Simplify the Tax Code

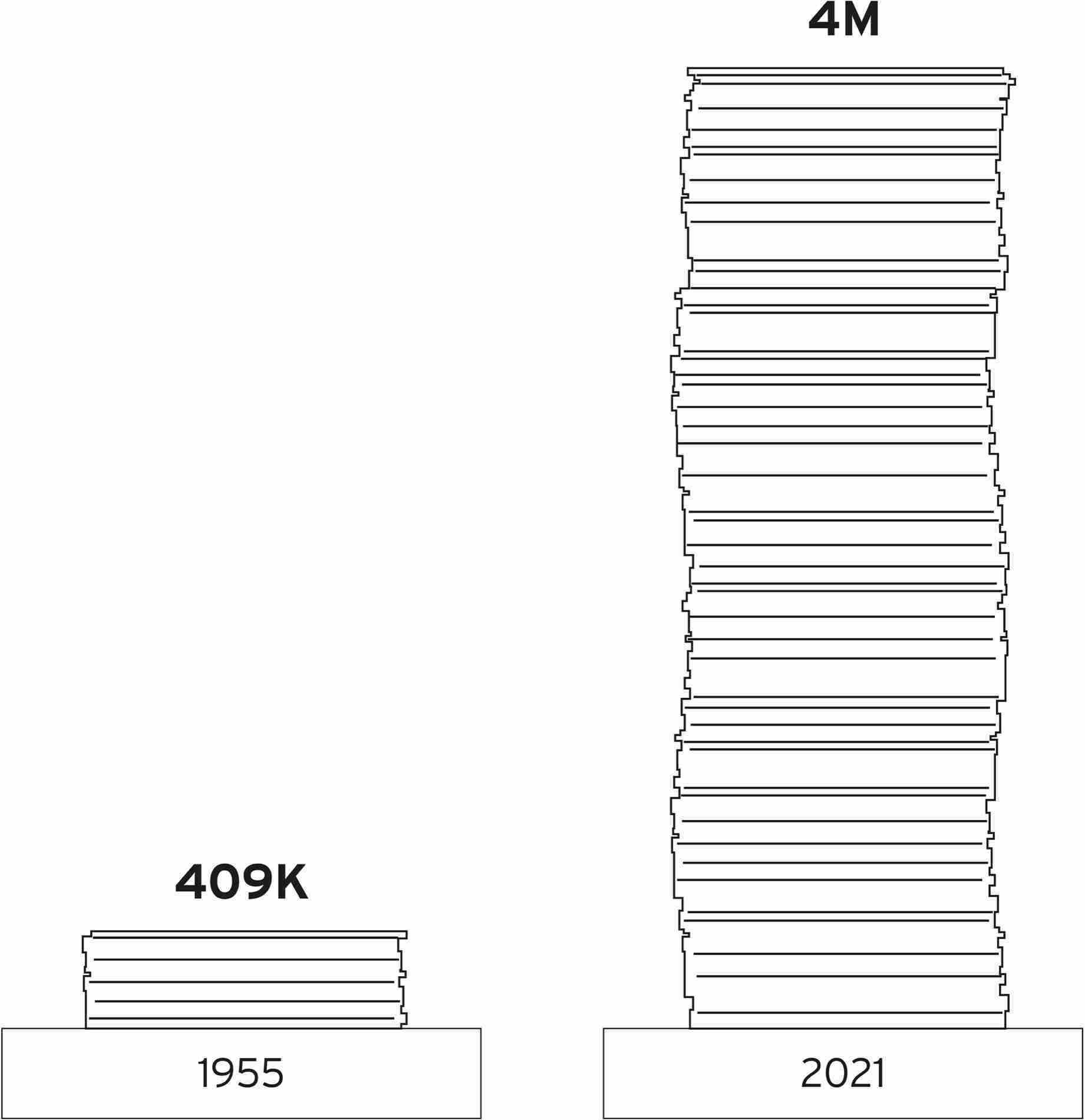

The idea of simplifying the tax system might be the only policy that all Americans universally support. Yet the tax code only gets more and more complex. In 1955, the Internal Revenue Code stood at 409,000 words; today it has roughly 4 million.

The complexity of the code is, in and of itself, a tax on the poor. The wealthy employ small militias to conquer the system and minimize their taxes. The dodges that benefit the wealthy are unavailable to everyday Americans, as is the high-priced advice necessary to take advantage of them. What this complexity means for regular people is a huge loss of time. In 2012, the IRS’s National Taxpayer Advocate estimated it took a total 6.1 billion hours for all taxpayers to handle their taxes. Compare that to the filer’s experience in thirty-six countries, including Germany, Japan, Norway, and Sweden, where the government calculates taxes and provides taxpayers with a pre-filled return.

We should revise the tax code with uniform definitions and eliminate itemized deductions in favor of higher standard deductions for households. Tax savings programs from Roth IRAs to Coverdell education savings accounts should also be consolidated to achieve one simple goal: encouraging personal savings by avoiding double taxation of them. And we should end the favorable tax treatment given to income earned by the sale of assets. Money (and the money it makes) is not more noble than sweat.

90

Words in the Tax Code

Sources: IRS, Tax Foundation, National Taypayers’ Union.