The modern world has encouraged us to live divided lives. One division is the time of our lives, segmented into efficient industrial boxes called education, work, and retirement. Another division is the why of our lives, split between our own core values and the larger forces at work in society. Another is the what of our lives, represented in the division of well-being into prosperity, health, and happiness. It’s true that these divisions help us understand what’s going on and make our way in the world. But it’s also true that we yearn for wholeness. We yearn for completeness. We yearn for integrity.

The new retirement is our opportunity to have what we yearn for. It’s our opportunity to live an undivided life. That’s why this chapter is about integrating all the parts of life.

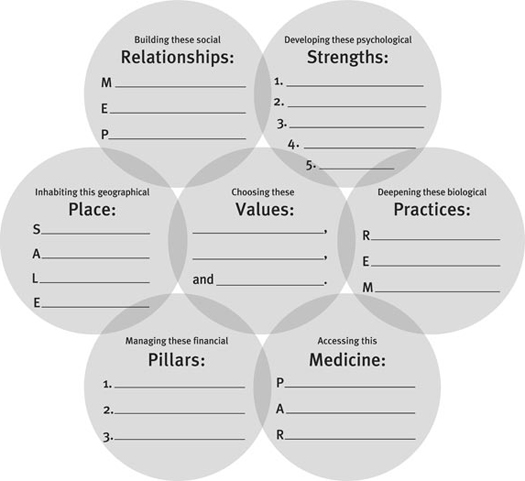

As you’ve worked on the chapter exercises, you’ve been filling in the circles that represent parts of the life you want to live. Now you’ll bring all the circles together to create a larger overall picture of your Ideal Retirement. At this point, I hope you have done the exercises and aren’t merely reading this book! If you haven’t done them yet, go back now and fill them in quickly, as a first draft. You can always get more detailed later.

Let’s review the elements: The outer circles represent six fields of knowledge that relate to six parts of your life (and also six chapters of this book). These are paired up to create the three dimensions of well-being: prosperity, health, and happiness. The icon in each outer circle represents a key idea related to that element and chapter. Each chapter offered an exercise that allowed you to fill in a Life Circle at the end. The exercise provided a process, but you provided the content. So the circles are really more about you than they are about those fields of retirement knowledge. The picture of the Ideal Retirement that you’re creating is really a picture of you!

The icon for the central circle is a picture of the world, to remind you to activate your values in your everyday world. Your values are at the center, because hopefully they’re at the center of your life. The exercises in chapter three gave you a taste of them. The more deeply you get to know them, though, the more you can bring your other circles into alignment with them. You can consciously use your values to help you make decisions in all the other circles—to create your own unique version of well-being.

This values-based guidance is crucial, because there aren’t obvious, objective answers to all your retirement planning questions in the six outer circles. Based on the knowledge in each field, some decisions are obviously the right ones. But for other decisions, there is no objective standard, no right or wrong, no shining truth. Your answers will be subjective and personal. You really need to design your next stage of life from the inside out.

You can choose from a variety of methods to assemble the picture of your Ideal Retirement. If you wrote your answers in the pages in this book, just flip back to each of those exercises to get your answers for the fill-in-the-blanks exercise that follows. If you wrote your answers on photocopies of the exercises, you can assemble those Life Circle sheets onto a larger sheet of paper or poster board. Just paste or tape them on the appropriate spots. Being the resourceful and adaptable person that you are, you may think of even more interesting ways to assemble your complete picture.

Whichever methods you use, the point is to create that One Piece of Paper that allows you to see the whole picture at once. Seeing a visual representation of these connected elements helps create a compelling vision of the retirement life that you really want.

Retirement planning has traditionally focused on just one dimension—financial. When it has included others, it’s been arbitrary—there hasn’t been a natural way to select, and then connect, the dimensions. They’ve typically been isolated from one another. And when we plan for each part of life in isolation, it’s easier for them to be out of sync with each other. When that happens, we may not be able to really see it, but at some level we’ll probably feel it. Because we’re wired to want all three dimensions of well-being, being able to finally see it all connected on our One Piece of Paper can be a real breakthrough. It’s a way to get our lives in sync!

For our life design, some of the easiest connections to spot are between adjacent circles. We’ve already seen the close connections between the two elements that make up each dimension of well-being: biological and medical, psychological and social, geographical and financial. But there are also many close connections between the other adjacent elements.

For example, geographical and social are next to each other because they have a strong connection. Remember “social is spatial, and spatial is social”? Also, financial and medical are next to each other, and it’s obvious why—access to medical care is usually based on finance. Finally, psychology and biology are next to each other because psychology has a strong biological aspect. And on a practical level, we know that psychology has an effect on biology, too: Research is starting to show that happier people tend to be healthier. So these connections between the six circles are easy to see, even when they’re from different dimensions of well-being. But all the circles are connected in our lives, even if they’re on opposite sides of the Well-Being Model.

The assembled picture of your Ideal Retirement as seven circles is a unique and powerful planning tool. However, you can go beyond seeing it as seven circles to seeing it as an integrated whole. The purpose of the seven circles isn’t to break down your planning into smaller parts—modern life does that already. No, the purpose is to help you put it all back together. As an integrated whole, you might think of your picture as:

• a retirement dream.

• a strategic plan.

• a treasure map.

• a life plan.

• a vision.

Or use any other term that comes to mind and makes sense for you.

Could this picture of your Ideal Retirement offer something more? Might it offer a clue to your calling in retirement? If you think that you may have had a calling, you should know that it’s not always easy to find it again in later life. Even though the Third Age can offer the greatest freedom, we may have trouble knowing what that freedom is for. Sometimes it’s actually easier to hear our calling earlier in life. Life is generally simpler then. Things get much more complex as the responsibilities pile up on us in the Second Age. We can become so strongly conditioned by what society wants that we sometimes mistake it for what we want. Then when we get to the Third Age, the marketing messages go into overdrive, selling us prefabricated lifestyles based on products and services. It’s not easy to hearken back to the small voice of calling that we may have first heard in the First Age. But we probably did hear a call, and on some level still yearn to fulfill it. It may be why we’re still here.

So—why are you still here?

Is it because there’s still something important left for you to do? As you get closer to retirement and realize the freedom that it brings, it may become easier to get a sense of your calling.

When you look at the picture of your Ideal Retirement, does it give you a hint about some contribution that you still want to make? That contribution could be connected to one of your circles. Or it might be inspired by your total picture rather than being just one part of your picture. Either way, something calls to you, beckons you, draws you toward it. You’re willing to do whatever is necessary to get there. In fact, you’d like to start tomorrow!

On the other hand, when you look at your Ideal Retirement, it might look wonderful but doesn’t feel like a calling. That’s OK. Maybe your next stage of life is still too far away for you, and this exercise is more like planning than it is like living. Or maybe your circles are about important things but not necessarily connected to your core values at the center. Values are usually where motivation comes from. To get closer, try activating your values more in your daily life now and see how it feels! Remember that your picture is a work in progress; it is always open to revision as you reflect more on what you truly want.

That means that finding your retirement calling isn’t a onetime, now-or-never deal. The ability to look for your heart’s desire and hear a call improves with practice. In doing these exercises, you may be tapping into parts of yourself you haven’t been in touch with for a while. Maybe not since your First Age. As you continue to visualize your Third Age, you’ll get better and better at it, and you may discover that the picture of your Ideal Retirement contains a calling.

Whether you’ve identified a calling or not, there may be some changes you should make to your picture right now. Would you like to change or add something in any of your circles? Is there a name, a title, or a label that you’d like to give this picture? A phrase, a sentence, or even a paragraph that you could add that would be meaningful to you? You can do any of these things anytime you want. It’s your picture!

Who’s coming with you to the next stage of life? Some companions? Some helpers? Should you let them in on part of your picture? Let’s see who those folks might be.

Your companions are the people with whom you have personal relationships. If you have a spouse or significant other, that loved one should know about your picture. It will help immensely if your partner is also creating a picture of his or her Ideal Retirement. Initially, it’s better to do these exercises separately and create your own individual pictures. When some couples work together, one partner can end up driving the process, and the other doesn’t get enough of a voice. It’s important for each of you to have your own authentic vision that comes from your own heart, then put your hearts (and minds) together. You’ll want to get on the same page—or at least adjoining pages. Two compatible pictures can be even more powerful than one!

Beyond your spouse or significant other, who else might be your companions? Your children? Your parents, if they’re alive? Your best friends? Who are the people you most want to spend time with in your retirement? You might do some of them a great service by inspiring them to create their own picture. But at the very least, they’ll gain a deeper understanding of you, what’s most important to you, and where you’re headed on your journey. When you become really clear about what you want and other people can see it too, they may even want to help you. (Although you may have some companions who tend to be jealous, or naysayers. You’re the best judge of who will help and who might hinder you.) Who knows what wonderful things might happen when you share your picture?

You may have some helpers and advisors, too. They provide assistance along the way, especially at key points. Do you have, or can you imagine having, any of these helpers?

• Accountant

• Alternative medical practitioner

• Attorney

• Benefits counselor

• Career counselor

• Financial planner

• Human resource professional

• Life coach

• Medical doctor

• Personal trainer

• Realtor

• Religious or spiritual guide

• Therapist, counselor, or psychologist

You may choose to share the full picture with them, but more likely you’ll just share the part that’s relevant to them. Some of these will be true helpers who genuinely want to assist you. Of these well-meaning helpers, some are competent, others less so, but at least they have your best interests at heart. However, along the way you may discover others who appear in the guise of a helper but seek only to serve themselves. You may need to be careful sharing much of your vision with them until you know whether you can trust them.

How do you bring this vision back with you into the everyday world? Even when you gain clarity and can see what you really want, it’s not always so easy to keep it alive. But it is essential for designing your next stage of life, because the everyday world is where you actually prepare for retirement. That’s where you gain the knowledge and make the changes in your life that will put you on the path to your Ideal Retirement. The more clearly you hold on to that vision, the more your day-to-day planning and preparations will come into alignment with it.

There are three effective approaches to bringing the vision of your Ideal Retirement into your everyday life: the no-brainer approach, the left-brain approach, and the right-brain approach. Although quite different from one another, they share a common perspective that retirement is not a problem to be solved, but an opportunity to be created. (A problem-solving and fixing perspective works well for things like machines. When a machine is working and then malfunctions, troubleshooting is the way to get it back up and running. But a life stage isn’t like that at all. You’re not troubleshooting it; you’re creating it.)

Brief descriptions of the three approaches follow, and you’ll find instructions and worksheets for using each at the end of this chapter.

Is your brain tired after your long journey through this book? Rest assured, this approach doesn’t take a lot of hard thinking. (Although it’s actually very smart!) It’s a no-brainer only because it’s such an obviously good idea. This approach comes from the psychology of human performance, and it has been used by athletes for many years. It’s based on the idea that we don’t always need to think consciously about something we want to achieve—we can turn it over to our automatic, unconscious mind. This approach brings your vision into everyday life in three distinct ways: as pictures, words, and feelings. If you want to try just one approach right now, this is the one for you.

On the other hand, if you’re up for a bit more thinking, try one of the other two approaches. They come from a very different source—organization management. Management is a discipline that coordinates a wide variety of disparate elements to reach a goal. That sounds a bit like retirement planning, doesn’t it?

Do you see yourself as a right-brain person? Are you intuitive, creative, and focused on the big picture? If so, this may be the approach for you. It’s loosely based on appreciative inquiry, a revolutionary field of organizational development. Appreciative inquiry looks for the best in people, searches for their highest values and abilities, and helps them expand. Using this approach, you discover positive experiences grounded in the past, dream of an even better future, design conditions that make that future possible, and then deliver it through inspired action. If you want an approach that increases your energy and helps you see new options, try this one!

Do you think of yourself as a left-brain person? Are you logical, linear, and focused on the details? This could be your ideal approach. It’s loosely based on an approach for strategic planning and execution called the Balanced Scorecard. This system creates performance standards not only for financial assets but also for nonfinancial ones. By establishing objectives, measures, targets, and initiatives across multiple domains, it offers quantitative feedback from a balanced perspective.

You’re the sole judge of which of these three approaches is best for you. At different times you may even use all of them. But please try at least one as soon as you finish this chapter, before you get caught up in those day-to-day realities again. You wouldn’t want all of your hard work to be lost!

Here’s one final thought for you, dear reader: You can begin bringing your life into more alignment with your core values right away! You can begin doing all the things you imagined in all of your circles, to greater and lesser degrees. Instead of living a divided life, you begin living an undivided life—you don’t need to wait until retirement.

Wouldn’t that be grand?

In the words of American mythologist Joseph Campbell: “If you follow your bliss, you put yourself on a kind of track that has been there all the while, waiting for you, and the life that you ought to be living is the one you are living.”

The No-Brainer Approach: Visualization and Affirmations

This approach brings the vision of your Ideal Retirement alive in three distinct ways: as pictures, words, and feelings. Follow these three simple steps. You may want to use a blank sheet of paper to record your answers and ideas.

Pictures. Expand or embellish the picture of your Ideal Retirement just as you please, with clippings from magazines, fine-art reproductions, or your own drawings. Then keep it where you can see it easily and refer back to it often. Where might that be? Your office wall? Your refrigerator? In front of your exercise equipment? Where you sit to pay the bills? Over time, you’ll notice that the words and images have seeped into your subconscious, forming an internal image of your Ideal Retirement that is more portable—and powerful—than That One Piece of Paper. The goal is to keep visualizing it in as much detail as possible.

Words. Are you familiar with affirmations? These are statements in the present tense about conditions and accomplishments you would like to realize in your life. You can use the terms, phrases, and statements from all of your Life Circles to create your own affirmations—a set of statements about your retirement. Be as specific and clear as possible, and state them in the present tense. Although there are all kinds of affirmations out there, in self-help books, magazine articles, websites, greeting cards, and so on, those that come from you will be a perfect fit. They will feel natural, will be easy for you to memorize and repeat to yourself every day, and they can have a significant positive effect. Internalizing those words makes them even more powerful than just displaying them on your picture. Repeat some of your affirmations several times every day—indeed, anytime you think of them—until they become automatic.

Feelings. Positive feelings in your body about your Ideal Retirement are usually triggered by your pictures or words (whether external or internal). With a little practice, you can learn to cultivate those positive feelings and connect them strongly to your pictures and to your affirmations. The stronger your positive feelings, the more effective this approach will be. So when you use your visualizations and affirmations, remember to recognize and welcome these positive feelings. Your goal is to feel confident and excited when you think about your retirement. Practicing the no-brainer approach all by itself will bring you closer to your vision, and it will also bring your vision closer to you. You’ll find yourself acquiring knowledge and accumulating resources without consciously planning to do so. Before you know it, you’ll catch yourself taking actions that move you in the direction of your Ideal Retirement.

The Right-Brain Approach: Appreciative Inquiry

Appreciative inquiry helps you discover positive experiences grounded in the past, dream of an even better future, design conditions that make that future possible, and then deliver it through inspired action. You’ll complete this process separately for each element of your Life Circles, beginning with the ones that give you the most pride in your accomplishments. Use a blank sheet of paper to record your answers and ideas.

Choose the first circle that you’d like to learn about and explore. Regardless of how well you think the planning and preparations have been going for this circle, you will focus on what has worked, not what hasn’t. And no matter how much success you feel there has been already, you’ll focus specifically and completely on what you want more of.

Discover. Think back to a specific time when things were going well in this element. Remember one of your high points or a peak experience. What were you grateful for or excited about? What did you do that was so successful? How did that make you feel? What made that success possible? What was the root cause of your success?

Dream. Now, based on your Life Circles exercise, consider the role this element plays in your Retirement Well-Being. What is the best possible future for this element? What would that future feel like?

Design. Now, keep in mind what has really worked in the past for this element when things have gone well. To bring about that best possible future, what values or principles would you need to act from? What conditions would you need to create?

Deliver. Brainstorm a wide variety of actions that you could possibly take. Generate options that are exciting but also tangible. Which actions would be a stretch for you but that you would feel confident about taking? Which actions would be the most inspiring to take and follow through on? What structure could you put in place to support those actions? What could you celebrate as a result of taking those actions successfully?

You can expect the actions you take as a result of this exercise to lead to more experiences of success. You can make them part of another discover, dream, design, and deliver exercise. You can consciously create a virtuous cycle that repeats itself.

The Left-Brain Approach: The Balanced Scorecard

The balanced scorecard is an approach for strategic planning that creates performance measures not only for financial assets but also for nonfinancial ones. By establishing objectives, measures, and initiatives across multiple elements, it offers feedback on your progress from a balanced perspective.

For designing your retirement, your strategy is built upon your core values. This worksheet will help you implement your strategy across the six elements of your Life Circles.

First, as a reminder, list your three core values:

,

,

,

,

and  .

.

Second, consider (1) the objectives you can identify that will bring you closer to your Ideal Retirement, (2) how you might measure your progress toward the objectives, and (3) what initiatives you can take to get there.

Objectives. When you filled in each of your Life Circles, you identified a state that you want to achieve for your Ideal Retirement. You can probably identify many other intermediate objectives that could lead up to it. Some of your objectives will be about accomplishing something specific, but many could be about learning, investigating, or making future plans.

And for all six elements, a worthy interim objective is simply sharing your goals and plans with someone!

Here are examples for each Life Circle.

Geographic: Researching potential retirement places; evaluating your existing place; taking a vacation or visiting people you know; making lifetime home improvements; interviewing a realtor about trends and opportunities.

Financial: Checking your Social Security projections; calculating how much income you’ll need; retaining a financial planner; setting up an autopilot for saving or investing; reaching an account balance goal.

Biological: Calculating your biological age; establishing a practice through a club or class, or tracking your frequency of participation; replacing an unhealthy habit with a healthy one; reaching a target weight, fitness measure, or lab result.

Medical: Researching the terms of your retirement medical plan; comparing Medicare Part D or other prescription plans; investigating your Veteran’s Administration benefits; getting age-appropriate medical screenings or tests; completing a medical power of attorney; interviewing a new potential doctor or practitioner.

Psychological: Taking the VIA survey online; shifting job responsibilities to better use your skills; exploring opportunities to use strengths outside of work; trying a new hobby for enjoyment; exploring a potentially meaningful responsibility or opportunity; testing the waters for engaging retirement work.

Social: Meeting with coworkers outside of work; looking up old friends; investigating a club or other membership; volunteering for an organization to meet new people; joining an athletic team; making specific arrangements to help family or friends.

Measures. How can you measure your progress toward each objective? It could have a numerical measure, as for a financial account or a biological test. If it’s a goal for participation in appealing groups or activities, it could be a simple count of memberships or dates. You can’t measure your progress toward some objectives numerically, but you should be able to identify milestones that show you’re getting closer to your objective. It’s good to set target dates for reaching numerical goals or milestones, then celebrate or treat yourself when you get there.

Initiatives. What specific actions can you take toward your objectives that fit your numerical or milestone measures? Better yet, what systems can you put in place to automatically reach your objectives? What can you put on autopilot?

Now use the following table to record your important objectives, measures, and initiatives for each element that will bring you closer to your Ideal Retirement. You may have one or many objectives for each element.

| Element | Objective | Measure | Initiative |