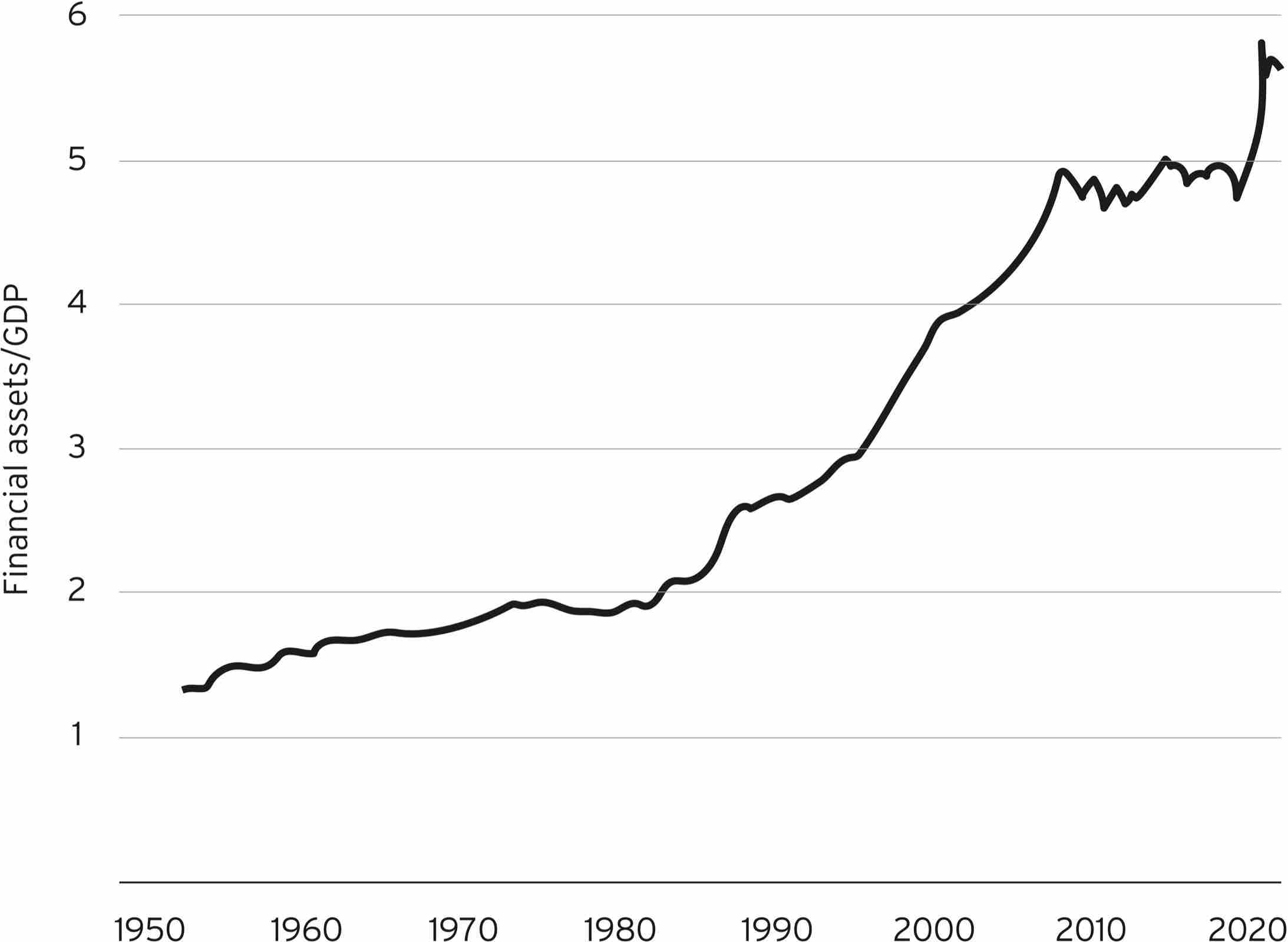

Financialization and Asset Inflation

America has never had such a disconnect between Main Street and Wall Street, or the real economy and the financial economy. Prior to 1980, America’s total financial assets never surpassed two times the nation’s GDP. That ratio has trended higher ever since, spiking to a high of 5.9:1 at the onset of the pandemic. This increased financialization has been driven by a multitude of factors, including unprecedented money printing and Wall Street’s ceaseless ability to create new financial products such as mortgage-backed securities and other weapons of mass financial destruction. This is also a global phenomenon: The total value of financial assets held by the ten countries with the largest GDPs leapt from $290 trillion in 2000 to an astounding $1,020 trillion in 2020. That’s over a quadrillion dollars, a number I didn’t know existed until five minutes ago. Over the same period, the value of real assets grew from $160 trillion to $520 trillion.

The benefits of financialization are not widespread, largely accruing to asset holders and those working in the financial sector. More importantly, financialization continues to elevate the significance of the markets at the expense of the real world. This might explain why our pandemic response decided to bail out companies, when we should’ve been bailing out people.

39

U.S. Financial Assets Relative to GDP

Source: Federal Reserve Bank of St. Louis.