Getting Banked

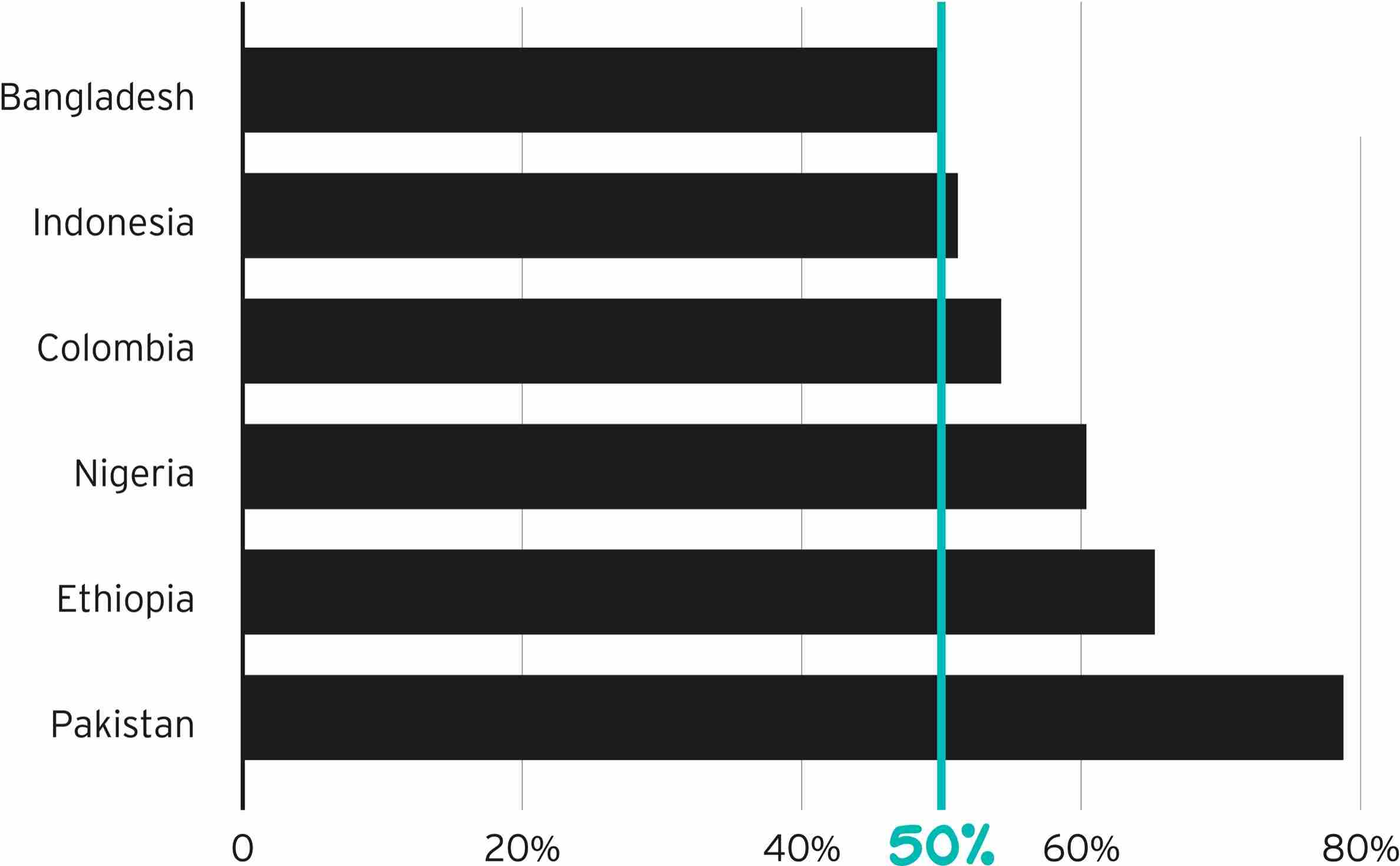

Unequal access to banking is a global problem. Almost a third of the world’s adults, 1.7 billion, are unbanked. In Colombia, Nigeria, Pakistan, and a few other countries, more than 50% of adults are unbanked. In the United States, it’s 5.4%, or 7.1 million households. This is more than an economic issue—it’s a societal problem. When people are excluded from financial institutions, they’re excluded from the fabric of the community.

For banking innovators, this is an opportunity. Take Argentine fintech Ualá. In just four years, more than 4 million people—about 9% of the country—have opened an account with the company, and more than 25% of eighteen- to twenty-five-year-olds now have a tarjeta Ualá, an online wallet.

There’s immense value creation for multiple stakeholders in this space. Financial inclusion bolsters the middle class and forms a solid base for democracy.

82

Economies With Half or More of Adults Unbanked

2017

Source: Global Findex Database.