Asset Inflation Comes Home

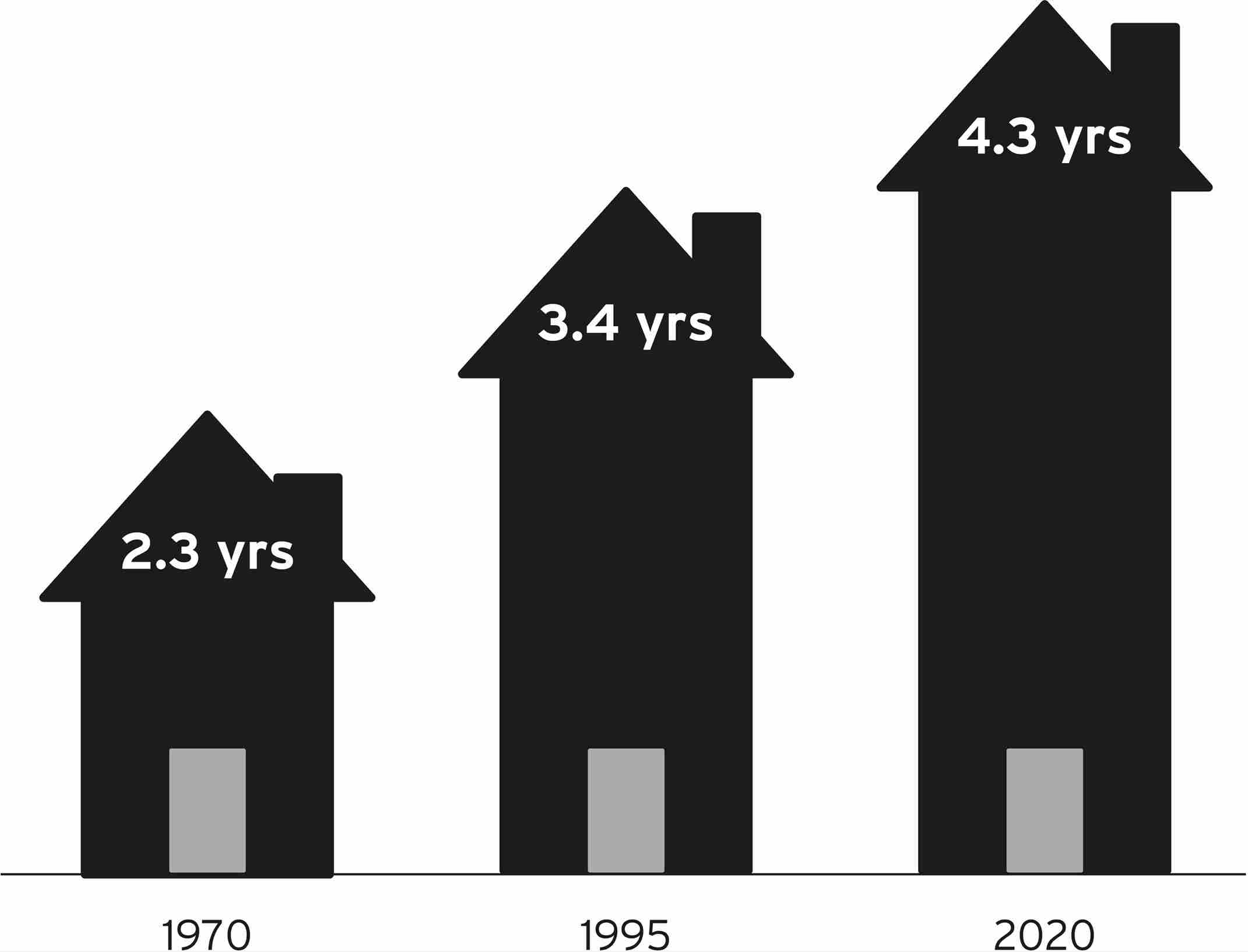

Policies that favor the redistribution of wealth from the young to the old have made it increasingly difficult for new generations to establish financial security. We can see this in the ratio of the median home value to the median household income over time. From 1960 through 1990, the median home price was equal to roughly two and a half years of household income. But by 2020 that ratio had nearly doubled: House prices were more than four times annual incomes.

Home ownership is a principal tenet of the American Dream. Owning a home builds credit, reduces housing costs, and makes a young family feel a sense of pride, belonging, and accomplishment. The home ownership rate in the U.S. peaked before the Great Recession, at almost 70%. Buying a home was cheap, compared to previous eras, and Americans took advantage. Since the disruption of the Great Recession, housing prices have skyrocketed. Older Americans reap the benefits of tax-deductible mortgage interest, while younger generations and the less wealthy are stuck paying nondeductible rent. We effectively transferred wealth from the young to the old.

40

Years of Median Household Income Equal to Median Home Sale Price

Source: Prof G analysis of Federal Reserve Bank of St. Louis data.