Chapter 10

Strategies for Mechanical Traders

As a mechanical trader, your main focus in trading the markets is not time driven but system driven. Your trades are based on a fixed routine, regardless of time frame and regardless of market activity.

This style of trading is especially suited to newbies because strategy execution is based purely on a set of fixed steps or rules. Due to its non-dependence on specific time frames, the three strategies discussed here employ time frames that span three different categories: scalping, day trading, and position trading.

The first strategy, the guppy burst, is based on the 5-minute (M5) chart. The second strategy, English breakfast tea, is based on the 15-minute (M15) chart. The third strategy, good morning Asia, is based on the daily (D1) chart.

Many newbies love the fixed routine by which mechanical trades are set up. It is also the reason why many go on to develop automated trading systems by coding the trading rules into software.

Let’s have a look at all three strategies.

STRATEGY 15: GUPPY BURST

The first step in developing a mechanical trading system is to understand and describe market behavior. The next step is to figure out the rules for entries and exits. The guppy burst seeks to exploit trading profits when the market is quiet.

There is a window of around three hours between the close of the U.S. market and the opening of the Asian market. The forex market is relatively quiet during this time and tends to move in a gentle yet predictable manner.

The market then springs to life again when the Asian market opens. The guppy burst seeks to identify the trading range during this 3-hour window and anticipate a potential breakout of the trading range.

To take full advantage of this potential breakout, I have selected one of the most volatile crosses, the GBP/JPY, commonly known as the guppy among forex traders.

Time Frame

The guppy burst method works with the 5-minute candle (M5). This means that each candle represents 5 minutes of price movement.

Indicators

We use only pure price action; no indicators are used for this strategy.

Currency Pairs

The guppy burst method applies only to the GBP/JPY.

Strategy Concept

After the trading range is identified, we place pending long and pending short orders. The entry price for the pending long is at the resistance level while the stop loss is located at the support level. The entry price for the pending short is at the support level while the stop loss is at the resistance level.

The profit target is set at twice the amount of the stop loss. As an example, if the stop loss is 50 pips from the entry price, the profit target will be 100 pips. This is a risk to reward ratio of 1:2.

Long Trade Setup

The reference candle for this strategy is the one that corresponds to 5 P.M. New York time, which is the closing time of the U.S. market. This is the 00:00-hour candle on the FXPRIMUS platform.

Here are the steps to execute the guppy burst strategy for long:

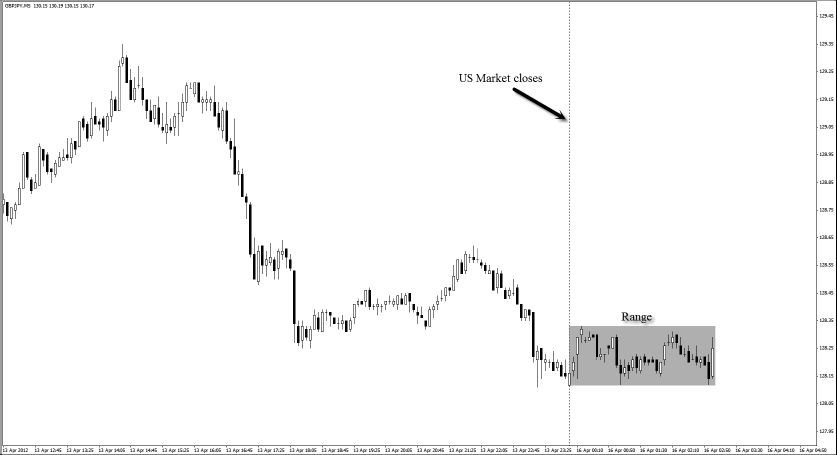

1. Identify the trading range in the first three hours after the U.S. market closes by referencing the highest high (resistance) and the lowest low (support) in these three hours. (See

Figure 10.1.)

2. Place a pending buy stop order with entry price at the highest high (resistance).

3. Set the stop loss at the lowest low (support). (See

Figure 10.2.)

4. Measure the number of pips between the EP and SL. The profit target is double that number of pips. In this example, the number of pips between EP (128.16) and SL (127.86) is 30, so the TP will be 60 pips above the EP at 128.76. (See

Figure 10.3.)

From the long example in Figure 10.4:

Entry price = 128.16

Stop loss = 127.86

Profit target = 128.76

The risk for this trade is 30 pips, and the reward is 60 pips. The risk to reward ratio is 1:2, which yields a tidy 6% return if we take a 3% risk.

Short Trade Setup

The reference candle for this strategy is the one that corresponds to 5 P.M. New York time, which is the closing time of the U.S. market. This is the 00:00-hour candle on the FXPRIMUS platform.

Here are the steps to execute the guppy burst strategy for short:

1. Identify the trading range in the first three hours after the U.S. market closes by referencing the highest high (resistance) and the lowest low (support) in these three hours. (See

Figure 10.5.)

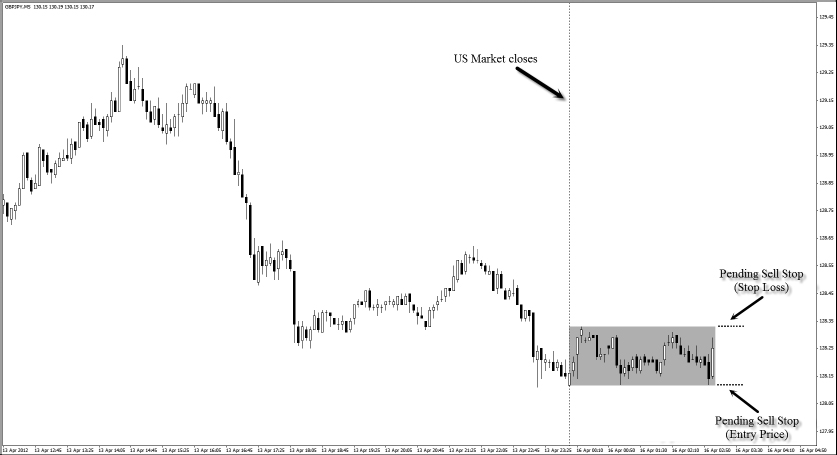

2. Place a pending sell stop order with entry price at the lowest low (support).

3. Set the stop loss at the highest high (resistance). (See

Figure 10.6.)

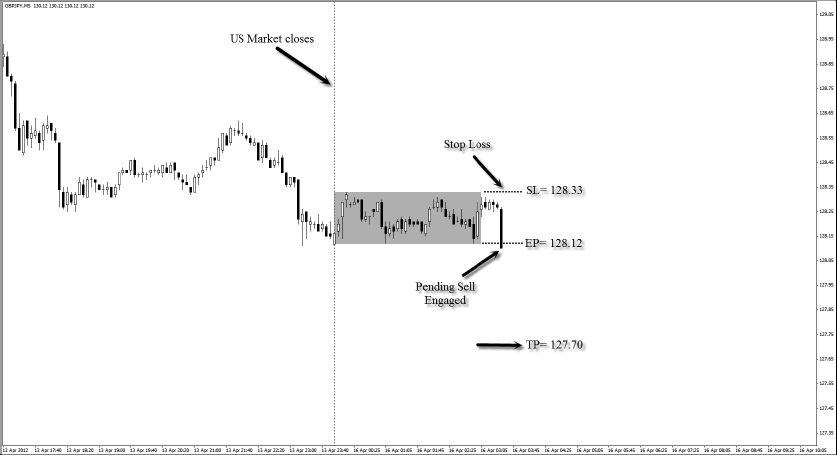

4. Measure the number of pips between the EP and SL. The profit target is double that number of pips. In this example, the number of pips between EP (128.12) and SL (128.33) is 21, so the TP will be 42 pips below the EP at 127.70. (See

Figure 10.7.)

From the short example in Figure 10.8:

Entry price = 128.12

Stop loss = 128.33

Profit target = 127.70

The risk for this trade is 21 pips, and the reward is 42 pips. The risk to reward ratio is 1:2, which yields a tidy 6% return if we take a 3% risk.

Strategy Roundup

As there is no way to anticipate when the market will reach the entry price, the best option is to create one pending long order and one pending short order after you have identified the trading range of the three-hour window.

Once either of the pending orders is triggered, delete the other pending order immediately. As an example, if the pending long order gets triggered first, delete the pending short order. If the pending short order gets triggered first, delete the pending long order.

This strategy is suitable for traders who are available during a specific time of the day to execute the trade during the three-hour gap.

STRATEGY 16: ENGLISH BREAKFAST TEA

When traders trade a particular currency pair for a long period of time, they may start to observe certain characteristics or behaviors of that currency pair. These characteristics or behaviors could happen during market opening hours, market closing hours, major news releases, Christmas and New Year holidays, financial year closings, and so on.

In my years of trading, I have noticed peculiar behaviors in various currency pairs. In this strategy, I share one of my observations about the GBP/USD during the London opening hours.

Time Frame

The English breakfast tea method works with the 15-minute candle (M15). This means that each candle represents 15 minutes of price movement.

Indicators

We use pure price action, and no indicators are used for this strategy.

Currency Pair

This strategy is applied to the GBP/USD only.

Strategy Concept

The English breakfast tea strategy is based on an observation I’ve had on the GBP/USD for a while now. This occurs before and after the London market opens in the morning.

Here’s what I discovered: When the GBP/USD trends in one direction from 04:15 hours to 08:30 hours London time, it has a tendency to move in the other direction after 08:30 hours.

Hence, we first compare the closing price of the 15-minute (M15) candle that corresponds to 04:15 hours and 08:15 hours London time to determine the direction of the GBP/USD. We then enter a trade in the opposite direction at 08:30 hours London time.

As an example, if the closing price of the M15 candle at 08:15 hours is lower than the closing price at 04:15 hours, we go long at 08:30 hours. If the closing price of the M15 candle at 08:15 hours is higher than the closing price at 04:15 hours, we go short at 08:30 hours.

The stop loss is fixed at 30 pips, and there are three profit targets for this strategy with risk to reward ratios of 1:1, 1:2, and 1:3. In other words, the profit targets are 30 pips, 60 pips, and 90 pips respectively.

Long Trade Setup

The 10:30-hour candle of the charts on FXPRIMUS platform is used to illustrate this strategy because it corresponds to London time 08:30 hours.

Here are the steps to execute the English breakfast tea for long:

1. The closing price of the M15 candle at 10:15 hours must be lower than the closing price at 06:15. (See

Figure 10.9.)

2. Enter at the opening of the candle at 10:30 hours. This is the entry price.

3. Set the stop loss at 30 pips below the entry price.

4. There are three profit targets at 30 pips, 60 pips, and 90 pips above the EP respectively. (See

Figure 10.10.)

From the long example in Figure 10.11:

Entry price = 1.5900

Stop loss = 1.5870

Profit target 1 = 1.5930

Profit target 2 = 1.5960

Profit target 3 = 1.5990

The risk for this trade is 30 pips, and the reward is 90 pips if all three targets are hit. The risk to reward ratio is 1:3, which yields a tidy 9% return if we take a 3% risk.

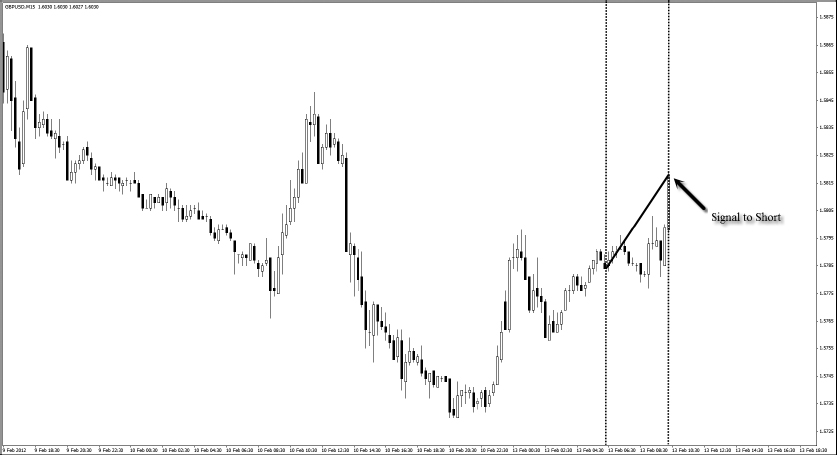

Short Trade Setup

The 10:30-hour candle of the charts on FXPRIMUS platform is used to illustrate this strategy because it corresponds to London time 08:30 hours.

Here are the steps to execute the English breakfast tea for short:

1. The closing price of the M15 candle at 10:15 hours must be higher than the closing price at 06:15 hours. (See

Figure 10.12.)

2. Enter at the opening of the candle at 10:30 hours. This is the entry price.

3. Set the stop loss at 30 pips above the entry price.

4. There will be three profit targets at 30 pips, 60 pips, and 90 pips below the EP respectively. (See

Figure 10.13.)

From the short example in Figure 10.14:

Entry price = 1.5819

Stop loss = 1.5849

Profit target 1 = 1.5789

Profit target 2 = 1.5759

Profit target 3 = 1.5729

The risk for this trade is 30 pips, and the reward is 90 pips if all three targets are hit. The risk to reward ratio is 1:3, which yields a tidy 9% return if we take a 3% risk.

Strategy Roundup

This strategy is based on a fixed time period every day, specifically geared towards the opening of the London market. The rules are simple and specific because there is no confusion as to the direction of the trade. Going long or short is the first step that new traders normally get confused on when they begin discretionary trading.

With its clear-cut rules and mechanical execution, the English breakfast tea method eliminates the guesswork in terms of strategy direction.

STRATEGY 17: GOOD MORNING ASIA

A fair number of traders prefer to trade the U.S. and Europe sessions of the forex market because they feel that the market tends to be more exciting at those times. These traders consider the Asian session boring and quiet most of the time.

However, many part-time retail traders who are based in the United States and Europe miss out trading opportunities in the U.S. and Europe sessions because of work or business commitments. The only time they can trade happens to fall within the perceived boring and quiet Asia session.

Thankfully, now we all know that the forex market is open 24 hours a day. When there are trade-related activities, there are opportunities.

My last strategy of this book is traded on the early-morning Asian hours. This time period can provide numerous opportunities for traders located in different time zones across the world, whether they are part time or full time. I hope that it will greet you like the bright morning sun.

Time Frame

The good morning Asia strategy works with the daily candle (D1). This means that each candle represents 1 day of price movement.

Indicators

We use only pure price action, and no indicators are used for this strategy.

Currency Pairs

This strategy applies only to the USD/JPY.

Strategy Concept

Opening hours of the Asian market begin after the U.S. market closes. The direction of the Asian market tends to take its cue from the previous day’s performance on the U.S. market because the U.S. market is the largest economy in the world.

If the U.S. market closes with a bullish sentiment, the Asian market usually starts the day bullish. If the U.S. market closes with a bearish sentiment, the Asian market usually starts off bearish.

During the early-morning Asian hours, the best currency pair to take advantage of this phenomenon is none other than the USD/JPY, as the Japanese yen is the only Asian major currency.

This strategy allows you to position yourself just before the opening of the Asian market—hence the name good morning Asia.

The entry time of this strategy is right after the U.S. market closes at 5 P.M. If the previous daily candle is a bull candle, we ride along the momentum to go long on Asia opening. If the previous daily candle is a bear candle, we follow the bearish flow with a short on Asia opening.

We take the low or high of the previous candle as the stop loss. The risk to reward for this strategy is 2:1. If the stop loss is 80 pips, the profit target is 40 pips.

Long Trade Setup

For this strategy, the opening and closing of the daily candle corresponds to 5 P.M. New York time, which is the closing time of the U.S. market.

Here are the steps to execute the good morning Asia strategy for long:

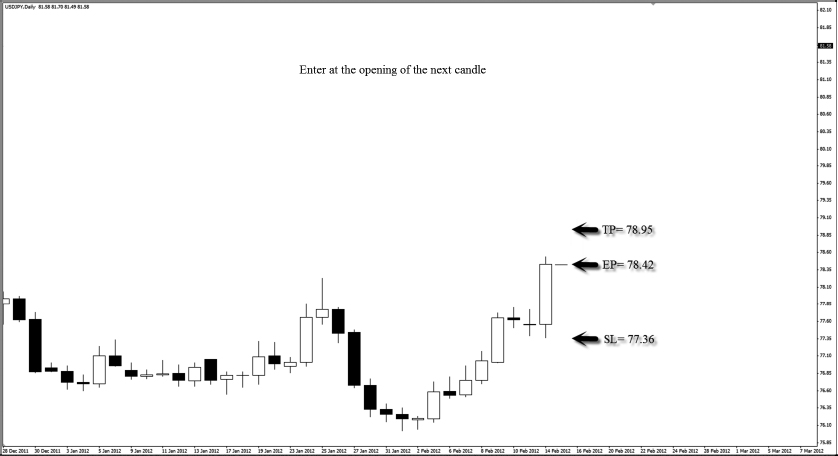

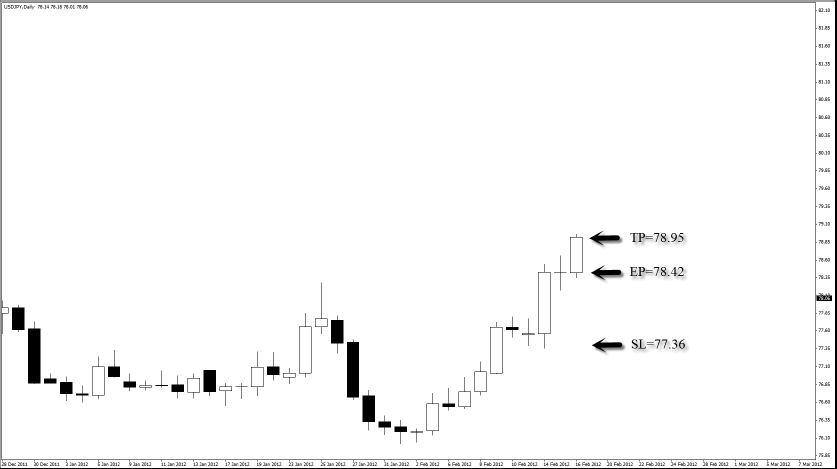

1. Ensure that the previous day’s candle is a bull candle (i.e., the closing price of the candle is higher than the opening price). (See

Figure 10.15.)

2. Enter at the opening of the next candle. This is the entry price.

3. Set the stop loss at the low of the previous day’s candle.

4. Measure the number of pips between the entry price and stop loss. If the number of pips is less than 30, shift the stop loss lower to make sure it is at least 30 pips from the entry price. The profit target is half that number of pips. In this example, the number of pips between entry price (78.42) and stop loss (77.36) is 106, so the profit target is 53 pips above the entry price at 78.95. (See

Figure 10.16.)

From the long example in Figure 10.17:

Entry price = 78.42

Stop loss = 77.36

Profit target = 78.95

The risk for this trade is 106 pips, and the reward is 53 pips. The risk to reward ratio is 2:1, which yields a 1.5% return if we take a 3% risk.

Short Trade Setup

Here are the steps to execute the good morning Asia strategy for short:

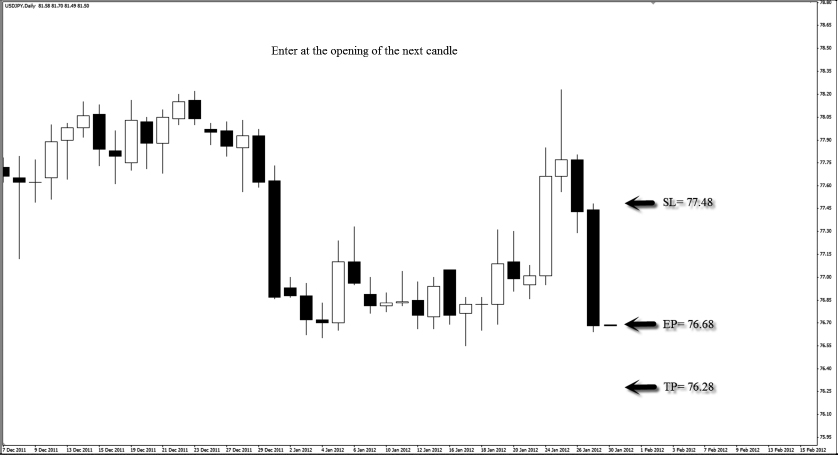

1. Ensure that the previous day’s candle is a bear candle (i.e., the closing price of the candle is lower than the opening price). (See

Figure 10.18.)

2. Enter at the opening of the next candle. This is the entry price.

3. Set the stop loss at the high of the previous day’s candle.

4. Measure the number of pips between the entry price and stop loss. If the number of pips is less than 30, shift the stop loss higher to make sure it is at least 30 pips from the entry price. The profit target is half of that number of pips. In this example, the number of pips between entry price (76.68) and stop loss (77.48) is 80 pips, so the profit target is 40 pips below the entry price at 76.28. (See

Figure 10.19.)

From the short example in Figure 10.20:

Entry price = 76.68

Stop loss = 77.48

Profit target = 76.28

The risk for this trade is 80 pips, and the reward is 40 pips. The risk to reward ratio is 2:1, which yields a 1.5% return if we take a 3% risk.

Strategy Roundup

This strategy is suitable for traders with very little time to monitor the market. Furthermore, it does not require any complex market analysis. The entry time is predictable because the market is entered at a fixed time of the day, every single day.

Good morning Asia centers on the USD/JPY for three reasons:

1. The United States and Japan are the largest and third largest economies in the world respectively.

2. The USD/JPY is the second most traded currency pair in the world, right after the EUR/USD.

3. Japan is the first country in Asia where markets open. Hence, ample liquidity on the USD/JPY allows traders to execute long and short positions easily.