Remember that to model something you need to find out what successful people do in common. These are the important tasks, and then you need to find the three ingredients of each task. It’s the ingredients that make everything become psychology. These three ingredients are the beliefs, the mental states, and the mental strategies involved in each task. And those three ingredients are 100 percent in the mind, which is why trading success is 100 percent psychology.

So let’s look at beliefs, the first ingredient. Beliefs are your filters to reality. They are the programming that I call the Matrix in my new book, Trading Beyond the Matrix: The Red Pill for Traders and Investors.

All of the statements you make, and all of the statements I’ve made in this e-book, are beliefs. They shape your reality. In fact, your beliefs about yourself determine your self-worth and who you think you are. You’ll create whatever you believe and defend it strongly. Thus, your beliefs about the market determine how you’ll trade. Even people who don’t know anything about the market have lots of beliefs about it. They might believe that:

All of those statements (and each of those I’ve written in this e-book) are beliefs. They shape your experience. So to gain some control over your experience in the market, you need to understand your beliefs about yourself and the market. You are not your beliefs, but they can control you if you don’t control them. Are your beliefs useful? How do they limit you? If they are not useful, then how can you find something more useful to replace those beliefs?

Now let’s look at mental states, the second ingredient. Every task you do has an optimal mental state for its performance. If you are in the optimal mental state, then you will do it well; but if you are in a suboptimal state, then you will perform poorly. For example, fear is not an optimal mental state for any task of trading unless you don’t know what you are doing. And if you don’t know what you are doing, then fear is an optimal state only if it prevents you from trading.

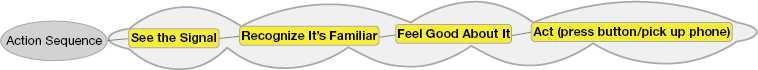

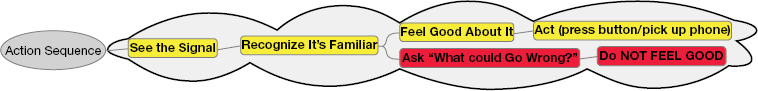

And last, let’s look at mental strategies, the third ingredient. Mental strategies refer to the sequence of your thinking. Some strategies are optimal and produce good results, whereas others are not optimal at all. So let me illustrate by using a task that most people would not consider to be psychological—the task of executing a trade.

Typically, people act by seeing a signal that they know is the signal for action. It tells them that if the stock or instrument you want to act on does this, then enter the market.

The first step in the strategy is to see the signal.

The second step in the strategy is to internally recognize that this is your action signal. You have to remember and recognize this signal. So this step is visual, internal, and remembered.

Third, people tend to act from feelings, so you need to feel good about what you see.

And last, when you feel good, then you need to press the button (or pick up the phone or whatever) to execute the trade.

Now what if you add one extraneous step to that optimal strategy? Once you recognize the signal, you ask yourself (i.e., this is internal dialogue), “What could go wrong?” Does that step get you to feeling good? No, it tends to produce images of disaster. And you now have to do a lot of processing to get back to feeling good so you can execute the trade. And if this trade has a limited time opportunity, then you probably will miss it.

It takes a lot of work to make sure that all of your beliefs involving trading are useful. It also takes a lot of work to make sure that you always act with an optimal mental state. And, equally, it takes a lot of work to make sure that that your thinking runs through the proper sequence necessary to be successful.

Because the key ingredients of success are all psychological, so are the key problems you will face.

The solutions to the first three problems take a lot of explanation, and are covered in my new book, Trading Beyond the Matrix.

But there is a fourth problem that will become obvious to everyone—making mistakes while trading. You should have well-thought-out rules to define everything you do in trading. And when you don’t follow those rules, then you’ve made a mistake. If you don’t have such rules, then everything you do as a trader is a mistake.

When I ask my clients to keep track of their mistakes, I find that most of them at first trade at about 70 percent efficiency or worse; that means that they make three mistakes for every 10 trades. That leads right into the next potential edge you could have.