CHAPTER 3

ADJUSTING ENTRIES

3.1 CASH BASIS OF ACCOUNTING

Businesses may use either the cash basis or the accrual basis of accounting to report revenues and expenses. Using the cash basis of accounting, a business would report revenues only when cash is received and expenses only when cash is disbursed. Net income is the difference between cash receipts and disbursements. This method may be acceptable for some small businesses, but its use is generally discouraged.

3.2 ACCRUAL BASIS OF ACCOUNTING

Businesses using the accrual basis of accounting report revenues in the period in which they are earned (even if the cash is received in the next accounting period). Under this basis, expenses are reported in the period in which they are incurred, not when cash is paid out.

As an example, assume that a business reports income and expenses on a monthly basis. Revenue from December sales would be reported as income during that month although cash for those sales may not be received until January (the next accounting period). Expenses are recognized monthly as they are incurred. Generally Accepted Accounting Principles require the use of the accrual basis so that revenues recognized during a given accounting period are matched with related expenses incurred in that same period. This process if facilitated by an adjusting process performed at the end of each accounting period.

3.3 THE ADJUSTING PROCESS

3.3.1 ADJUSTMENT OF PREPAID ASSET ACCOUNTS

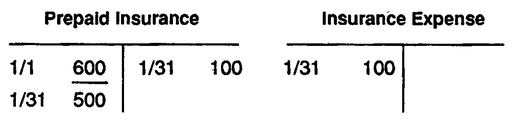

Many accounts do not require adjustment at the end of an accounting period. Accounts that are usually updated upon each transaction such as cash, accounts receivable or accounts payable, will probably reflect the true existing balance at the end of a period. Some accounts, however, are not ordinarily updated except at the end of a period. Insurance premiums are usually paid in advance, creating a prepaid insurance account. These premiums are amortized (or used) in equal portions each day of the accounting period. Most businesses forego making daily entries to reflect this “usage” and simply adjust the balance at the end of the period by crediting prepaid insurance and debiting insurance expense as shown in the T accounts below. Assume that insurance premiums for six months total $600 and are paid on January 1. Each month’s “usage” will be $100. At the end of January, the prepaid insurance and insurance expense accounts are adjusted to reflect the $100 charge by debiting insurance expense and crediting prepaid insurance.

EXAMPLE 3.3.1

After the adjustment, the prepaid insurance account has a debit balance of $500 and insurance expense has a debit balance of $100.

3.3.2 ADJUSTMENT OF ASSET ACCOUNTS

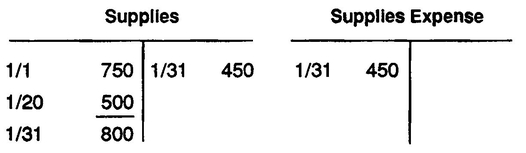

Many businesses are unlikely to record the use of supplies each day, preferring to adjust the account at the end of the period. Supplies usage can be determined in this case by subtracting the amount of supplies on hand at the end of the period from supplies available during the period. To illustrate, assume a balance of $750 in supplies as of January 1. $500 in supplies were purchased on January 20th, so available supplies during the period are $1,250. A physical count on January 31st indicates a balance of $800. Supplies used during January must then be $450 ($1,250— $800). The adjusting entry would be a debit to supplies expense and a credit to supplies of $450 each as shown in Example 3.3.2.

EXAMPLE 3.3.2

After the adjustment, the supplies account reflects a debit balance of $800 and supplies expense reflects a balance of $450.

3.3.3 ADJUSTMENT OF PLANT ASSET ACCOUNTS

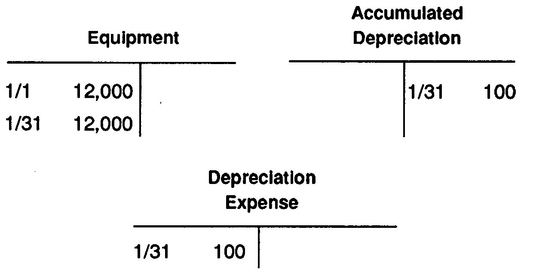

Plant assets like equipment are not “used up” like supplies, but equipment does suffer a loss in usefulness over its lifetime. This loss is a business expense known as depreciation. The adjusting process for depreciation expense is similar to those previously discussed, with one notable difference. It is common practice to report plant assets at their original cost along with the amount of depreciation accumulated since their acquisition. As before, the amount of depreciation expense for the period is reflected as a debit to depreciation expense, but instead of crediting the asset account, a contra-asset account called accumulated depreciation is credited. To illustrate, equipment is purchased on January 1st for $12,000 with a useful life of 10 years. Depreciation expense is calculated at $100 per month since the equipment is assumed to have no residual value. The required adjusting entries are shown in Example 3.3.3.

EXAMPLE 3.3.3

After adjustment, the balance in the equipment account is unchanged. Depreciation expense is debited for $100 and accumulated depreciation is credited for $100. The depreciable balance of equipment is now $11,900 ($12,000 cost — $100 accumulated depreciation). This is the book value of the equipment.

3.3.4 ADJUSTMENT OF LIABILITY ACCOUNTS

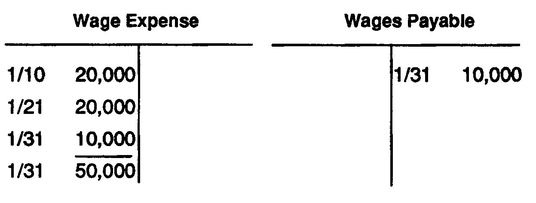

Liabilities can also require adjustment. If an accounting period, for instance, should end between payment periods, it would be proper to record the amount of wages due at the end of the accounting period. Wage expense accumulates as a liability each day and can be referred to as an accrued expense. To illustrate, assume employee wages total $20,000 each bi-weekly pay period. In this case, the accounting period ends between payment dates. The adjusting entry will be a debit to wage expense and a credit to wages payable for the amount of wages accrued as of 1/31 ($10,000), as shown in Example 3.3.4.

EXAMPLE 3.3.4

After the adjustment, the balance in the wage expense account is $50,000 (the true amount of expense for the month), while wages payable reflect the amount of liability for wages owned as of January 31st ($10,000).