The LBO Boom

In 1982, Gibson Greeting Cards was purchased for $80 million, of which only $1 million was contributed by the acquiring investor—the rest was borrowed. Back then, the notion of financing an acquisition almost entirely with debt was strange. But after Gibson IPO’d at $290 million and the investor made off with $66 million in cash, the strategy caught on like wildfire, ushering in the leveraged buyout (LBO) boom. “It’s kind of frightening to make this kind of money,” said the greeting card tycoon, former treasury secretary William Simon.

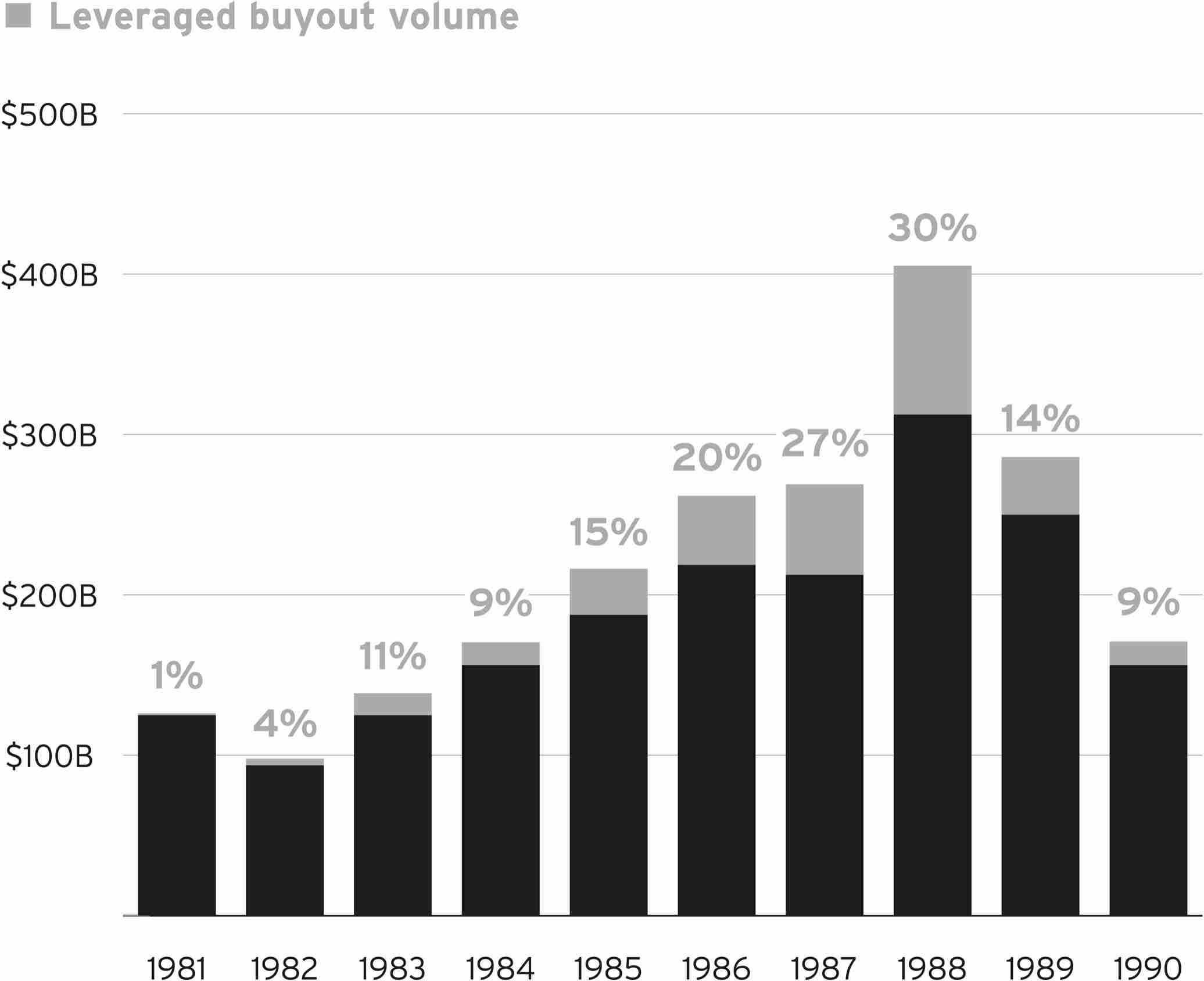

Within seven years, leveraged buyouts went from making up 1% of mergers and acquisitions (M&As) in America to 30%. Corporate raiders were the inquisition of the new religion. Any management team that wasn’t maximizing shareholder returns got bounced, and their company sold for parts to finance the debt. This led to the bankruptcy of many acquired companies. By the time the trend had cooled off in the early ’90s, the LBO industry’s pockets were more than stuffed.

06

Leveraged Buyout Volume as Percentage of M&A Volume

Source: Piper Sandler.

Note: Domestic deals only.