Printing Our Way to Prosperity

The government typically pays for things with money it obtains either by raising taxes or borrowing. But the government has another, unique way to generate funds: It can print more money. In practice, this involves bond sales and accounting sleight of hand, not a printing press, but the end result is the same: money for nothing.

Fears that increasing the money supply will lead to inflation have traditionally kept governments from employing this approach aggressively. But some economists think that fear is unjustified and say that governments should be more willing to print money. When combined with a government job guarantee and other measures, this philosophy is known as “modern monetary theory.” Ideally, the new money fuels productive economic activity, which creates value sufficient to absorb the additional currency, holding off inflation.

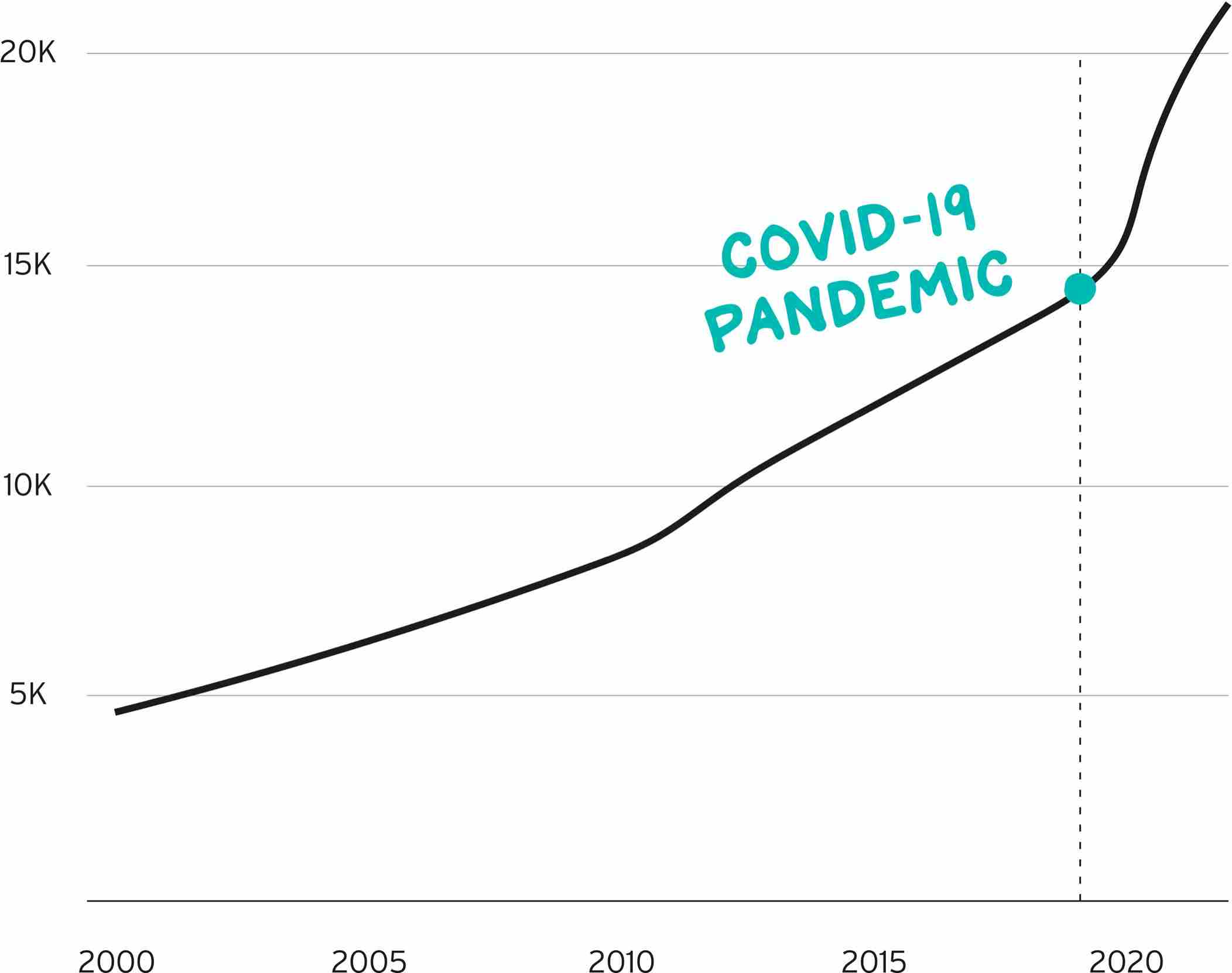

Crisis encourages innovation, and in recent decades, the U.S. government has twice resorted to aggressively expanding the money supply—after the 2008 financial crisis and the Covid-19 pandemic. In the short run, it appears to have worked—the Covid recession was shorter and shallower than anyone predicted. But the recovery has also been accompanied by inflation.

Creating money is a hard habit for a government to break. It’s likely that this won’t be Uncle Sam’s last trip to the money dealer. A willingness to pour money into the economy might produce the rising tide of income that lifts all our boats.

83

Money Supply

M2 money stock

Source: Federal Reserve Bank of St. Louis.

Note: M2 is the Federal Reserve’s main measure of the U.S. money supply and includes liquid currency (M1) plus savings deposits under $100,000 and shares in retail money market mutual funds.