, a PRIME Mantle Corporation PLC company. All rights reserved.

FIGURE 9.6 Trade Hits Breakeven After 36 Weeks

Source: Created with FX Primus Ltd, a PRIME Mantle Corporation PLC company. All rights reserved.

From the long example in Figure 9.6:

The swap for holding a long AUD/JPY position was AUD12 for every standard lot. This is equivalent to 1.2 pips. The swap per week is 1.2 pips × 7 = 8.4 pips. The swap for 36 weeks is 8.4 pips × 36 = 302.4 pips.

Once the position hits breakeven, there is no more risk for the trade. Swap is continuously earned for every day that the trade is open.

We use the GBP/AUD on the daily time frame to illustrate the short setup. Here are the steps to execute the swap and fly strategy for short:

FIGURE 9.7 Identify Three Black Crows Candlestick Pattern

Source: Created with FX Primus Ltd, a PRIME Mantle Corporation PLC company. All rights reserved.

FIGURE 9.8 Set Stop Loss and Profit Target

Source: Created with FX Primus Ltd, a PRIME Mantle Corporation PLC company. All rights reserved.

FIGURE 9.9 Stop Loss Shifted to Entry Price

Source: Created with FX Primus Ltd, a PRIME Mantle Corporation PLC company. All rights reserved.

FIGURE 9.10 Trade Hits Breakeven After 35 Weeks

Source: Created with FX Primus Ltd, a PRIME Mantle Corporation PLC company. All rights reserved.

From the short example in Figure 9.10:

The swap for holding a short GBP/AUD position was AUD14 per standard lot, which was equivalent to 1.4 pips. The swap per week is 1.4 pips × 7 = 9.8 pips. The swap for 35 weeks is 9.8 pips × 35 = 343 pips.

Once the position hits breakeven, there is no more risk for the trade. Swap is continuously earned for every day that the trade is open.

On FXPRIMUS platform, short positions on GBP/AUD and long positions on AUD/JPY give the highest positive swaps. For maximum results on this strategy, it is prudent to choose the currency pairs that yield the highest positive swap on the broker’s platform. Do take note that swap rates are not fixed. They move in tandem with central banks’ rates.

Once the trades are executed, the first milestone is to shift the stop loss to breakeven so that there is no more risk attached to the trade. We then allow the trade to remain open every day until the new stop loss is hit. Doing this allows us to earn positive swap every day.

Traders can also choose to close this trade before it exits, provided the risk to reward ratio is favorable. As an example, traders can choose to exit the entire position totally if the risk to reward ratio yields a minimum factor of 1:3.

For the long AUD/JPY trade, the stop loss was 570 pips. Hence, traders could have chosen to exit the trade entirely if the AUD/JPY was at a minimum of 1710 pips (570 × 3) above the entry price.

For the short GBP/AUD trade, the stop loss was 725 pips. Hence, traders could have chosen to exit the trade entirely if the GBP/AUD was at a minimum of 2175 pips (725 × 3) below the entry price.

Oil is one of the world’s basic necessities. Among other things, it is needed to run factories, plants, machinery, ships, and cars. A decline in oil prices is a nightmare for oil producers but a dream come true for oil consumers. The reverse is also true, when oil prices hit record highs. In July 2008, oil peaked at over USD147 a barrel. Those were the days when oil producers were smiling and oil consumers were sweating.

Canada is a country that exports most of its oil. In fact, as one of the world’s top ten oil-producing nations, its economy is severely hit when oil prices decline. Many traders today also utilize the price of oil to predict the movement of the Canadian dollar.

When oil prices are high, the Canadian dollar tends to strengthen. When oil prices are low, the Canadian dollar tends to weaken. Japan, in contrast, is considered a net oil importer. This causes the Japanese yen to weaken considerably when oil prices are high and vice versa.

Many traders ask me for a “magic” strategy to trade oil. However, I don’t particularly like to trade it because oil prices can be very volatile.

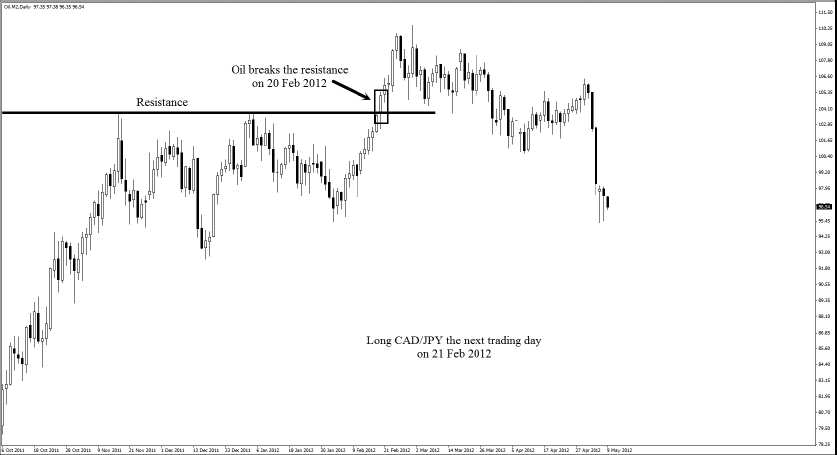

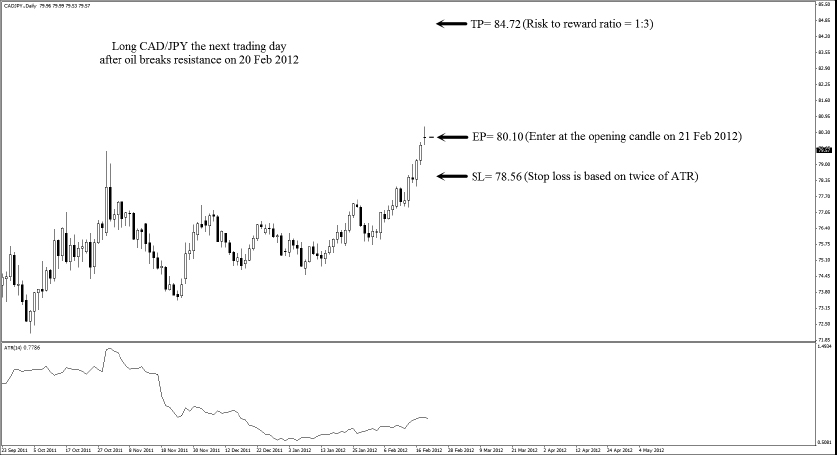

An easier improvisation of trading oil directly would be to utilize knowledge of oil prices to trade the CAD/JPY currency pair. As Canada is a net oil exporter and Japan is a net oil importer, the price of oil becomes a leading indicator for the movement of the CAD/JPY currency pair.

The commodity correlation method works with the daily charts (D1). This means that each candle on the chart represents 1 day of price movement.

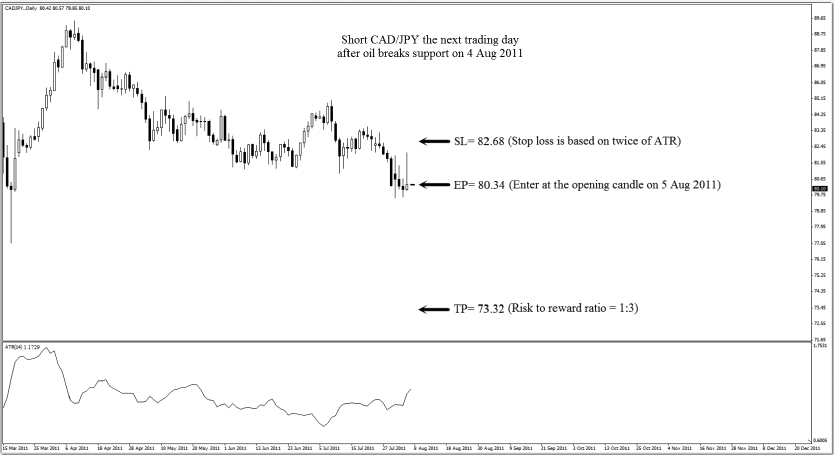

We use the average true range (ATR) indicator to set the stop loss for this strategy.

The ATR is an indicator developed by J. Welles Wilder to measure the volatility of the market. The true range is defined as the largest value of the absolute difference between the:

The ATR is an N-period exponential moving average of the true range. For example, ATR 14 is a 14-period exponential moving average of the true range.

A larger value of ATR indicates a higher volatility, and a smaller value of ATR indicates a lower volatility. We will use the ATR as a guide to set our stop losses and profit targets.

This strategy is used with CAD/JPY only, with the movement of oil prices acting as a leading indicator.

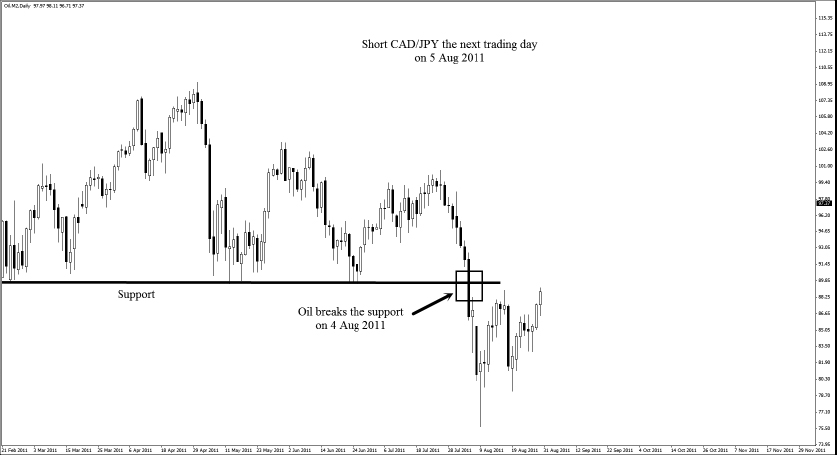

The price movement on the oil chart is used as a reference to trigger a trade on the CAD/JPY. Technical levels of support and resistance on the oil chart are used to spot long and short trades on CAD/JPY. If candles close above resistance on the oil chart, a long trade is triggered on the CAD/JPY the following day. Similarly, if candles close below support on the oil chart, a short trade is triggered on the CAD/JPY the following day.

The risk to reward ratio is set as 1:3. A bigger target is employed to allow the trade to run its course.

Here are the steps to execute the commodity correlation strategy for long:

FIGURE 9.11 Identify a Candle that Closes Above Resistance

Source: Created with FX Primus Ltd, a PRIME Mantle Corporation PLC company. All rights reserved.

FIGURE 9.12 Set Stop Loss and Profit Target

Source: Created with FX Primus Ltd, a PRIME Mantle Corporation PLC company. All rights reserved.

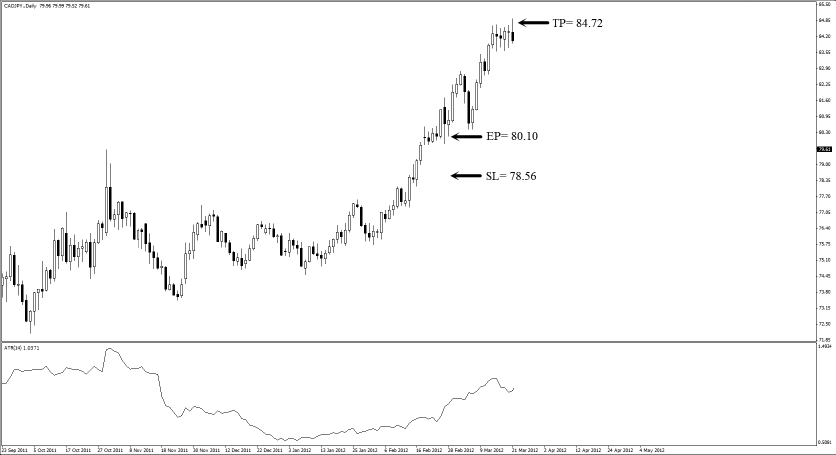

From the long example in Figure 9.13:

FIGURE 9.13 Trade Hits Profit Target

Source: Created with FX Primus Ltd, a PRIME Mantle Corporation PLC company. All rights reserved.

The risk for this trade is 154 pips, and the reward is 462 pips if the profit target is hit. The risk to reward ratio would be 1:3, which yields a tidy 9% return if we take a 3% risk.

Here are the steps to execute the commodity correlation strategy for short:

FIGURE 9.14 Identify a Candle that Closes Below Support

Source: Created with FX Primus Ltd, a PRIME Mantle Corporation PLC company. All rights reserved.

FIGURE 9.15 Set Stop Loss and Profit Target

Source: Created with FX Primus Ltd, a PRIME Mantle Corporation PLC company. All rights reserved.

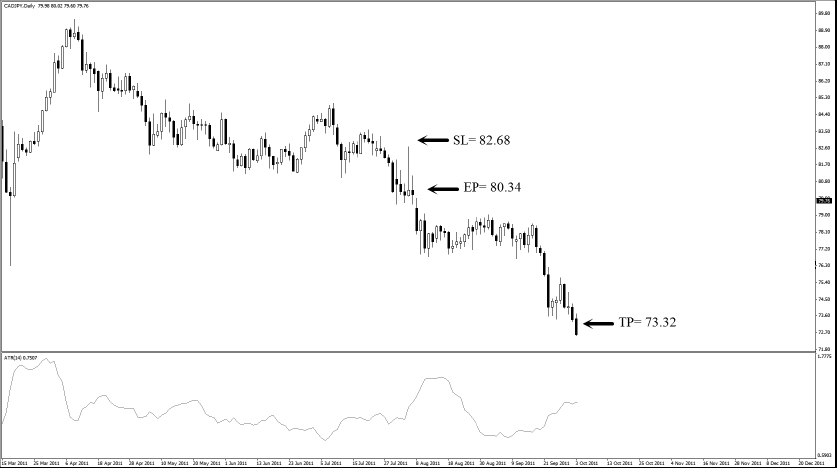

From the short example in Figure 9.16:

FIGURE 9.16 Trade Hits Profit Target

Source: Created with FX Primus Ltd, a PRIME Mantle Corporation PLC company. All rights reserved.

The risk for this trade is 154 pips, and the reward is 462 pips if the profit target is hit. The risk to reward ratio is 1:3, which yields a tidy 9% return if we take a 3% risk.

The correlation coefficient is a number that describes the extent to which two instruments are correlated to each other. The number oscillates between −1 and +1.

Commonly mistaken as a momentum oscillator, the correlation coefficient is instead a number that moves from periods of positive correlation to periods of negative correlation. Located on one end of the spectrum, +1 is considered a state of perfect positive correlation between the two instruments. If the number is anywhere between 0 and +1, the two instruments move in the same direction but with varying degrees of positive correlation.

On the other end of the spectrum, −1 is considered a state of perfect negative correlation between the two instruments. If the number is anywhere between 0 and −1, the two instruments move in the opposite direction but with varying degrees of negative correlation.

For much of 2011 and 2012, the correlation coefficient for gold and the dollar index was between −0.6 and −0.8. This means that if the dollar index was up, there was a 60% to 80% probability that gold prices would come down.

In contrast, if the dollar index was down, there was a 60% to 80% probability that gold prices would go up.

Here we explore how to trade spot gold using the U.S. Dollar Index as a reference. The U.S. Dollar Index is an exchange-traded index that represents the value of the U.S. dollar in terms of a basket of six major foreign currencies. These are:

The price action of the dollar index gives us an idea of how the U.S. economy is performing compared to other major world economies.

On August 15, 1971, the United States unilaterally terminated the Bretton Woods system of having the U.S. dollar pegged to gold at USD35 an ounce. At the same time, the U.S. dollar became a reserve currency.

The U.S. Dollar Index was started in March 1973. Its beginning value was 100.000.

Historically, from 1967 until 2012, the Dollar Index averaged 98.51, reaching a historical high of 164.72 in February 1985 and a low of 70.698 on March 16, 2008, during the global financial crisis.

Gold prices, however, have steadily been climbing. The end of 2011 marked the eleventh straight year of gold’s spectacular bull run, hitting a record high of USD1920 an ounce on September 16, 2011.

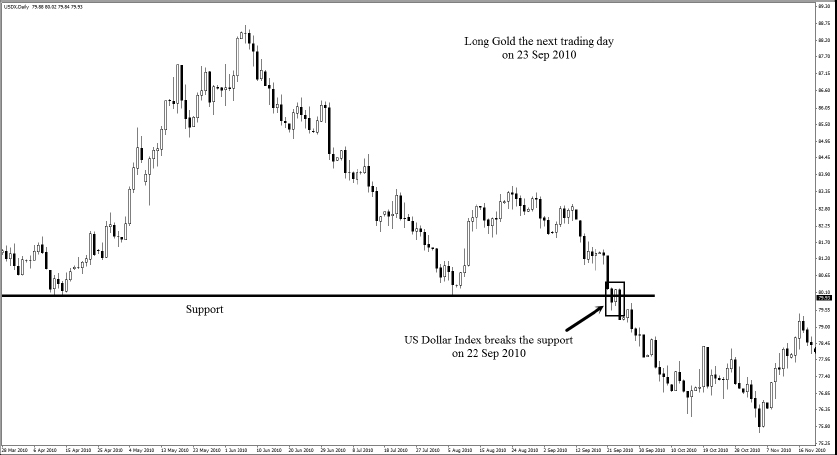

This strategy seeks to exploit the inverse relationship between the Dollar Index and the price of gold. According to the World Gold Council, “While holding all else equal, gold tends to rise when the US dollar falls.”

In November 2010, Federal Reserve chairman Ben Bernanke announced a second round of quantitative easing (QE2) by injecting USD600 billion into the financial system. The added supply of US dollars in the system caused gold prices to hit record highs within a month.

In September 2012, in a move widely touted as “QE3,” the Federal Reserve said it would expand its holdings of long-term securities with open-ended purchases of USD40 billion of mortgage debt a month. The announcement caused the price of gold to hit a 7-month high. With central banks worldwide taking unprecedented measures to ensure ample liquidity in the global financial system, the inverse relationship between the Dollar Index and gold prices looks set to continue.

Let’s see how this strategy works.

The commodity correlation strategy works with the daily candle (D1). This means that each candle on the chart represents 1 day of price movement.

We use the ATR indicator.

Use spot gold or XAU/USD only, with the price action of the Dollar Index as a leading indicator.

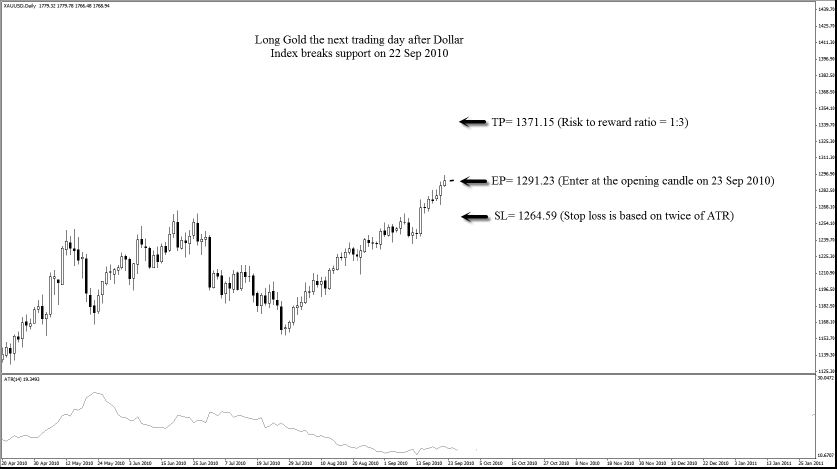

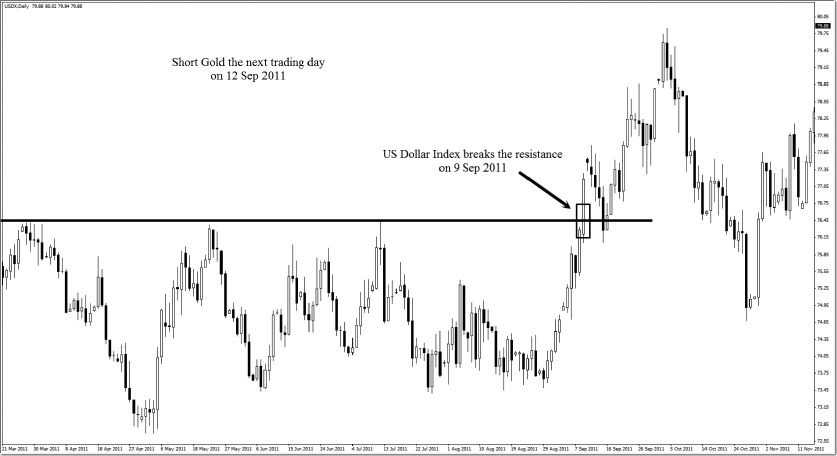

The price action of the Dollar Index is used as a reference to trigger a trade on the XAU/USD. Technical levels of support and resistance on the Dollar Index chart are used to spot long and short trades on XAU/USD. If a candle closes below support on the Dollar Index chart, a long trade is triggered on the XAU/USD the following day. Similarly, if a candle closes above resistance on the Dollar Index chart, a short trade is triggered on the XAU/USD the following day.

The risk to reward ratio is set as 1:3. A bigger target is employed to allow the trade to run its course.

Here are the steps to execute the commodity correlation strategy for long:

FIGURE 9.17 Identify a Candle that Closes Below Support

Source: Created with FX Primus Ltd, a PRIME Mantle Corporation PLC company. All rights reserved.

FIGURE 9.18 Set Stop Loss and Profit Target

Source: Created with FX Primus Ltd, a PRIME Mantle Corporation PLC company. All rights reserved.

From the short example in Figure 9.19:

FIGURE 9.19 Trade Hits Profit Target

Source: Created with FX Primus Ltd, a PRIME Mantle Corporation PLC company. All rights reserved.

The risk for this trade is 2,664 pips, and the reward is 7,992 pips if the profit target is hit. The risk to reward ratio is 1:3, which yields a tidy 9% return if we take a 3% risk.

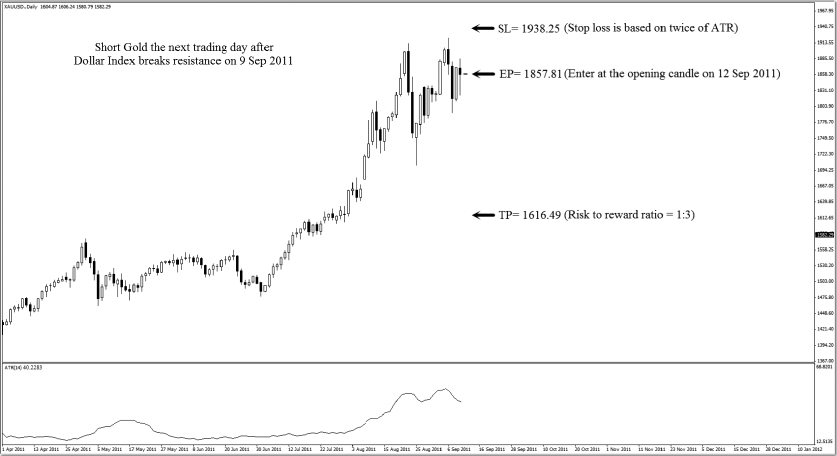

Here are the steps to execute the commodity correlation for short:

FIGURE 9.20 Identify a Candle that Closes Above Resistance

Source: Created with FX Primus Ltd, a PRIME Mantle Corporation PLC company. All rights reserved.

FIGURE 9.21 Set Stop Loss and Profit Target

Source: Created with FX Primus Ltd, a PRIME Mantle Corporation PLC company. All rights reserved.

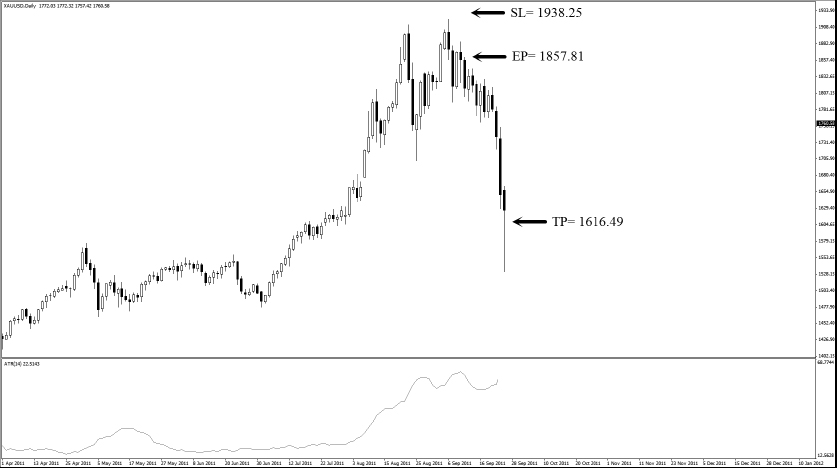

From the short example in Figure 9.22:

FIGURE 9.22 Trade Hits Profit Target

Source: Created with FX Primus Ltd, a PRIME Mantle Corporation PLC company. All rights reserved.

The risk for this trade is 8,044 pips, and the reward is 24,132 pips if the profit target is hit. The risk to reward ratio is 1:3, which yields a tidy 9% return if we take a 3% risk.

Part of the commodity correlation strategy seeks to take advantage of the positive correlation between oil prices and the CAD/JPY currency pair. Using oil prices as a reference, trades are triggered on the CAD/JPY. This strategy is especially suited to traders who would like to trade oil but prefer not to experience the volatility associated with it.

Part 2 of the commodity correlation strategy seeks to take advantage of the negative correlation between the Dollar Index and gold prices. Using the Dollar Index as a reference, trades are triggered on XAU/USD, which is the price for spot gold on FXPRIMUS.

With the Federal Reserve announcing its plans to keep interest rates low until the middle of 2015, the inverse relationship between the U.S. dollar and gold prices looks set to remain. This strategy is ideal for gold traders all around the world because it provides an objective way to take an entry for gold, using the Dollar Index as an important reference.

In late 2007, China overtook Japan to become Australia’s largest trading partner. In 2009, China became Australia’s largest export market, consuming commodities such as iron ore, coal, gas, and wool in record amounts.

According to Australia’s department of Foreign Affairs and Trade, Australia’s total trade with China in 2010 was $105 billion, almost 24% more than the previous year. It was the first time that Australia’s two-way trade with a single nation topped the $100 billion level. Forty years ago, two-way trade between China and Australia was less than $100 million.

For this reason alone, Australia’s economy tends to move in tandem with China’s economy. When China reports good numbers on the Purchasing Managers Index (PMI), gross domestic product (GDP) or the trade balance, Australia’s currency tends to rise. Similarly, when China reports disappointing figures, the Australian dollar tends to fall as well.

This strategy seeks to take advantage of the movement of the AUD/USD by taking cue from China’s reported figures and monetary policies. It is especially useful since we are not able to freely trade the Chinese currency (yuan) yet.

The Siamese twins method works with the daily candle (D1). This means that each candle on the chart represents 1 day of price movement.

No indicators are used for this strategy.

This strategy is applicable only to AUD/USD.

When China announces good data, such as high GDP and high PMI numbers, the AUD tends to strengthen for two reasons.

We take a long position on AUD/USD immediately after China announces better-than-expected data. Similarly, we take a short position on AUD/USD immediately after China announces worse-than-expected data.

I call this strategy Siamese twins because the economies of China and Australia are joined at the hip. When China does well, the Australian economy flourishes, and vice versa.

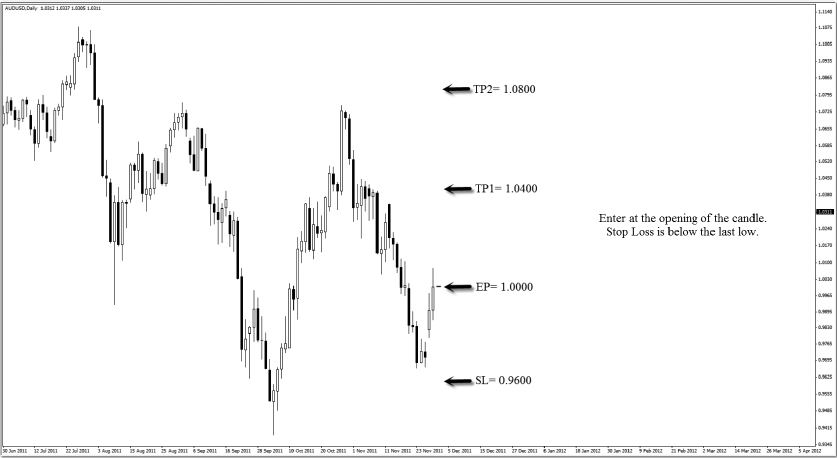

Here are the steps to execute the Siamese twins strategy for long:

FIGURE 9.23 News Release

Source: Created with FX Primus Ltd, a PRIME Mantle Corporation PLC company. All rights reserved.

FIGURE 9.24 Set Stop Loss and Profit Targets

Source: Created with FX Primus Ltd, a PRIME Mantle Corporation PLC company. All rights reserved.

From the long example in Figure 9.25:

FIGURE 9.25 Trade Hits Profit Targets

Source: Created with FX Primus Ltd, a PRIME Mantle Corporation PLC company. All rights reserved.

The risk for this trade is 400 pips, and the reward is 800 pips if both targets are hit. The risk to reward ratio is 1:2, which yields a 6% return if we take a 3% risk.

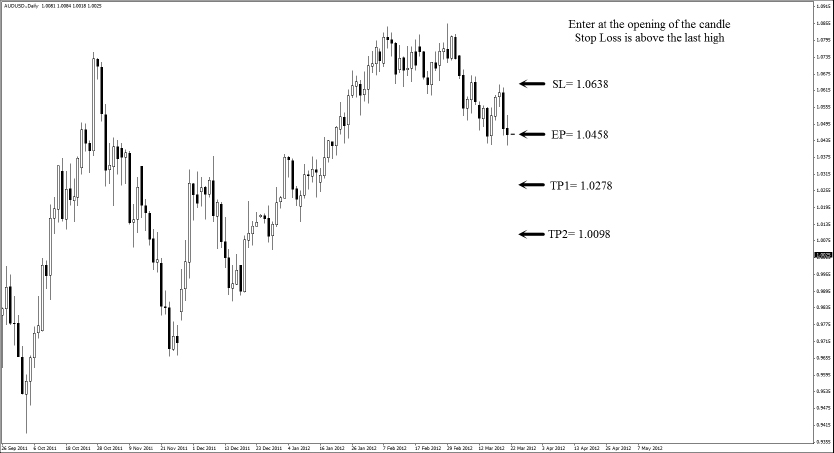

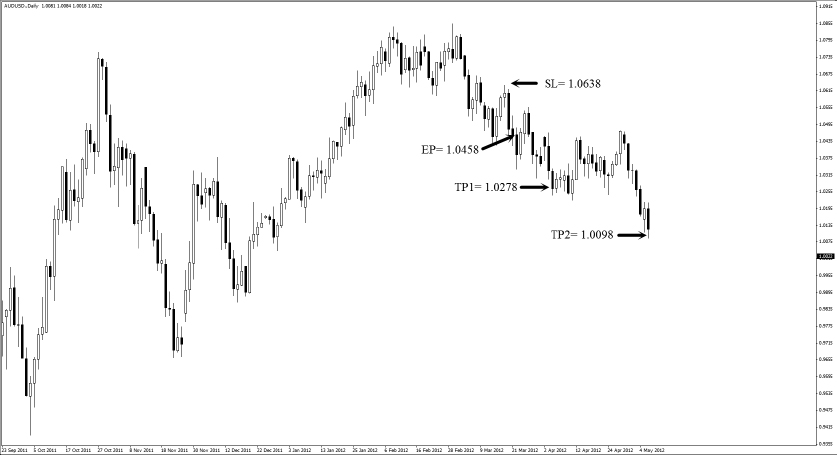

Here are the steps to execute the Siamese twins strategy for short:

FIGURE 9.26 News Release

Source: Created with FX Primus Ltd, a PRIME Mantle Corporation PLC company. All rights reserved.

FIGURE 9.27 Set Stop Loss and Profit Targets

Source: Created with FX Primus Ltd, a PRIME Mantle Corporation PLC company. All rights reserved.

From the long example in Figure 9.28:

FIGURE 9.28 Trade Hits Profit Targets

Source: Created with FX Primus Ltd, a PRIME Mantle Corporation PLC company. All rights reserved.

The risk for this trade is 180 pips, and the reward is 360 pips respectively if both targets are hit. The risk to reward ratio is 1:2, which yields a 6% return if we take a 3% risk.

The Siamese twins strategy is perfect for position traders because of the long time frame employed. When China announces news—either good or bad—the subsequent effect on the Australian economy may take weeks or even months to play out.

As we learned in the swap and fly strategy, a long AUD/USD trade can give you additional swap as well. This amount can be very significant if the trade is held for several months before it is exited.